Recruiters don’t wait for a market to move – and they won’t wait for your CV to get to the point either. If it doesn’t immediately show them your trading mindset and technical fluency, you might get passed over faster than a bad stock tip.

Whether you thrive on volatility or prefer long-term positioning, this guide and its 4 Trader CV examples will show you how to position your skills strategically – so your next career move is as sharp as your last trade.

Trader CV

Stock Broker CV

Equity Trader CV

Commodity Trader CV

How to write your Trader CV

Discover how to craft a winning Trader CV that lands interviews with this simple step-by-step guide.

A strong trading CV isn’t just a list of platforms and percentages – it’s a strategic document that tells a clear story of how you generate value under pressure. This guide shows you how to turn that story into something recruiters actually want to read.

From structuring to content, it covers everything about writing a CV that reflects your discipline, risk awareness, and performance record.

Structuring and formatting your Trader CV

Just like a solid trading strategy, your CV should be structured and built to deliver results. Recruiters won’t waste time deciphering messy layouts, visual mistakes, or vague descriptions – they want clear evidence of your trading knowledge and outcomes. Following a clear and coherent structure will make the application process better for recruiters – and for yourself.

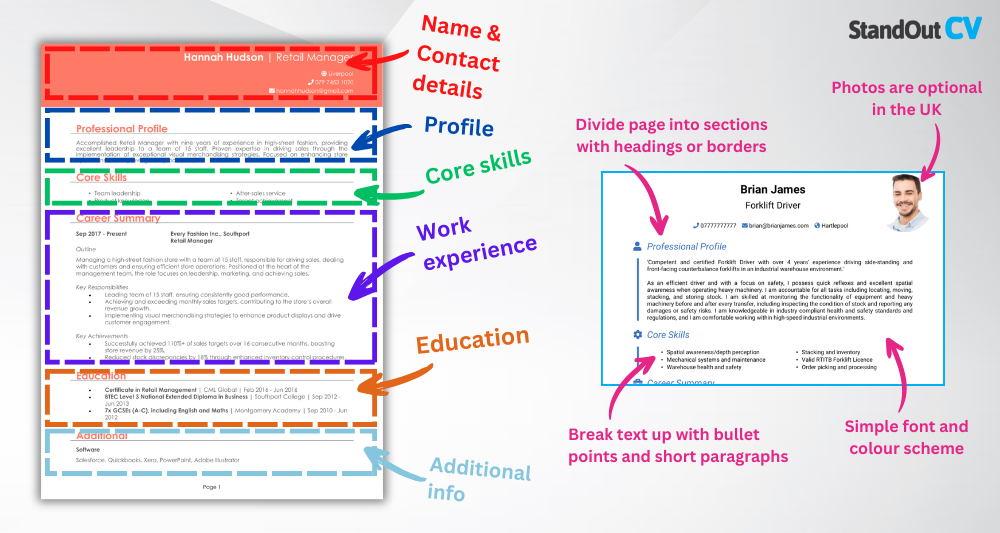

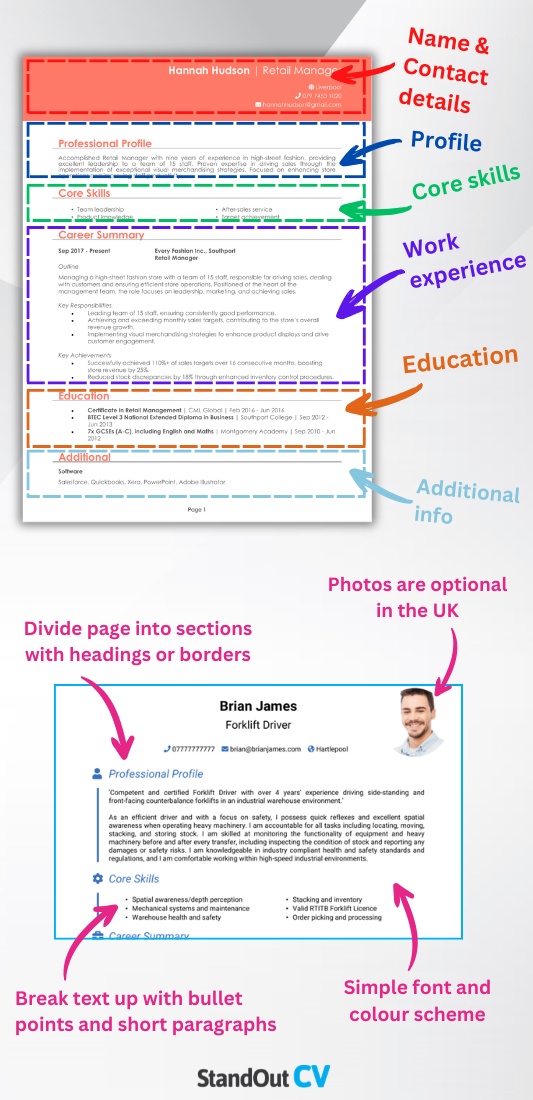

Here’s the layout to follow:

- Name and contact details – Place your name and personal details prominently at the top of your CV for quick access. Adding a photo is up to you.

- Profile – Open with a compelling overview of your skills, experience, and career goals.

- Core skills – List your key abilities in this section, focusing on those that will be most relevant to the job.

- Work experience – Provide a detailed breakdown of your work history, starting with the most recent job first.

- Education – List your qualifications, including degrees and relevant certifications, in reverse chronological order.

- Additional info – Use this optional space for relevant hobbies or personal pursuits that enhance your application.

Keep it under two pages in length and make sure every section is clearly labelled using bold headings. Use bullet points in your experience and skills sections to keep things digestible, and opt for a clean, professional font that’s easy to scan. Prioritise clarity and relevance with these tips – your CV format should be as sharp and decisive as your trades.

The best way to write a Trader CV profile

Your CV profile should immediately position you as a commercially minded trader who understands risk, market behaviour, and the value of clear communication.

This is your headline pitch – a short paragraph that summarises what markets you work in and what impact you’ve made. Whether you’re in proprietary trading, asset management, or investment banking, highlight the things which would make you a valuable asset to any company – especially your ability to make smart, data-driven decisions under pressure.

Trader CV profile examples

Profile 1

Experienced Trader with over ten years of experience in equity and derivatives trading within investment banking and hedge fund environments. Skilled in executing high-volume trades, analysing market trends, and managing risk exposure in real time. Proficient with Bloomberg Terminal, Eikon, and algorithmic trading platforms.

Profile 2

Strategic Trader with seven years of experience trading FX and commodities in global markets. Strong background in technical analysis, risk management, and fast-paced execution. Known for data-driven decision-making and delivering consistent P&L performance across volatile conditions.

Profile 3

Analytical Trader with five years of experience in fixed income and ETF trading for a multinational investment firm. Confident handling both discretionary and systematic strategies, managing positions, and collaborating closely with research and compliance teams. Skilled in Python-based trading tools and market monitoring software.

Details to put in your Trader CV profile

If you want to give employers a reason to invest in you, your profile should include the following:

- Where you worked – Mention investment banks, prop trading firms, hedge funds, or brokerages

- Your top qualifications – Degrees in finance, CFA levels, or technical certifications

- Essential skills – Trading strategies, market analysis, financial modelling, and systems knowledge

- Types of markets or assets traded – For example, forex, equities, options, or commodities

- Career highlights – Anything that proves results: P&L growth, trade volumes, or notable achievements

How to present your core skills section properly

This section offers a snapshot of your technical expertise and decision-making strengths. A strong trader needs more than just product knowledge – you’re expected to assess risk in real time, act decisively under pressure, and interpret data faster than the competition: your curated bullet-pointed list of CV skills needs to immediately assure recruiters of this.

Use this part of your CV to demonstrate a well-rounded skill set. Tailor your language to reflect the specific instruments and techniques relevant to your niche – and always keep it focused and commercially aware.

Key skills that make a Trader CV stand out

- Market Analysis and Research – Studying economic indicators, financial news, and technical data to inform trading decisions.

- Trading Strategy Development – Designing and implementing systematic approaches for short-term or long-term trading across various asset classes.

- Order Execution and Position Management – Placing trades efficiently and managing open positions to optimise entry and exit points.

- Risk Management and Hedging – Using stop-loss orders, diversification, and hedging strategies to control exposure and protect capital.

- Technical Analysis Proficiency – Interpreting charts, patterns, and indicators such as RSI, MACD, and moving averages to predict price movements.

- Fundamental Analysis – Evaluating company financials, earnings reports, and macroeconomic data to assess asset value and market impact.

- Portfolio Monitoring and Rebalancing – Tracking performance, adjusting asset allocations, and ensuring alignment with investment goals.

- Trading Platform and Software Use – Operating tools like Bloomberg Terminal, MetaTrader, or proprietary trading platforms for analysis and execution.

- Compliance and Regulatory Adherence – Following financial regulations and internal policies to ensure legal and ethical trading practices.

- Performance Reporting and Review – Documenting trade activity, generating performance metrics, and analysing outcomes for continual improvement.

How to present your work experience in your CV

This is where your CV really starts to deliver. Recruiters want to see the markets you’ve worked in, the size and scope of your responsibilities, and the kind of results you’ve produced.

List your work experience in reverse chronological order. For each one, provide a short overview and use bullet points to highlight responsibilities and achievements. Be specific – what did you trade? What strategies did you use? How did you perform? Use figures and performance metrics wherever you can, especially if you consistently hit or exceeded targets, to make your achievements more tangible.

Even early-career roles or internships are worth listing, as long as they show exposure to the industry or trading platforms.

How should you list jobs on your Trader CV?

- Outline – Give a brief intro to your employer and role: were you on a proprietary trading desk, working in commodities, part of a quant team, or handling client orders?

- Responsibilities – Use action words like “executed” and “analysed.” For example: “executed short-term equity trades based on technical indicators” or “analysed macroeconomic data to inform FX positioning.” Mention platforms, tools, and any collaborative work with analysts or risk teams.

- Achievements – Prove your value. List performance metrics such as P&L, trade volume, or hit rate. Include improvements to trading processes, reduction in risk exposure, or standout trades where relevant.

Work history examples for Traders

Trader | Stonebridge Capital Markets

Outline

Executed trades across equity and derivatives markets for a global asset management firm, supporting both client orders and proprietary trading activity.

Responsibilities

- Executed equity, index option, and futures trades across global exchanges

- Monitored real-time market data to identify trading opportunities

- Assessed portfolio risk and adjusted positions to align with risk limits

- Used Bloomberg and proprietary tools to model market scenarios

- Collaborated with analysts and portfolio managers on trade strategy

Achievements

- Generated £3.1M in profit during FY2022 through tactical index option trading

- Reduced slippage on high-volume trades by 22% via revised execution approach

- Played a key role in upgrading the internal order management system

Trader | Norridge FX Group

Outline

Managed daily FX trading desk operations for a boutique currency trading firm, focused on G10 pairs and emerging market currencies.

Responsibilities

- Placed spot, forward, and options trades based on macroeconomic analysis

- Maintained real-time exposure dashboards and P&L statements

- Executed trades on MT4 and Refinitiv FX platforms

- Communicated with liquidity providers and counterparties to secure best pricing

- Created technical analysis reports for internal and client use

Achievements

- Achieved 87% trade win rate over a 12-month period

- Improved average trade execution speed by 30% through new routing protocols

- Built automated alerts for economic data releases, improving reaction time

Trader | Leewood Investment Partners

Outline

Handled fixed income trading operations for a mid-sized hedge fund, executing trades in government bonds, ETFs, and interest rate derivatives.

Responsibilities

- Executed orders across Bloomberg TSOX and Tradeweb for bonds and related products

- Analysed yield curves and pricing discrepancies to identify arbitrage opportunities

- Managed daily reporting and trade reconciliation with back-office teams

- Coordinated with compliance to ensure trades met regulatory requirements

- Supported senior traders in portfolio hedging and risk calibration

Achievements

- Reduced error rate in trade bookings to near zero by developing a reconciliation checklist

- Increased trading desk efficiency by integrating Python-based trade log analysis

- Assisted with £250M bond repositioning project with minimal slippage

Presenting your education history

Your education section should reflect a solid academic foundation – especially in numerate or analytical subjects like finance, economics, maths, or statistics.

Start with your most recent qualifications and work backward. Include your degree(s), any relevant postgraduate study, and certifications like CFA or IMC where applicable. If you completed a dissertation or project related to trading or financial markets, it’s worth briefly referencing that too.

Best qualifications for a Trader

- BSc or MSc in Finance, Economics, Mathematics, or Statistics – These degrees provide the analytical base and market understanding needed in trading roles.

- CFA (Chartered Financial Analyst) – Highly regarded across trading and investment roles, especially for institutional positions.

- IMC (Investment Management Certificate) – Useful for traders working in asset management or regulated markets.

- Certificate in Derivatives or Technical Analysis – Strong additions for those focusing on options, futures, or technical trading strategies.

- Quantitative Finance or Data Science Courses – Ideal for algorithmic traders or those using quantitative models.