It’s no secret that investment banking is an extremely rewarding role. But breaking into this high-stakes world requires more than just ambition; it demands a CV that stands out like a blockbuster IPO.

Whether you’re looking to land a graduate analyst role or take the next step as an experienced associate, your CV needs to convince recruiters that you have what it takes to thrive in this competitive industry. This guide, complete with various Investment Banking CV examples, will enable you to do just that.

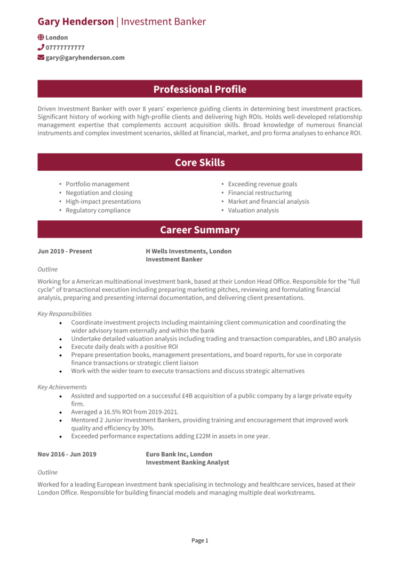

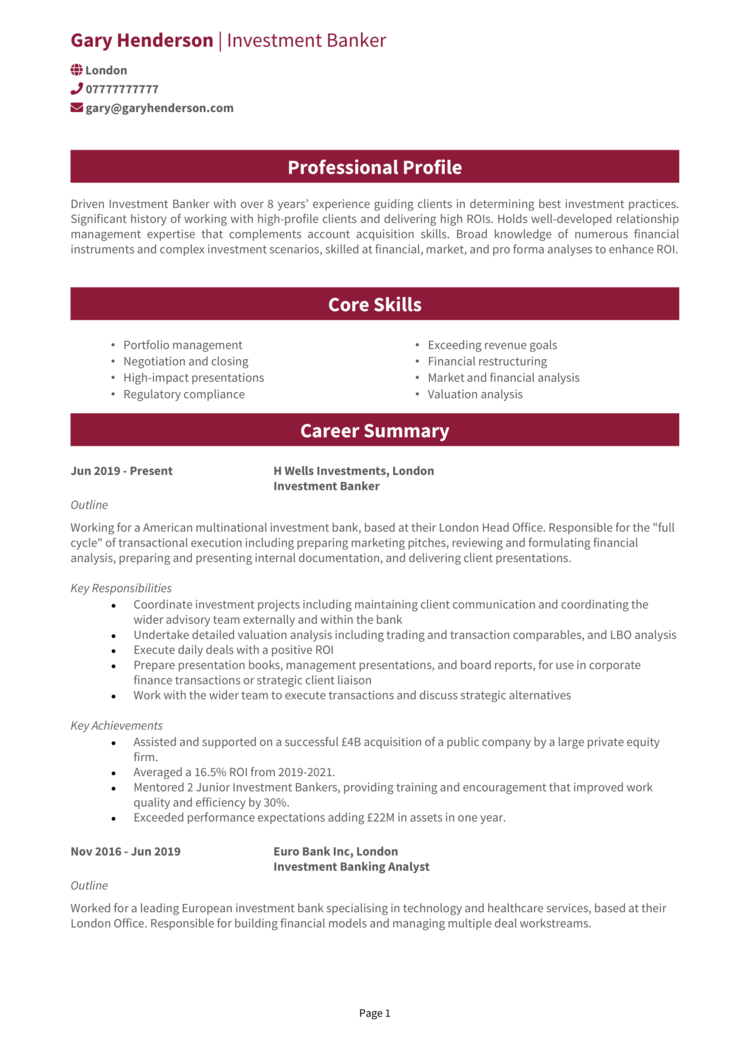

Investment Banker CV example

Trader CV example

Finance Analyst CV example

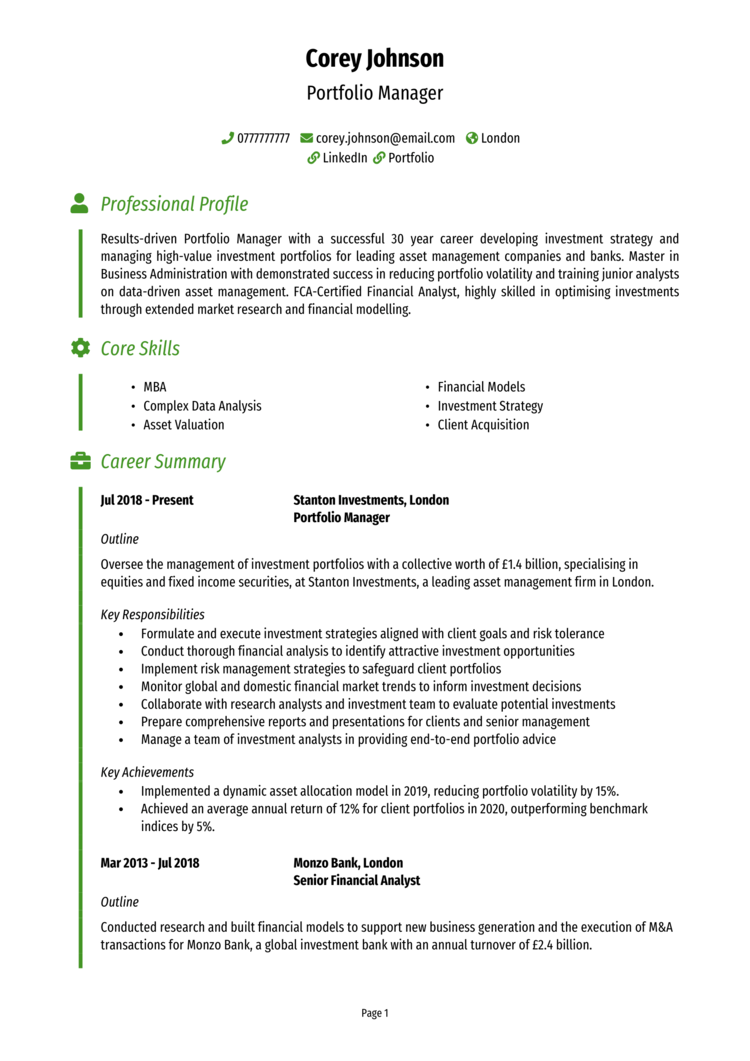

Portfolio Manager CV example

How to write your Investment Banking CV

Learn how to create your own interview-winning Investment Banking CV with this simple step-by-step guide.

This guide will take you step-by-step through writing an Investment Banking CV that highlights your analytical skills, financial acumen, and your ability to perform under pressure. From structuring your CV to showcasing the qualifications that make you a standout candidate, you’ll have everything you need to impress recruiters and advance your career.

Investment Banking CV structure

An investment banker’s CV will need to be as precise and professional as the models and presentations they produce. Recruiters will expect a clean, logical structure that highlights your education, experience, and core skills at a glance.

Here’s how to structure your Investment Banking CV:

- Name and contact details – Keep these at the top for easy access. A photo is optional.

- CV profile – Kick things off with a comprehensive summary of your career highlights, financial expertise, and key achievements.

- Core skills – Briefly list your prized technical and analytical abilities, such as financial modeling, risk analysis, and client relationship management.

- Work experience – Present your professional history in reverse chronological order: give more detail to the most recent roles.

- Education – List the qualifications and certificates that make you the right fit.

- Additional info – As an option, you can mention all the professional memberships and extracurriculars or interests that set you apart.

CV format for a role in Investment Banking

A cluttered or poorly designed CV can overshadow even the most impressive credentials: your application needs to be formatted in a way that lets a recruiter focus on what matters.

Keep it clean and easy to navigate, ensuring recruiters can quickly identify your skills and experience while reinforcing your organisation prowess. Key formatting tips include:

- Bullet points – Break down responsibilities and achievements into digestible details for recruiters.

- Divide sections – Use clear headings to make your CV logical and easy to scan.

- Use a professional font – Choose a font that is clear and readable, avoiding unnecessary embellishments and a difficult layout.

- No more than 2 pages – Provide enough space to highlight your expertise while keeping the recruiter engaged.

Writing an Investment Banking CV profile

Your CV profile is a really important investment pitch – clear, compelling, and designed to win over its audience immediately. It’s where you’ll show recruiters why you’re the perfect candidate, highlighting your experience and proven ability to navigate complex financial landscapes and deliver results.

Investment Banking CV profile examples

Profile 1

Organised Investment Banking Analyst with three years of experience in mergers and acquisitions. Skilled in financial modelling, conducting due diligence, and preparing detailed pitchbooks for high-value transactions. Proficient in Excel and Bloomberg Terminal to analyse market trends and create valuation models.

Profile 2

Dedicated Investment Banker with eight years of experience in capital markets, specialising in equity and debt financing. Adept at structuring deals, managing client relationships, and executing IPOs and bond issuances. Skilled in using FactSet and Power BI for market research and performance tracking.

Profile 3

Proficient Investment Banking Associate with five years of experience in private equity and asset management. Expertise in portfolio optimisation, financial planning, and conducting detailed risk assessments. Experienced in leveraging tools like Tableau and Python for data-driven decision-making and presentations.

What to include in your Investment Banking CV profile

Tailor your profile to the role, ensuring it reflects the key skills, qualifications, and industry experience the employer is looking for in this specific role.

Here’s what to include in your Investment Banking CV profile:

- Where you’ve worked – Mention notable financial institutions or the specific sector you’re specialised in.

- Your top qualifications – Include credentials like a CFA designation or relevant postgraduate degrees in finance or economics.

- Specialised skills – Mention whether you provide investment management or advice, handle trading, or work in the back office ensuring compliance.

- Transactions you’ve managed – Mention deal sizes, industries, or types of financial transactions, if applicable.

- Stakeholders you’ve worked with – Reference collaboration with clients, senior executives, or regulatory bodies.

- Software you know – Make a note of the most important software that proves you’d be able to handle the role.

Core skills section

With just a column or two of bullet points, the core skills section will outline what precisely it is that makes you the ideal candidate. Research the job specification and information about the role you’re after, and tailor this section well.

Focus on substantive skills rather than generic traits, ensuring each point aligns with the demands of the role.

Breaking into investment banking and need a strong CV?

With our CV builder, you’ll get professional templates, pre-written financial content, and expert guidance to craft a CV that makes an impact.

Top skills for your Investment Banking CV

- Financial Modelling – Building complex valuation models for mergers, acquisitions, and investment analysis.

- Equity and Debt Capital Markets – Advising on IPOs, private placements, and debt issuance strategies.

- Risk Assessment – Evaluating market, credit, and operational risks to inform strategic decisions.

- Mergers and Acquisitions (M&A) – Conducting due diligence and financial analysis to facilitate successful transactions.

- Portfolio Management – Optimising asset allocations and tracking performance to achieve client objectives.

- Regulatory Compliance – Ensuring adherence to financial regulations and legal standards across jurisdictions.

- Data Analysis – Leveraging tools like Excel and Bloomberg to identify trends and opportunities.

- Presentation Development – Crafting clear and compelling pitchbooks and client presentations.

- Client Relationship Management – Maintaining strong professional relationships to secure repeat business and referrals.

- Market Research – Analysing economic trends and industry developments to inform investment strategies.

Outlining your work experience

Your work experience section is where you demonstrate your ability to thrive in the demanding environment of investment banking. Highlight your contributions to major transactions, your role in managing client relationships, and your capacity for delivering results under pressure: these are all things the recruiter wants from their future employee.

List your positions in reverse chronological order, starting with the most recent. Focus on the scale and impact of your work, emphasising achievements that align with the specific investment banking role you’re targeting.

Formatting your job history for your CV

- Outline – Briefly describe the organisation, your role, and the type of financial activities you engaged in.

- Responsibilities – Highlight tasks such as financial modelling, transaction management, or client advisory. Use strong action verbs like “negotiated,” “managed,” or “evaluated.”

- Achievements – Quantify your successes, such as closing deals worth specific amounts or increasing client acquisition rates. Numbers and measurable results always make a stronger impression.

Example jobs for Investment Banking

Analyst | Pierce Investments

Outline

Worked as an Analyst in a leading investment bank’s mergers and acquisitions division, providing financial analysis and strategic advice for corporate transactions. Focused on delivering accurate valuations and facilitating smooth deal execution.

Responsibilities

- Prepared detailed financial models, including DCF, LBO, and comparable company analyses.

- Conducted market research and competitor analysis to support client transactions.

- Assisted in drafting pitchbooks and presentations for client meetings.

- Performed due diligence to identify risks and opportunities in potential deals.

- Collaborated with senior bankers to structure and execute mergers, acquisitions, and divestitures.

Achievements

- Contributed to the successful closure of three deals worth over £300M collectively.

- Improved the efficiency of financial models, reducing preparation time by 25%.

- Recognised by senior management for producing high-quality pitch materials.

Associate | Global Banking

Outline

Served as an Associate in the capital markets division of a global investment bank, focusing on equity and debt financing. Played a key role in structuring and executing deals to meet client financing needs.

Responsibilities

- Developed and presented client proposals for IPOs, bond issuances, and private placements.

- Coordinated with legal teams, auditors, and underwriters to ensure compliance during transactions.

- Performed credit analysis and assessed market conditions to optimise deal timing and structure.

- Built and maintained relationships with institutional investors and corporate clients.

- Prepared detailed post-transaction reports and performance analyses for stakeholders.

Achievements

- Executed three IPOs and two bond issuances, raising over £500M in capital.

- Increased investor participation by 20% through targeted outreach strategies.

- Streamlined post-transaction reporting processes, saving 10 hours per project.

Investment Banking Analyst | Aldridge Equity

Outline

Worked as an Investment Banking Analyst in the private equity team, focusing on identifying investment opportunities and managing client portfolios. Delivered comprehensive market insights and financial analyses to support investment decisions.

Responsibilities

- Conducted industry research and identified high-potential investment opportunities.

- Prepared detailed investment memorandums and financial due diligence reports.

- Built complex financial models to assess the performance of portfolio companies.

- Monitored market trends and macroeconomic indicators to inform investment strategies.

- Collaborated with senior associates to develop exit strategies for investments.

Achievements

- Identified an undervalued acquisition target, contributing to a £50M profit for clients.

- Reduced analysis turnaround times by 20% through automation of key processes.

- Recognised as a top-performing analyst for consistently delivering actionable insights.

Education section

The education section is critical for investment banking roles, as it demonstrates your foundational knowledge and long-standing commitment to the field.

For candidates newer to the field, emphasise relevant academic projects, internships, or extracurricular activities that demonstrate your potential. For most candidates, this is a brief but impactful section.

List your qualifications in reverse chronological order, starting with the most recent.

Qualifications recruiters look for in Investment Banking CVs

- Chartered Financial Analyst (CFA) – A globally recognised certification demonstrating expertise in investment management and financial analysis.

- Bachelor’s Degree in Finance, Economics, or Business – Provides a strong academic foundation for understanding financial markets and operations.

- Master of Business Administration (MBA) – Offers advanced training in leadership and financial decision-making, highly valued for senior roles.

- Financial Risk Manager (FRM) Certification – Focuses on identifying and mitigating risks in financial systems.

- Certified Investment Management Analyst (CIMA) – Demonstrates proficiency in portfolio construction and asset allocation.