If you’re looking for an important position as a KYC (Know Your Customer) analyst, then you first need to help potential employers get to know you.

To do this, you need an engaging and persuasive application that showcases your skill set and experience in the industry.

But if there seems to be a trend in your applications being rejected, let us help. Using our expert advice and KYC analyst CV example below, find out how to create an interview-winning CV.

|

KYC Analyst CV example

This CV example showcases the optimal structure and format for your KYC Analyst CV, providing a pleasant reading experience for busy recruiters.

It also demonstrates the skills, experience and qualifications you should emphasize in your own CV to increase your chances of landing job interviews.

KYC Analyst CV format and structure

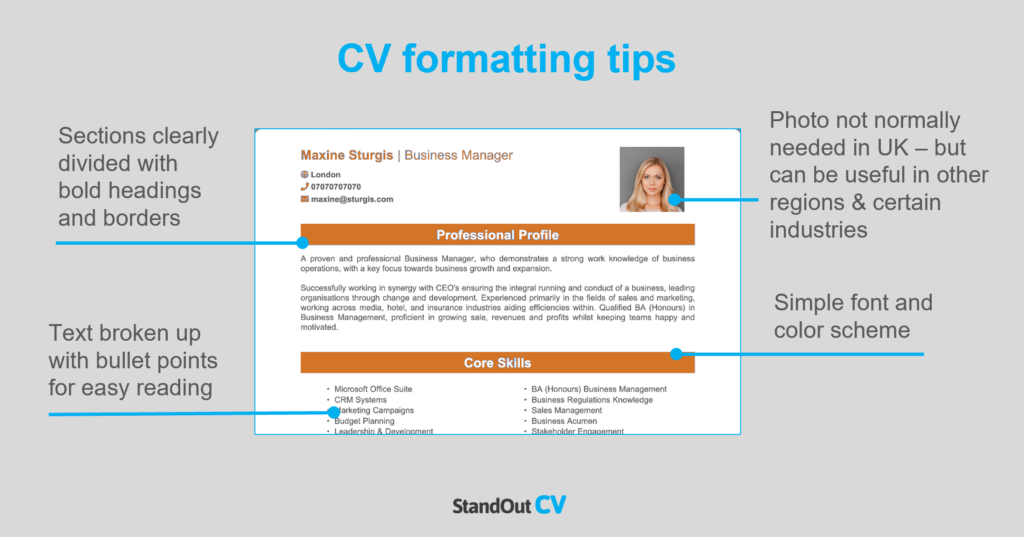

If you focus purely on the written content of your CV but ignore the style and layout, your efforts could end up wasted.

No matter how suitable you are for the role, no recruiter wants to spend time squinting and trying to navigate a badly designed and disorganised CV.

Instead, make sure to organise your content into a simple structure and spend some time formatting it for ease of reading – it will ensure every recruiter and hiring manager can read your CV with ease.

Tips for formatting your KYC Analyst CV

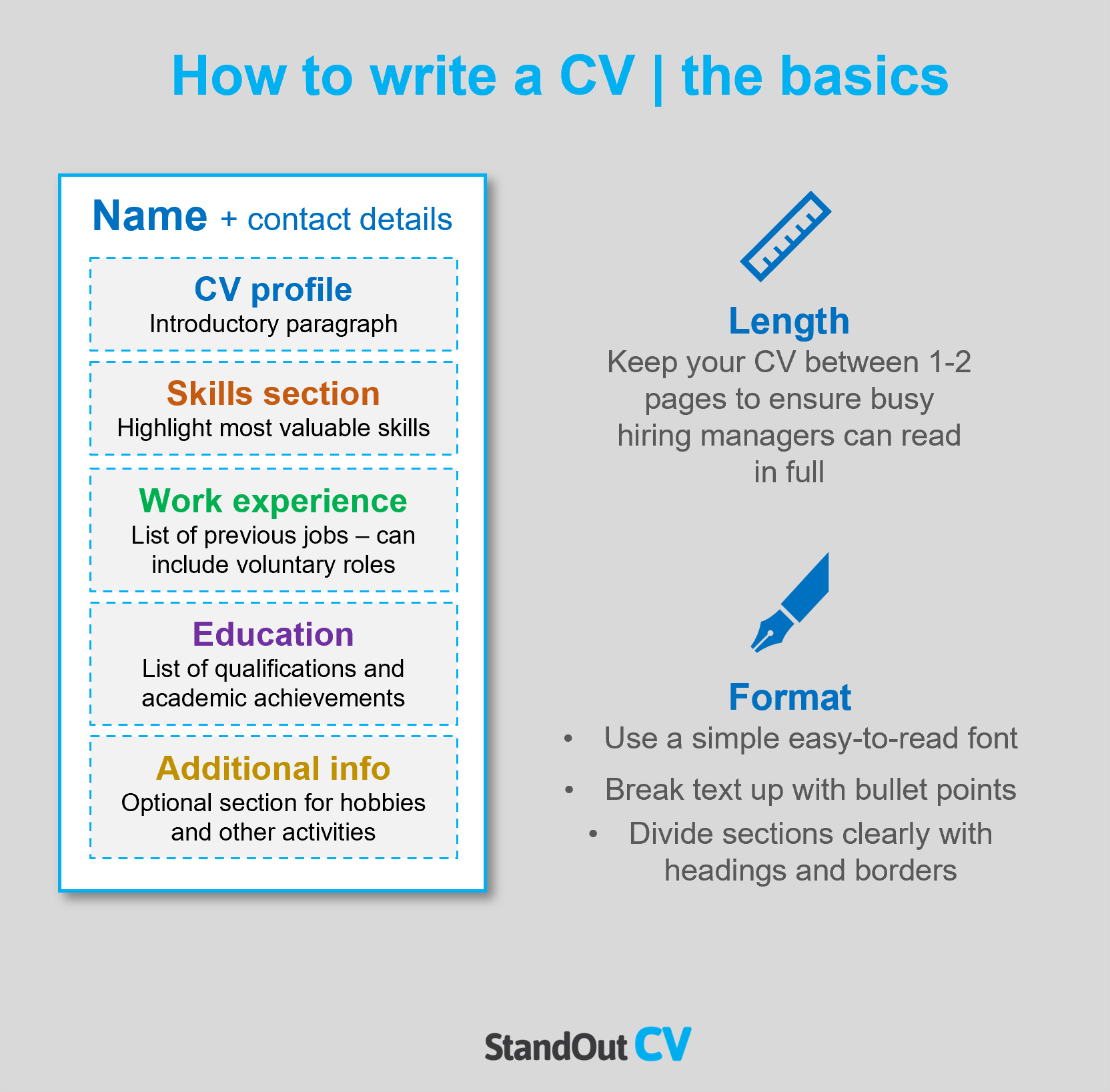

- Length: Whether you’ve got one year or three decades of experience, your CV should never be more than two sides of A4. Recruiters are busy people who’re often juggling numerous roles and tasks, so they don’t have time to read lengthy applications. If you’re a recent graduate or don’t have much industry experience, one side of A4 is fine.

- Readability: Make sure your CV is easy to read and looks professional by applying some simple formatting tricks. Bullet points are great for making large paragraphs more digestible, while formatting your headings with bold or coloured text will help the reader to find the information they need, with speed.

- Design & format: While it’s okay to add your own spin to your CV, avoid overdoing the design. If you go for something elaborate, you might end up frustrating recruiters who, above anything, value simplicity and clarity.

- Photos: Don’t add profile photos to your CV unless you work in an industry or region which prefers to see them. Most employers in the UK will not need to see one.

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

CV structure

When writing your CV, break up the content into the following key sections, to ensure it can be easily digested by busy recruiters and hiring managers:

- Contact details – Always list these at the very top of your CV – you don’t want them to be missed!

- Profile – An introductory paragraph, intended to grab recruiters attention and summarise your offering.

- Work experience / career history – Working from your current role and working backwards, list your relevant work experience.

- Education – Create a snappy summary of your education and qualifications.

- Interest and hobbies – An optional section to document any hobbies that demonstrate transferable skills.

Now you understand the basic layout of a CV, here’s what you should include in each section of yours.

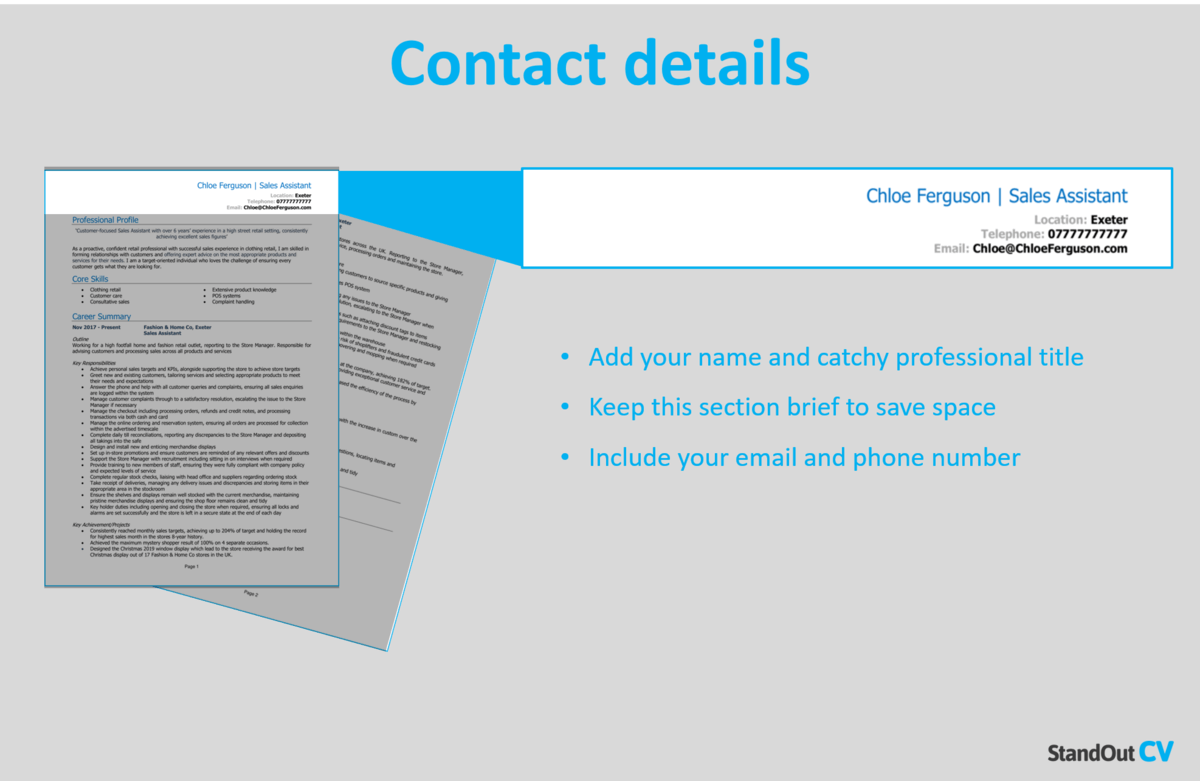

Contact Details

Write your contact details in the top corner of your CV, so that they’re easy to find but don’t take up too much space.

You only need to list your basic details, such as:

- Mobile number

- Email address

- Location – Don’t list your full address. Your town or city, such as ‘Norwich’ or ‘Coventry’ is perfect.

- LinkedIn profile or portfolio URL – Remember to update these before listing them on an application.

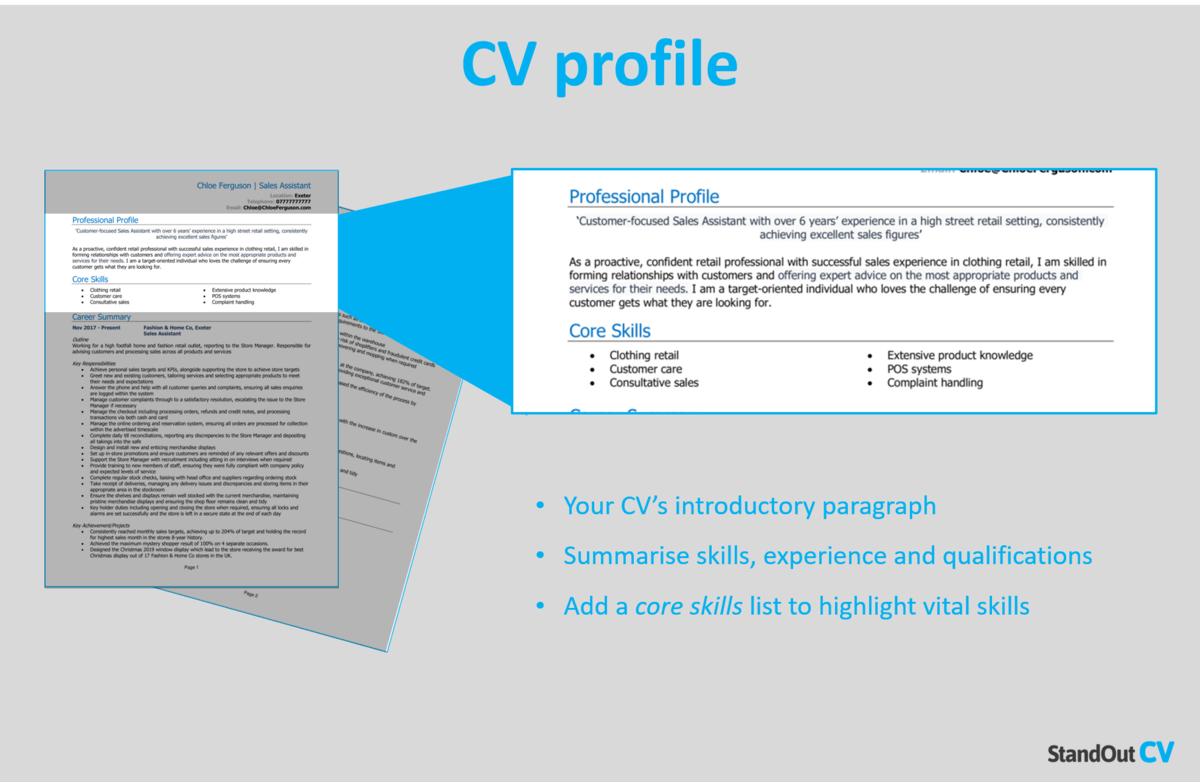

KYC Analyst CV Profile

Make a strong first impression with recruiters by starting your CV with an impactful profile (or personal statement for junior applicants).

This short introduction paragraph should summarise your skills, experience, and knowledge, highlighting your suitability for the job.

It should be compelling enough to encourage recruiters to read through the rest of your CV.

How to write a good CV profile:

- Make it short and sharp: Recruiters are busy, so to ensure your profile is actually read, it’s best to keep it short and snappy. 3-5 punchy lines makes for the perfect profile.

- Tailor it: Recruiters can spot a generic, mass-produced CV at a glance – and they certainly won’t be impressed! Before you write your profile (and CV as a whole), read through the job advert and make a list of any skills, knowledge and experience required. You should then incorporate your findings throughout your profile and the rest of your CV.

- Don’t add an objective: Want to talk about your career goals and objectives? While the profile may seem like a good space to do so, they’re actually much better suited to your cover letter.

- Avoid generic phrases: Cheesy clichès and generic phrases won’t impress recruiters, who read the same statements several times per day. Impress them with your skill-set, experience and accomplishments instead!

Example CV profile for KYC Analyst

What to include in your KYC Analyst CV profile?

- Experience overview: Recruiters will want to know what type of companies you’ve worked for, industries you have knowledge of, and the type of work you’ve carried out in the past, so give them a summary of this in your profile.

- Targeted skills: Make your most relevant Know Your Customer Analyst key skills clear in your profile. These should be tailored to the specific role you’re applying for – so make sure to check the job description first, and aim to match their requirements as closely as you can.

- Important qualifications: If you have any qualifications which are highly relevant to KYC Analyst jobs, then highlight them in your profile so that employers do not miss them.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

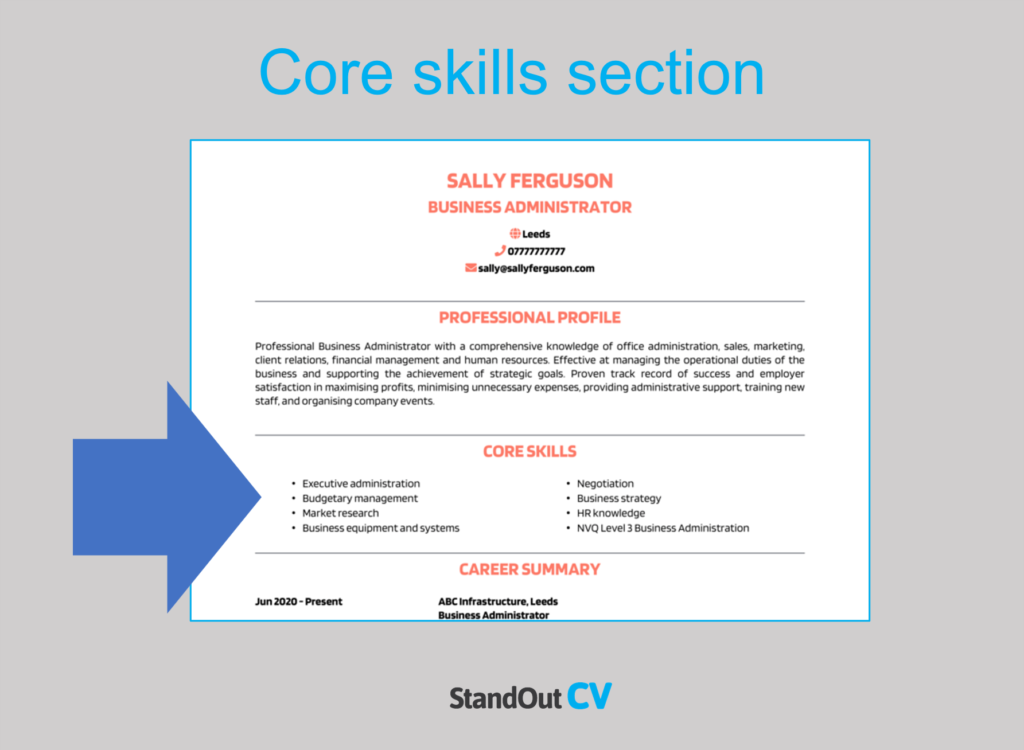

Core skills section

Create a core skills section underneath your profile to spotlight your most in-demand skills and grab the attention of readers.

This section should feature 2-3 columns of bullet points that emphasise your applicable skills for your target jobs. Before constructing this section, review the job description and compile a list of any specific skills, specialisms, or knowledge required.

Important skills for your KYC Analyst CV

Regulatory Compliance – Maintaining a deep understanding of UK and international regulations, such as Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, to ensure compliance in customer due diligence.

Customer Due Diligence (CDD) – Conducting thorough investigations and risk assessments of customers to verify their identities and assess potential risks.

AML Software – Using AML and KYC software tools and platforms to automate customer screening and identity verification processes.

Document Verification – Assessing and authenticating identification documents, including passports, driver’s licenses, and utility bills.

Risk Assessment – Evaluating the risk associated with customer relationships and transactions, including understanding risk factors and creating risk profiles.

Transaction Monitoring – Monitoring and analysing customer transactions for suspicious activity or unusual patterns and reporting any findings to compliance officers.

Data Analysis – Using data analysis tools and techniques to identify anomalies and trends in customer data and transaction records.

Stakeholder Communication – Liaising with clients, internal teams, and regulatory authorities while documenting findings and recommendations.

Customer Relationship Management (CRM) – Utilising CRM systems to maintain accurate customer records and ensure efficient communication and collaboration within the organization.

Auditing and Reporting – Conducting internal audits, generating reports, and presenting findings to senior management and regulatory bodies.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

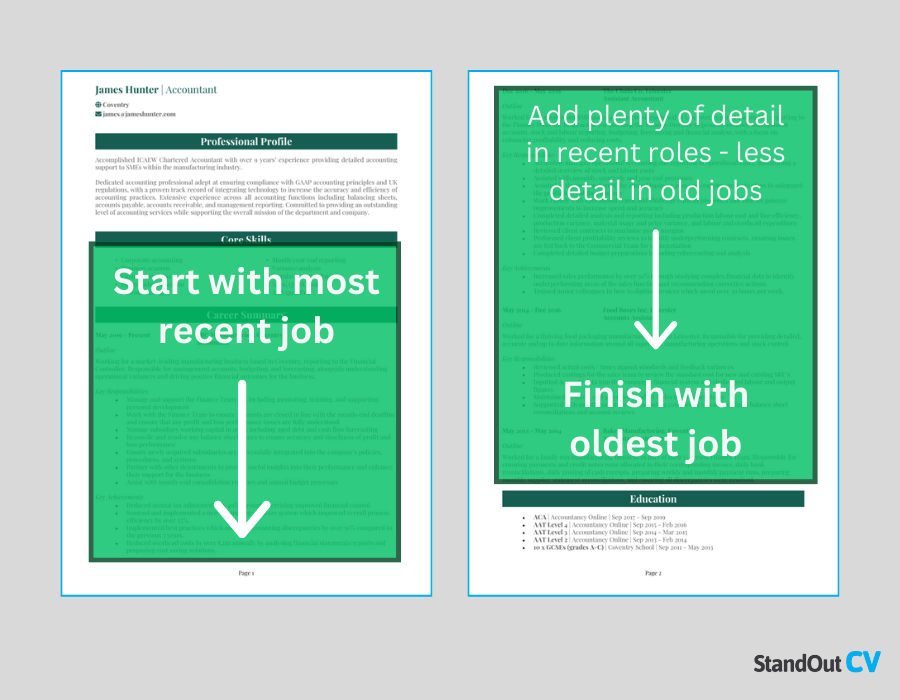

Work experience

Next up is your work experience section, which is normally the longest part of your CV.

Start with your current (or most recent) job and work your way backwards through your experience.

Can’t fit all your roles? Allow more space for your recent career history and shorten down descriptions for your older roles.

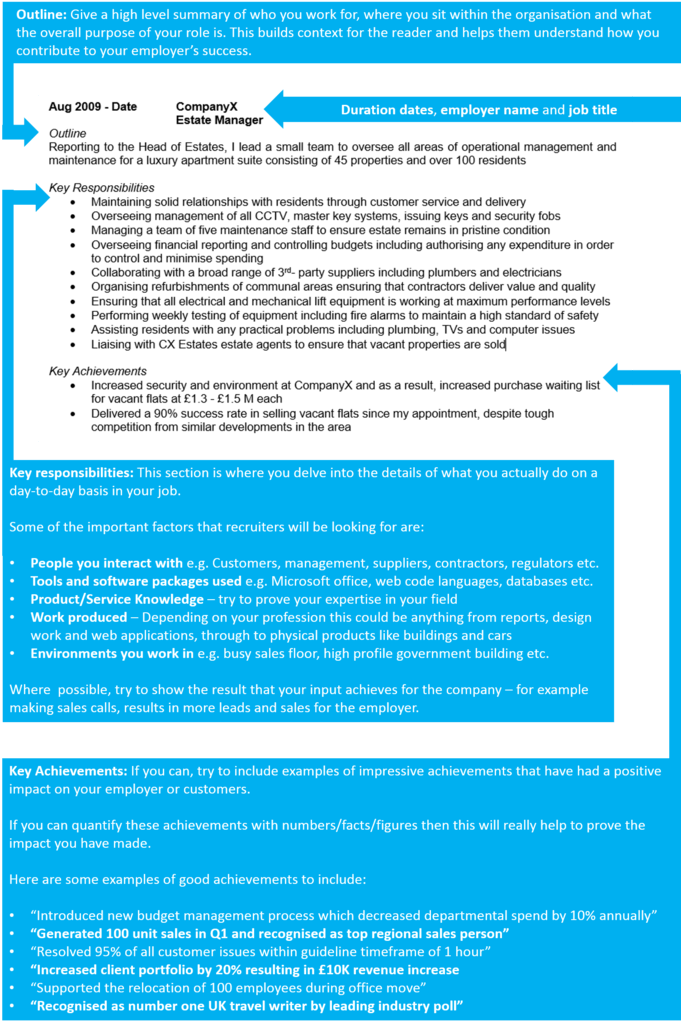

Structuring each job

Recruiters will be keen to gain a better idea of where you’ve worked and how you apply your skill-set in the workplace.

However, if they’re faced with huge, hard-to-read paragraphs, they may just gloss over it and move onto the next application.

To avoid this, use the simple 3-step role structure, as shown below:

Outline

Provide a brief overview of the job as a whole, such as what the overriding purpose of your job was and what type of company you worked for.

Key responsibilities

Using easy-to-read bullet points, note down your day-to-day responsibilities in the role.

Make sure to showcase how you used your hard sector skills and knowledge.

Key achievements

To finish off each role and prove the impact you made, list 1-3 stand out achievements, results or accomplishments.

This could be anything which had a positive outcome for the company you worked for, or perhaps a client/customer. Where applicable, quantify your examples with facts and figures.

Sample job description for KYC Analyst CV

Outline

Conduct comprehensive KYC reviews on new and existing customers of MoneyPot, an innovative online banking application worth £45M.

Key Responsibilities

- Perform comprehensive CDD assessments on new customers to verify their identities, assess risk levels, and ensure compliance with AML/KYC regulations

- Execute thorough EDD procedures on high-risk customers, analysing complex transaction patterns and identifying potential financial crimes

- Develop, implement, and regularly update KYC policies and procedures to align with evolving regulatory requirements

- Continuously monitor customer transactions for suspicious activities, analyse trends, and promptly report findings to relevant authorities

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

At the bottom of your CV is your full education section. You can list your formal academic qualifications, such as:

- Degree

- GCSE’s

- A levels

As well as any specific KYC Analyst qualifications that are essential to the jobs you are applying for.

Note down the name of the qualification, the organisation at which you studied, and the date of completion.

Hobbies and interests

Although this is an optional section, it can be useful if your hobbies and interests will add further depth to your CV.

Interests which are related to the sector you are applying to, or which show transferable skills like leadership or teamwork, can worth listing.

On the other hand, generic hobbies like “going out with friends” won’t add any value to your application, so are best left off your CV.

Once you’ve written your Know Your Customer Analyst CV, you should proofread it several times to ensure that there are no typos or grammatical errors.

With a tailored punchy profile that showcases your relevant experience and skills, paired with well-structured role descriptions, you’ll be able to impress employers and land interviews.

Good luck with your next job application!