Can you help companies to make smart financial decisions and prepare for potential deals?

Then you need a CV that showcases your research, financial and analytical skills and can help you seal the deal with the recruiter.

If you’re not sure how to create an engaging application, this guide is for you. Check out our top tips below, along with a mergers and acquisitions analyst CV example.

|

M&A Analyst CV example

This CV example illustrates the ideal structure and format for your M&A Analyst CV, making it easy for busy hiring managers to quickly identify your suitability for the jobs you’re applying for,

It also gives some guidance on the skills, experience and qualifications you should emphasise in your own CV.

M&A Analyst CV format and structure

In today’s fast-paced job market, recruiters and employers are often short on time. If they can’t locate the information they’re searching for within a few seconds, it could result in them overlooking your application.

To avoid this happening, it’s critical to structure and format your CV in a way that allows them to quickly identify your key skills and offerings, even when they’re pressed for time.

Tips for formatting your M&A Analyst CV

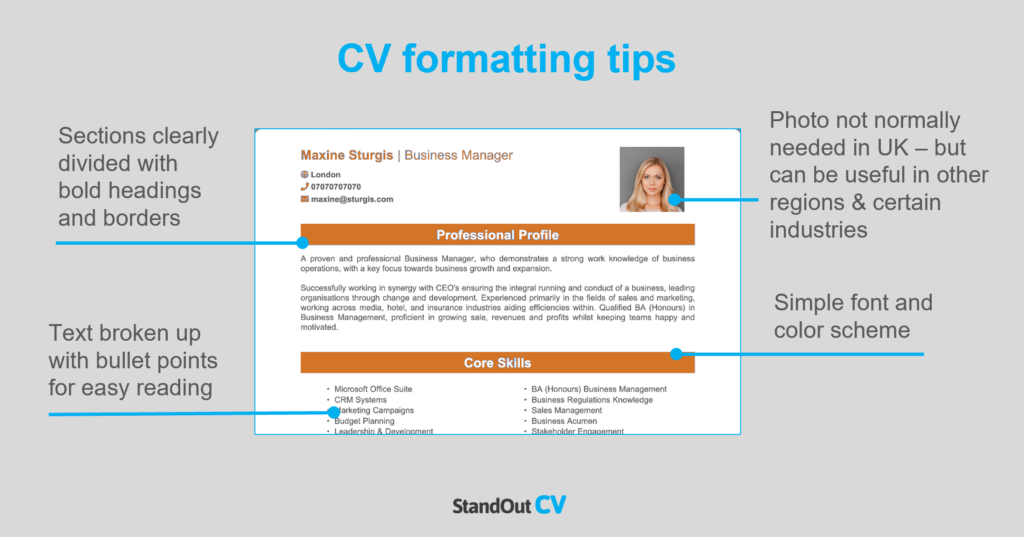

- Length: Whether you’ve got one year or three decades of experience, your CV should never be more than two sides of A4. Recruiters are busy people who’re often juggling numerous roles and tasks, so they don’t have time to read lengthy applications. If you’re a recent graduate or don’t have much industry experience, one side of A4 is fine.

- Readability: To help busy recruiters scan through your CV, make sure your section headings stand out – bold or coloured text works well. Additionally, try to use bullet points wherever you can, as they’re far easier to skim through than huge paragraphs. Lastly, don’t be afraid of white space on your CV – a little breathing space is great for readability.

- Design & format: When it comes to CV design, it’s best to keep things simple and sleek. While elaborate designs certainly command attention, it’s not always for the right reasons! Readability is key, so whatever you choose to do, make sure you prioritise readability above everything.

- Photos: Don’t add profile photos to your CV unless you work in an industry or region which prefers to see them. Most employers in the UK will not need to see one.

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

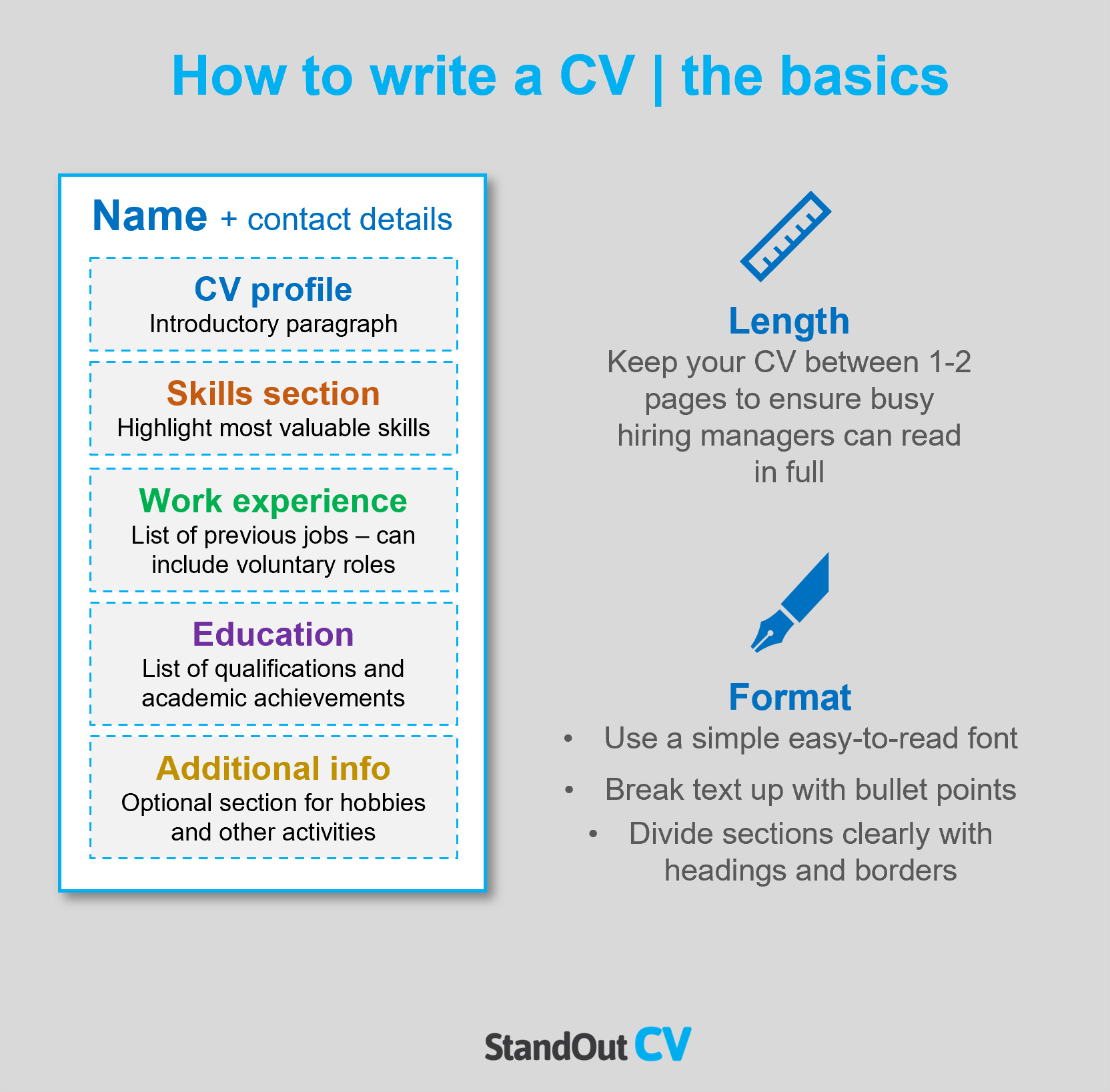

CV structure

When writing your CV, break up the content into the following key sections, to ensure it can be easily digested by busy recruiters and hiring managers:

- Contact details – Always list these at the very top of your CV – you don’t want them to be missed!

- Profile – An introductory paragraph, intended to grab recruiters attention and summarise your offering.

- Work experience / career history – Working from your current role and working backwards, list your relevant work experience.

- Education – Create a snappy summary of your education and qualifications.

- Interest and hobbies – An optional section to document any hobbies that demonstrate transferable skills.

Now you understand the basic layout of a CV, here’s what you should include in each section of yours.

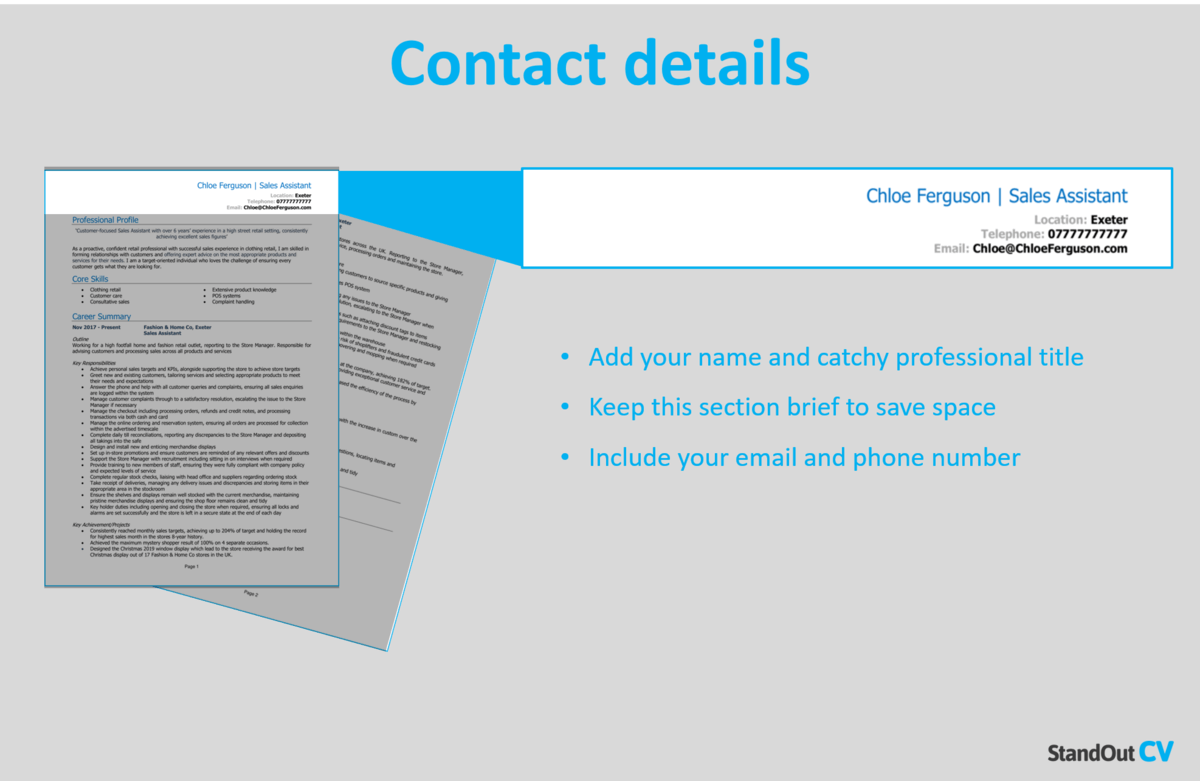

Contact Details

Kick-start your CV with your contact details, so recruiters can get in touch easily.

Here’s what you should include:

- Mobile number

- Email address – Make sure it’s professional, with no silly nicknames.

- Location – Your town or city is sufficient, rather than a full address.

- LinkedIn profile or portfolio URL – Ensure they’ve been updated and are looking slick and professional.

Quick tip: Avoid listing your date of birth, marital status or other irrelevant details – they’re unnecessary at this stage.

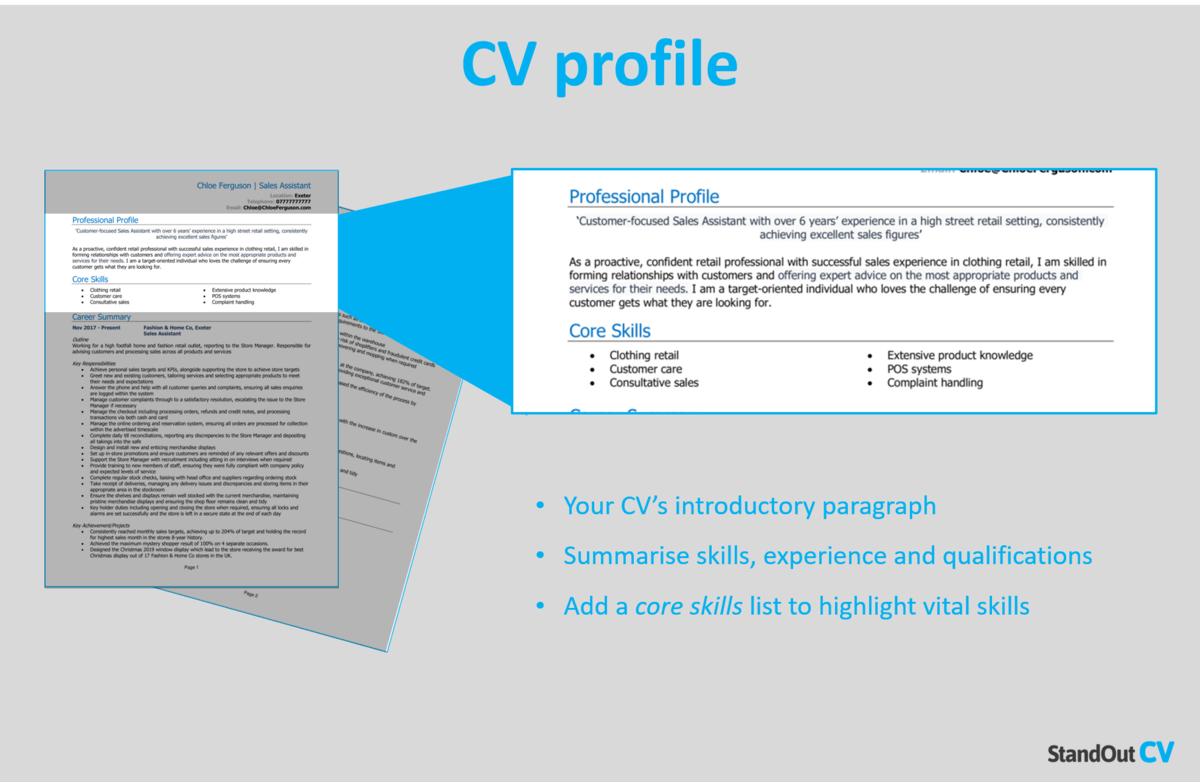

M&A Analyst CV Profile

Grab the reader’s attention by kick-starting your CV with a powerful profile (or personal statement, if you’re a junior applicant).

This is a short introduction paragraph which summarises your skills, knowledge and experience.

It should paint you as the perfect match for the job description and entice recruiters to read through the rest of your CV.

How to write a good CV profile:

- Make it short and sharp: Recruiters have piles of CVs to read through and limited time to dedicate to each, so it pays to showcase your abilities in as few words as possible. 3-4 lines is ideal.

- Tailor it: If recruiters don’t see your suitability within a few seconds, they may close your CV straight away. Your CV profile should closely match the essential requirements listed in the job ad, so make sure to review them before you write it.

- Don’t add an objective: Want to talk about your career goals and objectives? While the profile may seem like a good space to do so, they’re actually much better suited to your cover letter.

- Avoid generic phrases: Cheesy clichès and generic phrases won’t impress recruiters, who read the same statements several times per day. Impress them with your skill-set, experience and accomplishments instead!

Example CV profile for M&A Analyst

What to include in your M&A Analyst CV profile?

- Experience overview: Demonstrate your suitability for your target jobs by giving a high level summary of your previous work work experience, including the industries you have worked in, types of employer, and the type of roles you have previous experience of.

- Targeted skills: Highlight your skills which are most relevant to M&A (mergers and acquisitions) Analyst jobs, to ensure that recruiters see your most in-demand skills as soon as they open your CV.

- Important qualifications: If the jobs you are applying to require candidates to have certain qualifications, then you must add them in your profile to ensure they are seen by hiring managers.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

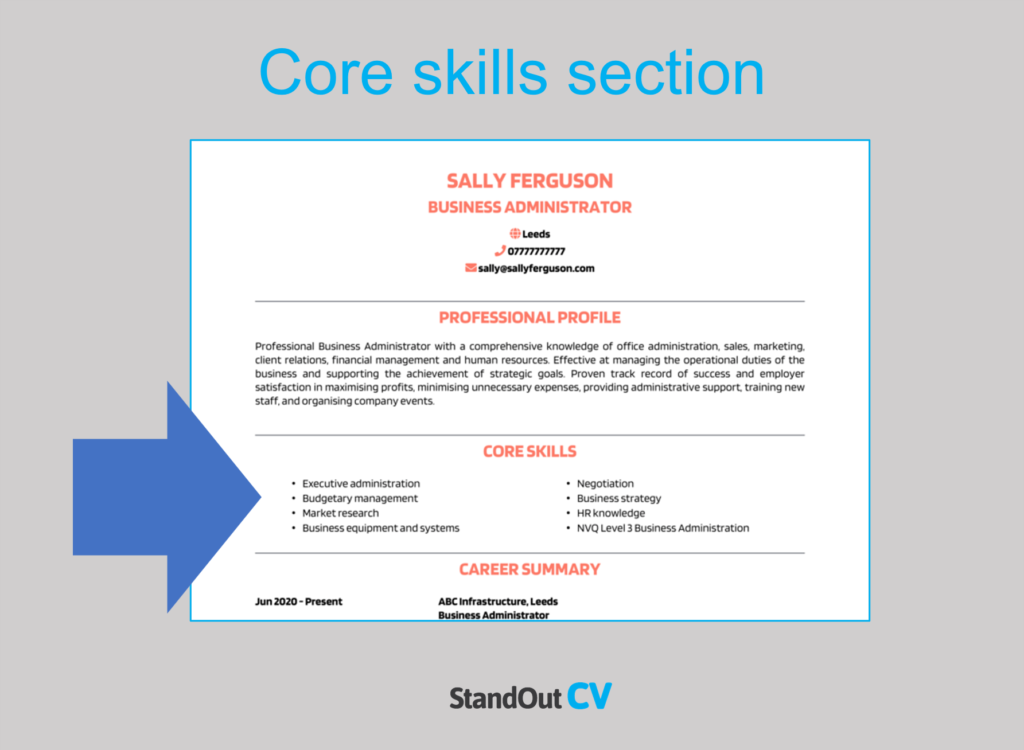

Core skills section

Next, you should create a bullet pointed list of your core skills, formatted into 2-3 columns.

Here, you should focus on including the most important skills or knowledge listed in the job advertisement.

This will instantly prove that you’re an ideal candidate, even if a recruiter only has time to briefly scan your CV.

Important skills for your M&A Analyst CV

Financial Modelling – Building complex financial models to evaluate the financial feasibility and impact of potential M&A transactions.

Valuation Techniques – Using valuation methods such as discounted cash flow (DCF), comparable company analysis (comps), and precedent transactions to determine the fair value of target companies.

Due Diligence – Conducting thorough due diligence, including reviewing financial statements, legal documents, and market research, to assess risks and opportunities in M&A deals.

Financial Analysis – Analysing financial statements, including income statements, balance sheets, and cash flow statements, to assess a target company’s financial health and performance.

Deal Structuring – Structuring M&A transactions, including consideration of tax implications, financing options, and legal agreements.

Market Research – Conducting market research to assess industry trends, competitive landscape, and potential growth opportunities related to M&A targets.

Data Analysis – Using data analysis tools and software, such as Excel or financial modeling software, to extract insights and support decision-making.

Legal and Regulatory Knowledge – Maintaining familiarity with relevant UK laws, regulations, and compliance requirements related to M&A transactions, including corporate governance and antitrust regulations.

Communication and Presentation – Preparing comprehensive reports, presentations, and memoranda to communicate findings and recommendations to senior management and stakeholders.

Negotiation – Using negotiation techniques and strategies to assist in deal negotiations, including price and terms, with a focus on achieving favourable outcomes for the organisation.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

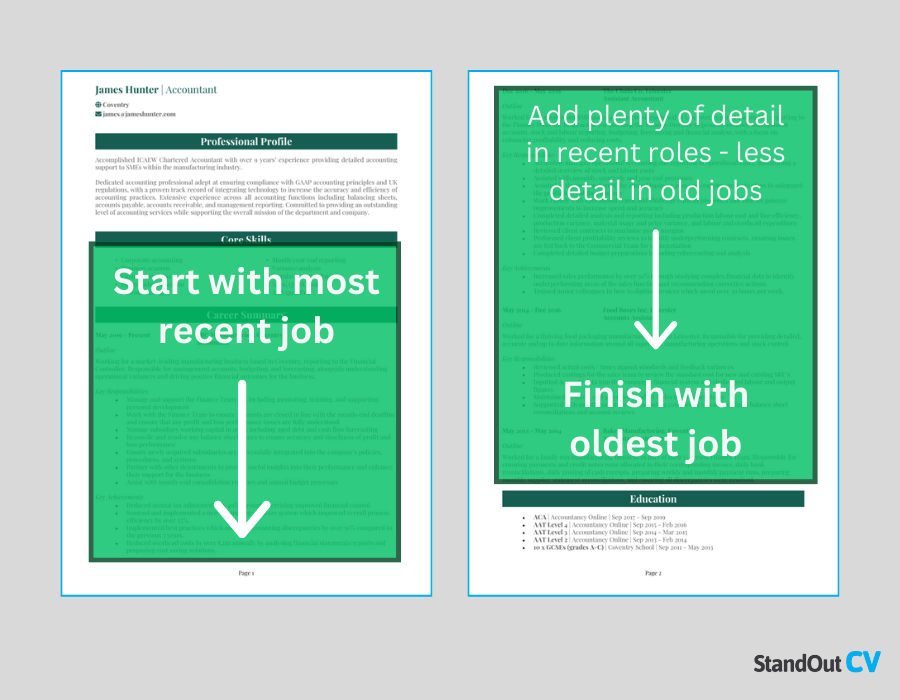

Work experience

By now, you’ll have hooked the reader’s attention and need to show them how you apply your skills and knowledge in the workplace, to benefit your employers.

So, starting with your most recent role and working backwards to your older roles, create a thorough summary of your career history to date.

If you’ve held several roles and are struggling for space, cut down the descriptions for your oldest jobs.

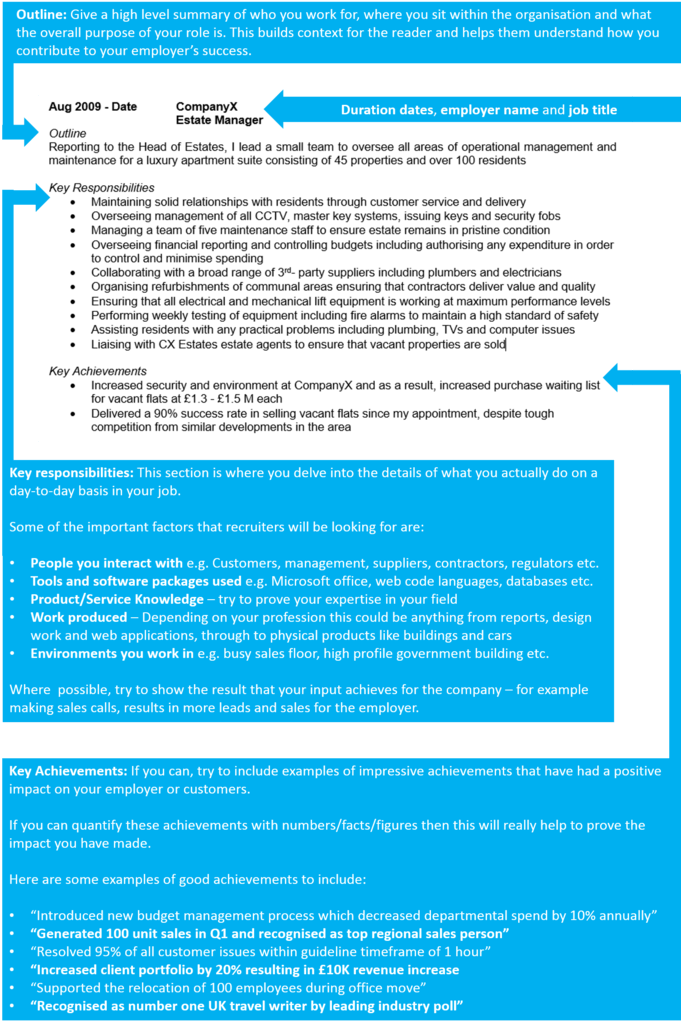

Structuring each job

Lengthy, unbroken chunks of text is a recruiters worst nightmare, but your work experience section can easily end up looking like that if you are not careful.

To avoid this, use my tried-and-tested 3-step structure, as illustrated below:

Outline

Start with a solid introduction to your role as a whole, in order to build some context.

Explain the nature of the organisation you worked for, the size of the team you were part of, who you reported to and what the overarching purpose of your job was.

Key responsibilities

Follow with a snappy list of bullet points, detailing your daily duties and responsibilities.

Tailor it to the role you’re applying for by mentioning how you put the target employer’s desired hard skills and knowledge to use in this role.

Key achievements

Lastly, add impact by highlight 1-3 key achievements that you made within the role.

Struggling to think of an achievement? If it had a positive impact on your company, it counts.

For example, you might increased company profits, improved processes, or something simpler, such as going above and beyond to solve a customer’s problem.

Sample job description for M&A Analyst CV

Outline

Examine and facilitate mergers and acquisitions, divestitures, and other corporate transactions, for one of the world’s most prominent international banks that provides a wide range of financial products and services to individuals, businesses, and institutions across the globe.

Key Responsibilities

- Conduct thorough fiscal analysis of statements, historical performance, and future projections to determine any risks.

- Utilise various valuation methodologies, such as discounted income and CCA to ascertain the fair appraisal of companies or assets.

- Develop robust models to weigh the impact of different contracts and scenarios on the metrics of combined entities.

- Help with due diligence processes, including reviewing legal documents, contracts, and statutory compliance.

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

Although there should be mentions of your highest and most relevant qualifications earlier on in your CV, save your exhaustive list of qualifications for the bottom.

If you’re an experienced candidate, simply include the qualifications that are highly relevant to M&A Analyst roles.

However, less experienced candidates can provide a more thorough list of qualifications, including A-Levels and GCSEs.

You can also dedicate more space to your degree, discussing relevant exams, assignments and modules in more detail, if your target employers consider them to be important.

Hobbies and interests

Although this is an optional section, it can be useful if your hobbies and interests will add further depth to your CV.

Interests which are related to the sector you are applying to, or which show transferable skills like leadership or teamwork, can worth listing.

On the other hand, generic hobbies like “going out with friends” won’t add any value to your application, so are best left off your CV.

An interview-winning CV for a M&A (mergers and acquisitions) Analyst role, needs to be both visually pleasing and packed with targeted content.

Whilst it needs to detail your experience, accomplishments and relevant skills, it also needs to be as clear and easy to read as possible.

Remember to research the role and review the job ad before applying, so you’re able to match yourself up to the requirements.

If you follow these guidelines and keep motivated in your job search, you should land an interview in no time.

Best of luck with your next application!