Banking is all about trust, precision, and managing money like a pro. But before you can crunch numbers or make deals, you need to secure your own investment – a solid CV that shows hiring managers you’ve got what it takes.

This guide, featuring Banking CV examples, will walk you through writing a CV that showcases your financial expertise and commitment to delivering results. Your new CV will open doors to your next big opportunity in the banking world.

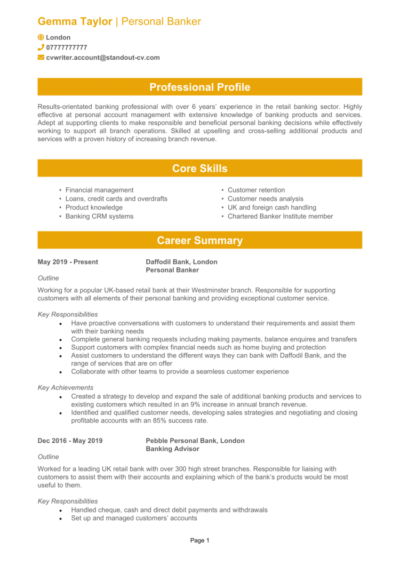

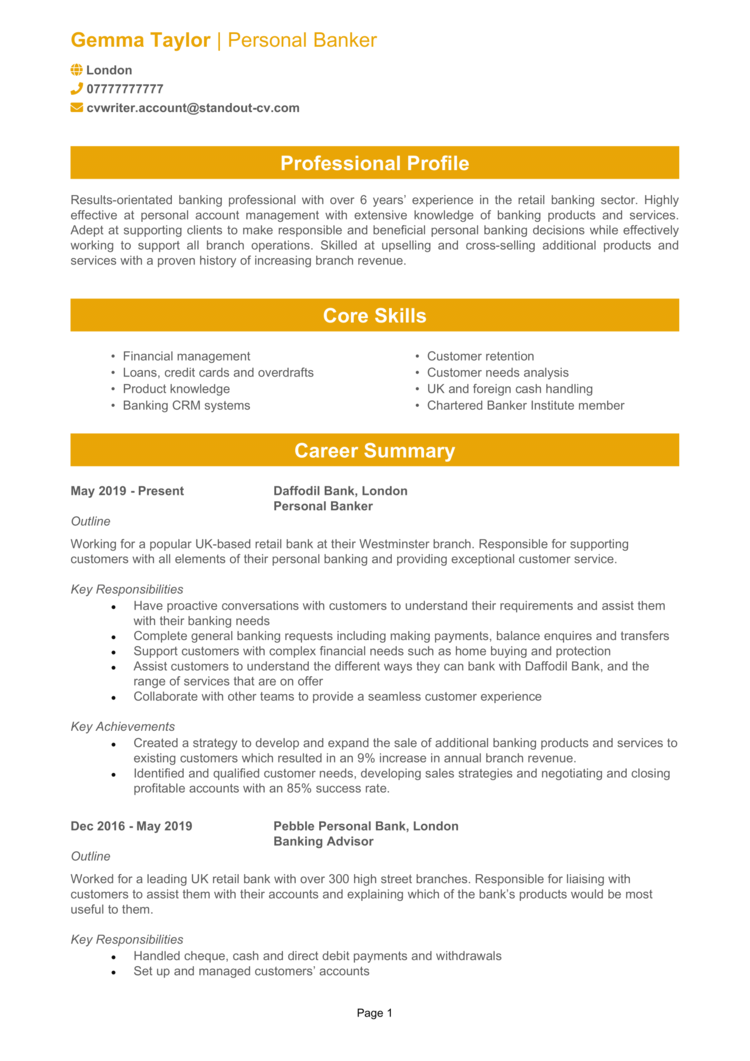

Banking CV example

Corporate Banking CV example

How to write your Banking CV

Learn how to create your own interview-winning Banking CV with this simple step-by-step guide.

A Banking CV needs to show more than just your ability to work with numbers. It’s your chance to demonstrate financial acumen, problem-solving skills, and the ability to build relationships with clients and colleagues.

Think of your CV as your first big investment – done right, it’ll yield a high return in interviews and opportunities. You’ll learn to highlight your qualifications and achievements in your CV, while positioning you as the top candidate for the role.

Structuring your Banking CV

This is your chance to turn a hiring manager’s interest into a long-term investment – your career. Your CV structure needs to be as organised and precise as a monthly statement. This’ll help recruiters quickly spot your key skills, experience, and qualifications.

Here’s the right layout for your Banking CV:

- Name and contact details – Place contact details at the top to make it easy for recruiters to reach you. Including a picture of yourself is always optional.

- Profile – Start with a snapshot of your expertise, career highlights, and goals.

- Core skills – Showcase your financial skills, analytical abilities, and client relationship expertise.

- Work experience – Walk the recruiter through your roles in reverse chronological order, focusing on achievements and responsibilities.

- Education – Show off those relevant degrees, certifications, and any relevant training.

- Additional info – You can optionally list any relevant hobbies and interests which help to convey your skills, as well as any relevant awards.

The best way to format your Banking CV

Your CV format should reflect the professionalism and attention to detail that you bring to the banking world. A polished format ensures your application gets the attention it deserves, and keeps the recruiters’ focus on your expertise – not your formatting mistakes.

Here’s how to format your Banking CV:

- Bullet points – Employ short, punchy bullet points to make responsibilities and achievements easy to read.

- Divide sections – Structure your CV with distinct sections that make it easy to scan.

- Use a clean font – Choose a professional, readable font that keeps the focus on your content.

- Keep it the right length – Two pages is the ideal length to provide all the essential information while staying concise.

What is a Banking CV profile?

Your profile (also known as a personal statement for junior candidates) is like the executive summary of a report – it should tell recruiters why you’re worth the read, without all the fluff. It’s a golden opportunity to quickly give recruiters a quick snapshot of who you are and what makes you the perfect candidate for the role.

Banking CV profile examples

Profile 1

Experienced Banking Professional with over eight years of expertise in retail banking, specialising in customer relationship management, loan processing, and cross-selling financial products. Skilled in using CRM tools, managing large client portfolios, and delivering personalised financial solutions to meet individual and business needs. Adept at achieving sales targets and fostering long-term client relationships.

Profile 2

Proficient Banking Advisor with five years of experience in corporate banking, focusing on business account management, financial risk assessment, and credit analysis. Experienced in working with SMEs to provide tailored financial products, including loans, lines of credit, and cash management solutions. Skilled in financial modelling and compliance with regulatory requirements.

Profile 3

Dedicated Investment Banking Analyst with four years of experience in M&A advisory and equity research. Skilled in performing financial analysis, conducting due diligence, and preparing pitch books and presentations for high-profile clients. Proficient in Bloomberg Terminal, Excel, and PowerPoint, with a strong focus on delivering actionable insights and supporting strategic decision-making.

What to include in your Banking CV profile

Here are some tips on what to include in your Banking CV profile:

- Where you’ve worked – Mention previous roles and types of financial institutions you’ve worked with.

- Your top qualifications – Highlight relevant certifications, degrees, or training in finance or economics.

- Essential skills – Note strengths like risk management, financial analysis, or client advisory services.

- Key achievements – Briefly reference a major career success, like meeting sales targets or streamlining processes.

- Career aspirations – Mention goals that align with the role, such as specialising in investment banking or managing a high-value portfolio.

Core skills section

Your core skills section is where you show recruiters the specific abilities that make you a strong candidate for the banking sector. Think of your CV skills as your financial statement – precise, impressive, and leaving no room for doubt about your value.

Tailor this section to highlight a mix of technical expertise and soft skills, like customer service or relationship building. For example, risk management, compliance knowledge, or client advisory skills would fit well here. Avoid vague descriptors like “good with numbers” – be specific about your skills, like “proficient in financial modelling” or “experienced in regulatory compliance.”

Top skills for your Banking CV

- Financial Analysis – Evaluating financial data to assess creditworthiness, investment opportunities, or market trends.

- Customer Account Management – Opening, managing, and maintaining personal and business accounts.

- Risk Assessment – Analysing risks associated with loans, investments, and market fluctuations to protect assets.

- Loan Processing – Reviewing applications, verifying documentation, and approving loans in compliance with regulations.

- Regulatory Compliance – Ensuring adherence to banking laws, policies, and financial reporting standards.

- Investment Advisory – Providing tailored investment recommendations based on client goals and risk profiles.

- Cash Flow Management – Monitoring and optimising cash flow for corporate or retail banking clients.

- Fraud Detection – Identifying suspicious activities and implementing measures to prevent financial fraud.

- Financial Product Sales – Promoting services like mortgages, insurance, or savings plans to meet customer needs.

- Digital Banking Tools – Proficiency with online platforms and banking software to enhance client experiences.

Work experience

Your work experience section is where recruiters will scrutinise how you’ve applied your skills and delivered results in previous roles. This section isn’t just about listing job titles; it’s about telling the story of your professional journey and showing how your expertise has made a tangible impact.

Start with your most recent role and work backwards, listing each position in reverse chronological order. Focus on roles that are most relevant to the job you’re applying for, but don’t shy away from mentioning positions where you developed transferable skills.

If you’re just starting out, don’t worry. You can include internships, part-time roles, or volunteer work that demonstrate your potential and dedication. Tailor each description to emphasise how these roles align with the responsibilities of the job you’re targeting.

How to structure jobs

- Outline – Provide an overview of the organisation, your role, and the scope of your responsibilities.

- Responsibilities – Focus on tasks like financial advising, budget planning, or streamlining internal processes. Use action verbs like “developed,” “advised,” or “implemented” to highlight your impact.

- Achievements – A really good CV will emphasise measurable results, like increasing client satisfaction or reducing operational costs. Numbers and percentages make your impact clear and impressive.

Sample jobs in Banking

Banking Advisor | First Choice Bank

Outline

Provided personalised financial advice and services to retail customers, focusing on account management, loan processing, and cross-selling financial products.

Responsibilities

- Opened and managed personal and business accounts, ensuring compliance with KYC and AML regulations.

- Advised clients on financial products such as mortgages, savings accounts, and investment opportunities.

- Processed loan applications and conducted preliminary credit assessments.

- Monitored client accounts to identify cross-selling opportunities and improve customer engagement.

- Resolved customer queries and complaints, maintaining high levels of satisfaction.

Achievements

- XXIncreased product cross-sales by 25 percent through effective customer consultations.

- Achieved a 95 percent customer retention rate by delivering excellent service.

- Reduced loan processing times by 20 percent through improved workflows and communication.

Corporate Banking Analyst | Global Financials

Outline

Supported corporate clients by providing tailored financial solutions, focusing on credit analysis, risk assessment, and relationship management.

Responsibilities

- Conducted financial assessments for business clients, analysing cash flow, profitability, and creditworthiness.

- Prepared detailed reports and presentations for loan approvals and credit committee reviews.

- Monitored client portfolios to ensure compliance with credit policies and mitigate risks.

- Collaborated with internal teams to develop bespoke financial products for corporate clients.

- Maintained strong relationships with business clients, addressing their financial needs promptly.

Achievements

- Approved £20M in corporate loans while maintaining a default rate of under 1 percent.

- Streamlined credit review processes, reducing turnaround time by 15 percent.

- Recognised as the top performer for client acquisition in the corporate division.

Investment Banker | Capital Banking Ventures

Outline

Worked on M&A advisory and equity research projects for high-profile clients, providing detailed financial analysis and market insights to support strategic decisions.

Responsibilities

- Prepared detailed financial models, including discounted cash flow and LBO analyses, to evaluate potential deals.

- Assisted in conducting due diligence and preparing data rooms for M&A transactions.

- Created pitch books and presentations for client meetings and investor roadshows.

- Monitored industry trends and prepared sector-specific research reports for internal and client use.

- Collaborated with senior bankers to identify new business opportunities and develop client relationships.

Achievements

- Supported the successful closing of M&A deals worth over £500M in transaction value.

- Reduced financial model preparation time by 20 percent through process automation.

- Praised by senior management for consistently delivering high-quality pitch materials under tight deadlines.

Education section

The education section is key for banking roles, as academic qualifications often serve as the foundation of your expertise.

Include degrees in finance, economics, or related fields, along with relevant certifications like CFA or ACCA. If you’re early in your career, focus on coursework, projects, or internships that demonstrate your knowledge of financial principles.

Always list your qualifications in reverse chronological order, starting with the most recent.

Key qualifications for a job in Banking

- Chartered Financial Analyst (CFA) – Demonstrates expertise in investment management and financial analysis.

- Bachelor’s Degree in Finance or Economics – Provides a strong foundation in financial principles.

- ACCA Qualification (Association of Chartered Certified Accountants) – Validates accounting and financial management skills.

- Certificate in Risk Management – Highlights your ability to identify and mitigate financial risks.

- MBA with Finance Specialisation – Reflects advanced business and financial acumen.