In an industry where every decimal matters, your CV needs to be surgically precise. You’re applying for a role where intensity, accuracy, and analytical skills are assumed – so every section of your CV has to reflect those strengths without drowning the reader in jargon.

With an Investment Banking Analyst CV example, this guide will show you how to highlight your quantitative skills and commercial insight, to land the lucrative jobs you’re after.

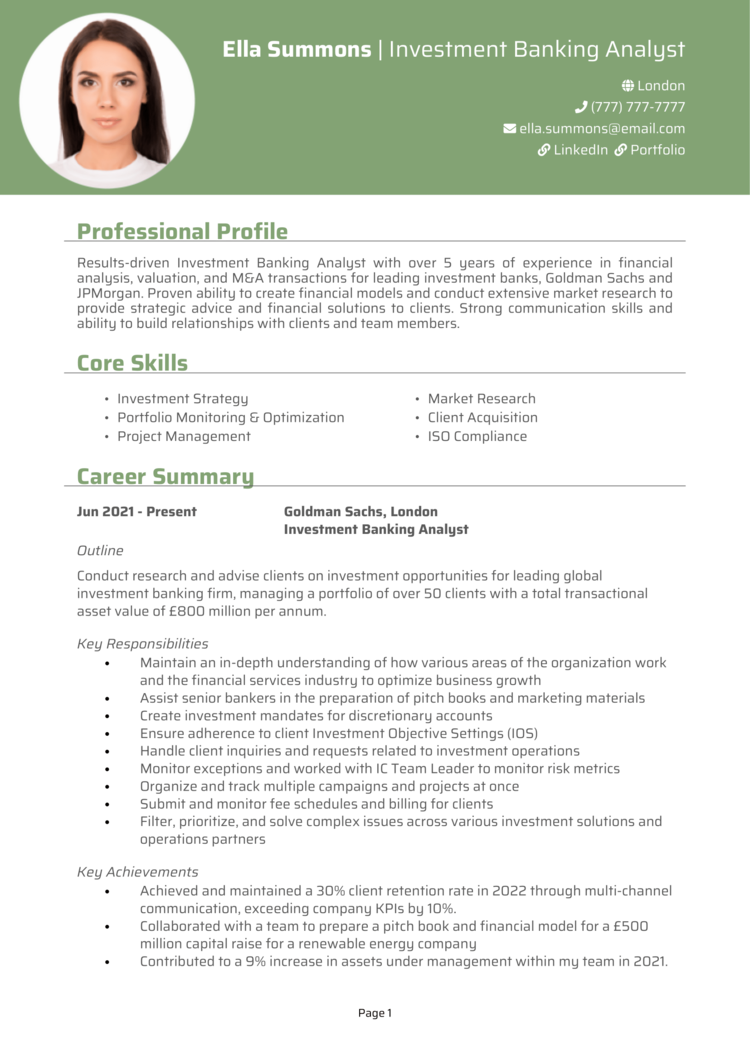

Investment Banking Analyst CV

How to write your Investment Banking Analyst CV

Discover how to craft a winning Investment Banking Analyst CV that lands interviews with this simple step-by-step guide.

Recruiters in investment banking don’t spend long on CVs – so yours needs to make an immediate impact. That doesn’t mean stuffing it with buzzwords or hoping the prestige of your degree speaks for itself. It means building a CV that proves your value in high-stakes, high-speed environments.

In this guide, you’ll learn how to write a CV by presenting your experience with clarity and punch, and tailoring every section to the demands of top-tier banking roles.

How to structure and format your Investment Banking Analyst CV

A CV in the finance world is less about flair, more about structure. Analysts are hired for precision and attention to detail – and if your CV doesn’t reflect those traits, you’re already on the back foot. If a recruiter opens up a disorganised CV full of mistakes, they’re only going to move onto the next one in the pile.

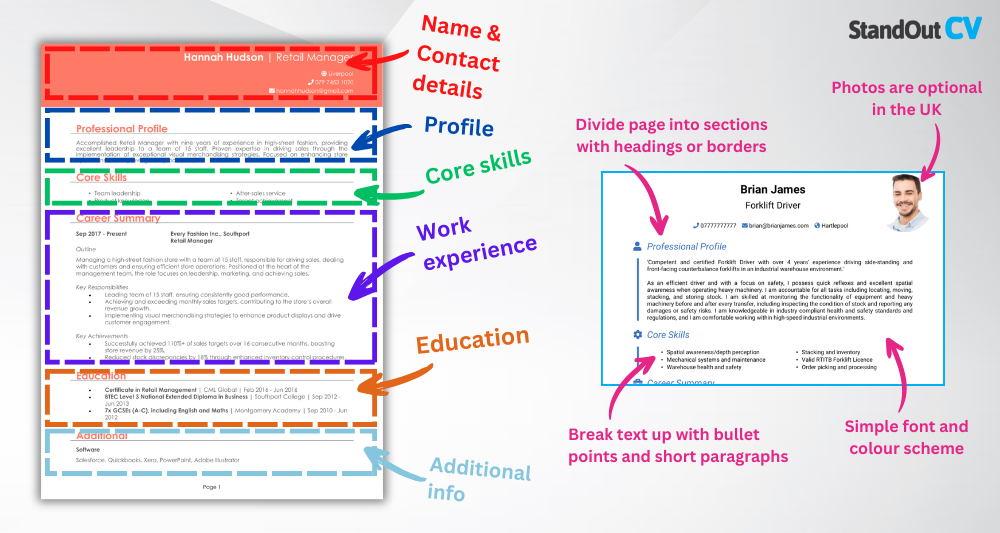

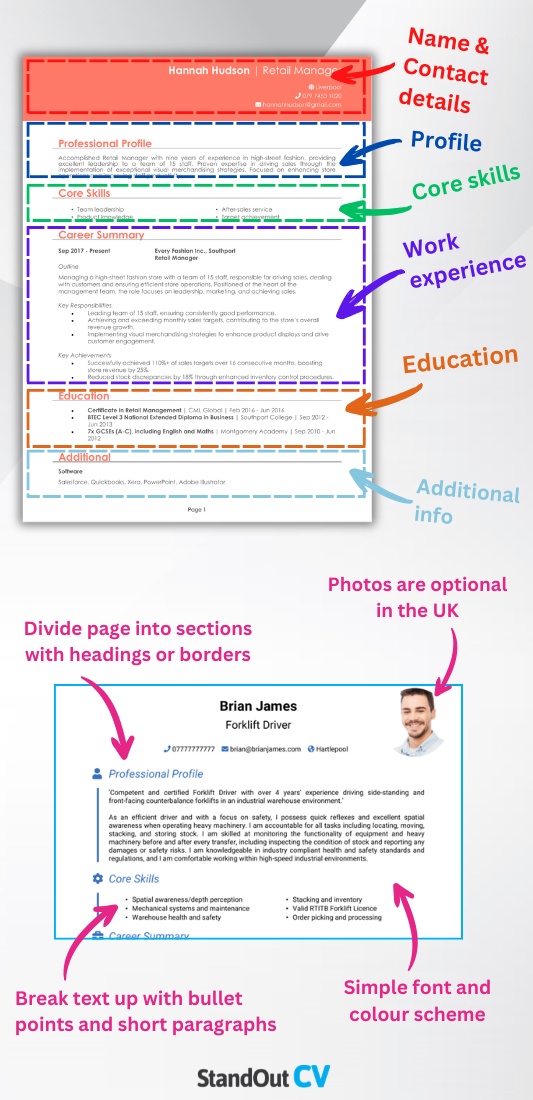

Here’s the layout to follow:

- Name and contact details – Keep these personal details at the top so a potential employer can reach out to you.

- Profile – Immediately draw in the recruiter with a brief summary of your skills and experience.

- Core skills – Briefly highlight those qualities which make you the best candidate.

- Work experience – Walk through your employment history in reverse chronological order.

- Education – List the qualifications and certificates that make you the right fit.

- Additional info – You can optionally list any relevant hobbies and interests which help to convey your fit for the role.

In terms of your CV format, keep it streamlined: break up dense sections with bullet points where appropriate, and use clear headings to organise each section. Choose a standard, professional font to keep things readable, and keep the total length under two pages, avoiding filler. Every line should contribute value, just as every slide in a pitchbook needs to earn its place.

How to write an Investment Banking Analyst CV profile

This section sits right at the top – and for analyst roles, it’s your chance to convey your drive, technical competence, and suitability for high-intensity environments. Your writing should reflect sharp thinking and clarity.

Focus less on general ambitions and more on what you’ve done and how you can add value to a deal team: your CV profile should give recruiters an immediate idea of what you’ll bring to the table.

Investment Banking Analyst CV profile examples

Profile 1

Experienced Investment Banking Analyst with over 10 years in global financial institutions, specialising in mergers and acquisitions, equity financing, and market analysis. Skilled in building financial models, conducting valuations, and preparing pitch books for senior stakeholders. Proficient in Bloomberg, FactSet, and Excel VBA with a proven ability to support complex transactions and deliver insights that influence high-level decision-making.

Profile 2

Analytical Investment Banking Analyst with six years of experience in corporate finance and capital markets. Supported deal execution through due diligence, industry research, and preparation of client-facing materials. Adept at using Thomson Reuters Eikon, PowerPoint, and advanced Excel modelling. Recognised for accuracy under pressure and strong collaboration with associates and VPs across multiple projects.

Profile 3

Motivated Investment Banking Analyst with three years of experience at a boutique advisory firm, focusing on mid-market M&A and private equity transactions. Assisted in financial modelling, market mapping, and investor presentations. Skilled in using PitchBook and Capital IQ to prepare reports and valuations. Known for strong attention to detail and ability to adapt quickly in a fast-paced deal environment.

Details to put in your Investment Banking Analyst CV profile

Here are some tips on what to include:

- Where you worked – Mention if you’ve gained experience in banking, finance, consulting, or other high-pressure analytical environments.

- Your top qualifications – State your most relevant academic credentials, such as your degree and any financial training or certifications.

- Essential skills – Reference your core strengths, such as financial modelling, market research, or presentation building – and make sure they align with the role.

- Projects or transactions supported – If you’ve had deal exposure, even in a supporting capacity, briefly reference it to show relevance.

- Value delivered – Show that your work contributes – whether through efficiency, insight, accuracy, or support to senior bankers and clients.

What to include in the core skills section of your CV

In a role like this, you can’t afford to be vague – the CV skills you list should speak directly to the job description. This is where you highlight your technical know-how, analytical tools, and any direct experience with financial modelling or client preparation.

Tailor the language here to match the expectations of investment banks. Use the job advert as a checklist, and make sure your strengths are grounded in real, demonstrable ability.

What are the most important skills for an Investment Banking Analyst CV?

- Financial Modelling and Valuation – Building detailed models to assess company performance, forecast earnings, and support deal structuring.

- Mergers and Acquisitions Support – Conducting due diligence, preparing pitch materials, and analysing targets for buy-side and sell-side transactions.

- Equity and Debt Capital Markets Analysis – Assisting in the execution of IPOs, bond issuances, and other capital-raising activities.

- Industry and Market Research – Analysing sector trends, competitor performance, and macroeconomic indicators to inform investment decisions.

- Pitch Book and Presentation Creation – Designing high-quality client presentations and pitch materials to communicate strategic ideas.

- Company Valuation Techniques – Applying methods such as DCF, precedent transactions, and comparable company analysis to determine enterprise value.

- Data Analysis and Interpretation – Working with financial databases and large datasets to extract insights and support investment recommendations.

- Client and Deal Team Coordination – Collaborating with senior bankers, legal advisors, and clients to manage timelines and deal execution.

- Regulatory and Compliance Awareness – Ensuring all materials and activities comply with financial regulations and internal policies.

- Time and Workflow Management – Balancing multiple projects under tight deadlines while maintaining accuracy and attention to detail.

How to write a strong work experience section for your CV

In banking, work experience is everything – but you don’t need a million internships to impress. What matters most is how you present the work you’ve done. Whether it’s a formal internship, part-time analyst role, or even university-led investment competitions or case study projects, each entry should show that you’ve handled real pressure, managed data, supported decisions, and shown initiative.

Use a clear heading for each role, followed by a short summary of what the position involved. Use bullet points to give concrete details: tasks and tangible outcomes. Always aim for clarity over volume – every point should feel necessary. List your experience in reverse chronological order.

The best way to structure job entries on your CV

- Outline – Briefly describe the employer, the team you worked in (e.g. M&A, ECM, Industrials), and the scope of your involvement.

- Responsibilities – Use action words like “analysed” and “modelled.” For example: “analysed precedent transactions to support valuation ranges” or “modelled cash flow impacts of proposed divestitures.”

- Achievements – Highlight contributions that added value – such as streamlining a process, improving accuracy, or supporting client deliverables under pressure. If you contributed to a deal, even in a junior way, mention it.

Sample jobs for Investment Banking Analysts

Investment Banking Analyst | Harrington Capital Partners

Outline

Provided analytical support for a global investment bank specialising in cross-border M&A and equity advisory. Worked with associates and VPs to deliver pitch materials, financial models, and industry insights for high-profile clients.

Responsibilities

- Built detailed financial models including DCF, LBO, and precedent transaction analyses

- Prepared client presentations, pitch books, and transaction documents

- Conducted industry and company-specific research to support valuations

- Assisted in due diligence processes by reviewing financial statements and data rooms

- Tracked market developments and competitor activity for weekly updates

Achievements

- Contributed to a £1.2bn cross-border acquisition by preparing valuation models

- Supported an IPO project that successfully raised £400m in equity financing

- Reduced turnaround times for pitch books by 25% through improved template design

Investment Banking Analyst | Blackwood Advisory Group

Outline

Worked at a boutique advisory firm focused on mid-market corporate finance transactions, supporting M&A deals, capital raising, and strategic advisory. Delivered client-ready analysis and presentations under tight deadlines.

Responsibilities

- Prepared valuation models and financial forecasts for target companies

- Created pitch decks and teasers for private equity and strategic buyers

- Researched potential buyers and investors using Capital IQ and PitchBook

- Collaborated with legal teams to coordinate transaction documents

- Maintained data rooms and responded to client and investor queries

Achievements

- Helped close three M&A deals in the £50m–£200m range within one year

- Improved client presentation quality by introducing new visual templates

- Built a buyer universe database that reduced research time by 40%

Investment Banking Analyst | Sterling Rowe Financial

Outline

Supported deal execution and client relationship management at a mid-sized investment bank specialising in healthcare and technology sectors. Contributed to both buy-side and sell-side advisory projects.

Responsibilities

- Built sector-specific comparable company and precedent transaction analyses

- Drafted sections of information memorandums and management presentations

- Analysed client operating models and identified key financial drivers

- Assisted in preparing investor Q&A responses and briefing notes

- Supported live deal execution by coordinating with clients and counterparties

Achievements

- Contributed to the successful sale of a healthcare firm for £320m by preparing financial analysis

- Increased team efficiency by automating parts of comp table updates in Excel VBA

- Recognised by senior associates for reliability during live deal execution

How to list your educational history

Your academic track record carries real weight in investment banking, so this section needs to be credible. Lead with your most recent education – typically your degree – and include the name of the institution, dates, grade, and any notable modules or achievements.

If you’ve taken additional financial courses or certifications (e.g. CFA Level 1, Wall Street Prep), include them here. Quantitative degrees and high academic achievement should be front and centre.

What are the best qualifications for an Investment Banking Analyst CV?

- BA/BSc in Economics, Finance, Maths or Business – Core academic foundation expected by most banks

- MSc in Finance or Investment Analysis – Shows advanced financial and analytical ability

- CFA Level 1 (or higher) – Widely respected certification that boosts technical credibility

- Excel & Financial Modelling Certifications (e.g. WSP) – Practical skills that translate directly into analyst work

- A-levels in Maths, Economics or Further Maths – Relevant secondary education that supports a strong academic base