You know the rules. You know how to enforce them. But when it comes to writing a CV that meets the standard? That takes a little strategic thinking.

This guide and its 3 Compliance Officer CV examples will help you write a CV that’s clear and convincing – one that proves you’re the person who keeps organisations on the right side of the law.

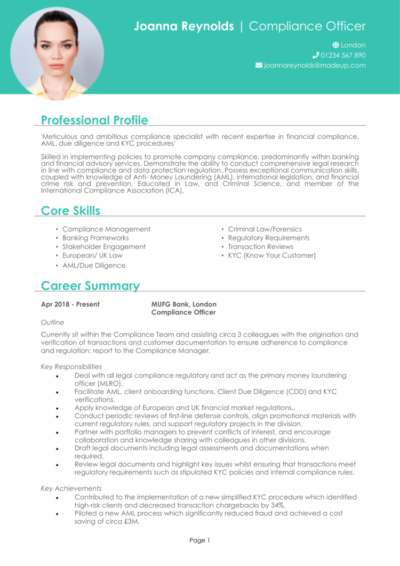

Compliance Officer CV

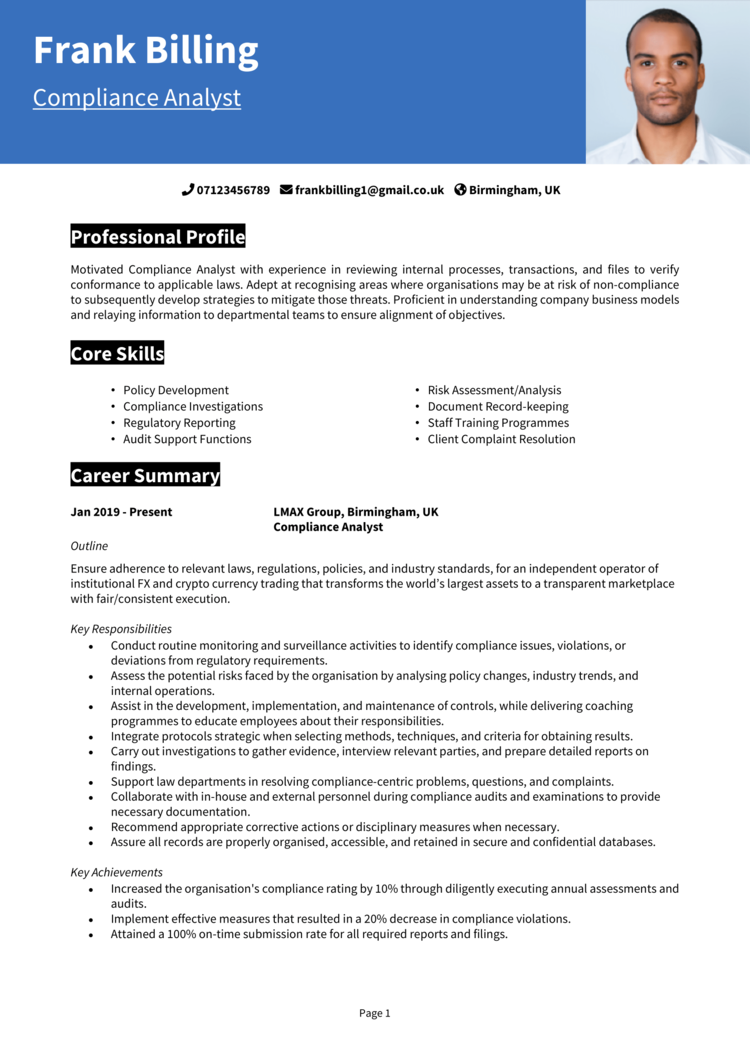

Compliance Analyst CV

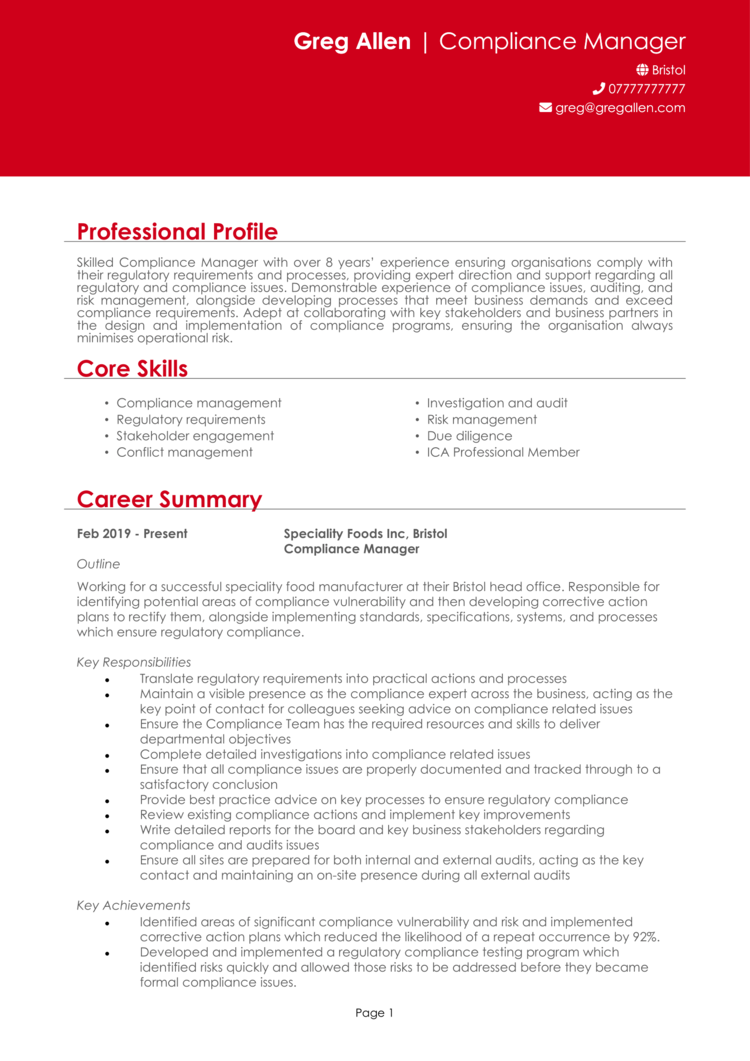

Compliance Manager CV

How to write your Compliance Officer CV

Discover how to craft a winning Compliance Officer CV that lands interviews with this simple step-by-step guide.

Writing a CV is your chance to show you don’t just follow rules – you make sure everyone else does too. But a strong compliance CV is more than a checklist of policies and procedures – it’s a chance to demonstrate how you keep organisations audit-ready.

This guide will take you through each step, from structuring your CV and highlighting relevant experience to choosing the right terminology and demonstrating your real impact.

How to structure and format your Compliance Officer CV

A Compliance Officer’s CV structure should be as watertight as the frameworks you work within. Recruiters want to see your qualifications, sector expertise, and track record of risk management without wading through clutter or jargon. Keep it clear, easy to scan, and free from avoidable mistakes that’d make employers overlook even the most qualified candidates. The following tips will ensure your CV is as pleasant a reading experience as possible.

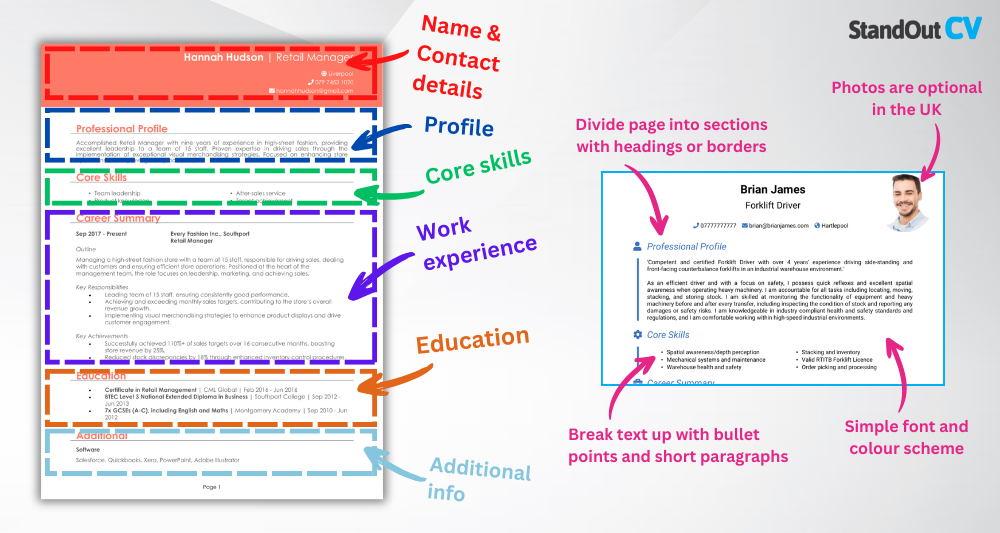

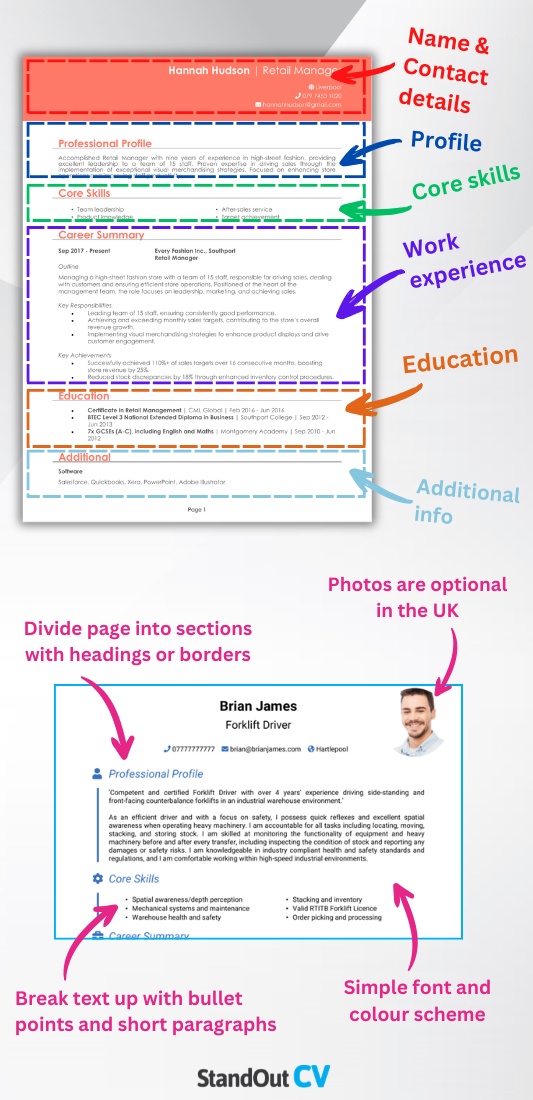

Here’s the layout to follow:

- Name and contact details – Place your personal details at the top so employers can get in touch easily.

- Profile – Kick things off with a concise overview of what makes you the ideal candidate for the job.

- Core skills – Briefly highlight those qualities which make you the best candidate

- Work experience – List your previous roles in reverse chronological order, with your most recent first.

- Education – Go through the academic history which underpins your expertise.

- Additional info – This optional section can include professional memberships, awards, or hobbies that showcase your suitability for the role.

Use bold headings to clearly divide each section, and keep your layout consistent from top to bottom. Stick to a clean, business-appropriate font, and limit your CV to a maximum length of two pages. Break down large sections of text using nice and readable bullet points, and leave enough white space so nothing feels overcrowded. The end result? A CV format that’s as compliant as your policies.

How to write a Compliance Officer CV profile

Your CV profile is your professional elevator pitch – a snapshot of your compliance expertise and the value you bring to an organisation. Use this section to highlight your knowledge of regulatory frameworks and your risk assessment experience.

Recruiters reading your profile should instantly get a sense of your authority, reliability, and technical skills – but also your ability to communicate clearly and handle sensitive information. Your job here is to quickly convince them that you’ll benefit any firm which takes you on board.

Compliance Officer CV profile examples

Profile 1

Experienced Compliance Officer with over ten years of experience in the financial services industry, specialising in regulatory reporting, internal audits, and policy enforcement. Skilled in ensuring adherence to FCA guidelines, AML regulations, and internal risk controls. Known for methodical processes and strong communication with cross-functional teams.

Profile 2

Detail-oriented Compliance Officer with six years of experience in the healthcare and insurance sectors. Proficient in conducting compliance audits, drafting internal policies, and ensuring GDPR and industry-specific regulatory compliance. Confident working under pressure and interpreting complex legal and regulatory requirements.

Profile 3

Reliable Compliance Officer with five years of experience in corporate governance, particularly within international logistics and supply chain operations. Strong understanding of ISO standards, anti-bribery frameworks, and third-party due diligence. Adept at producing compliance reports and delivering staff training programmes across departments.

Details to put in your Compliance Officer CV profile

Make sure your profile includes the following:

- Where you worked – Mention industries or companies (e.g. financial services, insurance, pharmaceuticals, public bodies)

- Your top qualifications – ICA, CeMAP, CII, law degrees, or GRC certifications

- Essential skills – Regulatory interpretation, auditing, reporting, policy development

- Types of compliance handled – E.g. GDPR, FCA, AML, ISO, internal risk

- Key achievements or focus areas – Such as training programmes, audit success, or regulatory approvals

What to include in the core skills section of your CV

Your CV skills section should give a short, focused overview of your main compliance strengths in a simple list of bullet points.

Briefly describe your ability to review and apply regulations, conduct audits, develop internal policies, and ensure operational teams stay within legal and procedural frameworks. Keep it relevant to your industry, and make sure it supports the rest of your CV.

What are the most important skills for a Compliance Officer CV?

- Regulatory Monitoring and Interpretation – Keeping up to date with relevant laws, regulations, and industry standards to ensure organisational compliance.

- Policy Development and Implementation – Creating, updating, and enforcing internal policies that align with legal and regulatory requirements.

- Risk Assessment and Mitigation – Identifying potential compliance risks and recommending strategies to minimise exposure.

- Internal Audits and Investigations – Conducting audits to assess compliance with procedures and investigating breaches or irregularities.

- Training and Staff Education – Delivering training sessions and resources to ensure employees understand compliance obligations and ethical conduct.

- Reporting and Documentation – Maintaining accurate records of compliance activities and producing reports for senior management and regulators.

- Incident Management and Resolution – Responding to compliance violations and guiding the organisation through remediation steps.

- Liaison with Regulatory Bodies – Communicating with external regulators, responding to inquiries, and supporting inspections or reviews.

- Data Protection and Privacy Oversight – Ensuring adherence to data protection laws such as GDPR and maintaining confidentiality standards.

- Compliance Monitoring Tools Use – Using digital platforms to track compliance metrics, manage reporting workflows, and monitor ongoing adherence.

How to write a strong work experience section for your CV

This is where you demonstrate that you don’t just know the rules – you’ve actively enforced and applied them in a business context. Employers want to see how you’ve managed compliance processes and dealt with audits or investigations.

List your roles in reverse chronological order. Make sure your contributions and achievements are clear, and that recruiters understand how your work experience has prepared you for the roles you’re applying for.

If you’re early in your career, include legal or regulatory internships, assistant roles, or analyst experience that shows exposure to compliance environments.

The best way to structure job entries on your CV

- Outline – Briefly explain the employer, the sector you worked in, and your role. State if you worked within a legal, compliance, or risk department, and who you reported to.

- Responsibilities – Use action words like “monitored” and “developed.” For example: “monitored internal controls in line with GDPR” or “developed new policies to address FCA regulatory changes.” Mention compliance software or frameworks if relevant.

- Achievements – Emphasise the outcomes of your work – successful audits, avoided penalties, reduced incidents of non-compliance, or faster regulatory reporting. Add numbers or specifics where possible.

Sample jobs for Compliance Officer

Compliance Officer | Ardinex Global Finance Ltd

Outline

Managed compliance operations for a mid-sized financial services firm, ensuring adherence to FCA rules and supporting internal controls across investment and advisory teams.

Responsibilities

- Monitored regulatory updates and advised senior managers on required actions

- Performed internal audits and submitted reports to risk and compliance committees

- Investigated suspected breaches and produced detailed documentation for review

- Delivered AML and KYC training to front-line staff and new joiners

- Maintained policies, registers, and compliance records in line with FCA standards

Achievements

- Reduced policy breaches by 35% through targeted internal communications

- Supported successful FCA audit with zero material findings

- Recognised for implementing a more efficient compliance monitoring plan

Compliance Officer | Grentwell Medical Insurance

Outline

Oversaw GDPR and regulatory compliance for a health insurance provider, ensuring customer data protection and internal policy alignment with UK legal frameworks.

Responsibilities

- Audited internal processes to identify data protection risks and compliance gaps

- Handled Subject Access Requests and coordinated with the DPO on data breaches

- Drafted updated privacy notices and consent procedures across customer touchpoints

- Liaised with legal advisors to implement compliance changes post-Brexit

- Maintained compliance training logs and risk registers for regulatory review

Achievements

- Reduced customer complaint volumes related to data handling by 40%

- Played a key role in achieving ISO 27001 certification for data security

- Trained 80+ employees in updated GDPR and data protection procedures

Compliance Officer | NetShore Logistics Group

Outline

Managed operational and international compliance for a supply chain company with contracts in the UK, Europe, and Southeast Asia.

Responsibilities

- Reviewed third-party suppliers for sanctions, bribery, and ethical trading risks

- Updated corporate policies in line with international trade regulations

- Provided quarterly compliance reports to board and external auditors

- Ran internal workshops on anti-corruption, trade controls, and whistleblowing

- Collaborated with legal team to revise supplier contract clauses for compliance

Achievements

- Helped company pass external audit from major client with full compliance clearance

- Reduced third-party risk exposure by 27% through improved onboarding controls

- Implemented training programme resulting in 100% staff policy completion rate

How to list your educational history

Your education section should reflect both academic qualifications and compliance-specific training. Begin with your most recent or relevant qualifications and move backwards, keeping everything clear and concise.

If you’ve completed a law degree, finance degree, or qualifications from bodies like the ICA or IRM, this is the place to mention them. You can also list shorter training courses in things like AML, GDPR, or audit procedures. If you’re newer to the field, relevant university modules or dissertation topics can be included for context.

What are the best qualifications for a Compliance Officer CV?

- ICA International Diploma in Governance, Risk and Compliance – Recognised standard for senior compliance professionals.

- LLB or Law Conversion Course – Valuable for legal-based compliance roles or policy-heavy positions.

- Certificate in Anti Money Laundering (ICA) – A strong qualification for roles in banking, finance, or insurance.

- CeMAP (Certificate in Mortgage Advice and Practice) – Useful for compliance roles within financial services and lending.

- BSc in Business, Finance or Risk Management – A strong academic base for any compliance or regulatory career.