Applications, numbers, reports – these, you can handle. But summing up your career in two pages? That takes a different kind of precision.

If you’re applying for underwriting roles, you already know the importance of making the right call. The same applies to your CV – it needs to make a strong case for you in seconds.

This guide is here to help you do just that, with 2 Underwriter CV examples and tailored advice to help you present your expertise in compliance and decision-making in the clearest, most compelling way possible.

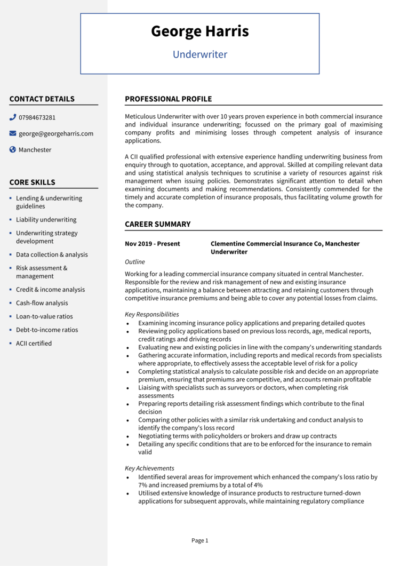

Underwriter CV

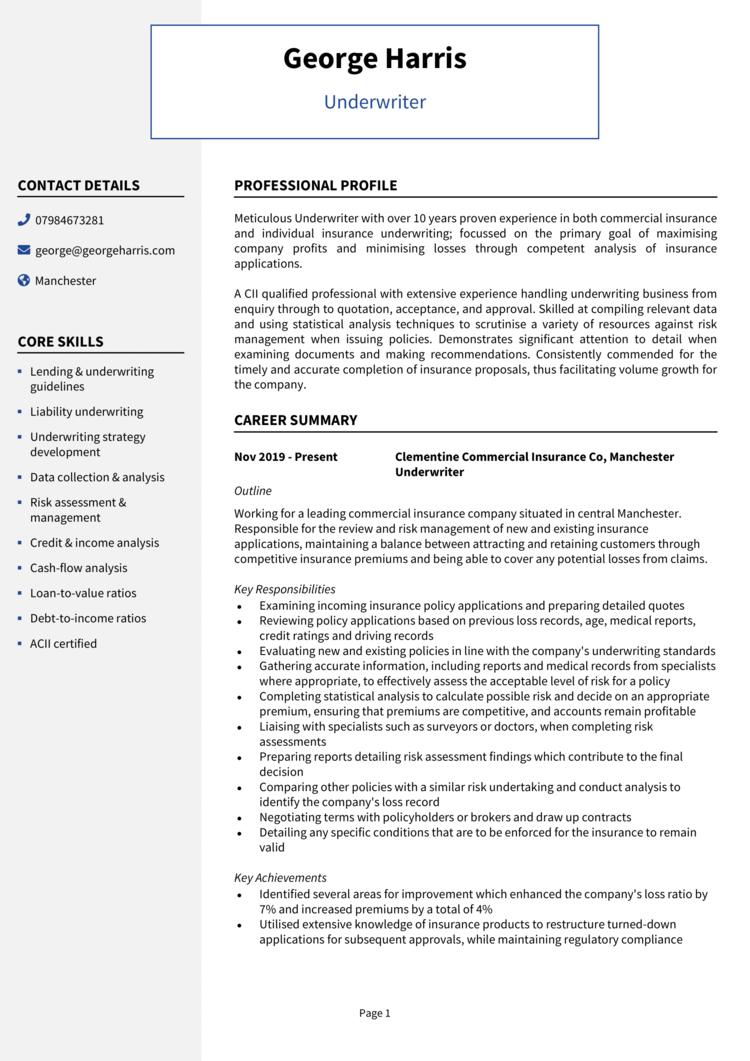

Insurance Underwriter CV

How to write your Underwriter CV

Discover how to craft a winning Underwriter CV that lands interviews with this simple step-by-step guide.

Underwriting is all about precision – and your CV should be no different. It’s not just a list of past roles; it’s your chance to show how you interpret risk, apply judgment, and deliver decisions that drive results.

This guide breaks down writing a CV clearly – from formatting tips to writing impactful content that reflects your technical skill and sector expertise.

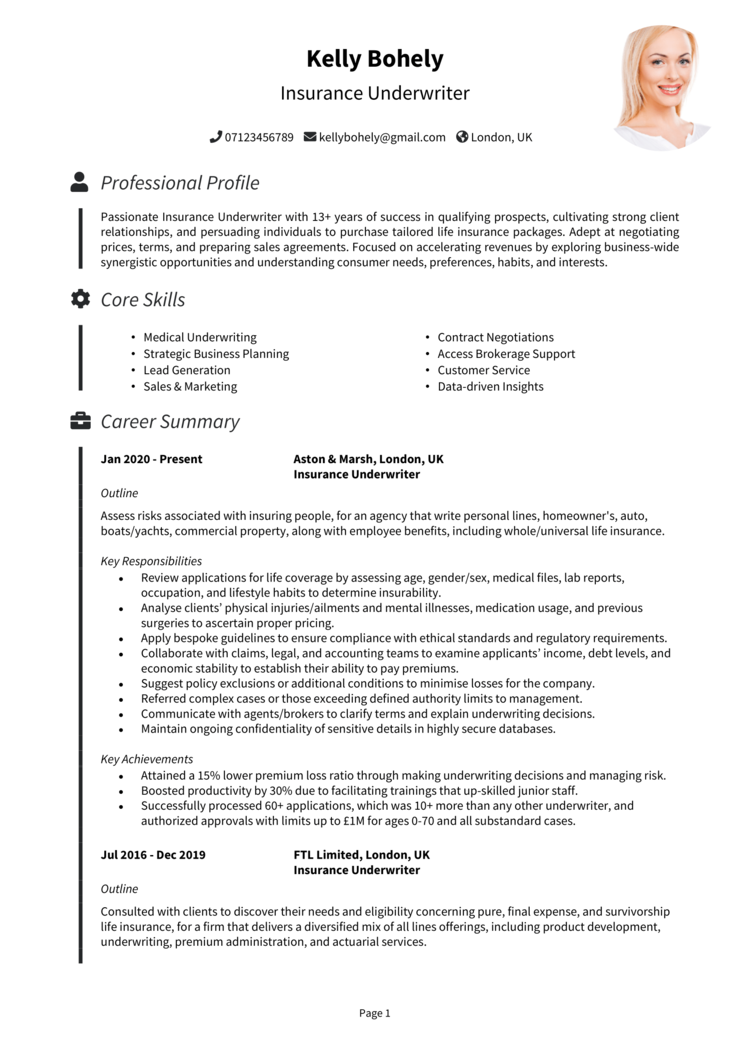

What’s the right way to structure and format your Underwriter CV?

When it comes to underwriting, details matter – and the same is true of your CV. A well-structured layout allows recruiters to quickly find your qualifications, experience, and the types of policies or portfolios you’ve worked on. It’s your first chance to prove that you think clearly and avoid mistakes when it comes to communication.

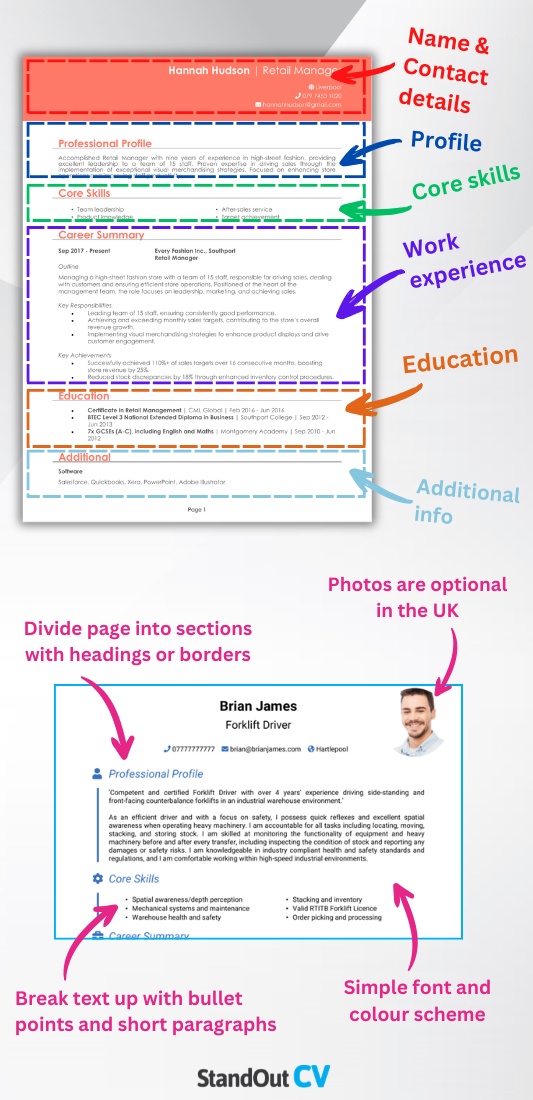

Here’s the structure to follow:

- Name and contact details – Ensure your name and personal details are easily visible at the top. A photo is optional and depends on the role.

- Profile – Craft a short introduction that showcases your professional background and key accomplishments.

- Core skills – Provide a quick overview of your top skills that show why you’re a great fit.

- Work experience – Outline your career progression in reverse order, emphasising your contributions and successes.

- Education – Provide details on your academic background, including certifications or specialised training.

- Additional info – You can add hobbies or activities here that reflect your enthusiasm for the industry.

To make your CV feel as well-organised as your assessments, use bold headings to define each section and break up responsibilities with bullet points. Keep your font clean and professional, use consistent formatting throughout, and limit the length to two pages. A polished CV format shows that you take structure seriously – just like any good risk assessment.

How to create a Underwriter CV profile

This short opening paragraph is your opportunity to establish your underwriting expertise and set the tone for the rest of your CV. It should highlight your knowledge of risk, policy review, and decision-making, along with any standout sector experience.

Recruiters will want to know that you’re not just familiar with underwriting tools and criteria, but that you also have the judgment and accuracy to back it up: your CV profile is there to quickly and thoroughly assure them of that.

Underwriter CV profile examples

Profile 1

Experienced Underwriter with over ten years in commercial and property insurance, assessing risk and structuring policies for SMEs and corporate clients. Skilled in analysing financial data, interpreting risk factors, and working within regulatory frameworks. Adept at balancing profitability with customer service, and proficient in tools like Acturis and Excel-based models.

Profile 2

Analytical Underwriter with six years of experience in personal lines and motor insurance. Experienced in evaluating applications, setting premium rates, and applying underwriting guidelines in line with FCA standards. Known for consistent decision-making, strong collaboration with brokers, and attention to loss ratios.

Profile 3

Detail-driven Underwriter with five years of experience in life and health insurance underwriting for a major UK insurer. Proficient in reviewing medical history, financial documentation, and legal disclosures to produce accurate, fair, and compliant policy decisions. Works confidently under pressure and delivers clear communication to intermediaries and clients.

Details to put in your Underwriter CV profile

If you want to reassure hiring managers you’re a safe bet, make sure to include:

- Where you worked – Mention insurers, banks, brokers, or mortgage lenders you’ve worked with

- Your top qualifications – CII, DipFA, CeMAP, or relevant finance/insurance certifications

- Essential skills – Risk evaluation, decision-making, technical systems, regulatory compliance

- Types of clients or products handled – From SME insurance and reinsurance to personal lending or life cover

- Specialist expertise – Experience with high-risk cases, underwriting limits, or financial analysis

Presenting your core skills

This section should give recruiters a fast, accurate overview of your underwriting strengths in a concise list of bullet points which show you understand the job and the skills it requires.

Focus on the keywords and specific skills which recruiters automatically start scanning for when they open up any application. Tailor the content to the specific branch of underwriting you specialise in, whether that’s general insurance, loans, or property risk.

Essential skills that recruiters look for in a Underwriter CV

- Risk Assessment and Analysis – Evaluating applications to determine the level of risk and deciding whether to approve, modify, or decline coverage.

- Policy Structuring and Pricing – Designing insurance policies with appropriate terms, premiums, and conditions based on risk profiles.

- Financial and Credit Evaluation – Reviewing financial statements, credit scores, and business viability to support underwriting decisions.

- Industry Regulation Compliance – Ensuring underwriting practices align with insurance regulations, legal standards, and company policies.

- Underwriting Software Proficiency – Using systems such as UW engines, CRM platforms, and data analysis tools to streamline decision-making.

- Client and Broker Liaison – Communicating with agents, brokers, and clients to gather information and explain underwriting outcomes.

- Portfolio Monitoring and Management – Reviewing the performance of underwritten policies and adjusting strategies to maintain profitability.

- Documentation and Reporting – Maintaining detailed underwriting records and preparing reports for internal audits and senior management.

- Claims and Loss Trend Analysis – Examining historical data and loss patterns to improve future underwriting accuracy and risk models.

- Cross-Departmental Collaboration – Working closely with claims, actuarial, legal, and sales teams to support well-rounded insurance offerings.

How to highlight work experience

Your work experience is the strongest part of your CV – and for underwriters, it’s where you demonstrate your value through the types of applications you’ve handled and your ability to manage both risk and stakeholder expectations.

List your roles in reverse chronological order. Under each job title, provide a brief outline of the company and your function, followed by bullet points breaking down your key responsibilities and achievements. Be specific – mention the volume or value of cases you handled, the tools and data sources you used, and the decisions or reviews you were responsible for.

If you’ve worked on large accounts, high-value clients, or regulated portfolios, make sure those stand out. And if you’re early in your career, focus on training placements, assistant roles, or admin experience that shows exposure to underwriting processes.

How to make your past experience easy to read for employers

- Outline – Introduce the employer and give context: what type of organisation it was, what lines of business it handled, and what your role was within that structure.

- Responsibilities – Highlight what you did using action words like “assessed” and “authorised.” For example: “assessed life insurance applications for compliance with underwriting standards” or “authorised risk decisions up to £250k for mortgage lending.” Mention tools, systems, and frameworks you used to guide those decisions.

- Achievements – Quantify the impact of your decisions where you can – whether that’s turnaround times, error reduction, increased efficiency, or client satisfaction. If you played a role in improving risk strategy or contributing to regulatory audits, include that too.

Example job entries for Underwriters

Underwriter | Merrion Risk and Finance Ltd

Outline

Assessed commercial insurance applications for a national brokerage, evaluating risk and determining appropriate premiums and coverage for business clients across various sectors.

Responsibilities

- Reviewed policy applications, financial statements, and claims history to assess risk

- Set policy terms, conditions, and premiums in line with company guidelines

- Liaised with brokers to clarify risk factors and negotiate acceptable terms

- Used Acturis and internal systems to quote, track, and amend policy data

- Maintained compliance with regulatory requirements and internal audit standards

Achievements

- Reduced claims exposure by 18% through improved assessment of high-risk applications

- Processed over £4.2M in annual premiums with consistently strong loss ratio performance

- Recognised for developing new broker relationships that increased regional submissions

Underwriter | Axial Life Group

Outline

Reviewed and approved life and critical illness insurance applications for a major provider, ensuring fair and compliant decision-making in line with FCA rules and underwriting manuals.

Responsibilities

- Assessed medical questionnaires, GP reports, and financial data to evaluate eligibility

- Applied automated underwriting rules and made manual referrals for complex cases

- Communicated clearly with advisers and brokers regarding outcomes and requirements

- Tracked decisions and documentation using internal case management systems

- Participated in regular training to stay current with product and legal changes

Achievements

- Maintained 99.5% accuracy rate across over 1,000 cases annually

- Reduced average case turnaround time by 2.5 days through improved triage

- Contributed to product update working group to improve underwriting guidance

Underwriter | FleetSure Motor Insurance

Outline

Managed personal motor underwriting for a high-volume insurer, handling both new business and renewals across private, taxi, and fleet policies.

Responsibilities

- Reviewed driving history, vehicle data, and previous claims to assess application risk

- Calculated premiums and adjusted terms in line with underwriting authority

- Responded to broker queries and provided guidance on complex submissions

- Monitored portfolio performance and loss ratio trends for ongoing improvement

- Worked closely with claims and pricing teams to ensure accurate risk segmentation

Achievements

- Helped reduce non-standard policy losses by 22% through targeted guideline updates

- Handled a portfolio worth £3.6M with consistent profitability year-on-year

- Built strong relationships with top-performing brokers, improving policy retention

Education and qualifications

The education section of your CV should clearly present your academic background and any qualifications that contribute to your professional knowledge in underwriting.

Begin with your most recent qualifications and work backwards. This might include degrees in finance or business, as well as specific industry certifications. Keep this section simple, structured as a short paragraph or list of sentences – bullet points are not used here.

Qualifications recruiters look for in an Underwriter

- Diploma in Insurance (CII) – A benchmark qualification in the UK insurance sector, ideal for professional underwriters.

CeMAP (Certificate in Mortgage Advice and Practice) – Especially useful for mortgage underwriters and property-focused roles. - DipFA (Diploma for Financial Advisers) – A valuable financial services qualification with crossover relevance to underwriting.

- BSc in Finance, Business, Economics, or Risk Management – Strong academic foundation for most types of underwriting.

- Compliance, Risk or FCA-Regulated Short Courses – Particularly useful for roles requiring close attention to regulation or internal audit.