You can develop effective strategies, manage multiple investment portfolios and woo fund managers.

But just because you’re an investment expert, that doesn’t mean you’re a CV writing specialist too.

That’s where we come in.

If you need help showcasing your impressive experience and your biggest achievements, check out our detailed guide and investment manager CV example below.

|

Investment Manager CV example

Use this CV example as a guide to formatting and structuring your Investment Manager CV, so that busy recruiters can easily digest your information and determine your suitability for the role.

It also provides some insight into the key skills, experience and qualifications you need to highlight.

Investment Manager CV format and structure

In today’s fast-paced job market, recruiters and employers are often short on time. If they can’t locate the information they’re searching for within a few seconds, it could result in them overlooking your application.

To avoid this happening, it’s critical to structure and format your CV in a way that allows them to quickly identify your key skills and offerings, even when they’re pressed for time.

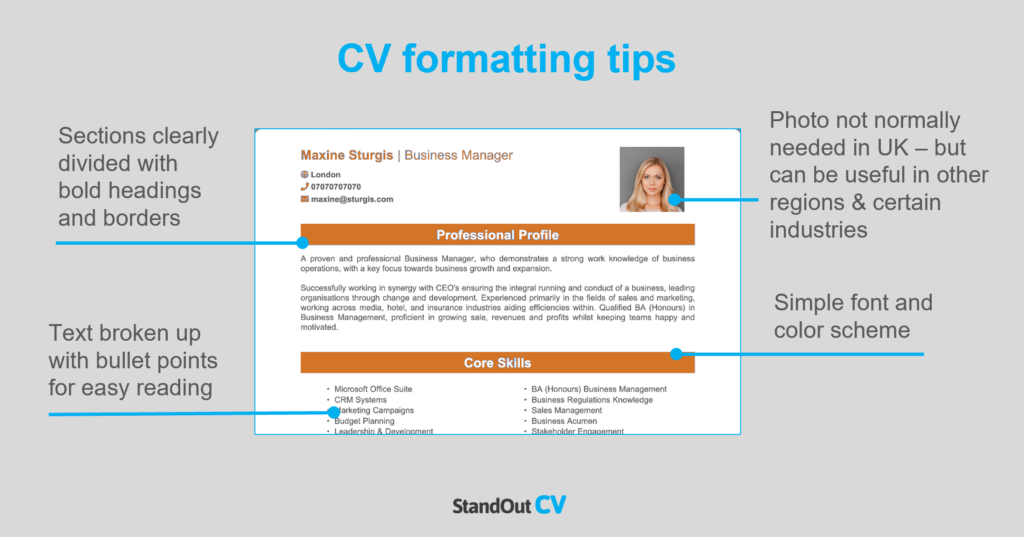

Tips for formatting your Investment Manager CV

- Length: Whether you’ve got one year or three decades of experience, your CV should never be more than two sides of A4. Recruiters are busy people who’re often juggling numerous roles and tasks, so they don’t have time to read lengthy applications. If you’re a recent graduate or don’t have much industry experience, one side of A4 is fine.

- Readability: To help busy recruiters scan through your CV, make sure your section headings stand out – bold or coloured text works well. Additionally, try to use bullet points wherever you can, as they’re far easier to skim through than huge paragraphs. Lastly, don’t be afraid of white space on your CV – a little breathing space is great for readability.

- Design & format: The saying ‘less is more’ couldn’t be more applicable to CVs. Readability is key, so avoid overly complicated designs and graphics. A subtle colour palette and easy-to-read font is all you need!

- Photos: Recruiters can’t factor in appearance, gender or race into the recruitment process, so a profile photo is not usually needed. However, creative employers do like to see them, so you can choose to include one if you think it will add value to your CV .

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

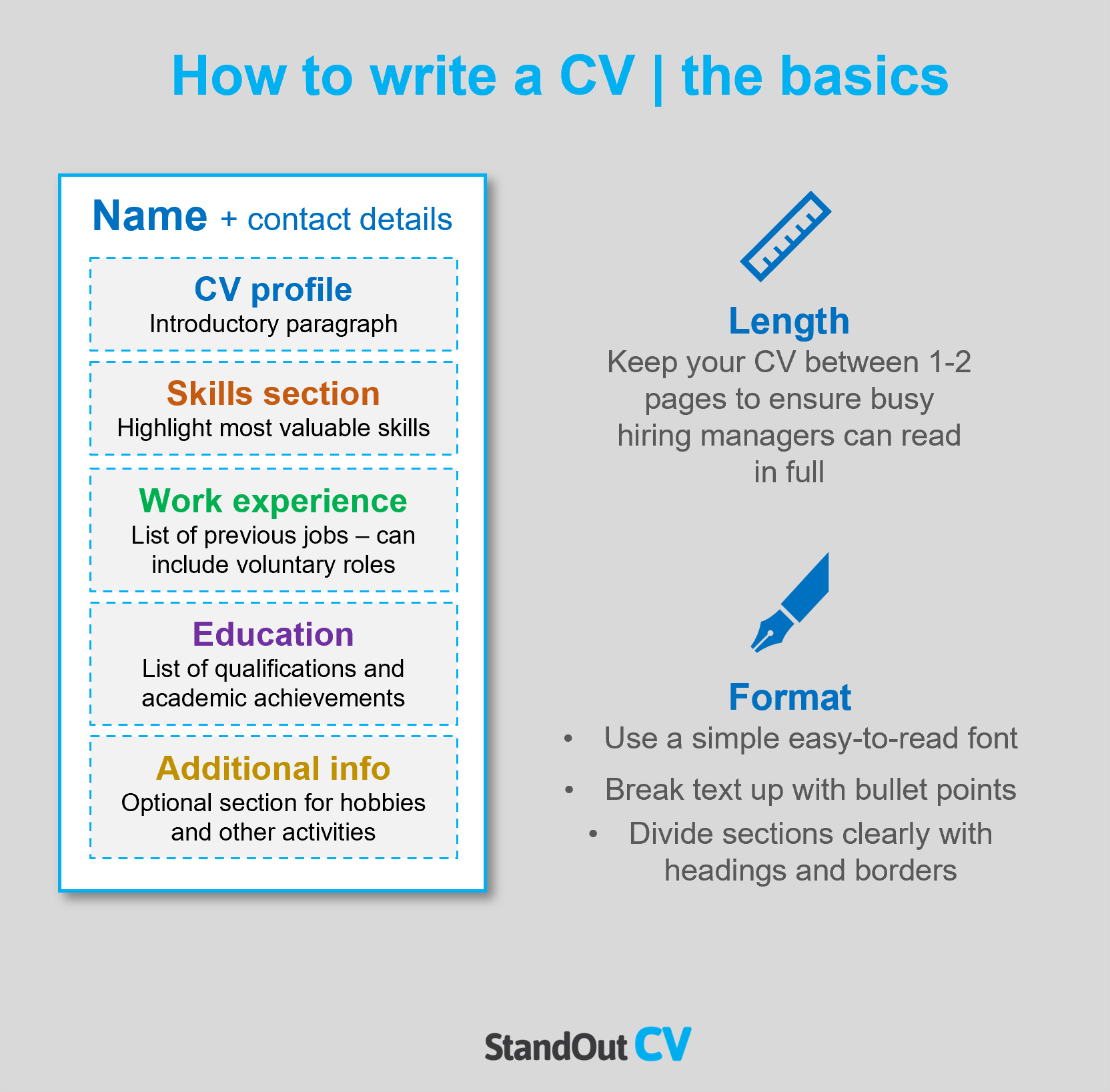

CV structure

When writing your CV, it’s important to structure the content into the following key sections to ensure easy digestion by busy recruiters and hiring managers:

- Contact details: List your contact details at the top of your CV to prevent them from being overlooked.

- Profile: Begin with an introductory paragraph that captures recruiters’ attention and summarises what you have to offer employers.

- Work experience/career history: List your relevant work experience in reverse chronological order, starting with your current position.

- Education: Provide a brief summary of your education and qualifications.

- Interests and hobbies: An optional section to showcase any hobbies that highlight transferable skills relevant to your target jobs.

Now you understand the basic layout of a CV, here’s what you should include in each section of yours.

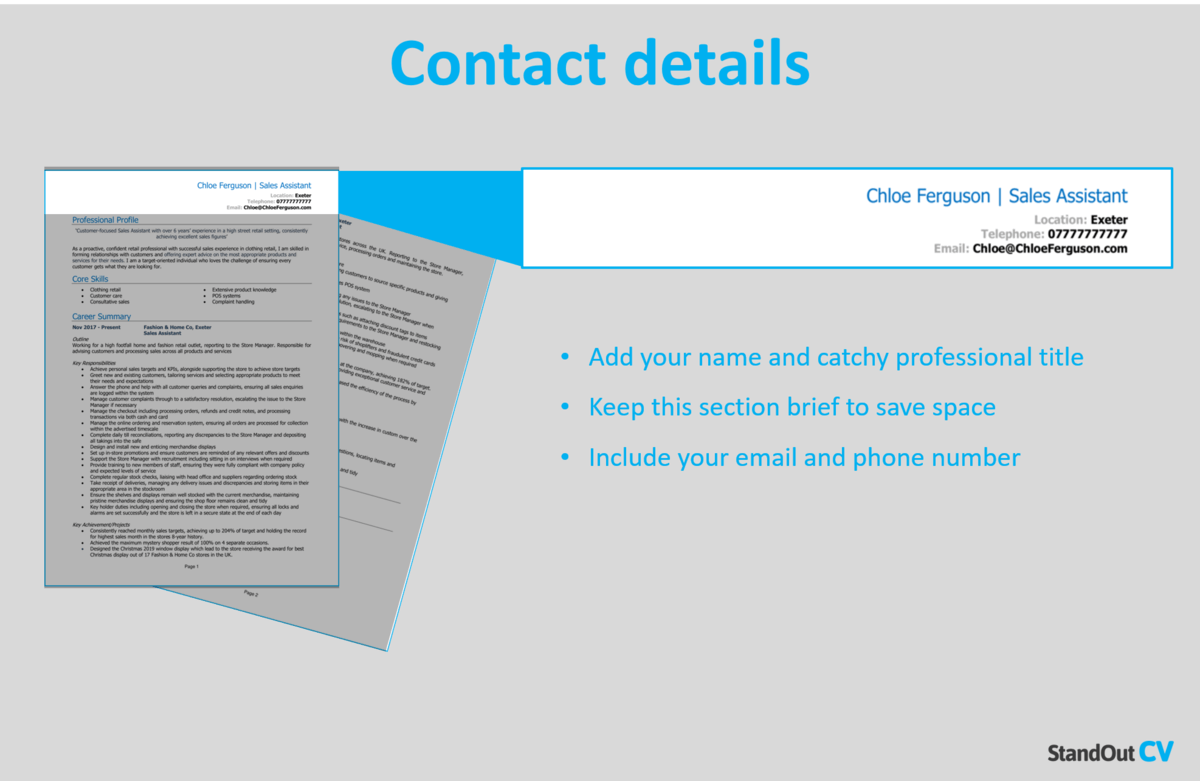

Contact Details

Begin by sharing your contact details, so it’s easy for employers to give you a call.

Keep to the basics, such as:

- Mobile number

- Email address – It should sound professional, with no slang or nicknames. Make a new one for your job applications if necessary.

- Location – Simply share your vague location, for example ‘Manchester’, rather than a full address.

- LinkedIn profile or portfolio URL – Remember to update them before you send your application.

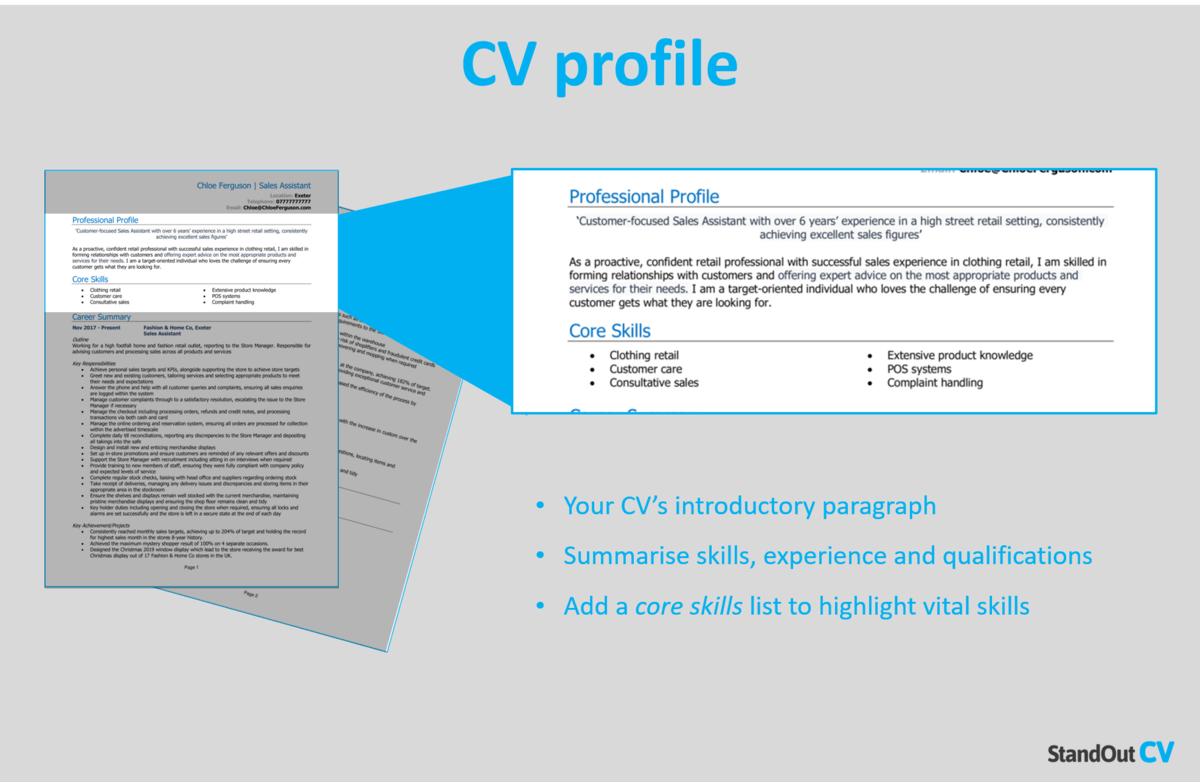

Investment Manager CV Profile

Your CV profile (or personal statement, if you’re an entry-level applicant) provides a brief overview of your skills, abilities and suitability for a position.

It’s ideal for busy recruiters and hiring managers, who don’t want to waste time reading unsuitable applications.

Think of it as your personal sales pitch. You’ve got just a few lines to sell yourself and prove you’re a great match for the job – make it count!

How to write a good CV profile:

- Make it short and sharp: Recruiters have piles of CVs to read through and limited time to dedicate to each, so it pays to showcase your abilities in as few words as possible. 3-4 lines is ideal.

- Tailor it: Before writing your CV, make sure to do some research. Figure out exactly what your desired employers are looking for and make sure that you are making those requirements prominent in your CV profile, and throughout.

- Don’t add an objective: You only have a small space for your CV profile, so avoid writing down your career goals or objectives. If you think these will help your application, incorporate them into your cover letter instead.

- Avoid generic phrases: “Determined team player who always gives 110%” might seem like a good way to fill up your CV profile, but generic phrases like this won’t land you an interview. Recruiters hear them time and time again and have no real reason to believe them. Instead, pack your profile with your hard skills and tangible achievements.

Example CV profile for Investment Manager

What to include in your Investment Manager CV profile?

- Experience overview: Recruiters will want to know what type of companies you’ve worked for, industries you have knowledge of, and the type of work you’ve carried out in the past, so give them a summary of this in your profile.

- Targeted skills: Make your most relevant Investment Manager key skills clear in your profile. These should be tailored to the specific role you’re applying for – so make sure to check the job description first, and aim to match their requirements as closely as you can.

- Important qualifications: If the job postings require specific qualifications, it is essential to incorporate them in your profile to ensure visibility to hiring managers.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

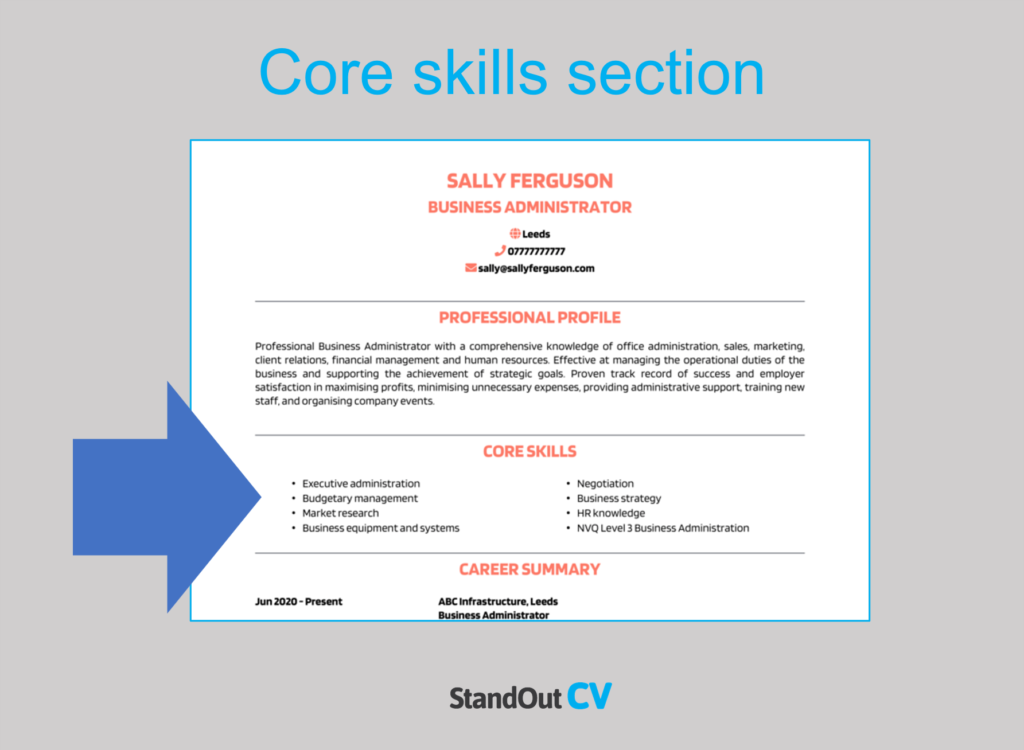

Core skills section

Create a core skills section underneath your profile to spotlight your most in-demand skills and grab the attention of readers.

This section should feature 2-3 columns of bullet points that emphasise your applicable skills for your target jobs. Before constructing this section, review the job description and compile a list of any specific skills, specialisms, or knowledge required.

Important skills for your Investment Manager CV

Portfolio Management – Construct, optimise, and rebalance investment portfolios to achieve specific financial objectives and risk tolerance levels.

Financial Analysis – Analysing financial statements, assessing the financial health of companies, and evaluating investment opportunities.

Asset Allocation Strategies – Developing and implementing asset allocation strategies based on market conditions, client goals, and risk profiles.

Risk Management – Assessing and mitigating investment risks, including market volatility, credit risk, and geopolitical factors.

Market Research – Conducting comprehensive research on financial markets, industries, and economic trends to inform investment decisions.

Due Diligence – Conducting thorough due diligence on potential investments, including assessing company fundamentals, management teams, and competitive positioning.

Investment Strategies – Developing and executing investment strategies, such as value investing, growth investing, or income generation, to meet client objectives.

Regulatory Compliance – Ensuring compliance with financial regulations, tax laws, and industry-specific rules governing investment activities in the UK.

Alternative Investments – Managing alternative investments, such as hedge funds, private equity, or real estate, if applicable.

Client Relationship Management – Building and maintaining strong client relationships, including effective communication, reporting, and addressing client concerns.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

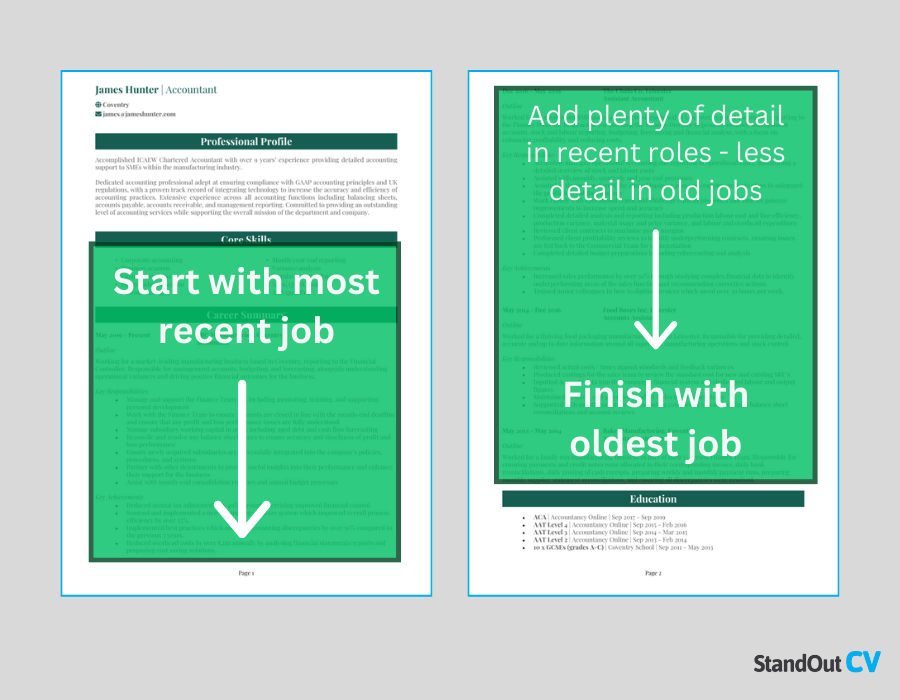

Work experience

By now, you’ll have hooked the reader’s attention and need to show them how you apply your skills and knowledge in the workplace, to benefit your employers.

So, starting with your most recent role and working backwards to your older roles, create a thorough summary of your career history to date.

If you’ve held several roles and are struggling for space, cut down the descriptions for your oldest jobs.

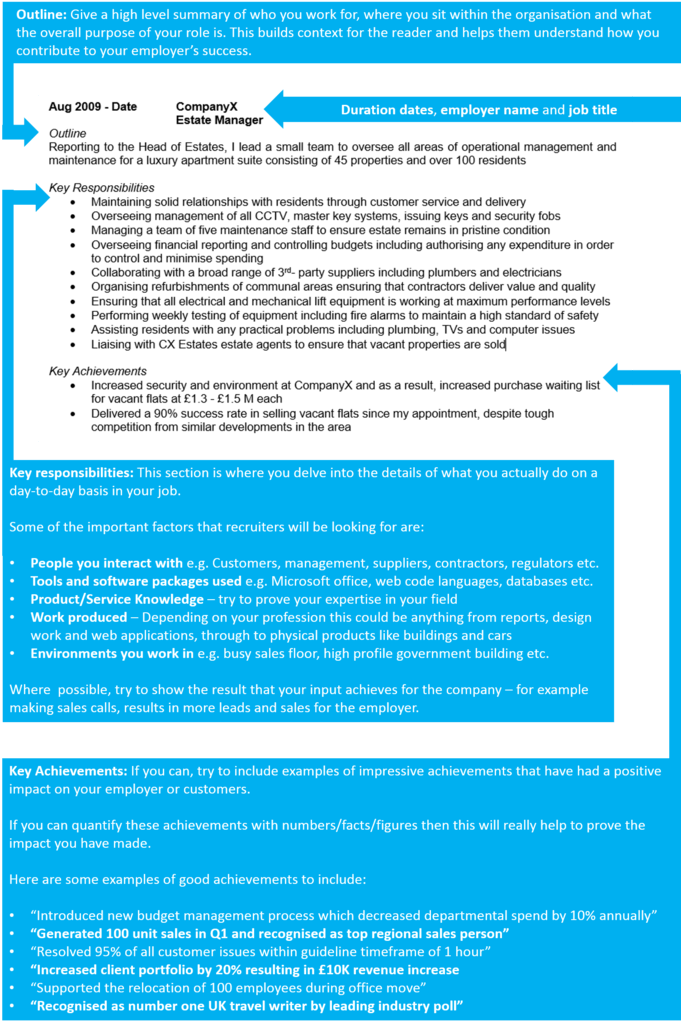

Structuring each job

Recruiters will be keen to gain a better idea of where you’ve worked and how you apply your skill-set in the workplace.

However, if they’re faced with huge, hard-to-read paragraphs, they may just gloss over it and move onto the next application.

To avoid this, use the simple 3-step role structure, as shown below:

Outline

Start with a 1-2 sentence summary of your role as a whole, detailing what the goal of your position was, who you reported to or managed, and the type of organisation you worked for.

Key responsibilities

Next up, you should write a short list of your day-to-day duties within the job.

Recruiters are most interested in your sector-specific skills and knowledge, so highlight these wherever possible.

Key achievements

Round up each role by listing 1-3 key achievements, accomplishments or results.

Wherever possible, quantify them using hard facts and figures, as this really helps to prove your value.

Sample job description for Investment Manager CV

Outline

Play a critical role in maturing investment portfolios on behalf of clients, for an authorised FSP that offers retail banking, insurance, and asset/wealth management services on a local and global scale.

Key Responsibilities

- Cultivate and nurture solid relationships by demonstrating awareness of people’s and entities’ financial goals, risk tolerance, and investment preferences.

- Relay announcements on performance levels and discuss any necessary adjustments by comparing results to benchmarks.

- Conduct research and evaluation of commercial markets and individual securities.

- Examine opportunities by considering trends, economic conditions, and geopolitical events.

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

After your work experience, your education section should provide a detailed view of your academic background.

Begin with those most relevant to Investment Manager jobs, such as vocational training or degrees.

If you have space, you can also mention your academic qualifications, such as A-Levels and GCSEs.

Focus on the qualifications that are most relevant to the jobs you are applying for.

Hobbies and interests

Although this is an optional section, it can be useful if your hobbies and interests will add further depth to your CV.

Interests which are related to the sector you are applying to, or which show transferable skills like leadership or teamwork, can worth listing.

On the other hand, generic hobbies like “going out with friends” won’t add any value to your application, so are best left off your CV.

A strong, compelling CV is essential to get noticed and land interviews with the best employers.

To ensure your CV stands out from the competition, make sure to tailor it to your target role and pack it with sector-specific skills and results.

Remember to triple-check for spelling and grammar errors before hitting send.

Good luck with the job search!