You can pinpoint customer needs and find the right policy for even the most conflicted client; the tricky part is writing a killer CV that reflects your experience.

The good news is we can help you to do this.

Using our CV writing guide and insurance broker CV example, you can prove that you’re persuasive and great at communicating.

|

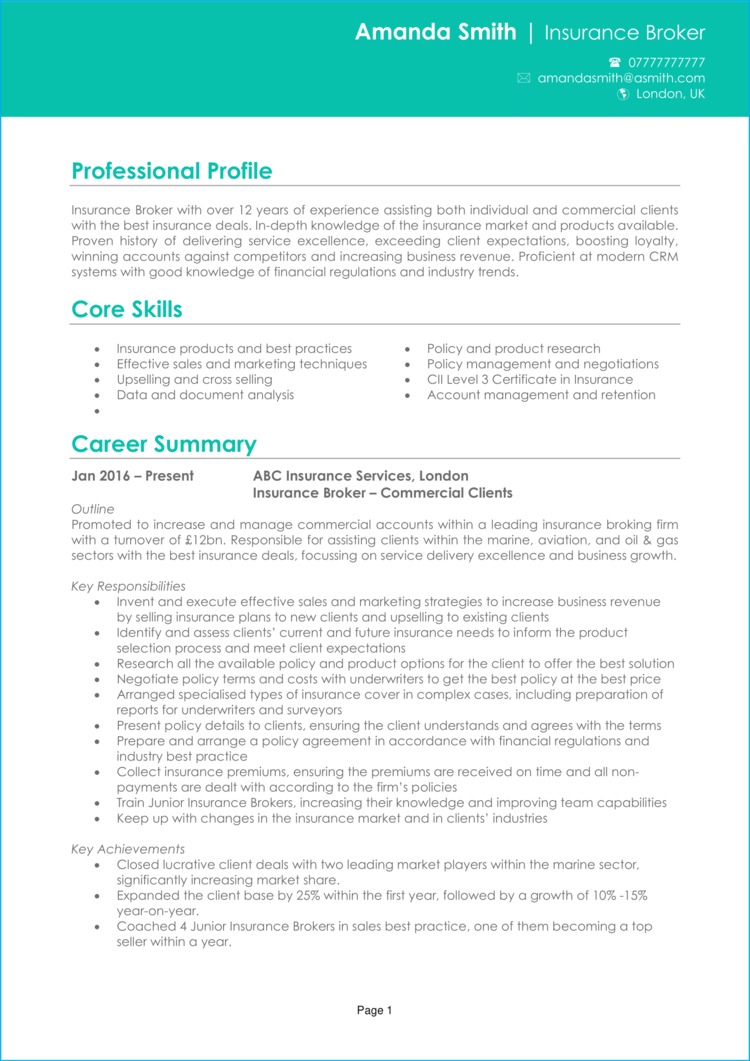

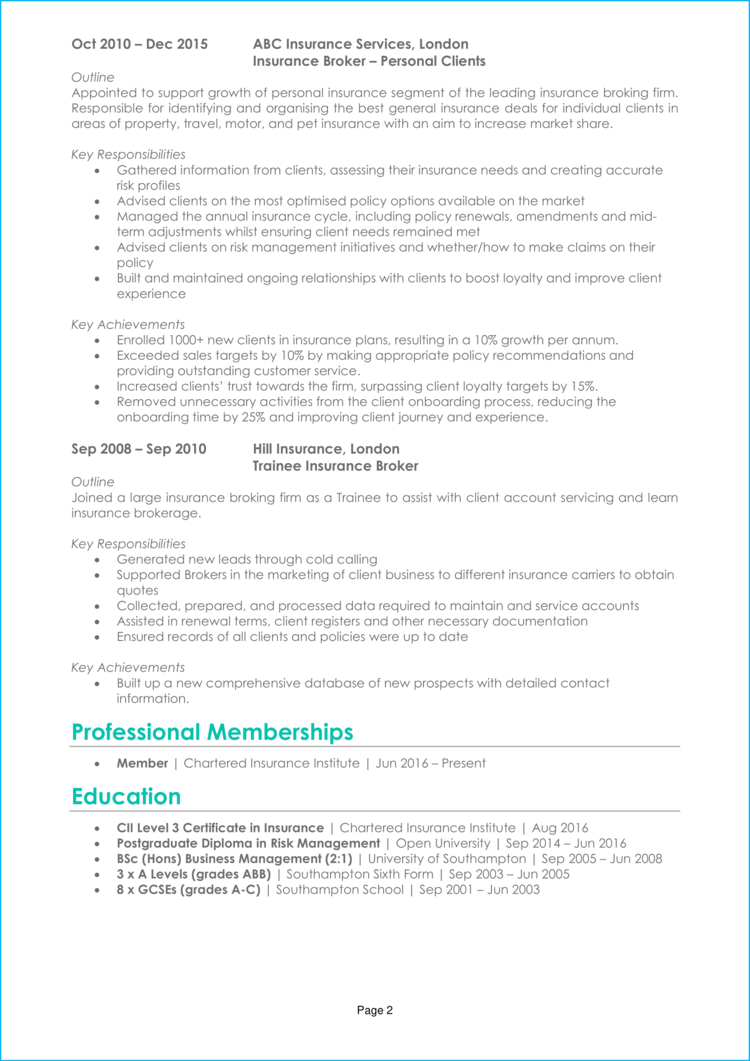

Insurance Broker CV example

This example CV demonstrates how to structure and format your own Insurance Broker CV, so that it can be easily digested by busy hiring managers, and quickly prove why you are the best candidate for the jobs you are applying to.

It also gives you a good idea of the type of skills, experience and qualifications that you need to be making prominent in your own CV.

Insurance Broker CV layout and format

Recruiters and employers are busy, and if they can’t find the information they’re looking for in a few seconds, it could be game over for your application.

You need to format and structure your CV in a way which allows the reader to pick out your key information with ease, even if they’re strapped for time.

It should be clear, easily legible, well-organised and scannable – check out some simple tips and tricks below:

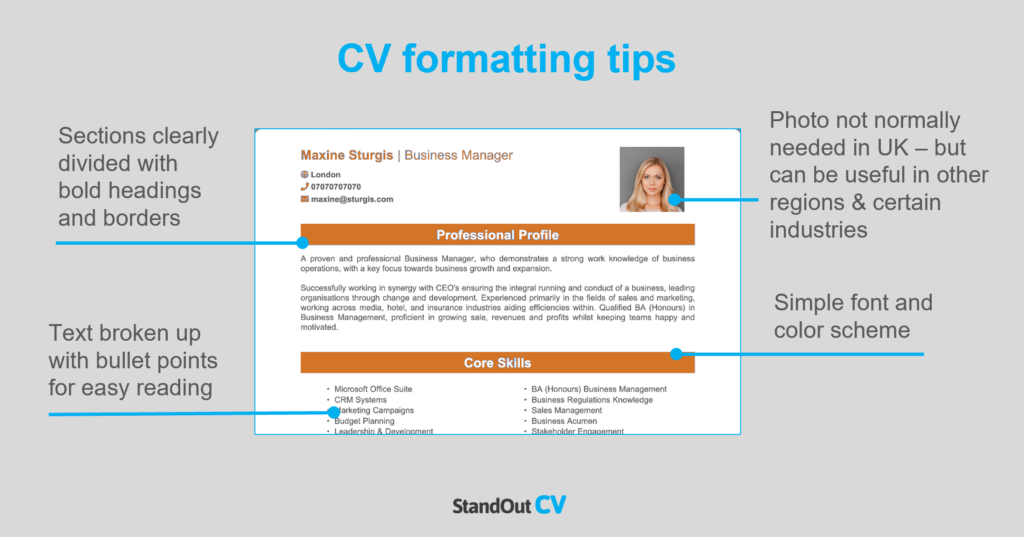

CV formatting tips

- Length: While there’s no ‘official’ CV length rule, the majority of recruiters agree that less is more. Aim for two pages of A4 or less. This is just enough room to showcase your suitability to the role, without overwhelming recruiters with irrelevant or excessive content.

- Readability: By clearly formatting your section headings (bold, or a different colour font, do the trick) and breaking up big chunks of text into snappy bullet points, time-strapped recruiters will be able to skim through your CV with ease.

- Design: The saying ‘less is more’ couldn’t be more applicable to CVs. Readability is key, so avoid overly complicated designs and graphics. A subtle colour palette and easy-to-read font is all you need!

- Avoid photos: Recruiters can’t factor in appearance, gender or race into the recruitment process, so a profile photo is totally unnecessary. Additionally, company logos or images won’t add any value to your application, so you’re better off saving the space to showcase your experience instead.

Quick tip: Formatting your CV to look professional can be difficult and time-consuming when using Microsoft Word or Google Docs. If you want to create an attractive CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

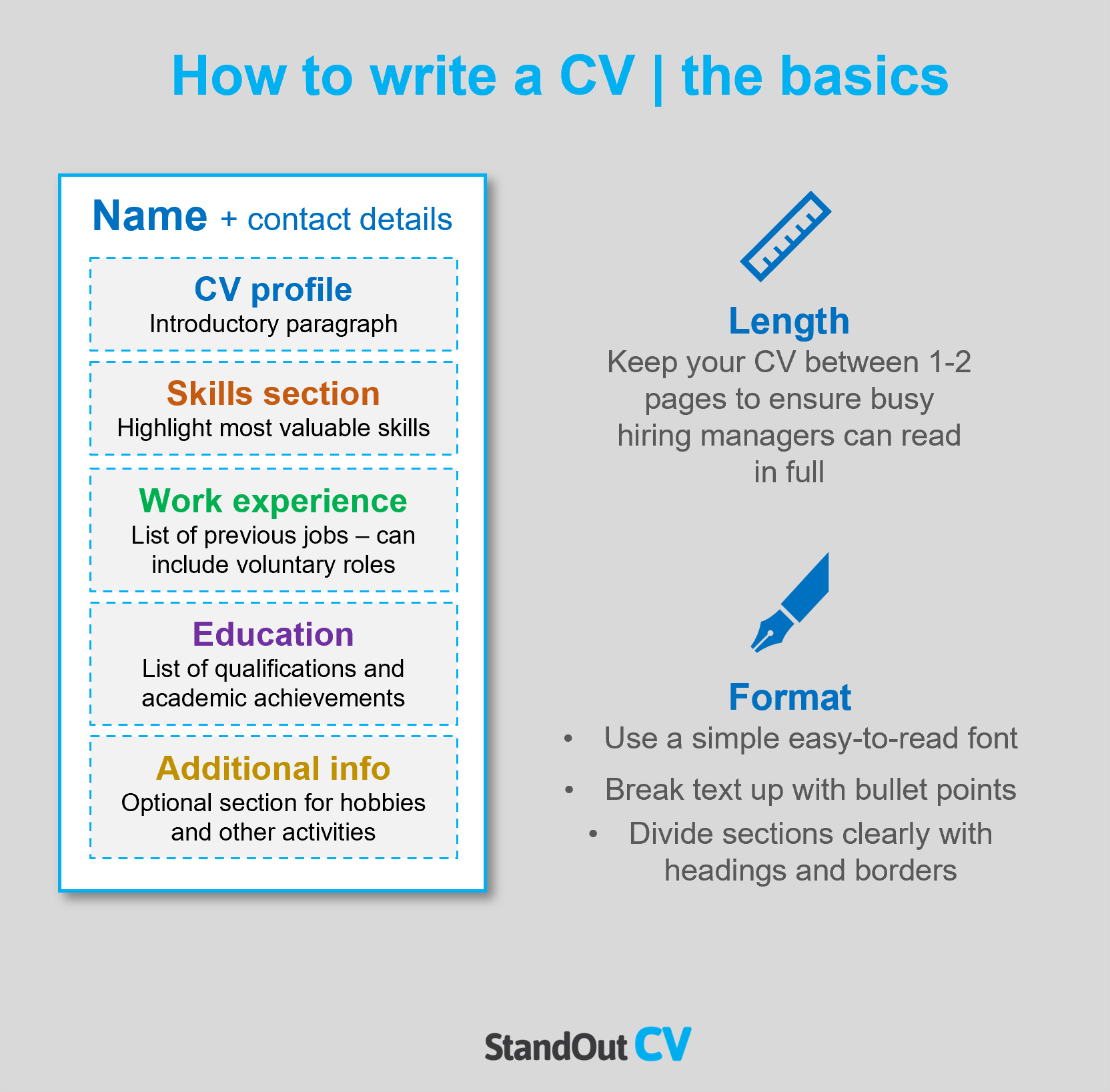

CV structure

As you write your CV, work to the simple but effective structure below:

- Name and contact details – Pop them at the top of your CV, so it’s easy for recruiters to contact you.

- CV profile – Write a snappy overview of what makes you a good fit for the role; discussing your key experience, skills and accomplishments.

- Core skills section – Add a short but snappy list of your relevant skills and knowledge.

- Work experience – A list of your relevant work experience, starting with your current role.

- Education – A summary of your relevant qualifications and professional/vocational training.

- Hobbies and interests – An optional sections, which you could use to write a short description of any relevant hobbies or interests.

Now I’ll tell you exactly what you should include in each CV section.

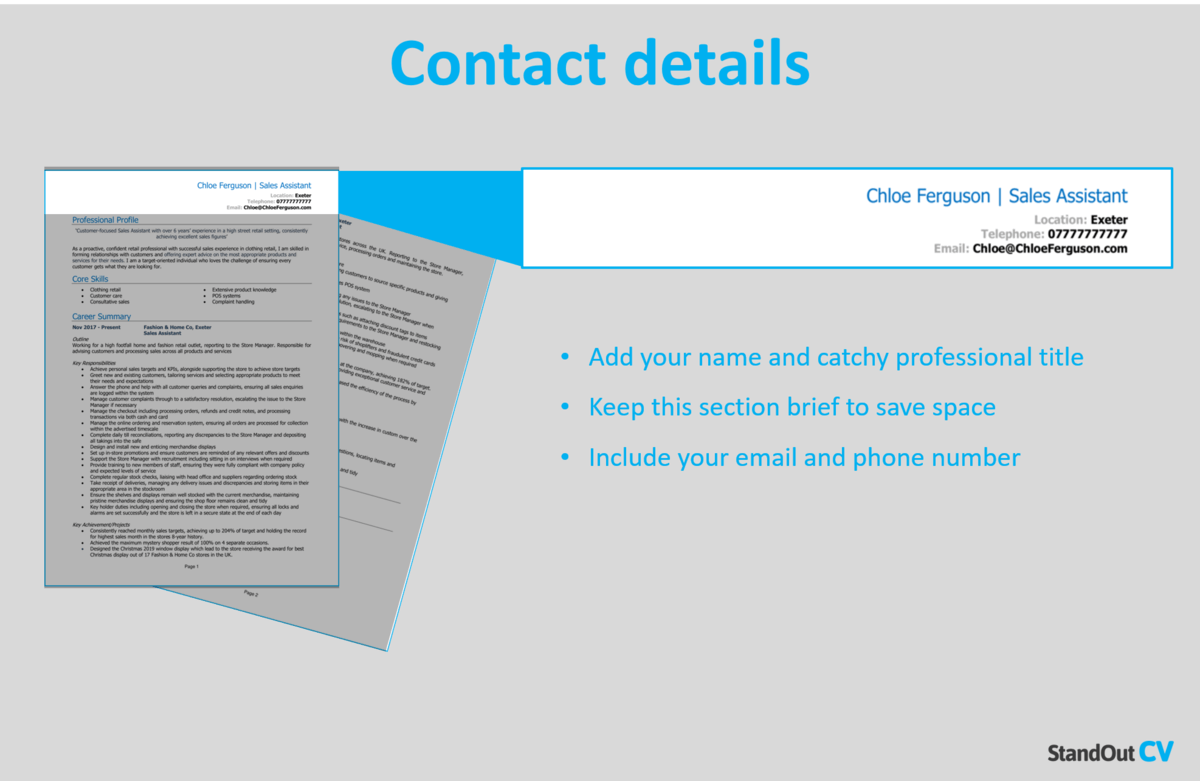

CV Contact Details

Make it easy for recruiters to get in touch, by heading your CV with your contact details.

There’s no need for excessive details – just list the basics:

- Mobile number

- Email address – Use a professional address with no nicknames.

- Location – Just write your general location, such as ‘London’ or ‘Cardiff’ – there’s no need to put your full address.

- LinkedIn profile or portfolio URL

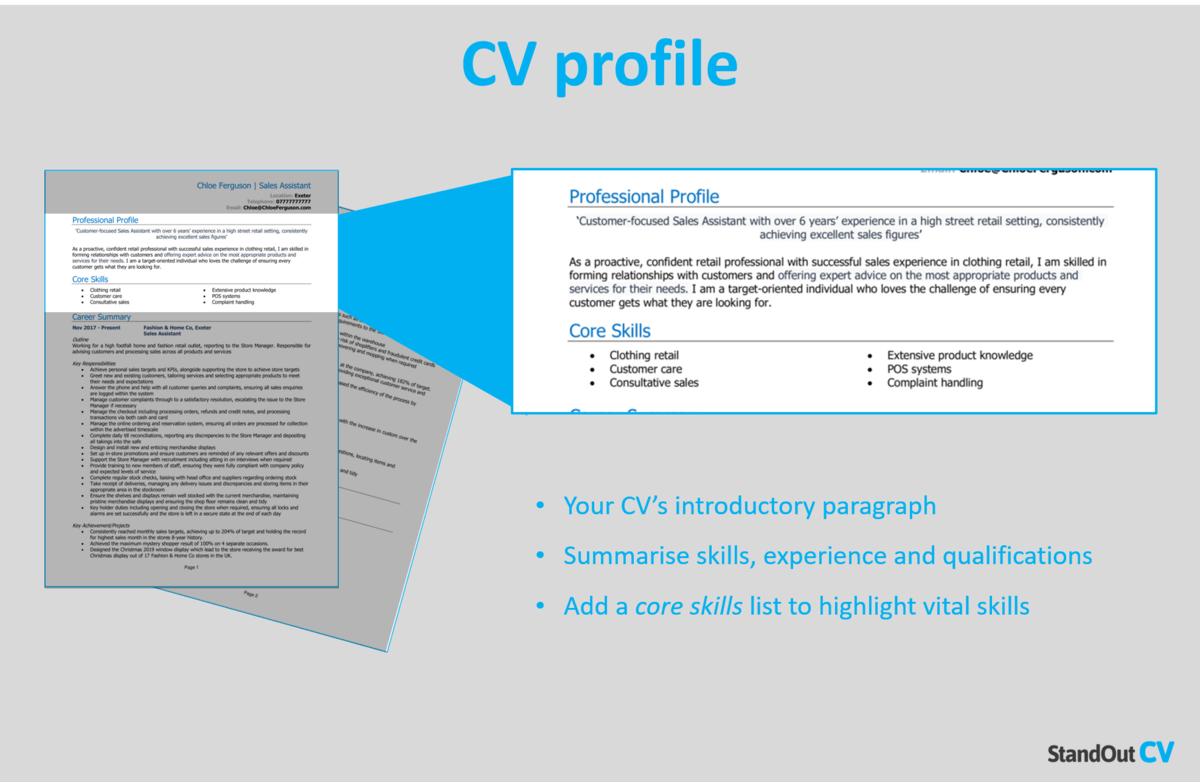

Insurance Broker CV Profile

Your CV profile is basically a short introductory paragraph, which summarises your key selling points and highlights why you’d make a good hire.

So, write a well-rounded summary of what you do, what your key skills are, and what relevant experience you have.

It needs to be short, snappy and punchy and, ultimately, entice the reader to read the rest of your CV.

Tips for creating an strong CV profile:

- Keep it concise: When it comes to CV profile length, less is more, as recruiters are often time-strapped. Aim for around of 3-5 persuasive lines.

- Tailor it: The biggest CV mistake? A generic, mass-produced document which is sent out to tens of employers. If you want to land an interview, you need to tailor your CV profile (and your application as a whole) to the specific roles you’re applying for. So, before you start writing, remember to read over those job descriptions and make a list of the skills, knowledge and experience the employers are looking for.

- Don’t add an objective: Career goals and objectives are best suited to your cover letter, so don’t waste space with them in your CV profile.

- Avoid cliches: If there’s one thing that’ll annoy a recruiter, it’s a clichè-packed CV. Focus on showcasing your hard skills, experience and the results you’ve gained in previous roles, which will impress recruiters far more.

Example CV profile for Insurance Broker

What to include in your Insurance Broker CV profile?

- Summary of experience: To give employers an idea of your capabilities, show them your track record by giving an overview of the types of companies you have worked for in the past and the roles you have carried out for previous employers – but keep it high level and save the details for your experience section.

- Relevant skills: Employers need to know what skills you can bring to their organisation, and ideally they want to see skills that match their job vacancy. So, research your target roles thoroughly and add the most important Insurance Broker skills to your profile.

- Essential qualifications: Be sure to outline your relevant Insurance Broker qualifications, so that anyone reading the CV can instantly see you are qualified for the jobs you are applying to.

Quick tip: Struggling to write a powerful profile? Choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All written by recruitment experts and easily tailored to suit your unique skillset.

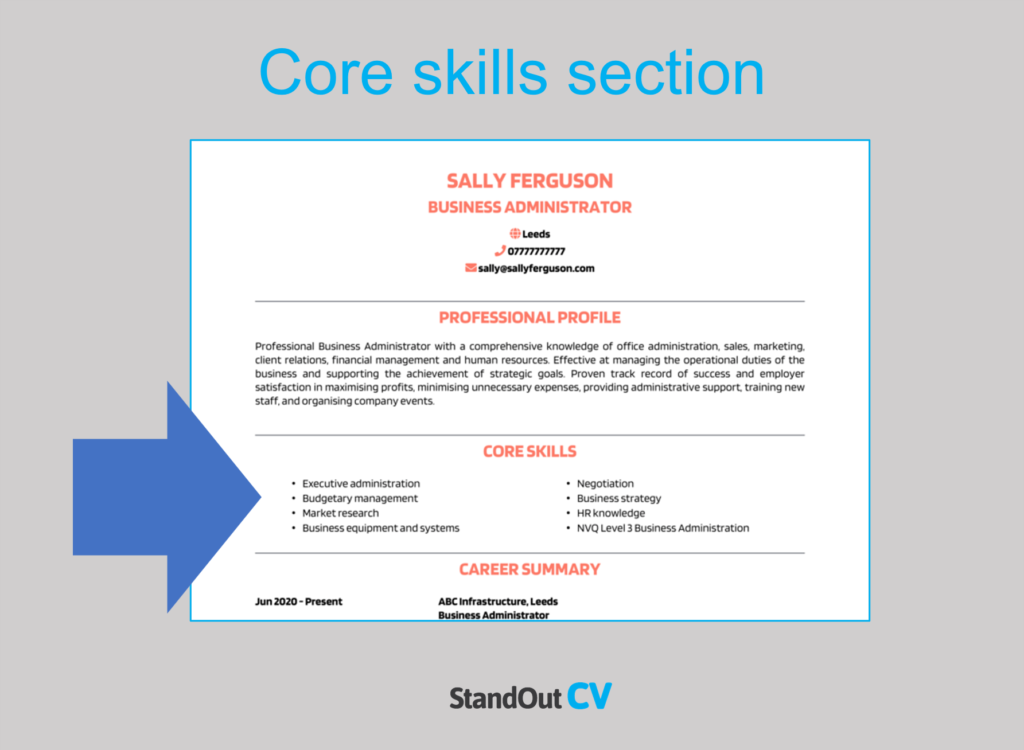

Core skills section

In addition to your CV profile, your core skills section provides an easily digestible snapshot of your skills – perfect for grabbing the attention of busy hiring managers.

As Insurance Broker jobs might receive a huge pile of applications, this is a great way to stand out and show off your suitability for the role.

It should be made up of 2-3 columns of bullet points and be made up of skills that are highly relevant to the jobs you are targeting.

Top skills for your Insurance Broker CV

Upselling and cross selling – encouraging customers to purchase a comparable higher-end insurance product than the one in question and inviting customers to buy related or complementary insurance products.

Data and document analysis – investigating information and documentation to ensure it meets expectations.

Policy and product research – analysing prospective policies to find suitable products for customers.

Policy management and negotiations – creating, managing and renewing insurance policies for clients including negotiating changes to policy terms and pricing.

Account management and retention – managing a portfolio of clients and offering suitable renewal products to ensure they are retained by the business.

Quick tip: Our quick-and-easy CV Builder contains thousands of in-demand skills for every profession that can be added to your CV in seconds – saving you time and greatly improving your chances of landing job interviews.

Work experience/Career history

By this point, employers will be keen to know more detail about you career history.

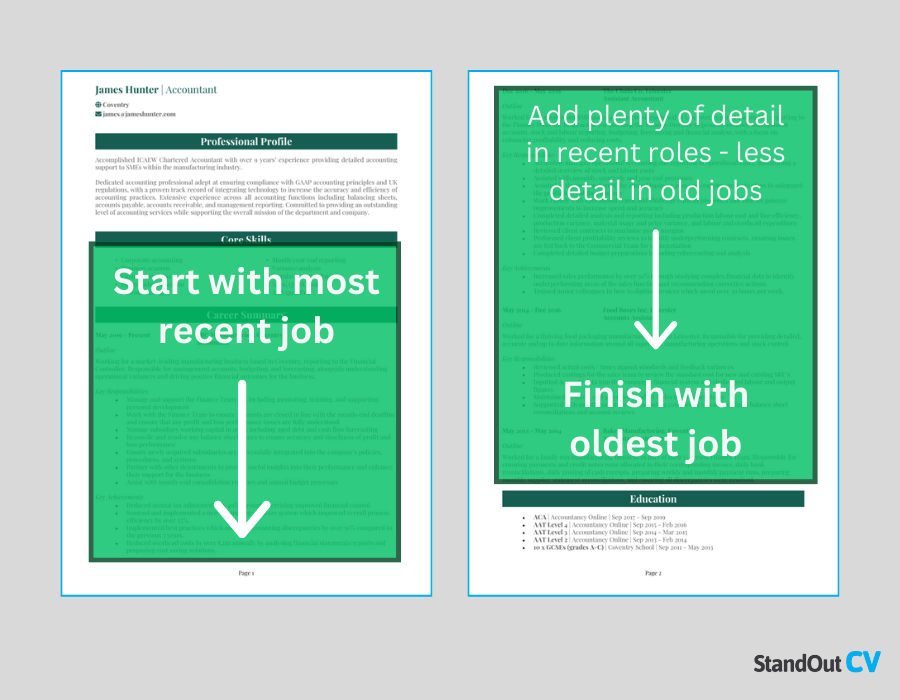

Starting with your most recent role and working backwards, create a snappy list of any relevant roles you’ve held.

This could be freelance, voluntary, part-time or temporary jobs too. Anything that’s relevant to your target role is well-worth listing!

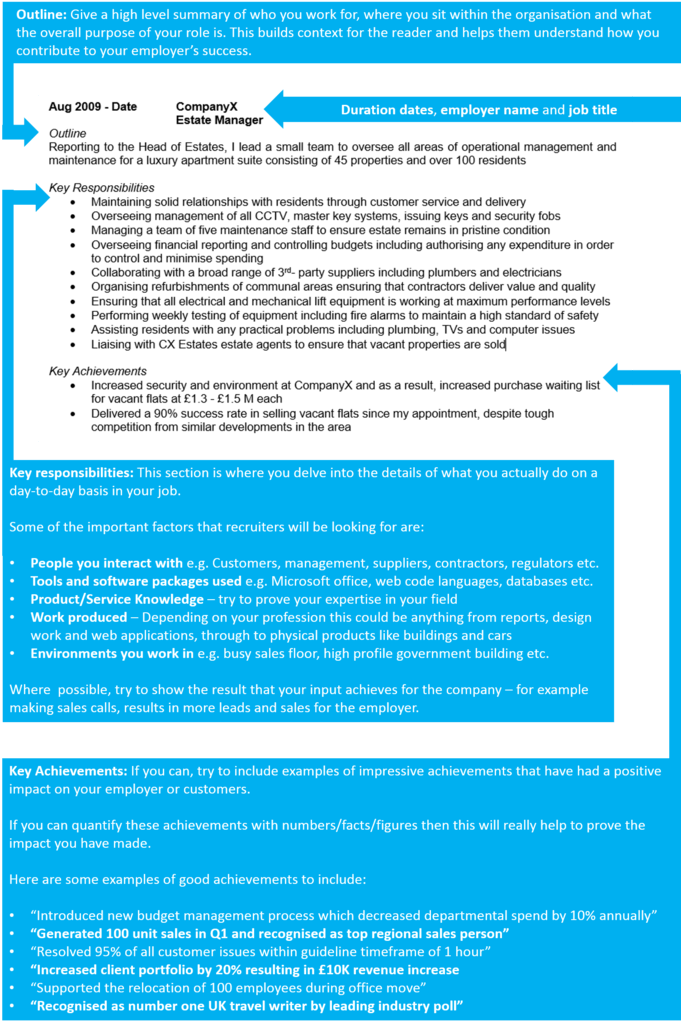

Structuring your roles

Lengthy, unbroken chunks of text is a recruiters worst nightmare, but your work experience section can easily end up looking like that if you are not careful.

To avoid this, use my tried-and-tested 3-step structure, as illustrated below:

Outline

Firstly, give the reader some context by creating a punchy summary of the job as a whole.

You should mention what the purpose or goal of your role was, what team you were part of and who you reported to.

Key responsibilities

Use bullet points to detail the key responsibilities of your role, highlighting hard skills, software and knowledge wherever you can.

Keep them short and sharp to make them easily digestible by readers.

Key achievements

To finish off each role and prove the impact you made, list 1-3 stand out achievements, results or accomplishments.

This could be anything which had a positive outcome for the company you worked for, or perhaps a client/customer.

Where applicable, quantify your examples with facts and figures.

Example job for Insurance Broker CV

Outline

Promoted to increase and manage commercial accounts within a leading insurance broking firm with a turnover of £12bn. Responsible for assisting clients within the marine, aviation, and oil & gas sectors with the best insurance deals, focussing on service delivery excellence and business growth.

Key Responsibilities

- Invent and execute effective sales and marketing strategies to increase business revenue by selling insurance plans to new clients and upselling to existing clients

- Identify and assess clients’ current and future insurance needs to inform the product selection process and meet client expectations

- Research all the available policy and product options for the client to offer the best solution

- Negotiate policy terms and costs with underwriters to get the best policy at the best price

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

In your education section, make any degrees, qualifications or training which are relevant to Insurance Broker roles a focal point.

As well as mentioning the name of the organisation, qualification titles and dates of study, you should showcase any particularly relevant modules, assignments or projects.

Interests and hobbies

The hobbies and interests CV section isn’t mandatory, so don’t worry if you’re out of room by this point.

However, if you have an interesting hobby, or an interest that could make you seem more suitable for the role, then certainly think about adding.

Be careful what you include though… Only consider hobbies that exhibit skills that are required for roles as a Insurance Broker, or transferable workplace skills.

There is never any need to tell employers that you like to watch TV and eat out.

Writing your Insurance Broker CV

Once you’ve written your Insurance Broker CV, you should proofread it several times to ensure that there are no typos or grammatical errors.

With a tailored punchy profile that showcases your relevant experience and skills, paired with well-structured role descriptions, you’ll be able to impress employers and land interviews.

Good luck with your next job application!