You’ve cracked complex models. Now let’s crack a CV that actually gets read.

This guide and its 2 Actuary CV examples will help show off your analytical expertise while communicating your professional value, all in order to give hiring managers exactly what they need to put you on their books.

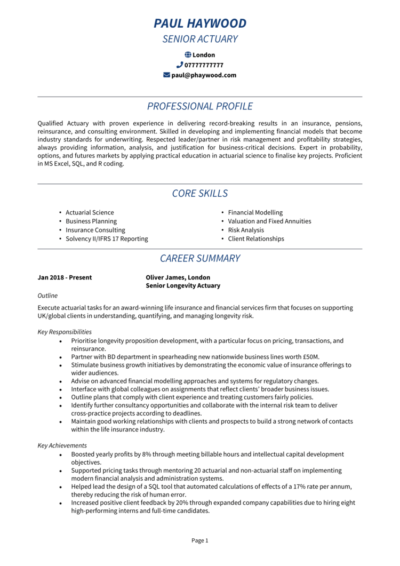

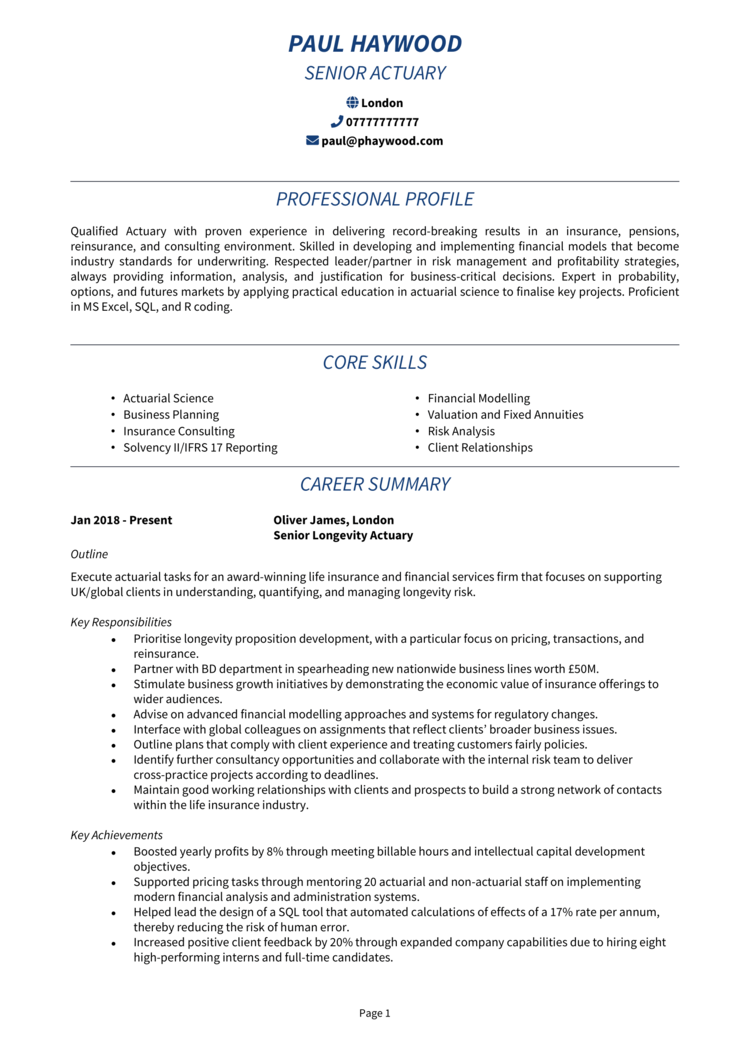

Actuary CV example

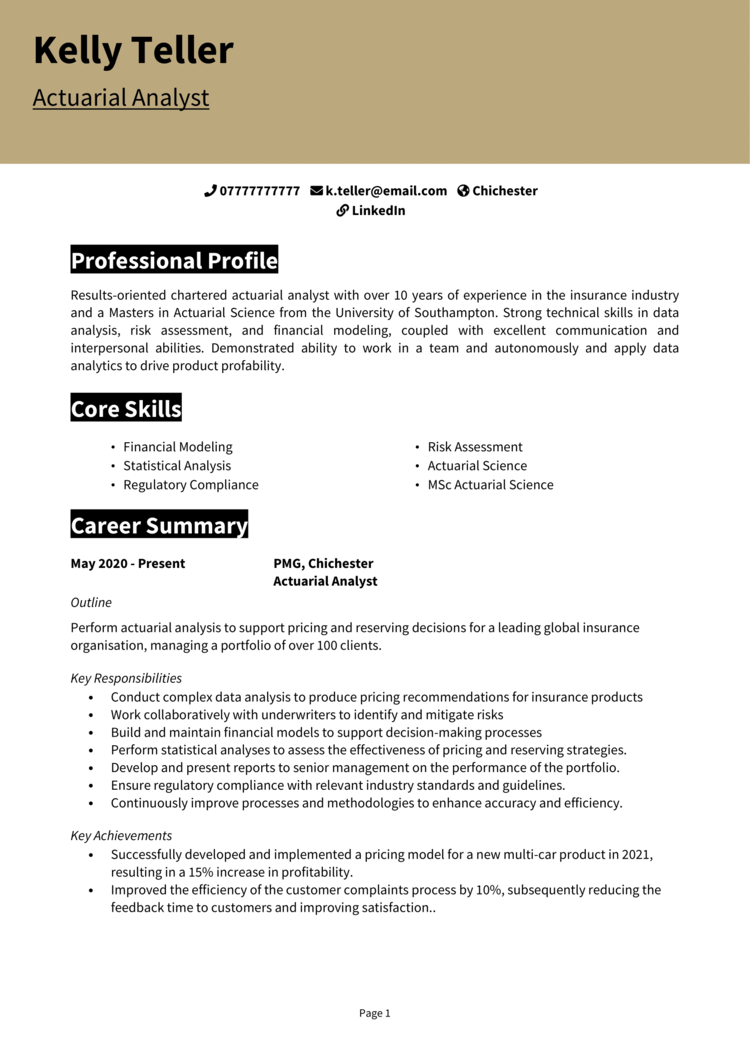

Actuarial Analyst CV example

How to write your Actuary CV

Discover how to craft a winning Actuary CV that lands interviews with this simple step-by-step guide.

Whether you’re forecasting financial trends or pricing complex insurance portfolios, your job relies on precision – and your CV should reflect that same level of sharpness. It’s not about listing every dataset you’ve ever dissected; it’s about showcasing the judgement and value you bring to a business.

This guide will walk you through the formatting and content needed to write a CV like a data-backed argument for hiring you.

How to structure and format your Actuary CV

If your structure is as logical as your calculations, you’re already halfway to the shortlist. Your work depends on methodologies and clear documentation, so your CV should be no different. If a recruiter can’t follow your qualifications or quickly understand your skill set, you’ve already lost them.

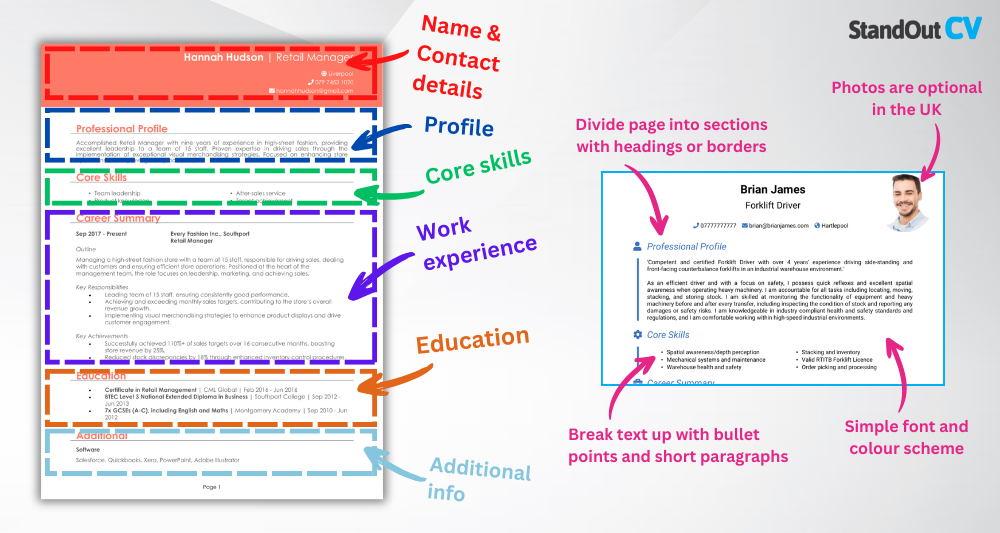

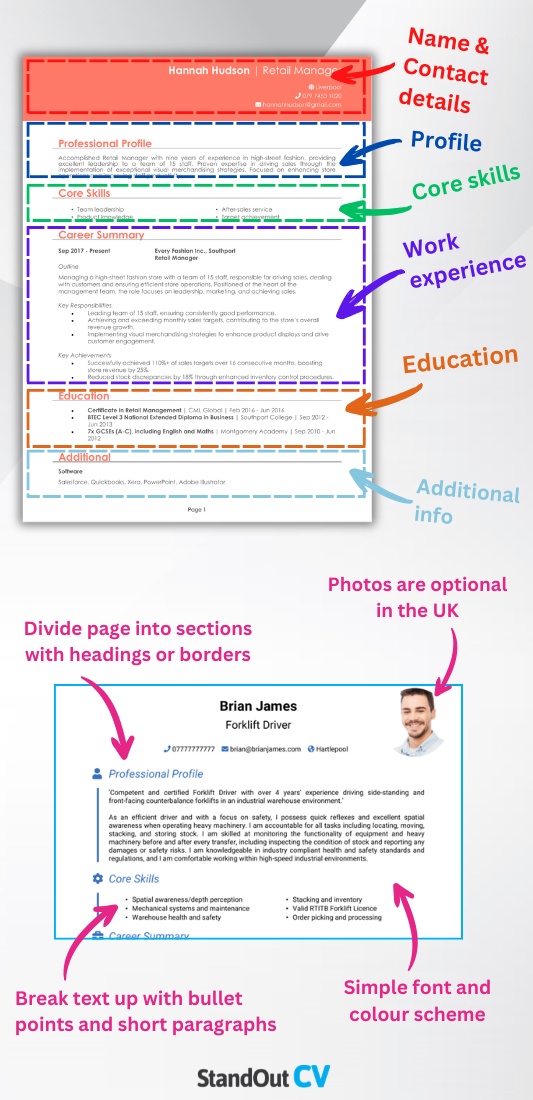

Here’s the layout to follow:

- Name and contact details – Start with your name and personal details – make it simple for recruiters to reach you. Including a photo is a personal choice.

- Profile – Use this section to summarise your experience, strengths, and what makes you a standout candidate.

- Core skills – Outline your primary competencies to give recruiters a snapshot of your strengths.

- Work experience – Walk through your professional experience, beginning with your latest position and moving backwards.

- Education – Outline your education and certifications, focusing on those most relevant to the role.

- Additional info – You can add hobbies or activities here that reflect your enthusiasm for the industry.

Keep formatting clear and efficient: use bullet points to make dense text nice and readable, and divide your CV with clean section headings. Stick to a professional font and layout that makes your document easy to scan. Aim for a two-page maximum length – and make every line count. The more accessible your CV is, the more likely it is that your application will be seriously considered.

How to write an Actuary CV profile

Your CV profile is your short elevator pitch at the top of your CV – and for actuaries, it should strike a balance between technical competence and business insight. It’s where you tell the recruiter what kind of actuary you are, what sectors you’ve worked in, and what you bring to the table in terms of strategic value.

Actuary CV profile examples

Profile 1

Experienced Actuary with over 15 years in the life insurance and pensions sector, advising large financial institutions on risk modelling, reserving, and regulatory compliance. Skilled in using Prophet and R for actuarial analysis, with a strong track record of delivering accurate forecasts and supporting executive decision-making.

Profile 2

Analytical Actuary with eight years of experience in general insurance, specialising in pricing, loss modelling, and claims analysis. Proficient in SQL, SAS, and Python, with a strong grasp of Solvency II and IFRS 17 requirements. Frequently collaborates with underwriting and finance teams to support strategic planning.

Profile 3

Detail-oriented Actuary with three years of experience working at a pensions consultancy. Supported scheme valuations, liability modelling, and benefit calculations for corporate clients. Comfortable working with Excel VBA and actuarial modelling tools in a fast-paced advisory setting.

Details to put in your Actuary CV profile

Here’s some tips on what your CV profile should include:

- Where you worked – State the type of organisations you’ve worked with, whether that’s insurers, consultancies, pension providers, or corporate finance teams.

- Your top qualifications – Mention if you’re a Fellow of the IFoA, part-qualified, or currently completing actuarial exams.

- Essential skills – Summarise your key strengths – but focus on what matters to hiring managers, such as pricing, reserving, modelling, or risk analysis.

- Sectors or clients supported – Mention if you’ve worked in general insurance, life insurance, pensions, reinsurance, or investment – and what sort of clients or portfolios you’ve advised on.

- Value delivered – Demonstrate how your actuarial work has helped reduce risk, improve forecasting, or support major financial decisions.

What to include in the core skills section of your CV

This section offers a snapshot of your capabilities – and in a highly technical field like actuarial science, it should be carefully aligned with the job you’re applying for. Avoid generic statements and instead focus on demonstrating that you have the precise analytical, regulatory, and financial skills required.

Don’t just list every tool or technique you’ve touched – prioritise those that match the role’s responsibilities. This section is all about matching recruiter expectations with your CV skills.

What are the most important skills for an Actuary CV?

- Statistical Modelling and Forecasting – Building predictive models using statistical techniques to assess future risks and financial outcomes.

- Insurance Risk Assessment – Evaluating the likelihood and financial impact of events such as illness, accidents, or natural disasters for underwriting purposes.

- Pension Scheme Valuation – Calculating pension liabilities and future obligations to ensure long-term scheme sustainability and compliance.

- Data Analysis and Interpretation – Analysing large datasets to identify trends, draw insights, and inform risk and investment strategies.

- Regulatory and Compliance Knowledge – Ensuring actuarial practices meet legal standards and industry-specific regulatory requirements.

- Financial Reporting and Reserving – Determining reserves and provisions for future claims in line with accounting standards and actuarial assumptions.

- Pricing and Product Development – Designing insurance or financial products using actuarial models to balance competitiveness and profitability.

- Use of Actuarial Software and Tools – Proficient in tools like R, Python, Prophet, Emblem, or Excel VBA to automate and refine actuarial calculations.

- Stress Testing and Scenario Analysis – Evaluating the impact of adverse events or economic changes on business performance and risk exposure.

- Cross-Functional Collaboration – Working with finance, underwriting, and investment teams to support sound business and strategic decisions.

How to write a strong work experience section for your CV

Your work experience section is where your numbers speak. Whether you’ve worked in-house, as part of a consultancy, or within an insurance firm, this is where you prove that your work makes a measurable difference – through modelling accuracy, compliance, or client value.

List your roles in reverse chronological order. For each, begin with a short paragraph describing the employer and your position, followed by bullet points that highlight your responsibilities and achievements. Be clear about the tools you used, the scale of your impact, and the types of clients or portfolios you supported.

The best way to structure job entries on your CV

- Outline – Give context about your employer and the scope of your actuarial responsibilities – were you in a technical modelling role, advising clients, or providing risk oversight?

- Responsibilities – Use action words like “modelled” and “forecasted.” For example: “modelled risk exposure for large pension fund portfolios” or “forecasted claims costs using internal tools and external datasets.”

- Achievements – Focus on quantifiable outcomes: reducing loss ratios, enhancing reporting accuracy, or helping clients make more informed financial decisions.

Sample jobs for an Actuary

Actuary | Centura Life & Pensions

Outline

Provided actuarial analysis and regulatory reporting for a large UK life insurer with a broad retirement and protection product portfolio. Played a key role in modelling assumptions and presenting risk insights to senior management.

Responsibilities

- Developed and maintained Prophet models for statutory valuations and embedded value reporting

- Reviewed mortality, lapse, and expense assumptions as part of quarterly model updates

- Prepared solvency capital requirement (SCR) calculations under Solvency II

- Worked with finance to align actuarial outputs with IFRS 17 reporting requirements

- Presented experience analysis findings to board-level committees

Achievements

- Improved model run efficiency by 35% through code optimisation and runtime diagnostics

- Supported a £200m product repricing initiative with scenario modelling and sensitivity testing

- Contributed to a regulatory submission that passed audit with zero technical queries

Actuary | Halworth General Insurance

Outline

Worked within the pricing and reserving team at a mid-sized UK motor and property insurer. Supported product development, rate setting, and performance monitoring using statistical modelling tools.

Responsibilities

- Built and calibrated pricing models using GLMs in SAS and Python

- Monitored claims trends and analysed frequency/severity shifts across portfolios

- Generated monthly reserve analyses for inclusion in financial statements

- Collaborated with underwriting on risk appetite reviews and loss cost projections

- Provided actuarial support during the launch of three new regional motor products

Achievements

- Reduced pricing volatility by implementing a new risk segmentation model

- Helped decrease average claims cost by 12% through targeted analysis of fraud indicators

- Shortened month-end reserving cycle by two days through automated reporting scripts

Actuary | Ordan Consulting

Outline

Supported DB and DC pension scheme clients at a specialist actuarial and employee benefits consultancy. Assisted in preparing valuation reports, funding updates, and long-term projections for corporate sponsors.

Responsibilities

- Calculated technical provisions and liabilities for scheme valuations and accounting purposes

- Drafted actuarial reports and advised on recovery plans and contribution schedules

- Created benefit statements and retirement illustrations for scheme members

- Analysed demographic and salary data to support assumption setting

- Used Excel and internal modelling software to prepare asset-liability projections

Achievements

- Improved turnaround time for annual statements by 40% through template redesign

- Supported two scheme buy-in transactions by preparing liability data packs for insurers

- Helped win a new client account through a tailored valuation proposal with senior actuary

How to list your educational history

Your academic background carries real weight in actuarial hiring, particularly when paired with exam progress. This section should clearly show the depth of your mathematical and analytical education, as well as your progress toward full actuarial qualification.

List your highest qualifications first – typically a degree in mathematics, actuarial science, statistics or economics – along with your university, degree classification, and year of graduation. Also include your actuarial exam progress: state if you’re part-qualified or a full Fellow of the IFoA.

What are the best qualifications for an Actuary CV?

- Fellowship of the Institute and Faculty of Actuaries (IFoA) – The gold standard for qualified actuaries in the UK

- BSc in Actuarial Science or Mathematics – A strong academic foundation in quantitative methods

- Chartered Enterprise Risk Actuary (CERA) – Useful for actuaries working in risk and capital modelling

- MSc in Financial Mathematics or Data Science – Adds technical depth and value for certain specialisms

- CPD and regulatory training (e.g. Solvency II, IFRS 17) – Supports compliance and reporting responsibilities