You know how to balance the books, but can you balance your CV to show off both technical skills and business impact?

Employers aren’t just looking for someone who understands spreadsheets and profit margins; they want a finance professional who can analyse data and drive smart business decisions.

Along with numerous Finance CV examples, this guide will show you how to structure your CV to highlight your financial expertise and prove to hiring managers that you’re the safe investment they need.

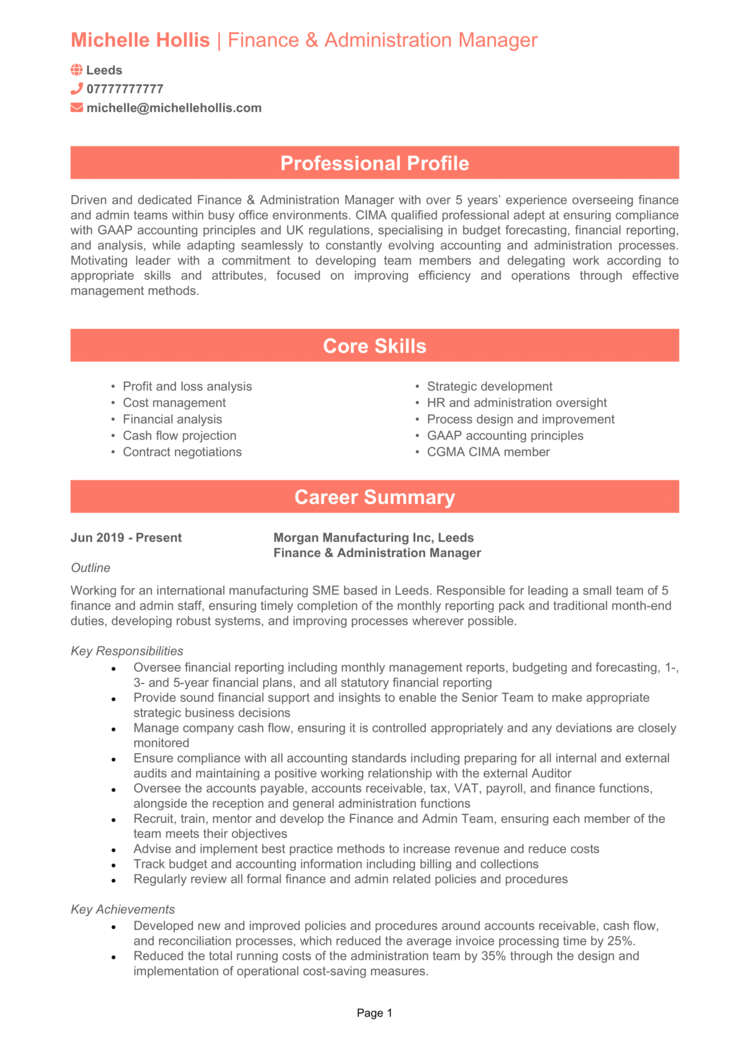

Finance Manager CV example

Finance Analyst CV example

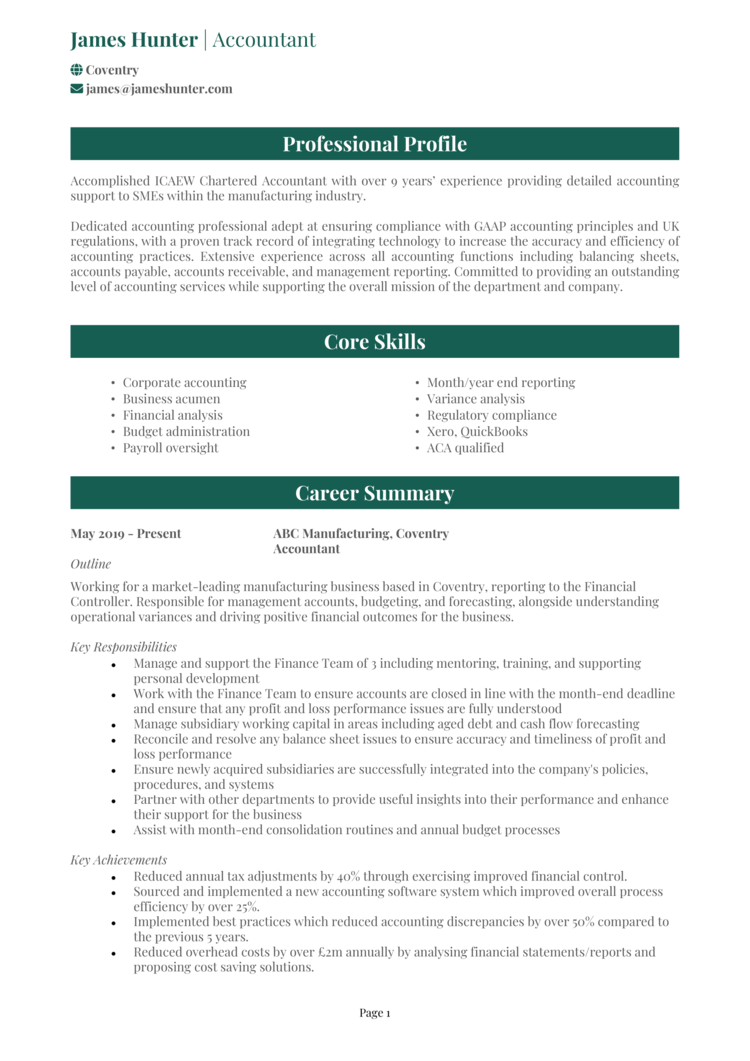

Accountant CV example

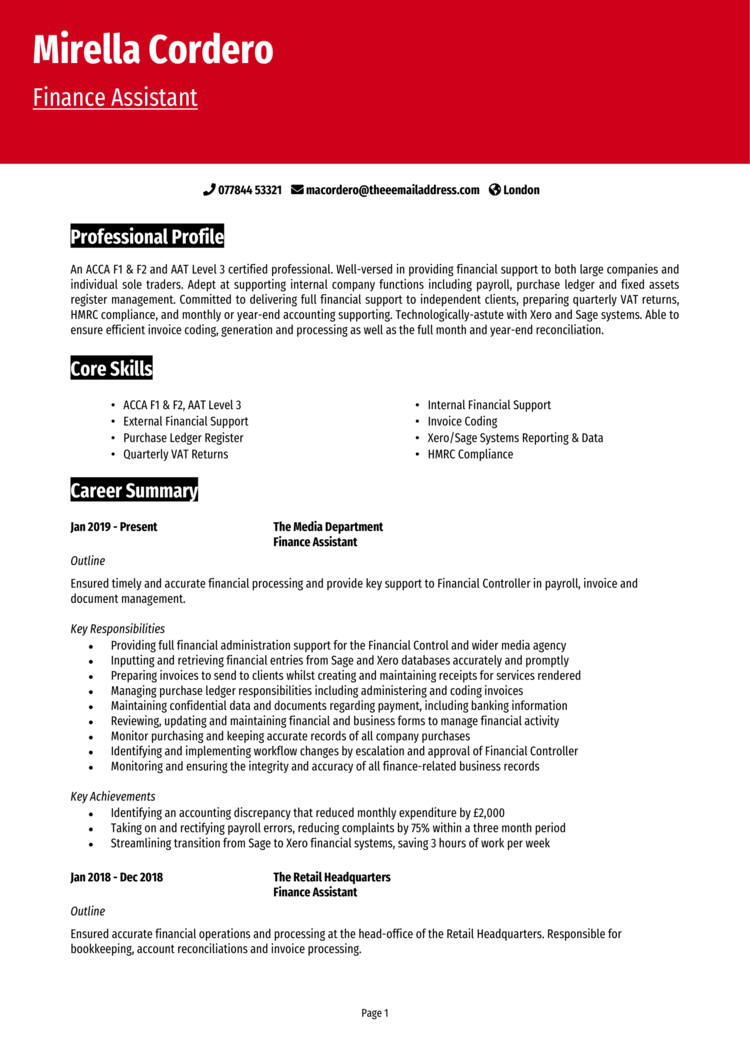

Finance Assistant CV example

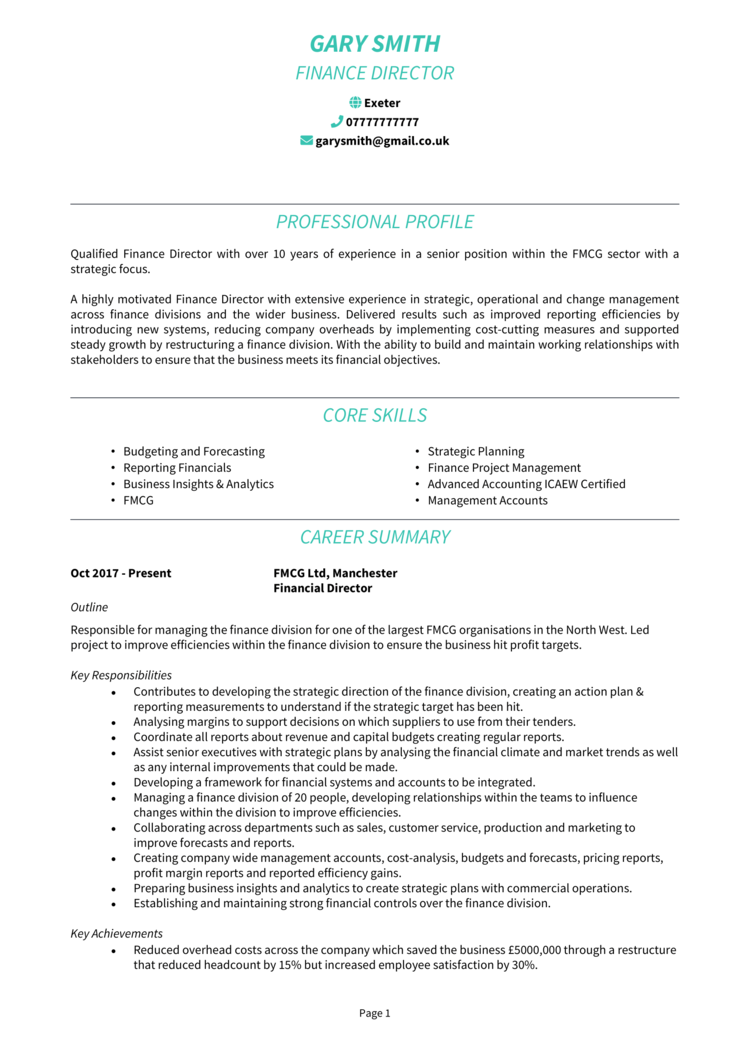

Finance Director CV example

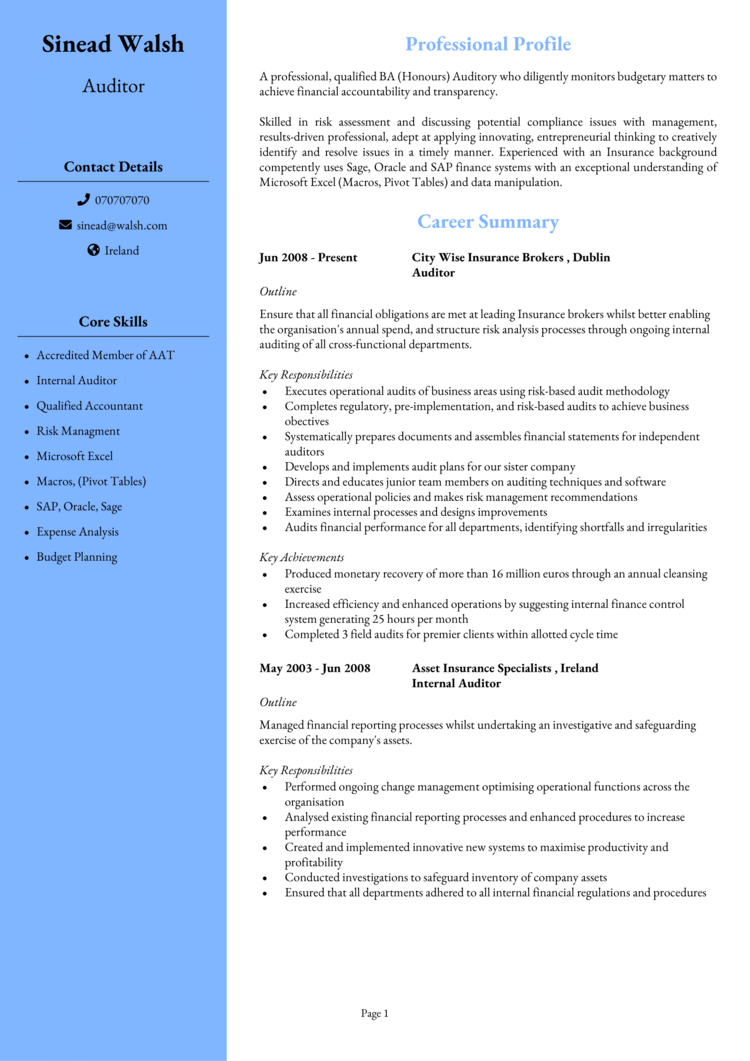

Auditor CV example

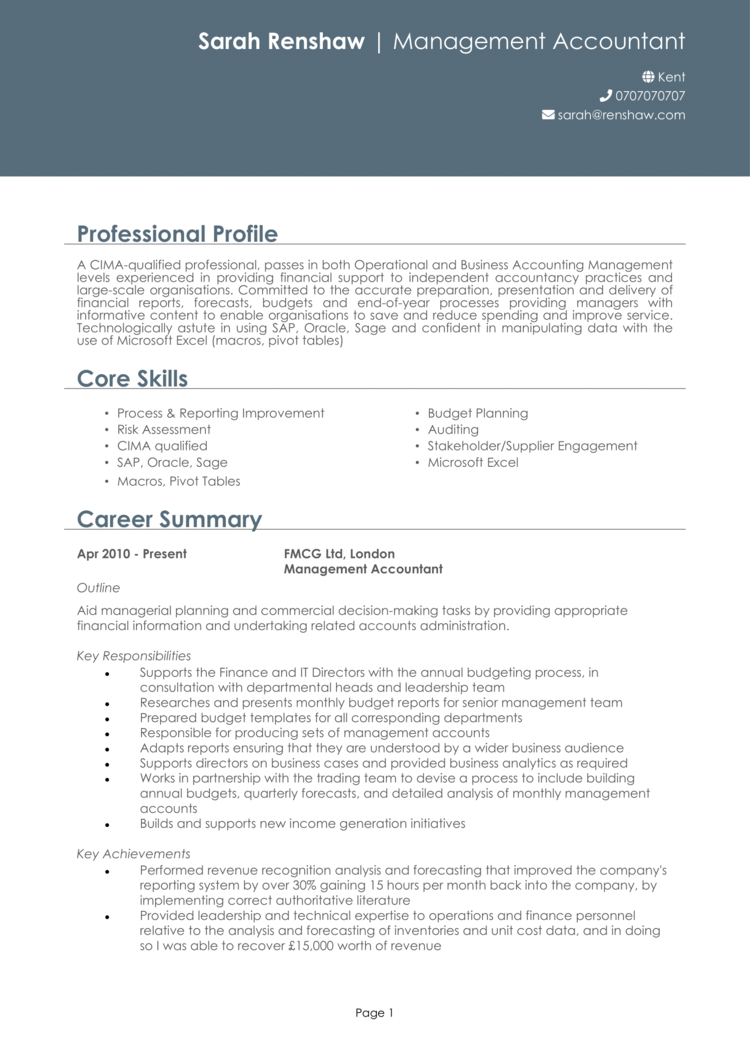

Management Accountant CV example

How to write your Finance CV

Learn how to create your own interview-winning Finance CV with this simple step-by-step guide.

A low quality CV is like a financial report with missing data – frustrating to read and unlikely to get the results you want. Recruiters need to see your key qualifications, experience, and skills at a glance, so a clear and professional application is essential.

This guide will walk you through formatting your CV, showcasing your financial strengths, and demonstrating your ability to make informed, strategic decisions. By the end, your CV will be fully audited and ready for approval.

Structuring your Finance CV

Just like a financial statement, writing a CV should be well-organised and easy to understand. Hiring managers need to quickly assess your suitability, so keep it structured and professional: if they have to dig through pages of irrelevant details, they’ll move on faster than investors after a bad earnings report

Here’s the structure you should follow:

- Name and contact details – Make sure your personal details are easy to find to make it easier to send you the inevitable job offers.

- Profile – Immediately draw in the recruiter with a brief summary of your skills and experience.

- Core skills – Quickly list your biggest strengths, like financial forecasting and risk management.

- Work experience – Walk through your employment history in reverse chronological order.

- Education – List the qualifications and certificates that make you the right fit

- Additional info – You can optionally list any relevant hobbies, technical proficiencies, or awards which help to convey your suitability.

Best format for a Finance CV

In finance, presentation matters – if your reports are clear and well-structured, your CV should be too. If your CV layout is cluttered or difficult to read, recruiters may assume your financial reports would be the same – so avoid simple formatting mistakes.

Here’s some helpful tips to keep your CV format as good as it can be:

- Bullet points – Help the recruiter skim your CV quickly and pick up the important bits with ease.

- Divide sections – Logically organise the information and make it easy to navigate.

- Use a clear and readable font – Just make sure it’s a clear and easy font to read for a polished and professional look.

- No more than 2 pages – 2 pages is the perfect length to cover the essentials without getting boring.

Creating a strong Finance CV profile

Your CV profile is your chance to introduce yourself as a finance professional who delivers results. Think of it as your executive summary – concise, impactful, and giving recruiters a reason to keep reading.

Finance CV profile examples

Profile 1

Analytical Finance Analyst with four years of experience in financial planning, forecasting, and performance analysis. Skilled in building financial models, conducting variance analysis, and presenting insights to senior stakeholders. Proficient in Excel, SAP, and Tableau for data-driven decision-making. Passionate about improving financial efficiency and supporting strategic growth.

Profile 2

Proactive Financial Advisor with three years of experience in investment planning, wealth management, and risk assessment. Skilled in developing personalised financial strategies, portfolio management, and retirement planning. Experienced in using Morningstar, FactSet, and CRM software to track client portfolios. Dedicated to helping clients build sustainable financial success through data-driven advice.

Profile 3

Experienced Finance Manager with over six years of expertise in managing budgets, cash flow, and financial reporting for multinational corporations. Skilled in cost optimisation, financial compliance, and stakeholder engagement. Proficient in Power BI, Oracle Financials, and IFRS reporting. Focused on enhancing financial efficiency and ensuring long-term business sustainability.

What to include in your Finance CV profile

Try to include:

- Finance specialisation – Are you skilled in corporate finance, investment analysis, risk management, or financial planning?

- Industry experience – Have you worked in banking, accounting, fintech, or a corporate finance role?

- Technical expertise – Whether it’s financial modelling, auditing, or regulatory compliance, highlight your strengths.

- Your impact – Have you optimised budgets, reduced financial risk, or improved forecasting accuracy?

- Software proficiency – If you’re experienced with SAP, QuickBooks, or other financial tools, mention them here.

Core skills section

Time for your key performance indicators (KPIs) – what makes you a standout candidate? A well-crafted core skills section allows hiring managers to quickly assess whether you have the expertise they need.

Finance is a broad field, so tailor your CV skills to the specific role you’re applying for. If the job is in investment analysis, focus on risk assessment and portfolio management. If it’s an accounting role, highlight regulatory compliance and financial reporting.

Top skills for your Finance CV

- Financial Analysis – Interpreting financial data to assess company performance, identify trends, and support decision-making.

- Budgeting and Forecasting – Developing financial plans, setting budgets, and projecting future financial performance.

- Financial Reporting – Preparing balance sheets, income statements, and cash flow reports for internal and external stakeholders.

- Risk Management – Identifying financial risks and implementing strategies to mitigate potential losses.

- Tax Compliance and Planning – Ensuring adherence to tax regulations and optimising tax strategies for businesses and individuals.

- Investment Analysis – Evaluating market trends, financial instruments, and investment opportunities to maximise returns.

- Cost Control and Reduction – Analysing expenses and implementing measures to improve financial efficiency.

- Accounting Software Proficiency – Using tools like QuickBooks, SAP, or Xero to manage financial records and transactions.

- Auditing and Compliance – Conducting internal audits and ensuring compliance with financial regulations and company policies.

- Corporate Finance – Managing capital structure, funding strategies, and financial planning for business growth.

Work experience

Finance is all about numbers, but hiring managers want more than just figures – they want proof of how you’ve made a financial impact. Your work experience should highlight not just what you did, but how it benefited the business.

Start with your most recent role and work backwards, keeping each entry structured with bullet points. If you’re new to finance, focus on internships, voluntary work, or transferable skills from related roles.

How to make your past experience easy to read for employers

- Outline – Introduce the company, your role, and the financial functions you were responsible for.

- Responsibilities – List your key tasks, such as financial analysis, reporting, and compliance. Use action words like “analysed”, “managed”, and “developed”.

- Achievements – Showcase measurable successes. Saying you ‘handled budgets’ is fine, but saying you ‘optimised cost efficiencies by 15%’ is better – always back up your claims with numbers.

Example jobs for Finance

Finance Analyst | Sterling Capital Group

Outline

Provided financial insights and analysis within the finance department of a multinational corporation, assisting in budgeting, forecasting, and investment evaluations to improve operational performance.

Responsibilities

- Prepared monthly and quarterly financial reports, tracking company revenue and expenditure.

- Developed financial models to assess business performance and future growth opportunities.

- Conducted variance analysis to identify cost-saving measures and revenue optimisations.

- Collaborated with finance and operations teams to support budget planning and cash flow management.

- Used SAP and Power BI to generate real-time financial dashboards for senior leadership.

Achievements

- Reduced budget discrepancies by 25 percent through improved financial forecasting.

- Optimised operational expenses, leading to a 15 percent reduction in unnecessary costs.

- Recognised by management for delivering high-quality financial reports that enhanced decision-making.

Financial Advisor | Pinnacle Wealth Advisory

Outline

Advised clients on financial planning, investment strategies, and risk management within a wealth management firm, helping individuals and businesses achieve long-term financial stability.

Responsibilities

- Developed customised financial plans tailored to client goals, including investments, savings, and retirement planning.

- Managed a diverse portfolio of high-net-worth clients, providing insights on asset allocation and market trends.

- Conducted risk assessments to ensure client portfolios aligned with their financial objectives.

- Built strong client relationships through regular financial reviews and strategic planning sessions.

- Ensured compliance with regulatory frameworks and maintained up-to-date financial records.

Achievements

- Increased client portfolio value by an average of 20 percent through strategic investment planning.

- Expanded the firm’s client base by 30 percent through referrals and proactive outreach.

- Achieved a 98 percent client retention rate through personalised financial advice and service excellence.

Finance Manager | Everton Global Solutions

Outline

Led financial operations within a multinational corporation, managing budgets, overseeing financial planning, and developing corporate financial strategies to drive business growth and profitability.

Responsibilities

- Oversaw financial reporting, ensuring accuracy in forecasting and strategic planning.

- Managed cash flow and optimised working capital to improve financial efficiency.

- Developed and implemented cost-control measures that enhanced profit margins.

- Liaised with auditors and regulatory bodies to maintain compliance with financial laws and standards.

- Led financial risk assessments, ensuring strong mitigation strategies for long-term stability.

Achievements

- Reduced company expenses by 18 percent through strategic budget restructuring.

- Improved financial reporting efficiency by implementing an automated financial tracking system.

- Played a key role in a corporate restructuring initiative that boosted profitability by 22 percent.

Education section

In finance, qualifications certainly carry weight, so make sure your education section is clear and well-structured. But your experience is still the priority for recruiters, so keep this bit brief. If you hold a degree in Finance, Accounting, or Economics, list it prominently, along with any key certifications.

If you’ve completed professional training in financial analysis, taxation, or compliance, include those details here to strengthen your application.

Qualifications recruiters look for in Finance CVs

- Chartered Financial Analyst (CFA) Certification – Highly respected for investment professionals and financial analysts.

- Association of Chartered Certified Accountants (ACCA) Qualification – A strong credential for accountants and financial managers.

- Chartered Institute of Management Accountants (CIMA) Qualification – Ideal for finance professionals in business management roles.

- Certified Public Accountant (CPA) Qualification – Valuable for accounting and auditing roles.

- Master’s Degree in Finance or MBA – Useful for leadership roles in corporate finance or investment banking.