Securing a new role in finance requires more than just your analytical skills – you need a CV that effectively highlights how your technical and problem-solving abilities drive business growth.

This guide and its Financial Analyst CV examples will let you properly showcase your financial expertise and analytical mindset, ensuring you stand out in a competitive job market.

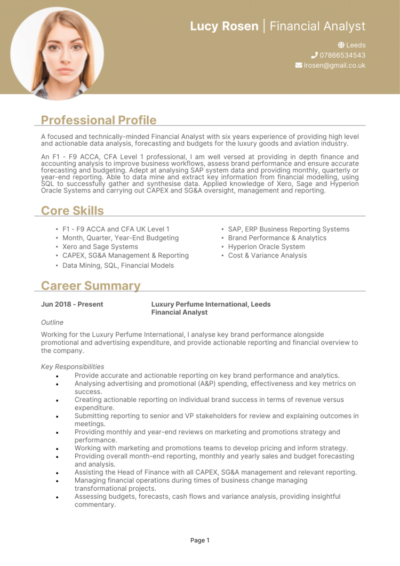

Financial Analyst CV

Finance Business Analyst CV

Junior Financial Analyst CV

How to write your Financial Analyst CV

Discover how to craft a Financial Analyst CV that lands interviews with this simple step-by-step guide.

Recruiters don’t have time to analyse every application like a balance sheet – your CV needs to make an impact at first glance

This guide will take you through every step of writing a CV that presents your experience, technical abilities, and strategic impact in a clear and compelling way. No matter your specialty, this guide will ensure your CV positions you as the strongest candidate for the job.

Structuring your Financial Analyst CV

Your CV should reflect the clarity and precision of a well-prepared financial report. A strong and coherent structure ensures that hiring managers can quickly assess your qualifications, experience, and analytical skills without struggling to navigate through it.

Here’s the layout your CV should follow:

- Name and contact details – Display your personal information clearly at the top so employers can get in touch easily. Including a photo is entirely optional.

- Profile – Begin with a concise summary that highlights your expertise and what you bring to the role.

- Core skills – Highlight your strongest skills, such as financial modelling, data analysis, and budgeting.

- Work experience – Start with your most recent role and work backwards, showcasing achievements and responsibilities.

- Education – Mention your degrees, certifications, and any training that supports your career path.

- Additional info – Include any additional details, like awards, hobbies, or memberships, that highlight your skills or personality.

Best format for a Financial Analyst CV

A well-formatted CV ensures hiring managers can quickly identify your key strengths without searching for details. If your CV is messy and full of visual mistakes, important information may be overlooked and you’ll lose out on opportunities.

These tips will help ensure a quality format:

- Bullet points – These help recruiters skim through your accomplishments quickly and easily.

- Divide sections – Use clear headings to organise your experience and qualifications.

- Use a clear and readable font – Use a simple, professional font and keep your layout uncluttered for maximum readability.

- No more than 2 pages – This is enough length to highlight your expertise while keeping the recruiter interested.

The best way to write a Financial Analyst CV profile

Your CV profile should introduce you as a skilled financial analyst with strong analytical and problem-solving skills. If your profile doesn’t grab attention in the first few seconds, your CV might not get a second look: it should highlight your ability to assess financial data and forecast trends in a way that makes a positive impact on your company.

Financial Analyst CV profile examples

Profile 1

Detail-oriented Financial Analyst with four years of experience in financial modelling, data analysis, and investment evaluation. Skilled in forecasting, budget management, and variance analysis to support strategic decision-making. Proficient in Excel, Power BI, and financial software such as SAP and Bloomberg Terminal. Passionate about optimising financial performance and identifying growth opportunities.

Profile 2

Analytical Financial Analyst with three years of expertise in corporate finance, market research, and risk assessment. Adept at interpreting financial data, preparing reports, and advising on investment strategies. Experienced in working with large datasets and financial modelling techniques. Committed to providing accurate insights to support data-driven decision-making.

Profile 3

Experienced Financial Analyst with over six years of expertise in financial planning, cost control, and revenue forecasting within multinational corporations. Skilled in financial reporting, business intelligence tools, and regulatory compliance. Proficient in data visualisation and strategic financial planning to drive company profitability. Dedicated to delivering actionable insights that enhance business performance.

Details to put in your Financial Analyst CV profile

Here’s what to include:

- Financial analysis experience – Mention your experience in evaluating financial statements, forecasting trends, or providing investment recommendations.

- Technical skills – Highlight your proficiency in financial modelling, data visualisation, and risk assessment.

- Strategic impact – Demonstrate how your insights have helped businesses optimise costs, improve cash flow, or increase profitability.

- Industry knowledge – Showcase your understanding of financial regulations, market trends, and economic indicators.

- Software proficiency – If you’re skilled in tools like Excel, SQL, or financial planning software, mention them here.

Show off the core skills recruiters look for

Hiring managers should be able to scan this section like a stock ticker. You should list the tangible hard skills which recruiters want to see from a candidate – any that demonstrate a balance of technical expertise and business insight.

If you specialise in areas like risk assessment, corporate finance, or investment analysis, tailor this section to reflect your expertise. Employers also look for candidates with strong proficiency in data analytics, financial reporting, and regulatory compliance, so make sure your CV skills section reflects that.

Most important skills for a Financial Analyst

- Financial Modelling – Developing detailed financial models to forecast business performance and assess investment opportunities.

- Data Analysis and Interpretation – Analysing financial statements, market trends, and economic indicators to support decision-making.

- Budgeting and Forecasting – Creating financial projections and monitoring budgets to ensure fiscal responsibility.

- Risk Assessment and Mitigation – Evaluating financial risks and implementing strategies to minimise potential losses.

- Investment Analysis – Assessing stocks, bonds, and other investment vehicles to provide recommendations.

- Variance Analysis – Comparing actual financial results to forecasts and identifying discrepancies to improve financial planning.

- Cost-Benefit Analysis – Assessing business expenditures and determining the financial impact of strategic initiatives.

- Financial Reporting – Preparing reports, dashboards, and presentations for senior management and stakeholders.

- Excel and Financial Software Proficiency – Using advanced Excel functions, Bloomberg, SAP, or QuickBooks for data analysis.

- Regulatory Compliance and GAAP/IFRS Knowledge – Ensuring financial practices align with accounting standards and industry regulations.

Describing your work experience

Hiring managers want to see clear evidence of your ability to assess financial performance and support business decisions. Your work experience should read like a case study – highlighting the key numbers and outcomes that prove your impact, rather than just listing daily tasks.

For candidates new to financial analysis, include internships, financial projects, or research roles that demonstrate analytical skills and industry knowledge.

What’s the correct way to structure job history on your CV?

- Outline – Provide a brief introduction to the company or financial sector you worked in and your role within the team.

- Responsibilities – Detail your key tasks, such as conducting financial analysis, building forecasting models, or advising on investment strategies. Use action verbs like “analysed,” “developed,” and “assessed.”

- Achievements – Showcase measurable success, such as improving financial reporting accuracy, increasing efficiency in forecasting, or influencing key business decisions.

Sample work experience for Financial Analyst

Financial Analyst | Harbourstone Capital

Outline

For a global investment management firm, conducted financial analysis, investment research, and risk assessment to support portfolio decisions.

Responsibilities

- Performed financial modelling and valuation analysis for equities, bonds, and alternative investments.

- Analysed market trends and company financial statements to assess investment opportunities.

- Prepared detailed financial reports and presentations for senior analysts and investors.

- Assisted in portfolio risk management, ensuring compliance with regulatory requirements.

- Collaborated with investment managers to provide data-driven insights for strategic planning.

Achievements

- Increased portfolio returns by 15 percent through improved risk assessment models.

- Developed a forecasting model that improved investment decision accuracy.

- Recognised for delivering high-quality reports that enhanced client investment strategies.

Financial Analyst | Westbridge Consultancy

Outline

Within the finance department of a multinational business consultancy, provided financial analysis and strategic recommendations to improve business performance.

Responsibilities

- Compiled and analysed financial data to track company performance and profitability.

- Created financial models to evaluate potential business investments and expansion projects.

- Monitored budget variances and conducted cost-benefit analysis to optimise resource allocation.

- Prepared quarterly and annual financial statements in compliance with IFRS and GAAP.

- Liaised with department heads to align financial planning with business objectives.

Achievements

- Reduced company expenses by 12 percent through cost-saving initiatives.

- Developed an advanced financial dashboard, improving reporting efficiency by 30 percent.

- Played a key role in securing £10M in funding by preparing investor-ready financial reports.

Senior Financial Analyst | NovaTech Solutions

Outline

For a multinational technology firm, led financial planning, forecasting, and business intelligence initiatives to drive company growth.

Responsibilities

- Developed financial models to project revenue, costs, and cash flow scenarios.

- Conducted in-depth financial analysis to support mergers, acquisitions, and investment decisions.

- Implemented automation tools to streamline data collection and financial reporting.

- Managed financial risk assessments, ensuring compliance with global financial regulations.

- Worked closely with senior leadership to shape long-term financial strategies.

Achievements

- Increased profit margins by 18 percent through strategic cost analysis and revenue optimisation.

- Automated financial reporting processes, reducing manual workload by 40 percent.

- Recognised for providing key financial insights that influenced strategic company decisions.

What should your CV’s education section include?

Financial analysis is a field where strong academic credentials can set you apart. With that in mind, recruiters prioritise work experience more, so this section should be brief.

Your education section should clearly highlight your degrees, certifications, and specialised training. If you have taken courses in financial modelling, data analysis, or risk management, mention them here.

For those entering the field, highlight relevant coursework, internships, or research projects that demonstrate strong analytical skills and financial knowledge.

What qualifications do employers look for in a Financial Analyst?

- CFA (Chartered Financial Analyst) – A globally recognised certification that strengthens investment analysis expertise.

- ACCA (Association of Chartered Certified Accountants) – Useful for financial analysts involved in corporate finance or accounting.

- FRM (Financial Risk Manager) – Beneficial for analysts focusing on risk assessment and financial strategy.

- MBA (Master of Business Administration) with a Finance Focus – Strengthens strategic financial expertise.

- Financial Modelling & Valuation Certification – Valuable for candidates specialising in investment analysis or corporate finance.