Behind every successful business decision is someone who doesn’t just count numbers – they make them count. But while you’re comfortable navigating balance sheets and regulatory mazes, writing a winning CV might feel less straightforward.

This guide, complete with a Chartered Accountant CV example, is here to help you highlight your unique financial fluency and show potential employers exactly why you’re an asset who can guide their financial future – not just another set of impressive letters after a name.

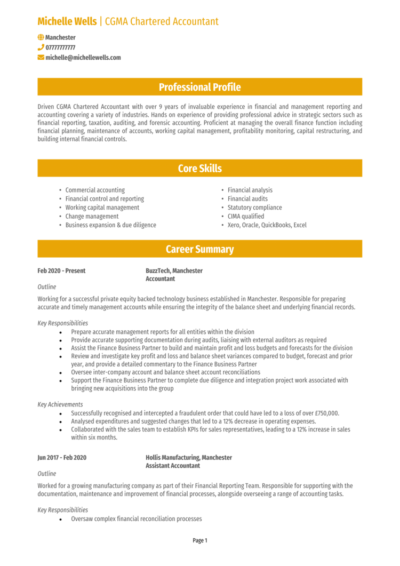

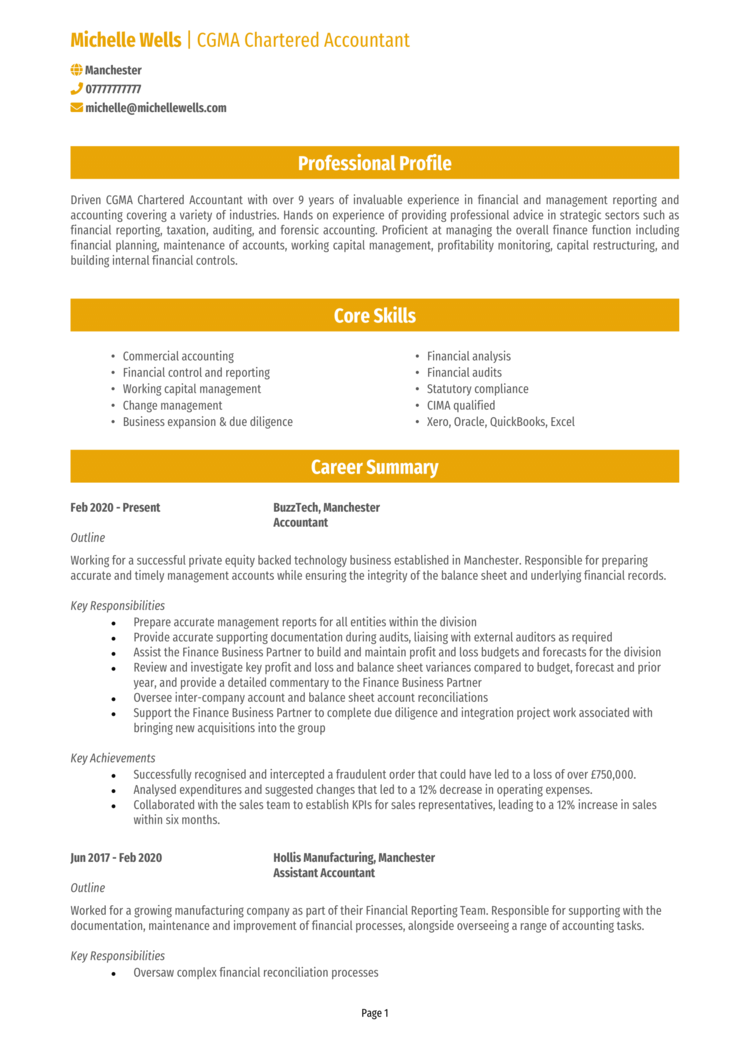

Chartered Accountant CV

How to write your Chartered Accountant CV

Discover how to craft a winning Chartered Accountant CV that lands interviews with this simple step-by-step guide.

As a Chartered Accountant, precision, clarity, and trustworthiness aren’t just words – they’re part of your professional DNA. Your CV should reflect the same meticulous approach.

In this guide, you’ll learn exactly how to structure and highlight your expertise, demonstrate your value, and ensure recruiters instantly recognise your qualifications and the difference you can make to their finance team.

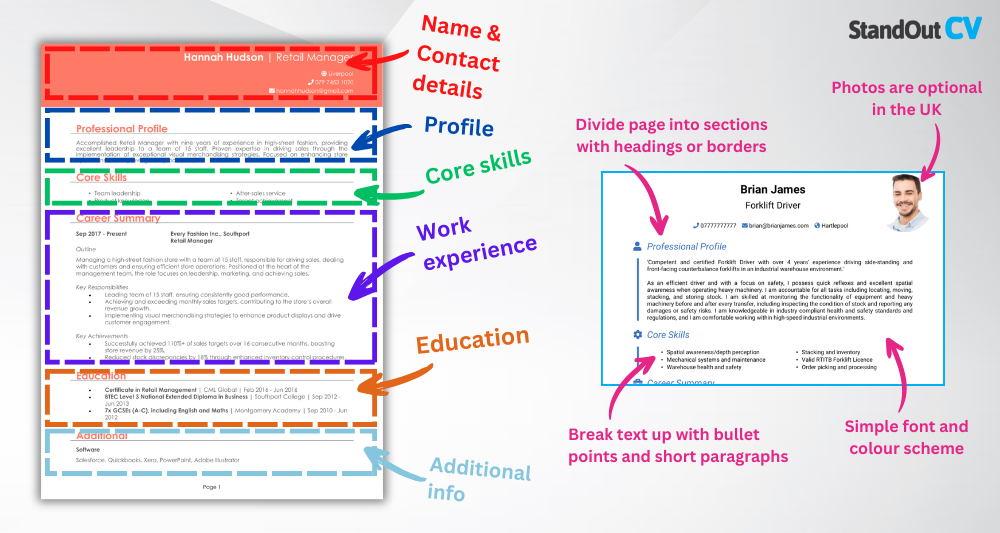

Structuring and formatting your Chartered Accountant CV

A Chartered Accountant knows the value of clarity, and writing your CV needs to prove that. Make sure recruiters immediately see your qualifications, skills, and career achievements, without having to search through layers of unnecessary detail. Think of your CV as a carefully-prepared balance sheet – it should provide exactly the right information at a glance, presented professionally and logically.

Follow this clean, professional layout:

- Name and contact details – Display your personal details clearly at the top so employers can get in touch easily. Including a photo is entirely optional.

- Profile – Begin with a concise summary that highlights your expertise and what you bring to the role.

- Core skills – Highlight your strongest skills that align with the role’s requirements.

- Work experience – Start with your most recent role and work backwards, showcasing achievements and responsibilities.

- Education – Mention your degree, certifications, and any training that supports your career path.

- Additional info – Include any additional details, like awards, professional memberships, or hobbies that highlight your skills or personality.

Choose a clear, easy-to-read font that matches your professional credibility. Format sections with well-labelled headings, and break down experience into concise bullet points for effortless reading. Limit your CV to two pages maximum length – concise enough to show efficiency, detailed enough to highlight your impact. Following these tips and steering clear from avoidable mistakes will assure hiring managers of your competence.

The best way to write a Chartered Accountant CV profile

Your CV profile is more than a summary – it’s your opening statement. It should clearly show recruiters why you’re the Chartered Accountant they need, highlighting your skills, qualifications, and the tangible difference you make to the bottom line. This brief intro sets the tone and proves your value from the very first glance.

Chartered Accountant CV profile examples

Profile 1

Qualified Chartered Accountant with over seven years of experience delivering financial reporting, audit, and tax compliance services for both SMEs and large corporations. Strong knowledge of UK GAAP, IFRS, and corporate taxation. Skilled in using Sage, Xero, and SAP to produce accurate financial statements and advise on business strategy. Known for analytical thinking, attention to detail, and a commitment to regulatory compliance.

Profile 2

Experienced Chartered Accountant with a background in practice and industry, offering over six years of expertise in budgeting, forecasting, and statutory reporting. Adept at managing audit processes, preparing year-end accounts, and implementing internal controls. Proficient in financial modelling and working closely with senior stakeholders to support data-driven decisions.

Profile 3

Detail-focused Chartered Accountant with eight years of post-qualification experience supporting clients in the retail, manufacturing, and professional services sectors. Strong command of audit procedures, cost control, and financial risk assessment. Trusted advisor to clients and colleagues, with a reputation for accuracy, integrity, and sound financial judgement.

Details to put in your Chartered Accountant CV profile

Here’s what to include:

- Where you’ve worked – Industries or sectors, such as corporate finance, public practice, or financial services.

- Your top qualifications – Emphasise your Chartered status and other relevant certifications.

- Essential skills – Audit expertise, financial reporting, strategic financial management, or compliance knowledge.

- Types of clients or businesses – SME, large corporates, international clients.

- Business impact – Note achievements such as cost-saving initiatives, process improvements, or increased accuracy in reporting.

How to present your core skills section properly

Think of your core skills section as your ‘greatest hits’ – the financial strengths and professional talents that define your reputation. Avoid generic phrases (“detail-oriented” doesn’t exactly thrill a finance manager) and instead, use this space to quickly highlight where you truly excel: whether that’s solving tax issues or completing audits.

Every accounting role is different, so feel free to use the job description to help tailor your list of CV skills to include the keywords recruiters have already said they’re looking for.

Key skills that make a Chartered Accountant CV stand out

- Financial Reporting and Analysis – Preparing accurate financial statements and reports in compliance with IFRS, GAAP, or local standards.

- Tax Planning and Compliance – Managing corporate and personal tax obligations, filing returns, and advising on tax-efficient strategies.

- Audit and Assurance Services – Conducting internal and external audits to ensure financial accuracy and regulatory compliance.

- Budgeting and Forecasting – Developing financial plans and projections to guide strategic decision-making.

- Regulatory and Ethical Compliance – Ensuring adherence to financial regulations, ethical codes, and professional standards set by bodies like ICAEW or ACCA.

- Management Accounting – Analysing costs, revenues, and operational data to support business performance and profitability.

- Risk Management and Internal Controls – Identifying financial risks and implementing controls to safeguard assets and ensure compliance.

- Business Advisory Services – Providing strategic advice on business structure, mergers, acquisitions, and financial planning.

- Financial System Management – Using accounting software such as SAP, Oracle, or Sage to manage and streamline financial operations.

- Stakeholder Communication – Presenting financial insights and reports to senior management, boards, or external clients with clarity and precision.

How to present your work experience in your CV

Now’s the chance to prove you’re not just qualified – you’re genuinely valuable. Employers don’t just want to see your job titles; they want to understand how your financial expertise has improved organisations. Show how you’ve supported audits, streamlined financial processes, implemented strategic improvements, or navigated complex compliance issues.

List your work experience in reverse chronological order, clearly stating your job title, employer, and the dates you worked there. Below that, use concise, impactful bullet points to highlight responsibilities and results – backed by numbers wherever possible. Measurable outcomes always speak louder than generic responsibilities.

How should you list jobs on your Chartered Accountant CV?

- Outline – Briefly describe the business, your position, and the financial scope.

- Responsibilities – Use action words like “audited,” “analysed,” “implemented,” or “streamlined” to outline your contributions.

- Achievements – Highlight measurable impacts: “Reduced monthly reporting time by 20%,” “Saved £40,000 through tax efficiency measures,” or “Improved compliance standards, achieving 100% audit pass rate.”

Work history examples for Chartered Accountants

Chartered Accountant | Landsbury & Co.

Outline

Provided full accountancy and advisory services to a diverse client base, including sole traders, partnerships, and limited companies at a well-established accounting practice.

Responsibilities

- Prepared statutory accounts and tax returns in compliance with HMRC and Companies House regulations.

- Managed end-of-year financial reporting for multiple clients using Sage and Xero.

- Advised clients on tax efficiency, cash flow, and business planning.

- Led external audit assignments and liaised with clients during fieldwork.

- Reviewed junior accountants’ work and provided mentoring and training.

Achievements

- Reduced client tax liabilities by up to 15% through proactive planning.

- Maintained 100% client retention over a two-year period.

- Successfully implemented a new workflow system that improved turnaround times.

Chartered Accountant | Vertex Retail Group

Outline

Oversaw financial reporting and compliance for a national retail chain, ensuring accurate month-end accounts and year-end audit readiness.

Responsibilities

- Produced monthly management accounts, P&L statements, and cash flow forecasts.

- Worked with department heads to support budgeting and cost control initiatives.

- Managed the fixed asset register and depreciation schedules.

- Liaised with external auditors and prepared supporting documentation.

- Ensured VAT, PAYE, and corporation tax submissions were completed accurately and on time.

Achievements

- Improved reporting accuracy by introducing automated reconciliation tools.

- Supported a 12% reduction in overheads through analysis and reporting.

- Achieved audit sign-off with no material adjustments for three consecutive years.

Chartered Accountant | Orion Engineering

Outline

Managed all financial operations for a mid-sized engineering firm, including internal controls, statutory accounts, and business advisory services.

Responsibilities

- Prepared annual financial statements in accordance with FRS 102.

- Conducted variance analysis and presented insights to the board.

- Led internal audit reviews and implemented control improvements.

- Maintained payroll and pension compliance for 60+ employees.

- Monitored working capital and advised on investment and financing decisions.

Achievements

- Streamlined month-end processes, cutting completion time by 40%.

- Identified £75K in annual savings through review of supplier contracts.

- Led successful transition to cloud-based accounting software with minimal disruption.

Presenting your education history

Being great with numbers is one thing – being Chartered proves you’re on a different level entirely. This section clearly shows you’re not only experienced but formally trained and continuously developing. Include your Chartered Accountant qualification first, then highlight relevant degrees or CPD you’ve undertaken.

You can include additional professional courses or relevant financial software training to demonstrate ongoing professional growth and education.

Best qualifications for a Chartered Accountant

- ACA/CA Chartered Accountant Qualification – Essential and widely respected accreditation.

- ACCA/CIMA Qualification – Additional qualifications strengthening your financial management profile.

- Certificate in IFRS or GAAP – Highlights your expertise in international financial reporting standards.

- Advanced Diploma in Taxation – Ideal if specialising in tax consultancy or compliance.

- CPD in Financial Modelling or Analysis – Great for demonstrating advanced analytical and strategic skills.