As a bookkeeper, you’re behind every successful business, making sure the numbers add up, the deadlines are met, and the taxman stays happy.

Your eye for detail and head for figures keeps everything running smoothly – but none of that matters if your CV doesn’t add up.

This guide and its Bookkeeper CV examples will show you how to craft a Bookkeeper CV that proves you’re accurate, reliable, and exactly the kind of financial whiz businesses want keeping their books in order.

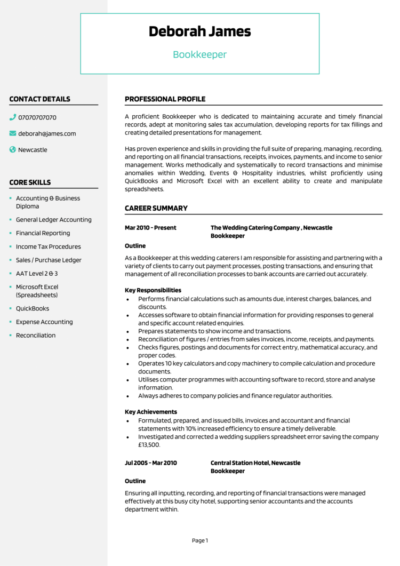

Bookkeeper CV example

Finance Assistant CV example

How to write your Bookkeeper CV

Discover how to craft a Bookkeeper CV that lands interviews with this simple step-by-step guide.

If you’re writing a CV that doesn’t immediately show employers your accounting skills or software knowledge, they’ll move on to the next applicant.

This guide takes you step-by-step through crafting a polished, professional CV that highlights your technical know-how, financial accuracy, and ability to keep businesses compliant and in the black.

How should you structure your Bookkeeper CV?

An effectively structured CV works like a clear set of financial records – easy to follow, with all the important details exactly where they need to be. Busy recruiters just don’t have the time to dig to find out what makes you the right candidate; a clear structure makes this easy.

Here’s the layout to follow:

- Name and contact details – Your personal details go right at the top so employers know who to contact when they want to book you in for an interview.

- Profile – Open with a summary highlighting your bookkeeping expertise, software proficiency, and eye for detail.

- Core skills – List key abilities, from ledger reconciliation to payroll processing.

- Work experience – Provide your employment history, focusing on financial processes, reporting, and compliance.

- Education – Outline relevant qualifications like degrees, certifications, and accounting training.

- Additional info – Optionally, add any professional memberships, relevant hobbies, and awards.

How to format your Bookkeeper CV

Messy records make for unhappy auditors – and a messy CV won’t win you interviews either. Keep your formatting clean and professional so employers can quickly find the information they need. Even the most qualified candidates will lose out because of avoidable formatting mistakes, so follow the below tips to ensure your CV is as readable as possible.

Stick to these format principles:

- Bullet points – Break down responsibilities and achievements into skimmable points.

- Divide sections – Clearly separate each part of your CV so nothing gets overlooked.

- Use a clear and readable font – A simple, professional font ensures readability while keeping the layout polished and tidy.

- No more than 2 pages – This gives you the length to detail your experience while keeping it concise enough to respect the recruiter’s time.

What is a Bookkeeper CV profile?

Your profile gives employers a fast overview of who you are and why you’re the bookkeeper they need. It should show you’ve got both the technical skills and the reliability to keep their finances accurate and compliant. Think of it like a financial summary – it needs to show your value upfront, to prove the value in hiring you.

Bookkeeper CV profile examples

Profile 1

Detail-oriented Bookkeeper with four years of experience in managing financial records, processing invoices, and reconciling accounts. Skilled in using accounting software such as QuickBooks, Xero, and Sage. Adept at preparing financial reports, managing payroll, and ensuring compliance with tax regulations. Committed to maintaining accurate financial records and supporting business operations.

Profile 2

Organised and efficient Bookkeeper with three years of experience in small business accounting and financial administration. Adept at managing accounts payable and receivable, reconciling bank statements, and handling tax filings. Proficient in Excel, payroll processing, and financial data analysis. Passionate about helping businesses maintain financial health and regulatory compliance.

Profile 3

Experienced Bookkeeper with over six years of expertise in managing financial transactions, maintaining ledgers, and producing management reports. Skilled in VAT returns, cash flow forecasting, and financial compliance. Proficient in cloud-based accounting software and financial reporting tools. Dedicated to ensuring financial accuracy and efficiency for business success.

Details to put in your Bookkeeper CV profile

Here’s what to include:

- Bookkeeping experience – Mention your years of experience and the types of businesses you’ve worked for.

- Financial processes handled – From reconciling bank statements to preparing VAT returns.

- Software proficiency – Highlight experience with accounting packages like Xero, Sage, or QuickBooks.

- Compliance knowledge – Show your understanding of tax regulations and financial reporting requirements.

- Attention to detail – Emphasise your accuracy and ability to spot errors before they become problems.

How to highlight your core skills

This section gives employers a quick view of your bookkeeping toolkit – everything you rely on to keep finances in perfect order.

Tailor the skills for your CV to each application. Some businesses need payroll support, others care more about VAT expertise or cash flow management. Adjust your core skills to match the job advert and the business type.

This quick-glance section helps employers see your most valuable skills straight away – perfect for busy recruiters reviewing financial CVs.

Best skills for your Bookkeeper CV

- Financial Record Keeping – Maintaining accurate records of financial transactions, including purchases, sales, receipts, and payments.

- Accounts Payable and Receivable Management – Processing invoices, tracking payments, and ensuring timely collections.

- Bank Reconciliation – Comparing financial records with bank statements to identify discrepancies and ensure accuracy.

- Payroll Processing – Managing employee wages, tax deductions, and pension contributions.

- VAT and Tax Compliance – Calculating and filing VAT returns, ensuring compliance with tax regulations.

- Financial Reporting – Preparing profit and loss statements, balance sheets, and other financial summaries.

- Budgeting and Expense Tracking – Monitoring company expenses and assisting in financial planning.

- Accounting Software Proficiency – Using tools like QuickBooks, Xero, or Sage for efficient bookkeeping.

- Regulatory Compliance – Ensuring financial records align with legal standards, including GAAP and HMRC guidelines.

- Communication and Collaboration – Working with accountants, business owners, and financial teams to support financial decision-making.

How to showcase your work experience in your CV

Your work experience proves you’re more than just good with numbers – you’re someone who’s used those skills to keep real businesses financially healthy.

List your experience in reverse chronological order, starting with your most recent role. Focus on processes you managed, reports you created, and any compliance responsibilities you handled. If you helped businesses improve their financial processes, cut costs, or recover from errors, make sure that’s highlighted too.

If you’re newer to bookkeeping, mention any admin roles with financial duties, or even voluntary roles where you managed accounts.

How to format previous jobs in your CV correctly

- Outline – Briefly explain the company, its size, and your role in keeping its financial records accurate.

- Responsibilities – Describe your core duties, such as processing invoices, preparing reports, or reconciling accounts. Use action words like “prepared,” “reconciled,” and “maintained.”

- Achievements – Highlight improvements you made, errors you caught, or processes you improved – anything that demonstrates your value.

Example work history for Bookkeeper

Bookkeeper | Sterling Finances

Outline

For a leading UK financial consultancy, managed financial records, processed transactions, and ensured compliance with accounting regulations.

Responsibilities

- Maintained accurate financial records, updating general ledgers and reconciling accounts.

- Processed invoices, payments, and expense claims to ensure timely transactions.

- Prepared VAT returns and submitted financial reports in line with HMRC regulations.

- Assisted in payroll processing, ensuring correct calculations and deductions.

- Collaborated with accountants to support tax preparation and end-of-year reporting.

Achievements

- Reduced invoicing errors by 30 percent by implementing a new record-keeping system.

- Improved cash flow forecasting accuracy, enhancing financial planning efficiency.

- Received positive feedback from senior accountants for maintaining high data accuracy.

Bookkeeper | Inspire Business Services

Outline

Within the finance team of a national business support firm, managed day-to-day bookkeeping, ensuring accurate financial reporting and compliance.

Responsibilities

- Processed supplier and customer invoices, managing accounts payable and receivable.

- Reconciled bank statements and monitored cash flow to maintain financial stability.

- Generated profit and loss statements, balance sheets, and financial summaries for management.

- Handled payroll administration, ensuring compliance with tax and employment regulations.

- Liaised with external auditors and accountants to support financial audits and tax filings.

Achievements

- Improved financial reporting efficiency by 25 percent by automating reconciliation processes.

- Helped reduce outstanding payments by 20 percent through proactive credit control measures.

- Recognised for maintaining meticulous financial records and improving overall bookkeeping accuracy.

Bookkeeper | Lodestone Property Group

Outline

For a fast-growing real estate company, managed financial transactions, reconciliations, and client accounts to ensure financial accuracy.

Responsibilities

- Maintained and updated property rental income records, tracking payments and expenses.

- Prepared monthly and quarterly financial statements for management review.

- Monitored outstanding balances, issuing payment reminders and managing credit control.

- Processed payroll for employees, ensuring accuracy in deductions and benefits.

- Reviewed tax documentation and assisted with compliance for property-related financial regulations.

Achievements

- Reduced overdue rent payments by 35 percent through improved client communication and follow-ups.

- Implemented a new digital bookkeeping system, reducing administrative workload by 40 percent.

- Recognised for improving financial data accuracy, supporting better decision-making.

Structuring your education section

Bookkeeping roles value both formal qualifications and practical experience, so make sure your education section highlights both. Keep your education section brief, as experience is more valued.

List your qualifications in reverse chronological order, including bookkeeping diplomas, accounting certifications, and software training. If you’re working towards a professional qualification, mention that too – it shows commitment to development.

For less experienced candidates, you can also mention any finance-related courses, maths qualifications, or business studies that are relevant.

Top qualifications to showcase on a Bookkeeper CV

- AAT Level 2 or 3 Certificate in Bookkeeping – One of the most recognised qualifications in the field.

- ICB (Institute of Certified Bookkeepers) Membership – Professional recognition and access to ongoing development.

- Sage 50 or Xero Certification – Proves you’re competent with popular accounting software.

- AAT Advanced Diploma in Accounting – Ideal for bookkeepers handling more advanced financial processes.

- Diploma in Payroll Management – Useful if payroll is part of your role.