Numbers tell a story, and as a Management Accountant, you ensure that story leads to financial success. It’s a competitive and skilled role, so you’ll need a CV that puts you above the rest and prove you can translate data into actionable insights.

This guide and its Management Accountant CV examples will help you craft a CV that highlights your financial expertise and analytical skills to recruiters, boosting your odds of landing interviews and the job you want.

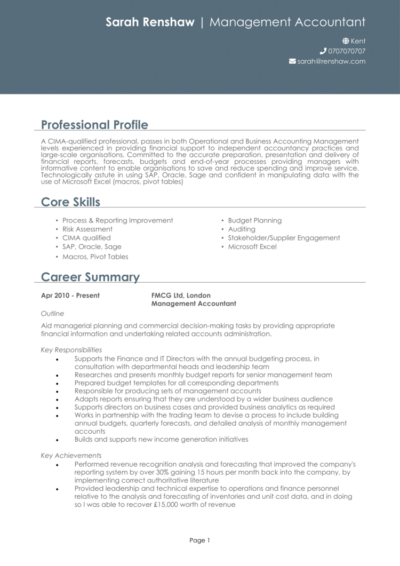

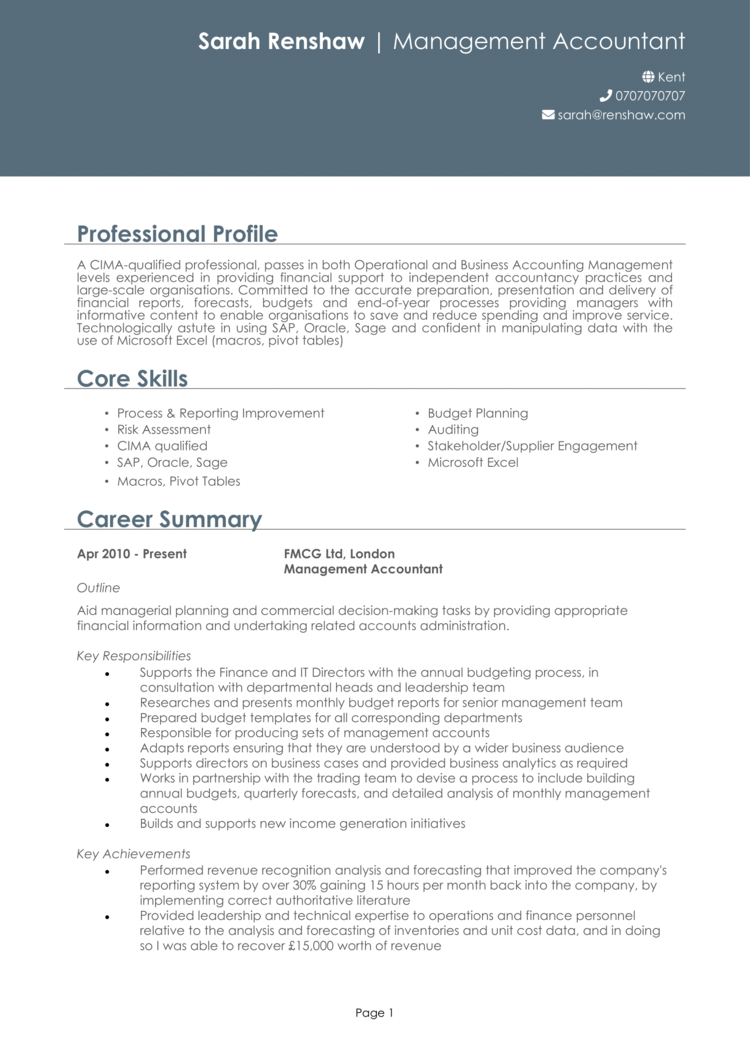

Management Accountant CV example

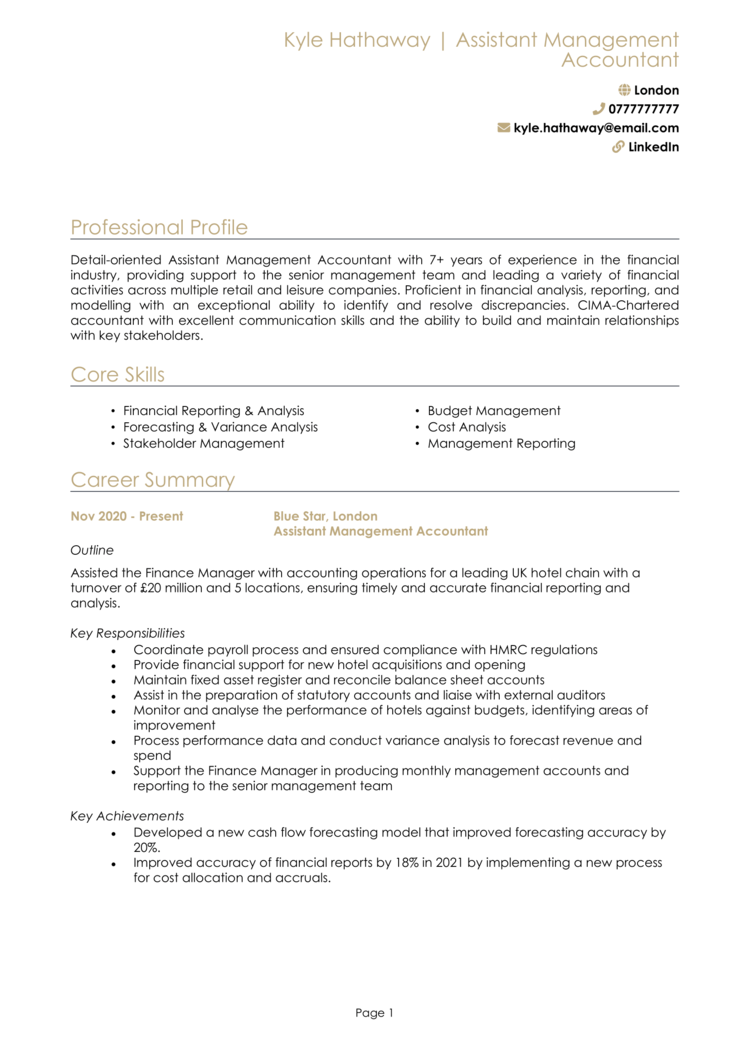

Assistant Management Accountant CV example

How to write your Management Accountant CV

Learn how to create your own interview-winning Management Accountant CV with this simple step-by-step guide.

A strong financial plan keeps a company on track – your CV should do the same for your job search. This guide will show you how to structure your CV so that your qualifications, financial expertise, and strategic contributions are easy to find. By the end, your CV won’t just be another document – it’ll be a clear financial statement of your value to employers.

The best way to structure your Management Accountant CV

As a Management Accountant, your role is all about organisation and efficiency. If your CV follows the same principles, you’ll make it easy for hiring managers to see why you’re the right fit for the job. If they’re forced to struggle through a confusing and incoherent layout, they’ll just move onto the next applicant.

Here’s the structure your CV should follow:

- Name and contact details – Place your name and personal details prominently at the top of your CV for quick access. Adding a photo is up to you.

- Profile – Open with a compelling overview of your skills, experience, and the value your financial expertise will bring to companies.

- Core skills – List your key abilities in this section, focusing on those that will be most relevant to the job, like variance analysis and financial forecasting.

- Work experience – Provide a detailed breakdown of your roles, with a focus on cost control, reporting, and financial strategy.

- Education – List your qualifications, including degrees and relevant certifications, in reverse chronological order.

- Additional info – Use this optional space for relevant hobbies or personal pursuits that enhance your application.

Management Accountant CV format

Hiring managers need to process financial data quickly and efficiently – your CV format should follow the same principle. If your layout is cluttered or unclear and full of formatting mistakes, key details could get lost.

These useful tips will keep your CV flowing nicely:

- Bullet points – Use short, sharp bullet points to present your responsibilities and achievements clearly.

- Divide sections – Make use of distinct headings and logical spacing to guide recruiters through your CV..

- Use a clear and readable font – A simple, professional font ensures readability while keeping the layout polished and tidy.

- No more than 2 pages – This gives you the length to detail your experience while keeping it concise enough to respect the recruiter’s time.

CV profile for a Management Accountant

Your CV profile is your financial summary – a quick snapshot of what makes you the right candidate. Writing a CV profile properly will set the tone for the rest of your application and help employers see your expertise immediately, convincing recruiters to read further.

Management Accountant CV profile examples

Profile 1

Detail-oriented Management Accountant with four years of experience in financial planning, budgeting, and cost analysis. Skilled in preparing management reports, financial forecasting, and variance analysis to support strategic decision-making. Proficient in using accounting software such as SAP, QuickBooks, and Oracle Financials. Committed to improving financial efficiency and maximising business profitability.

Profile 2

Results-driven Management Accountant with three years of experience in corporate finance, specialising in performance analysis and cost control. Adept at preparing financial statements, monitoring cash flow, and providing data-driven recommendations to senior management. Experienced in working with financial modelling and risk assessment tools. Passionate about optimising financial processes and ensuring business sustainability.

Profile 3

Experienced Management Accountant with over six years of expertise in financial reporting, business planning, and regulatory compliance. Skilled in consolidating financial data, preparing budgets, and implementing cost-saving initiatives. Proficient in Microsoft Excel, Power BI, and Sage for in-depth financial analysis. Dedicated to supporting executive teams with strategic financial insights for sustainable growth.

What to include in your Management Accountant CV profile

Here’s what to include:

- Accounting experience – Specify whether you’ve worked in industry, practice, or the public sector.

- Financial strategy expertise – Mention your ability to support decision-making through data analysis.

- Budgeting and forecasting skills – Highlight your experience in planning and financial control.

- Regulatory knowledge – If you’re familiar with IFRS, UK GAAP, or other financial standards, include them here.

- Technology proficiency – Employers value accountants who can work with financial software, so mention relevant systems like SAP, Sage, or Power BI.

Presenting your core skills

Your technical abilities, analytical mindset, and business acumen are what set you apart. The core skills section should give hiring managers a quick highlight of the skills that make you a strong Management Accountant.

Every bullet point should highlight a core strength that aligns with the job description. If you specialise in certain industries, tailor your skills to reflect the financial challenges unique to that sector.

Top skills for your Management Accountant CV

- Financial Reporting – Preparing accurate financial statements, management reports, and performance analyses.

- Budgeting and Forecasting – Developing financial plans, monitoring expenses, and predicting future revenue and costs.

- Cost Analysis and Control – Assessing business expenditures and identifying cost-saving opportunities to improve profitability.

- Variance Analysis – Comparing actual financial performance against budgets and forecasts to highlight discrepancies.

- Tax Compliance and Planning – Ensuring adherence to tax regulations and optimising financial strategies for tax efficiency.

- Profit and Loss Management – Analysing revenue and expenses to support decision-making and financial stability.

- Financial Modelling – Creating projections and scenario analyses to guide business planning and strategy.

- Regulatory Compliance – Ensuring financial processes adhere to legal standards, IFRS, GAAP, and corporate policies.

- ERP and Accounting Software Proficiency – Using tools like SAP, QuickBooks, Xero, or Oracle for financial tracking and reporting.

- Stakeholder Communication – Presenting financial insights to senior management, department heads, and external auditors.

How to present your work experience in your CV

Producing financial reports is one thing – using them to drive business decisions is another. Your work experience section should showcase how you’ve helped organisations reduce costs, improve profitability, or enhance financial efficiency.

List your past roles in reverse chronological order, giving recruiters an insight into what you did and how you did it. If you’re stepping into a Management Accountant role for the first time, focus on responsibilities from previous positions that show transferable skills, such as financial planning, variance analysis, or cost control.

How to structure jobs

- Outline – Provide a brief introduction to the company, the finance team, and your main responsibilities.

- Key responsibilities – Outline your primary duties, including financial reporting, budgeting, and risk management. Use action words like “analysed”, “developed”, and “implemented”.

- Key achievements – Demonstrate the impact you’ve had, whether it’s improving financial efficiency, reducing costs, or introducing better reporting systems.

Example jobs for Management Accountant

Management Accountant | Summit Financials

Outline

Managed financial reporting and budgeting processes for a corporate finance department, providing insights to improve business decision-making and drive cost efficiency.

Responsibilities

- Prepared monthly and quarterly management reports, analysing key financial data.

- Conducted variance analysis to assess budget performance and identify cost-saving opportunities.

- Monitored company cash flow and provided forecasts to support financial planning.

- Collaborated with department heads to optimise budgets and allocate resources effectively.

- Ensured compliance with financial regulations and internal audit requirements.

Achievements

- Reduced operational costs by 15 percent by identifying inefficiencies in financial processes.

- Implemented a new reporting system that improved accuracy and reduced reporting time by 30 percent.

- Recognised for providing strategic insights that contributed to a 20 percent increase in profitability.

Assistant Management Accountant | Vertex Ltd

Outline

Supported the finance team at a professional accounting firm by preparing management reports, conducting financial analysis, and assisting with budget planning for clients across various industries.

Responsibilities

- Compiled and analysed financial data to track company performance against budgets.

- Assisted in preparing forecasts and financial models to support business planning.

- Reviewed expense reports and recommended areas for cost reduction.

- Prepared tax calculations and ensured compliance with financial regulations.

- Maintained accurate records in accounting software, ensuring data integrity.

Achievements

- Improved financial reporting efficiency by streamlining data consolidation processes.

- Helped reduce expenses by 12 percent through improved budget monitoring and analysis.

- Received positive feedback from senior management for accuracy and attention to detail.

Senior Management Accountant | GTech Enterprise

Outline

Led financial planning and analysis at a multinational corporation, ensuring strong financial controls, strategic budget allocation, and sustainable business growth.

Responsibilities

- Developed and maintained detailed financial models to assess business performance.

- Conducted risk analysis and provided financial recommendations to senior executives.

- Managed multi-currency financial reporting and consolidated group accounts.

- Oversaw financial compliance, ensuring adherence to IFRS and GAAP standards.

- Led a team of junior accountants, providing training and mentorship.

Achievements

- Increased profit margins by 18 percent through cost-control initiatives and financial restructuring.

- Led the implementation of a new ERP system, improving financial reporting accuracy by 25 percent.

- Recognised for successfully developing long-term financial strategies that improved cash flow management.

Education section

Management accountants need strong financial qualifications, so make sure your degrees and certifications are clearly listed. That said, recruiters value work experience more: so keep your education section brief and to the point.

If you’ve completed professional accounting qualifications, such as ACCA or CIMA, these should be prioritised. Additional training in financial software or advanced analytics can also be beneficial.

What are the best qualifications for a Management Accountant CV?

- CIMA (Chartered Institute of Management Accountants) – The leading qualification for management accountants.

- ACCA (Association of Chartered Certified Accountants) – A globally recognised certification for financial professionals.

- AAT (Association of Accounting Technicians) Qualification – Useful for those progressing towards full chartered status.

- MBA with Finance Specialisation – Beneficial for senior roles that involve financial strategy and decision-making.

- Financial Modelling & Forecasting Certifications – Demonstrates advanced skills in data-driven financial planning.