Balancing the books is second nature to you, but balancing the perfect CV? That’s a whole different equation. If you’re struggling to land your dream accounting role, the problem might not be your skills – it could be your CV letting you down.

But don’t worry: this guide will give you the tools and perfectly-crafted Accountant CV examples you need to produce an application that adds up to success.

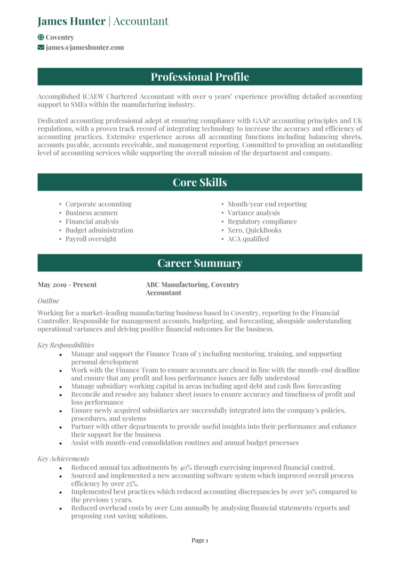

Accountant CV example

Financial Accountant CV example

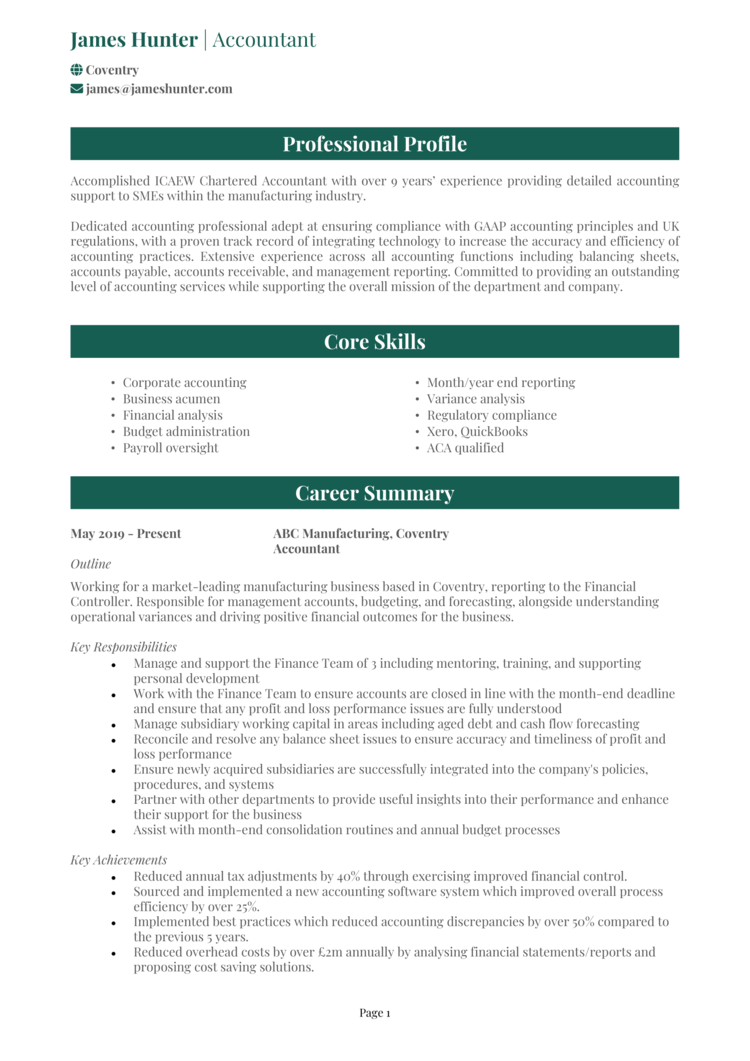

Senior Accountant CV example

Practice Accountant CV example

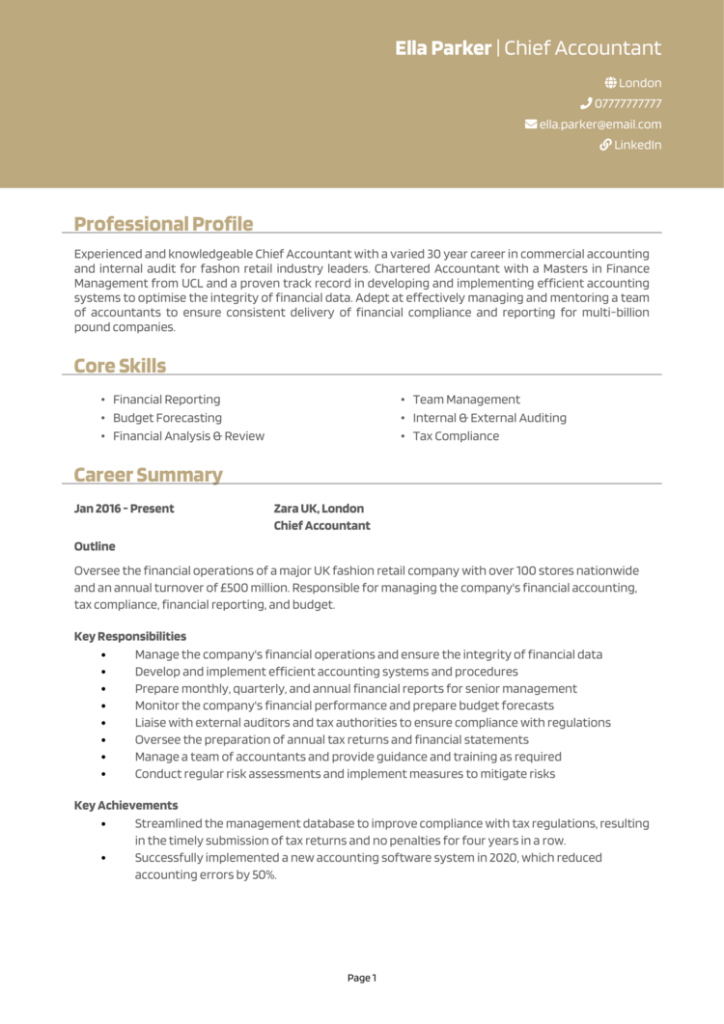

Chief Accountant CV example

How to write your Accountant CV

Learn how to create your own interview-winning Accountant CV with this simple step-by-step guide.

This guide will walk you through writing an Accountant CV that stands out. From organising its structure and format to highlighting your accounting skills and technical expertise, you’ll have everything you need to make a strong impression and land the role you want.

The best way to structure your Accountant CV

Let’s start with the basics: your CV structure should be kind of like a financial report – clear, logical, and easy to follow. Recruiters need to quickly spot your accounting skills and experience, so organisation is key.

Here’s the structure you should always be following:

- Name and contact details – Place these at the top so employers can get in touch quickly.

- CV profile – Start with a concise summary of your accounting expertise and professional achievements.

- Core skills – Highlight your technical strengths, like financial analysis or tax compliance.

- Work experience – Detail your previous roles in reverse chronological order.

- Education – Include your academic qualifications and any professional certifications.

- Additional info – Optionally, mention hobbies or interests that show off attention to detail or your business acumen.

The correct format for an Accountant CV

A clean and professional format ensures your CV reflects your prized precision and attention to detail – qualities every good accountant needs.

Follow these formatting guidelines:

- Bullet points – Give the recruiter a hand in skimming through your CV, and let them pick out the important bits with ease.

- Divide sections – Use clear headings to make your CV easy to navigate.

- Use an appropriate font – Keep it professional and simple to read. A traditional, formal template would be best for an accounting role.

- No more than 2 pages – This is short enough to keep the recruiter engaged, while giving you ample space to showcase your expertise.

Accountant CV profile

Your profile provides a speedy snapshot of your accounting expertise and professional achievements. For accountants, this section should briefly focus on your technical skills, certifications, and track record of delivering results.

Accountant CV profile examples

Profile 1

Organised Accountant with five years of experience in the manufacturing sector, specialising in financial reporting, cost analysis, and budgeting. Skilled in using Sage and Excel to deliver accurate and actionable insights that support business growth.

Profile 2

Reliable Accountant with three years of experience in public practice, focusing on preparing financial statements, managing audits, and filing tax returns for SMEs. Proficient in QuickBooks and Xero for maintaining compliance and streamlining accounting processes.

Profile 3

Dedicated Accountant with over eight years in the retail industry, adept at cash flow forecasting, balance sheet reconciliations, and financial strategy development. Experienced in using Oracle Financials and Power BI to provide detailed financial analyses for stakeholders.

What to include in your Accountant CV profile

Tailor your profile to the role you’re applying for, ensuring it aligns with the job description.

Here’s what to include in your Accountant CV profile:

- Where you worked – Mention the industries or companies you’ve managed finances, as well as the size of the team you work within.

- Your top qualifications – Highlight degrees and certifications, such as ACA or CIMA.

- Technical expertise – Include key areas like tax preparation and budgeting.

- People you’ve worked with – Specify whether you collaborated with stakeholders or auditors, for example.

- Types of financial statements you’ve handled – If you’ve worked with balance sheets or cash flow reports, give them a mention.

- Relevant tools you know – Note proficiency with accounting software like QuickBooks or Xero.

- Compliance expertise – Mention which regulatory frameworks you’ve become familiar with.

Core skills section

Your core skills section is a quick overview of your most valuable abilities that grabs the recruiter’s attention as soon as they open your application.

For accountants, this section is the perfect place to showcase your technical expertise and highlight the tools and methods you rely on to keep things running smoothly.

Focus on precision and relevance: avoid vague cliche phrases and make sure every bullet point speaks directly to the requirements of the job description.

Not sure how to present your financial expertise in an accountant CV?

Check out our CV builder for industry-specific content for accountants, professional templates, and expert advice to showcase your skills effectively.

Key skills that make an Accountant CV stand out

- Financial Reporting – Preparing accurate financial statements in compliance with regulatory standards.

- Tax Compliance – Ensuring timely preparation and submission of tax returns to meet legal requirements.

- Budget Management – Developing and monitoring budgets to ensure financial efficiency and profitability.

- Audit Preparation – Collaborating with external auditors and preparing documentation for smooth audits.

- Payroll Management – Overseeing payroll processes, including tax deductions and employee benefits.

- Cost Analysis – Evaluating expenses to identify areas for cost savings and improved efficiency.

- Specialist Software Proficiency – Expertise in accounting tools like QuickBooks, Sage, or Xero.

- Multi-Currency Management – Handling international transactions and currency conversions.

- Regulatory Compliance – Staying updated with financial regulations and ensuring company adherence.

How to highlight work experience

Your work experience section is there to show recruiters how you’ve applied your accounting skills to make a genuine impact on your past employers.

List your roles in reverse chronological order, starting with your most recent position. Use bullet points to clearly outline your responsibilities and achievements, and if you’re light on experience, include internships or any freelance accounting work.

How to structure jobs

- Outline – Briefly describe the company, your role, and the overall purpose of your position.

- Responsibilities – Highlight your key duties and the value you brought to the organisation.

- Achievements – Focus on measurable results, such as improving efficiency or contributing to revenue growth.

Example work history for an Accountant

Accountant | Fox Financials

Outline

Managed financial operations for a mid-sized manufacturing company, focusing on cost control, financial reporting, and process improvements. Ensured compliance with accounting standards and company policies.

Responsibilities

- Prepared monthly management accounts, including variance analysis and budget forecasting.

- Maintained accurate financial records and reconciled accounts using Sage.

- Conducted cost analysis to identify savings opportunities in production processes.

- Managed the preparation and submission of VAT and tax returns to HMRC.

- Collaborated with auditors to ensure smooth year-end reporting and compliance.

Achievements

- Reduced production costs by 10% through detailed cost analysis and recommendations.

- Streamlined financial reporting processes, cutting preparation time by 20%.

- Improved cash flow management, reducing overdue receivables by 15%.

Tax Accountant | McKenzie LLC

Outline

Provided accounting services to a portfolio of SME clients in a public practice firm. Focused on preparing accurate financial statements and ensuring compliance with tax regulations.

Responsibilities

- Prepared financial statements for submission to Companies House and HMRC.

- Managed bookkeeping and reconciliations for multiple clients using QuickBooks.

- Assisted clients with tax planning and prepared corporate and personal tax returns.

- Conducted audits and provided recommendations to improve internal controls.

- Delivered financial insights to clients, helping them make informed business decisions.

Achievements

- Reduced tax liabilities for clients by 12% through effective planning strategies.

- Completed audits ahead of schedule, improving client satisfaction.

- Increased client retention rates by 15% by providing proactive financial advice.

Practice Accountant | Pure Accountancy

Outline

Handled financial reporting and strategic planning for a large retail chain, ensuring timely and accurate insights to support decision-making. Focused on optimising financial performance and resource allocation.

Responsibilities

- Prepared and analysed balance sheets, profit and loss statements, and cash flow reports.

- Monitored budgets across multiple departments, ensuring adherence to financial plans.

- Provided financial insights to support store expansion and operational efficiency.

- Led month-end and year-end closing processes, ensuring accuracy and timeliness.

- Implemented financial controls to mitigate risks and improve compliance.

Achievements

- Achieved a 25% reduction in budget variances by implementing tighter controls.

- Improved reporting efficiency by 30% by automating key financial processes.

- Played a key role in expanding operations, supporting the opening of 10 new stores.

Education section

The education section is where you list the qualifications that form the foundation of your accounting expertise. Include certifications and training in accounting and similar fields.

If you’re light on experience, expand this section to include coursework or academic projects that align with the job description.

List your qualifications in reverse chronological order, starting with the most recent.

Best qualifications for Accountants

- Association of Chartered Certified Accountants (ACCA) – A globally recognised qualification that equips accountants with skills in financial reporting, taxation, audit, and management accounting.

- Chartered Institute of Management Accountants (CIMA) – A qualification focused on management accounting, preparing candidates to guide strategic decisions using financial insights.

- ACA Chartered Accountant Qualification – A prestigious UK qualification provided by ICAEW, covering auditing, taxation, financial management, and ethics.

- AAT Accounting Qualification – An entry-level qualification ideal for aspiring accountants, offering foundational knowledge in bookkeeping, payroll, and financial processes.

- Bachelor’s Degree in Accounting or Finance – An undergraduate degree would provide comprehensive education in financial principles, accounting standards, and business management.