Auditors keep organisations honest, efficient, and compliant – making sure every pound, policy, and process lines up exactly as it should.

But before you can step into your next role scrutinising financial statements or reviewing compliance standards, your CV needs to pass a rigorous audit of its own.

This guide and its Auditor CV examples will help you craft a compelling application, showcasing your analytical skills, professional integrity, and proven ability to protect and improve businesses, all with the aim of landing you the job you deserve.

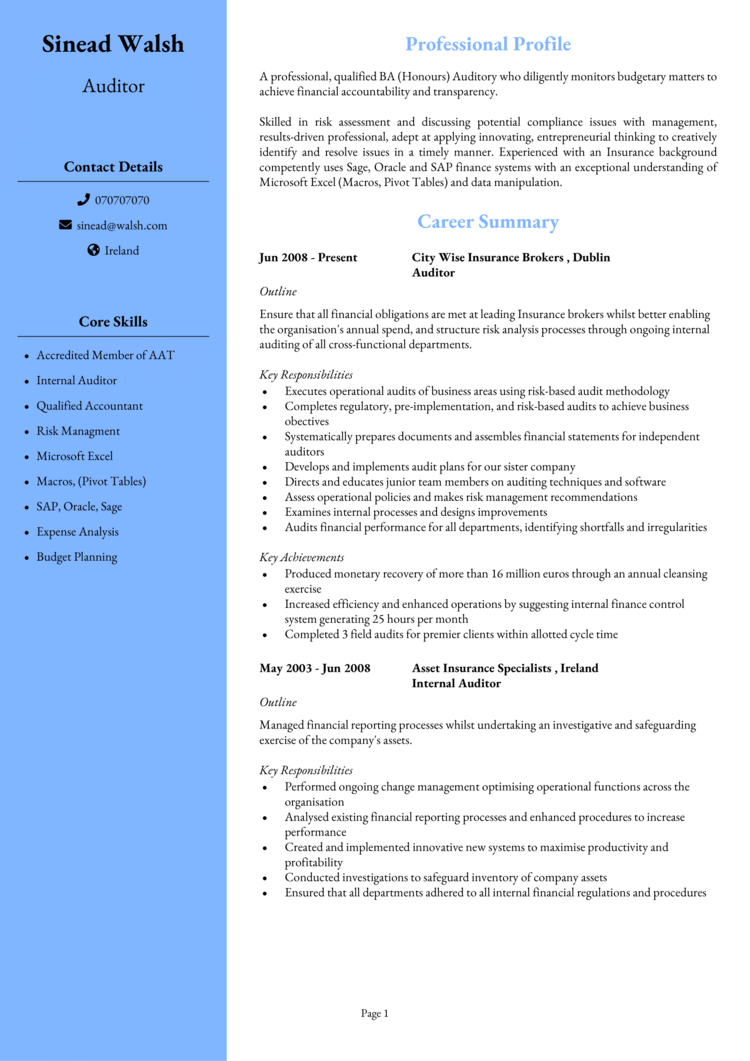

Auditor CV example

Senior Auditor CV example

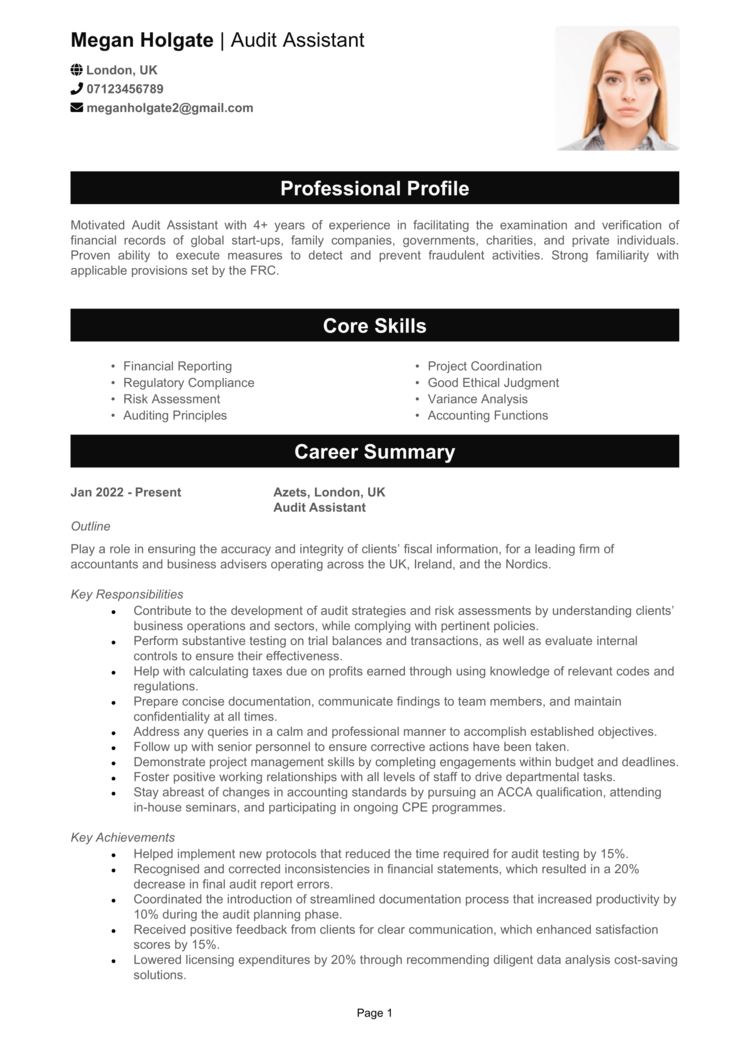

Audit Assistant CV example

External Auditor CV example

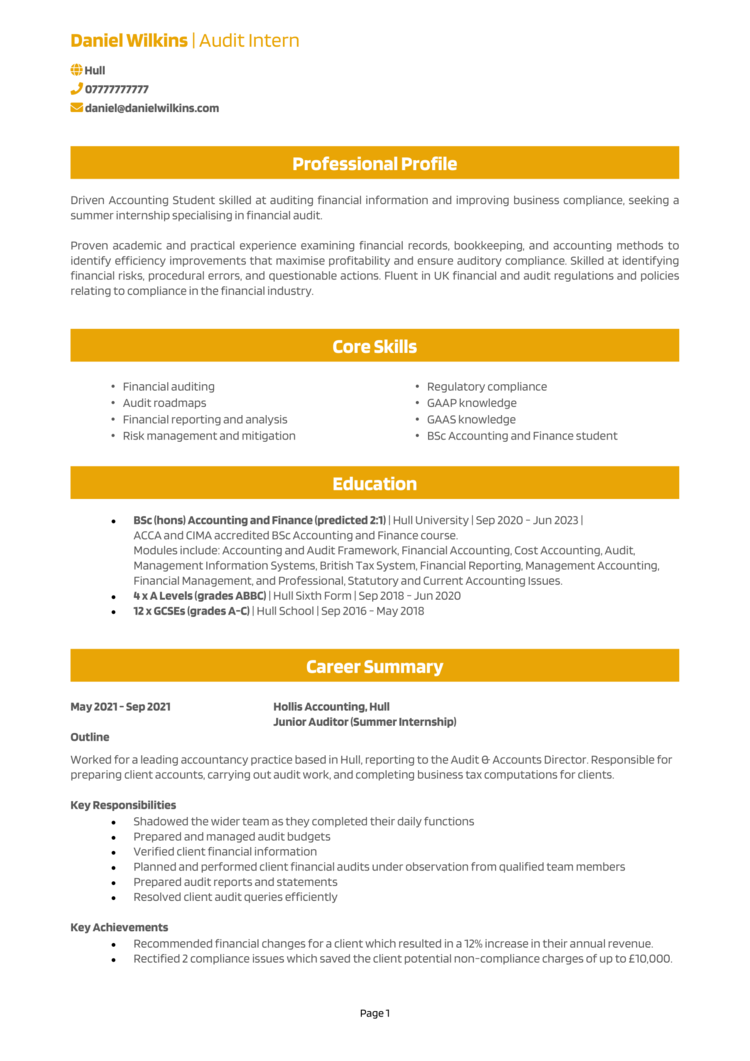

Audit Intern CV example

How to write your Auditor CV

Discover how to craft a winning Auditor CV that lands interviews with this simple step-by-step guide.

Just as a thorough audit clearly presents critical findings, your CV must highlight your expertise, qualifications, and achievements without confusion. Auditing requires attention to detail and a structured approach – qualities your CV should immediately demonstrate.

This guide walks you through the process of writing a CV that clearly shows your ability to conduct effective audits, and provide actionable recommendations. Whether you specialise in internal, external, financial, or compliance audits, your application will stand up under even the closest scrutiny.

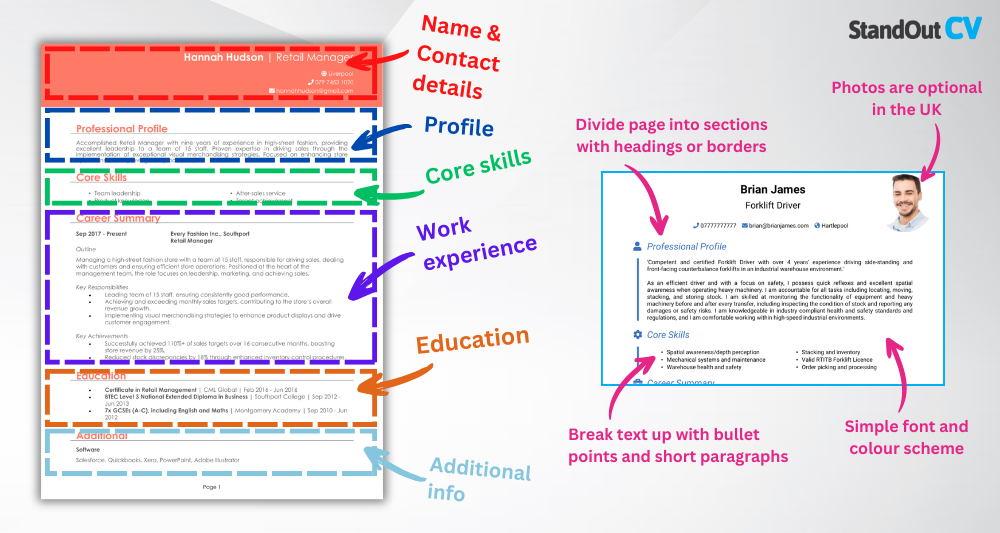

The correct structure and formatting for an Auditor CV

Hiring managers aren’t auditors – don’t expect them to dive into overly complex CVs. A well-organised and presentable CV structure ensures recruiters can quickly find your qualifications, audit experience, and technical expertise without unnecessary distractions.

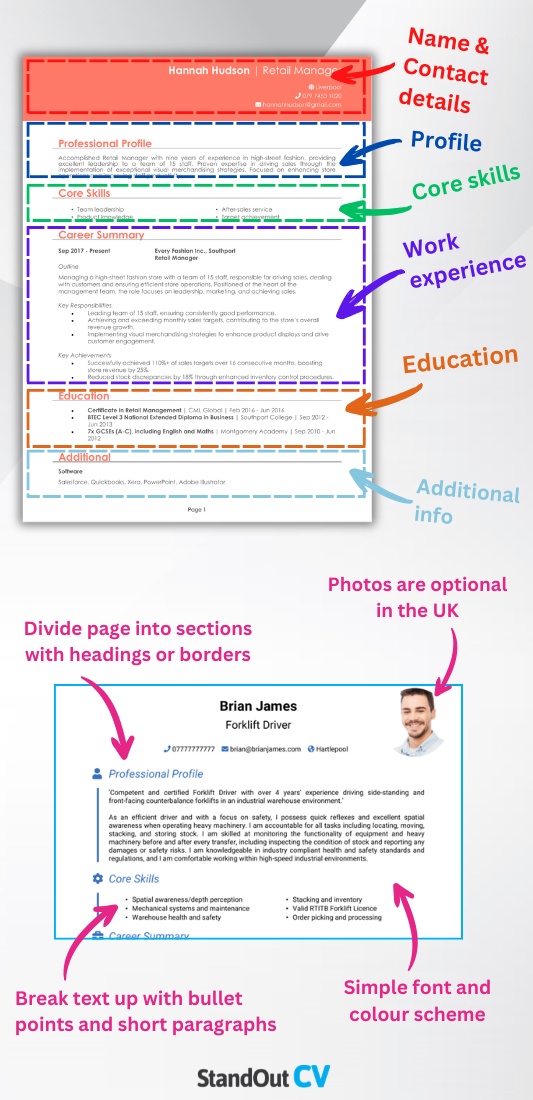

Here’s the layout to follow:

- Name and contact details – Place your name and contact details prominently at the top of your CV for quick access. Adding a photo is up to you.

- Profile – Open with a compelling overview of your skills, experience, and career goals.

- Core skills – List your key abilities in this section, focusing on those that will be most relevant to the job, like compliance auditing and financial analysis.

- Work experience – List your previous audit roles in reverse chronological order, with your most recent first.

- Education & certifications – Detail the academic background and professional qualifications that underpin your audit expertise.

- Additional info – Optionally, include professional memberships (like ACCA or ICAEW), software expertise, awards, or relevant hobbies.

Your CV format should be as precise as your financial reconciliations: avoid mistakes which will only frustrate the reader. Stick with bullet points to keep things clear, divide sections with headings, and stick to a professional, easy-to-read font. Keep it concise, no longer than two pages in length, to maintain recruiter engagement.

CV profile for an Auditor

Your professional profile summarises your audit background and analytical skills in just a few lines. It’s your chance to clearly state why you’re the auditor an organisation needs – someone who improves processes, mitigates risks, and ensures compliance, and makes a genuinely positive impact on any company which hires them.

Auditor CV profile examples

Profile 1

Detail-oriented Auditor with four years of experience in financial audits, risk assessment, and regulatory compliance. Skilled in analysing financial statements, identifying discrepancies, and ensuring adherence to IFRS and GAAP. Proficient in audit software such as CaseWare, ACL, and SAP. Committed to improving financial accuracy and transparency through meticulous auditing practices.

Profile 2

Experienced Internal Auditor with three years of expertise in evaluating business processes, assessing internal controls, and mitigating financial risks. Adept at conducting compliance audits, fraud investigations, and operational reviews. Proficient in data analysis and risk management frameworks. Passionate about enhancing organisational efficiency and regulatory compliance.

Profile 3

Certified External Auditor with over six years of experience in financial audits, forensic accounting, and corporate governance. Skilled in conducting audits for multinational corporations, reviewing tax filings, and advising on risk mitigation strategies. Proficient in using advanced data analytics tools to detect financial anomalies. Dedicated to ensuring financial integrity and business sustainability.

Details to put in your Auditor CV profile

Consider these tips on what to include:

- Auditing experience – Highlight your specific expertise, such as internal audits, statutory audits, compliance reviews, or financial controls.

- Industry knowledge – State the sectors you’ve audited, like finance, healthcare, or public sector.

- Key strengths – Emphasise analytical thinking, attention to detail, or ability to handle complex information.

- Compliance and regulation awareness – Mention your experience with relevant standards, such as IFRS, UK GAAP, or Sarbanes-Oxley.

- Career objective – Express your ambition and how your skills can add value to the organisation.

How should you write a core skills section?

Employers want clear, specific skills – such as data analytics, risk assessment, report writing, or proficiency in auditing software like IDEA or ACL. Consider your CV skills section your skills inventory – if it’s not relevant, it shouldn’t be there.

Adapt this section to align with the job you’re targeting. For financial audit roles, emphasise analytical skills and accounting knowledge. If it’s compliance or internal auditing, highlight process improvement, risk management, or regulatory knowledge.

Key skills for an Auditor CV

- Financial Statement Auditing – Examining company financial records to ensure accuracy and compliance with accounting standards.

- Internal Controls Assessment – Evaluating and testing internal control systems to identify risks and areas for improvement.

- Regulatory Compliance – Ensuring adherence to financial regulations, tax laws, and industry-specific legal requirements.

- Risk Management and Fraud Detection – Identifying potential financial misstatements, fraud risks, and operational inefficiencies.

- Data Analysis and Reconciliation – Analysing financial data, reconciling discrepancies, and verifying the accuracy of reports.

- Audit Planning and Execution – Developing audit strategies, conducting fieldwork, and preparing comprehensive reports.

- GAAP and IFRS Knowledge – Applying Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- Tax and VAT Auditing – Reviewing tax records to ensure compliance with corporate tax laws and VAT regulations.

- Report Writing and Presentation – Documenting audit findings and presenting recommendations to management and stakeholders.

- Accounting Software Proficiency – Using tools like SAP, QuickBooks, Xero, or ACL Analytics for audit and financial analysis.

Writing about your work experience

Your work experience section should provide proof that you deliver audit insights that truly matter. It isn’t just your career history – it’s evidence of how you’ve protected and improved businesses

Emphasise measurable outcomes as you walk through your past roles. Be sure to mention any audit frameworks you’ve applied, such as COSO, ISO standards, or specific industry regulations.

If you’re less experienced, include relevant internships, junior audit roles, or finance positions that showcase transferable auditing skills.

Formatting your job history for your CV

- Outline – Briefly describe the organisation and your role within the audit function.

- Responsibilities – Explain your key tasks clearly, such as conducting risk assessments, evaluating financial statements, or recommending improvements. Use action words like “analysed,” “reviewed,” and “evaluated.”

- Achievements – Highlight measurable results like reduced financial risk, improved internal controls, or successful completion of complex audits.

Work experience samples for Auditors

Financial Auditor | Lennox & Co. Accountants

Outline

Conducting financial audits for a leading accountancy firm, ensuring compliance with regulatory standards and financial accuracy.

Responsibilities

- Reviewed financial statements and transactions to ensure accuracy and adherence to IFRS and GAAP.

- Identified financial discrepancies and provided recommendations for corrective actions.

- Assisted in the preparation of audit reports and presentations for senior management.

- Collaborated with finance teams to assess internal controls and risk management practices.

- Used data analytics tools to detect irregularities and improve audit efficiency.

Achievements

- Improved audit efficiency by 20 percent through automation of data collection processes.

- Identified cost-saving opportunities that reduced operational expenses by £200K.

- Recognised for delivering high-quality audit reports that strengthened client trust.

Internal Auditor | Summit Accounting

Outline

Evaluating financial and operational processes for a multinational consultancy firm, ensuring compliance with internal controls and risk management frameworks.

Responsibilities

- Conducted internal audits across various departments to assess compliance with company policies.

- Analysed financial transactions to detect anomalies and potential fraud risks.

- Developed risk mitigation strategies to enhance corporate governance.

- Prepared audit findings and recommendations, presenting them to senior leadership.

- Implemented audit procedures that improved overall financial transparency and accountability.

Achievements

- Reduced financial risk exposure by 30 percent through enhanced internal control measures.

- Helped recover £500K in misallocated funds through detailed audit investigations.

- Developed a risk assessment framework adopted across multiple business units.

External Auditor | Omni Advisory

Outline

Conducting external audits for a global audit firm, ensuring financial accuracy and regulatory compliance for corporate clients.

Responsibilities

- Reviewed financial records and tax filings to verify compliance with regulatory requirements.

- Assessed corporate financial statements, identifying discrepancies and reporting findings.

- Led audit teams in conducting fieldwork and preparing audit documentation.

- Advised clients on improving financial reporting processes and risk management strategies.

- Liaised with regulatory bodies to ensure businesses met industry standards.

Achievements

- Successfully identified and corrected a £1M accounting error, preventing regulatory fines.

- Implemented an audit methodology that improved report turnaround times by 25 percent.

- Recognised for providing strategic financial insights that improved client business operations.

How to write your education section

Auditing is heavily regulated, making professional qualifications highly valuable. Recruiters love credentials – don’t let yours get buried like forgotten expense receipts. With that in mind, they still value experience, so keep your education section concise and towards the bottom.

Clearly list relevant degrees, diplomas, and professional certifications, such as ACA, ACCA, or CIA (Certified Internal Auditor).

If you hold or are working towards a certification, specify your progress or qualification dates clearly. Include professional training, regulatory updates, or seminars attended, demonstrating your ongoing commitment to professional development.

Recommended qualifications for Auditors

- ACA (ICAEW) – Highly respected for external auditors and financial professionals in the UK.

- ACCA (Association of Chartered Certified Accountants) – Widely recognised qualification for auditors worldwide.

- CIA (Certified Internal Auditor) – Internationally recognised certification specifically for internal auditors.

- CISA (Certified Information Systems Auditor) – Ideal for auditors specialising in information systems and IT audits.

- CFSA (Certified Financial Services Auditor) – Excellent qualification for auditors working specifically within banking and financial services.