As a credit controller you get to combine your love of numbers with a purposeful and valuable role in a broad range of businesses.

But you need a strong CV if you want to stand out from the crowd and get noticed by employers.

This guide will take you through an example credit controller CV whilst also providing you with specific advice on how to write a CV that will win you an interview.

|

Credit controller CV example

Before you start writing your own CV, take a look at the example Credit controller CV above to give yourself a basic understanding of the style and format that recruiters and hiring managers prefer to see.

Also, take note of the type of content that is included to impress recruiters, and how the most relevant information is made prominent.

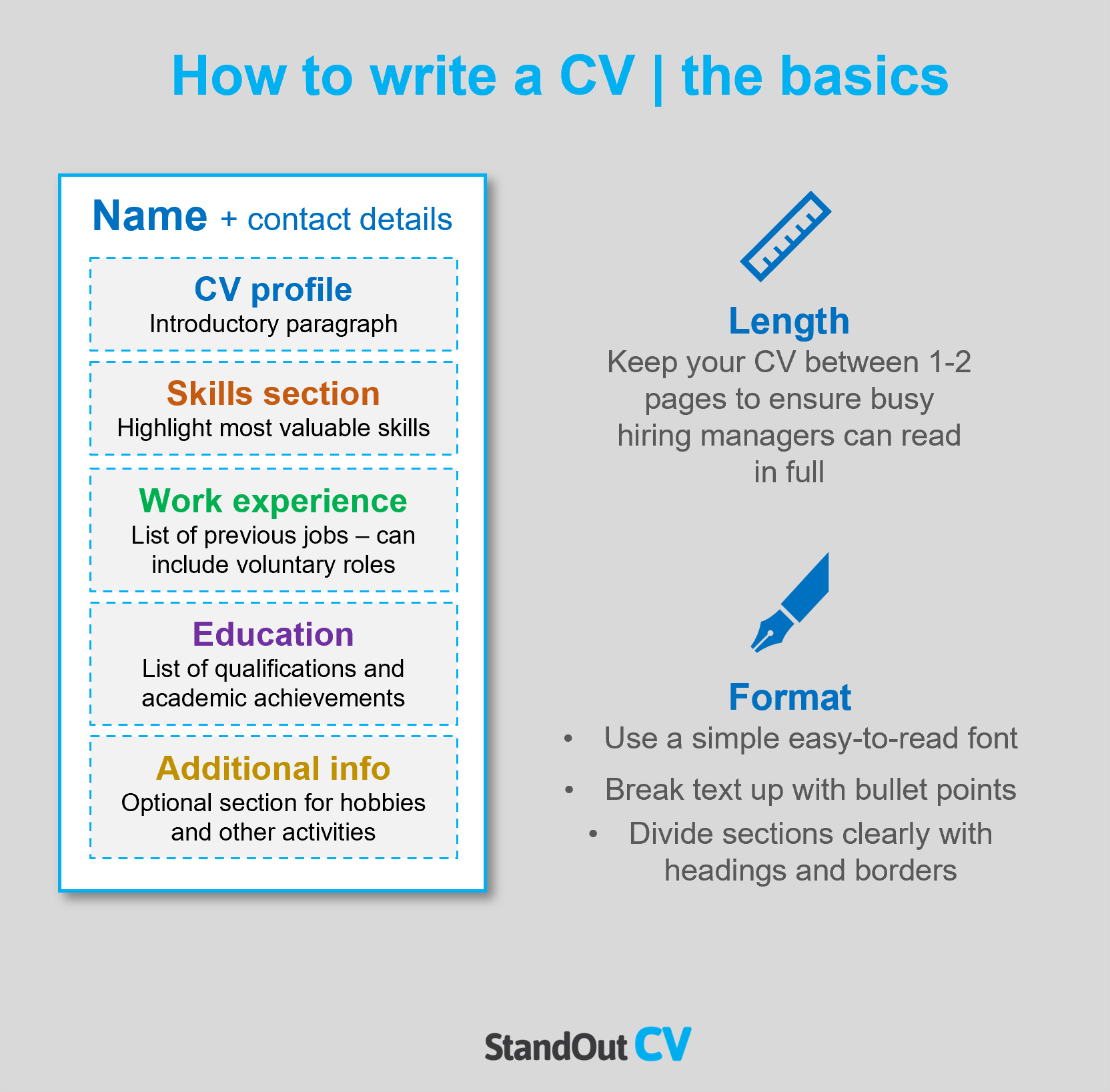

Credit controller CV structure & format

If you focus on the written content of your CV but ignore how it actually looks, your efforts could end up wasted.

No matter how suitable you are for the role, no recruiter wants to spend time squinting and trying to navigate a badly designed and disorganised CV.

Instead, make sure to organise your content into a simple structure and spend some time formatting it for ease of reading – it’ll get you in recruiter’s good books from the get-go!

Formatting Tips

- Length: Recruiters will be immediately put off by lengthy CVs – with hundreds of applications to read through, they simply don’t have the time! Grabbing their attention with a short, snappy and highly relevant CV is far more likely to lead to success. Aim for two sides of A4 or less.

- Readability: By clearly formatting your section headings (bold, or a different colour font, do the trick) and breaking up big chunks of text into snappy bullet points, time-strapped recruiters will be able to skim through your CV with ease.

- Design: When it comes to CV design, it’s best to keep things simple and sleek. While elaborate designs certainly command attention, it’s not always for the right reasons! Readability is key, so whatever you choose to do, make sure you prioritise readability above everything.

- Avoid photos: Don’t add photos, images or profile pictures to your CV. Not only do they take up much-needed CV space, but they’re actually completely unnecessary and won’t boost your CV at all.

Structuring your CV

Divide your CV into the following major sections when writing it:

- Name and contact details – Head your CV with your name and contact details, to let the reader know who you are and how to contact you.

- CV profile – A brief paragraph which summarises your skills and experience and highlights why you’re a good match for the role.

- Core skills list – A snappy, bullet-pointed list of your most relevant skills.

- Work experience – A structured list of your work experience in reverse chronological order.

- Education – A summary of any relevant qualifications or professional training you’ve completed.

- Hobbies and interests – An optional section, which should only be used if your hobbies are relevant to the jobs you’re applying to.

Now I’ll guide you through exactly what you should include in each CV section.

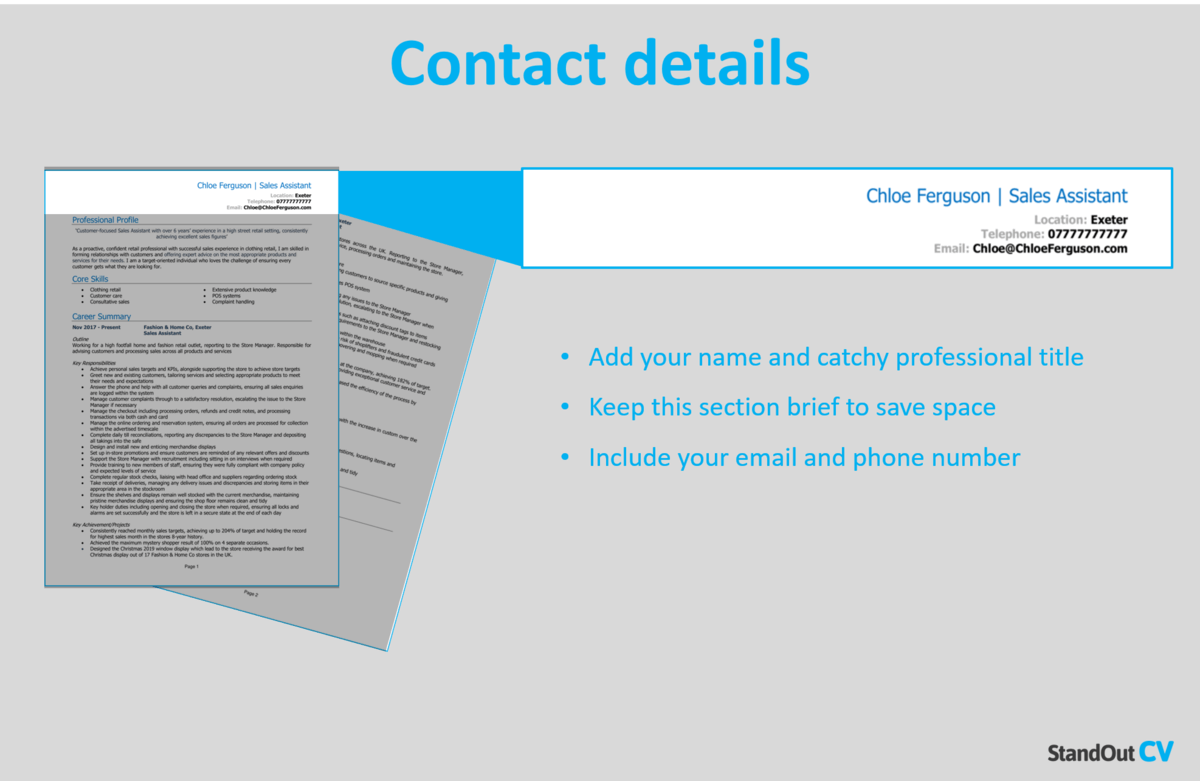

CV Contact Details

Tuck your contact details into the corner of your CV, so that they don’t take up too much space.

Stick to the basic details, such as:

- Mobile number

- Email address – It should sound professional, such as your full name.

- Location -Just write your rough location, rather than your full address.

- LinkedIn profile or portfolio URL – If you include these, ensure they’re sleek, professional and up-to-date.

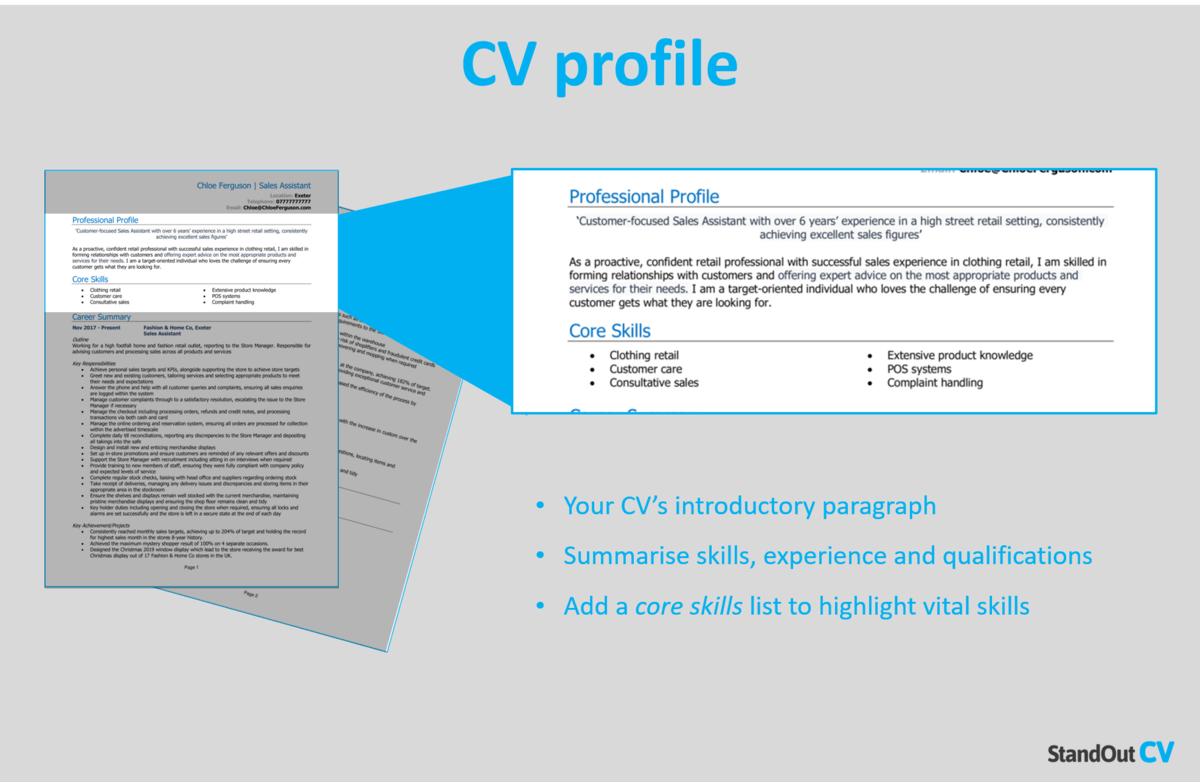

Credit controller CV Profile

Your CV profile (or personal statement, if you’re an entry-level applicant) provides a brief overview of your skills, abilities and suitability for a position.

It’s ideal for busy recruiters and hiring managers, who don’t want to waste time reading unsuitable applications.

Think of it as your personal sales pitch. You’ve got just a few lines to sell yourself and prove you’re a great match for the job – make it count!

Tips for creating an impactful CV profile:

- Keep it brief: When it comes to CV profile length, less is more, as recruiters are often time-strapped. Aim for around of 3-5 persuasive lines.

- Tailor it: Not tailoring your profile (and the rest of your CV) to the role you’re applying for, is the worst CV mistake you could make. Before setting pen to paper, look over the job ad and make a note of the skills and experience required. Then, incorporate your findings throughout.

- Don’t add an objective: You only have a short space for your CV profile, so avoid writing down your career goals or objectives. If you think these will help your application, incorporate them into your cover letter instead.

- Avoid cliches: Cheesy clichès and generic phrases won’t impress recruiters, who read the same statements several times per day. Impress them with your skill-set, experience and accomplishments instead!

What to include in your Credit controller CV profile?

- Summary of experience: Demonstrate your suitability for your target jobs by giving a high level summary of your previous work experience, including the industries you have worked in, types of employer, and the type of roles you have previous experience of.

- Relevant skills: Employers need to know what skills you can bring to their organisation, and ideally they want to see skills that match their job vacancy. So, research your target roles thoroughly and add the most important Credit controller skills to your profile.

- Essential qualifications: If you have any qualifications which are highly relevant to Credit controller jobs, then highlight them in your profile so that employers do not miss them.

Quick tip: Remember to triple-check for spelling and grammar errors before hitting send. If you’re unsure, try using our quick-and-easy CV Builder for a quick and easy approach.

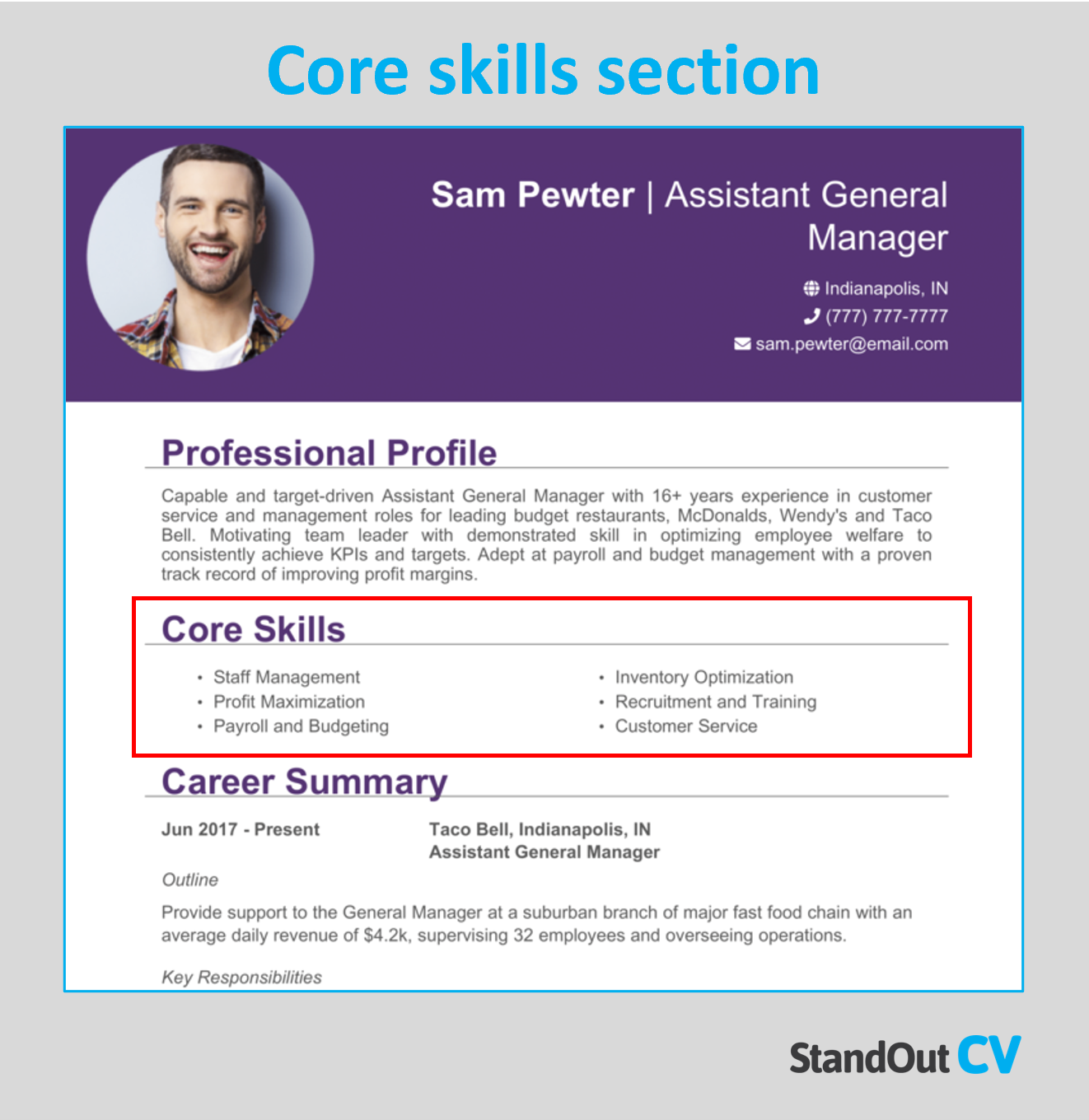

Core skills section

Next, you should create a bullet pointed list of your core skills, formatted into 2-3 columns.

Here, you should focus on including the most important skills or knowledge listed in the job advertisement.

This will instantly prove that you’re an ideal candidate, even if a recruiter only has time to briefly scan your CV.

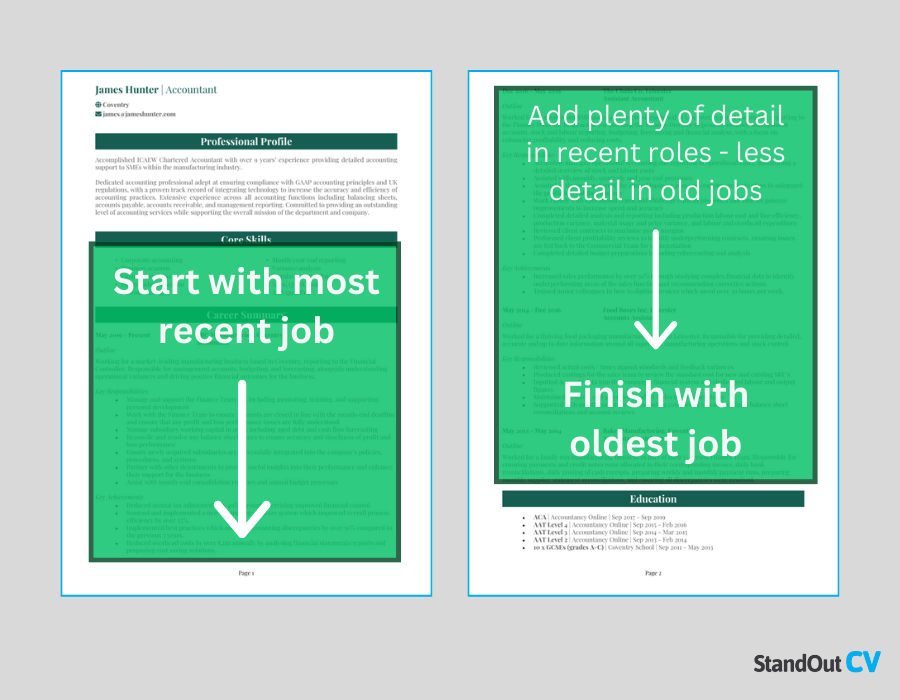

Work experience/Career history

Now it’s time to get stuck into your work experience, which should make up the bulk of your CV.

Begin with your current (or most recent) job, and work your way backwards.

If you’ve got too much experience to fit onto two pages, prioritise space for your most recent and relevant roles.

Structuring your roles

Lengthy, unbroken chunks of text is a recruiters worst nightmare, but your work experience section can easily end up looking like that if you are not careful.

To avoid this, use my tried-and-tested 3-step structure, as illustrated below:

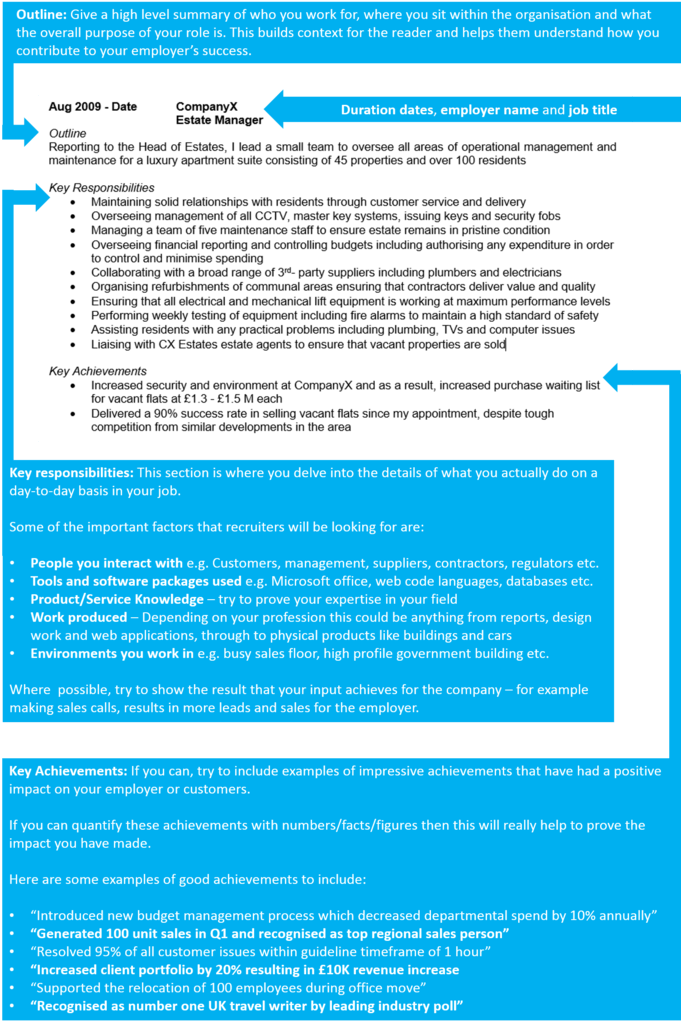

Outline

Firstly, give the reader some context by creating a punchy summary of the job as a whole.

You should mention what the purpose or goal of your role was, what team you were part of and who you reported to.

E.g.

“Worked as the Credit Controller within a small accounts receivable team to ensure timely payments following invoices and resolving outstanding debt from clients for a retail supplier across the UK and Ireland.”

Key responsibilities

Follow with a snappy list of bullet points, detailing your daily duties and responsibilities.

Tailor it to the role you’re applying for by mentioning how you put the target employer’s desired hard skills and knowledge to use in this role.

E.g.

- Ensuring that all new clients complete a credit application in order to carry out effective credit management research

- Carrying out credit references from client suppliers where appropriate

- Continually reviewing and managing accounts to ensure payments are made within the contractual timeframes

Key achievements

Round up each role by listing 1-3 key achievements, accomplishments or results.

Wherever possible, quantify them using hard facts and figures, as this really helps to prove your value.

E.g.

- Reduced the average monthly DSO from 29 days down to 24 days by improving existing customer relationships and implementing stricter credit control policies such as reminder letters on the date the credit is due.

Education

Although there should be mentions of your highest and most relevant qualifications earlier on in your CV, save your exhaustive list of qualifications for the bottom.

If you’re an experienced candidate, simply include the qualifications that are highly relevant to Credit controller roles.

However, less experienced candidates can provide a more thorough list of qualifications, including A-Levels and GCSEs.

You can also dedicate more space to your degree, discussing relevant exams, assignments and modules in more detail, if your target employers consider them to be important.

Interests and hobbies

Although this is an optional section, it can be useful if your hobbies and interests will add further depth to your CV.

Interests which are related to the sector you are applying to, or which show transferable skills like leadership or teamwork, can worth listing.

On the other hand, generic hobbies like “going out with friends” won’t add any value to your application, so are best left off your CV.

Essential skills for your Credit controller CV

Tailoring your CV to the roles you are applying for is key to success, so make sure to read through the job descriptions and tailor your skills accordingly.

However, commonly desired Credit controller skills include:

Financial and numerical – Showcase your skill with numbers, particularly within a financial and debt context.

Customer service – Your CV needs to specify how you are capable of handling complex customer situations with professionalism, resulting in the desired outcome.

Database skills – Credit controller CVs must evidence skill with complex and evolving databases.

Negotiation – You need to display your tenacity with negotiation through outstanding communication.

Interpersonal skills – A credit controller must explain how they strike a balance of different interpersonal skills such as confidence and the ability to apply pressure against empathy and listening.

Writing your Credit controller CV

When putting together your Credit controller CV, there are a few key points to remember.

Always tailor your CV to the target role, even if it means creating several versions for different roles.

Additionally, remember that the structure and format of your CV needs just as much attention as the content.

Remember to triple-check for spelling and grammar errors before hitting send. If you’re unsure, try using our quick-and-easy CV Builder for a quick and easy approach.

Good luck with your job search!