As a credit manager, you’ll be tasked with overseeing credit collections, evaluating credit applications and risk assessments, while also maintaining strong relationships with creditors and lenders.

If you want to maximise your chances of landing the role, you need to demonstrate to employers that you have organisation skills, problem solving skills, as well as solid interpersonal capabilities.

For instructions on how to craft a CV for this role, take a look at our credit manager CV example for inspiration.

|

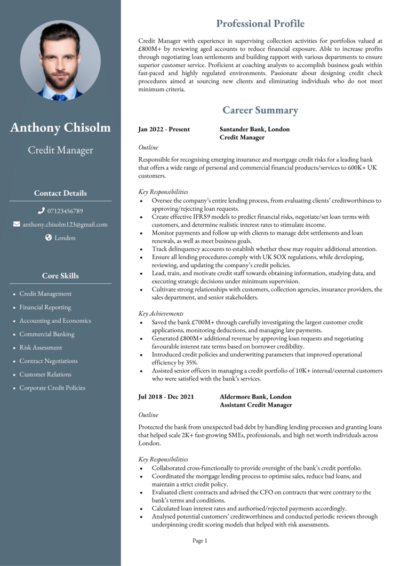

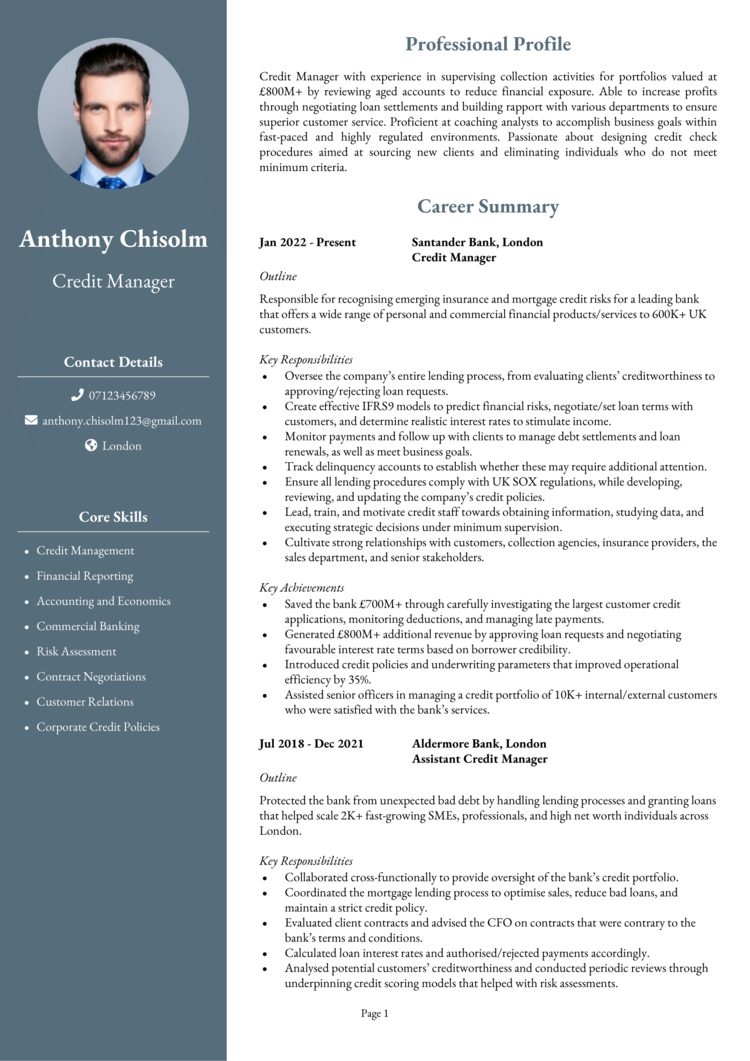

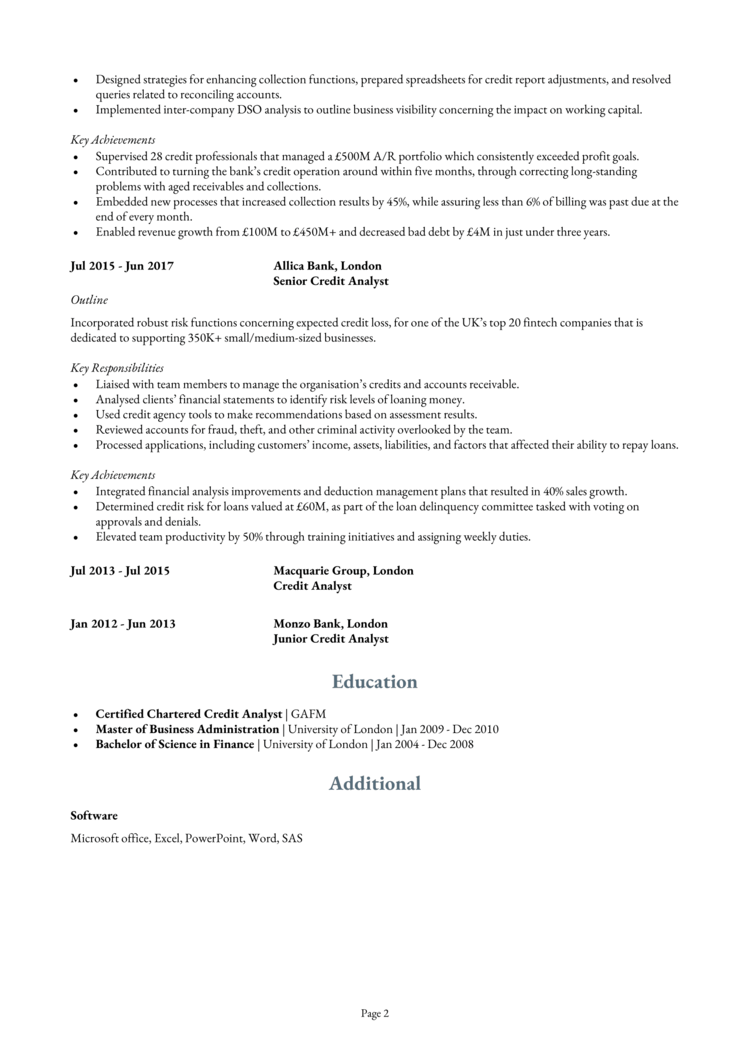

Credit Manager CV example

This is a good example of a Credit Manager CV which is professionally formatted, and structured in a way that allows recruiters to easily find and understand the candidate’s key selling points.

Take some time to look at this CV and refer to it throughout the writing of your own CV for best results.

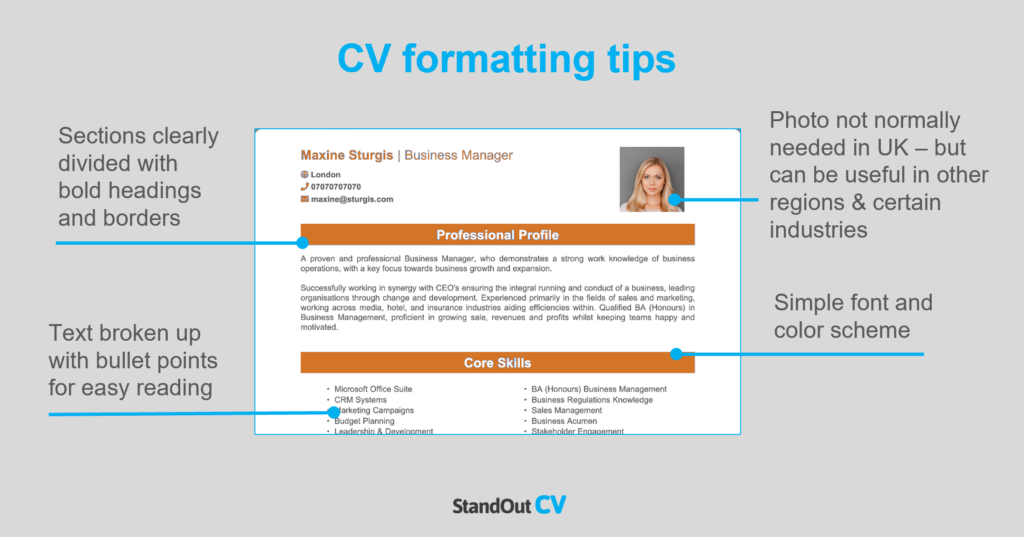

Credit Manager CV structure & formatting

The format and structure of your CV is important because it will determine how easy it is for recruiters and employers to read your CV.

If they can find the information they need quickly, they’ll be happy; but if they struggle, your application could be overlooked.

A simple and logical structure will always create a better reading experience than a complex structure, and with a few simple formatting tricks, you’ll be good to go.

How to format your CV

- Length: Think that submitting a five page CV will impress recruiters? You’re wrong! Even if you’ve got tons of experience to brag about, recruiters don’t have time to read through overly detailed CVs. Keep it short, concise and relevant – a CV length of 2 sides of A4 pages or less is perfect.

- Readability: To help busy recruiters scan through your CV, make sure your section headings stand out – bold or coloured text works well. Additionally, try to use bullet points wherever you can, as they’re far easier to skim through than huge paragraphs. Lastly, don’t be afraid of white space on your CV – a little breathing space is great for readability.

- CV design: While it’s okay to add your own spin to your CV, avoid overdoing the design. If you go for something elaborate, you might end up frustrating recruiters who, above anything, value simplicity and clarity.

- Photographs: Profile photos or aren’t a requirement for most industries, so you don’t need to add one in the UK – but if you do, just make sure it looks professional

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

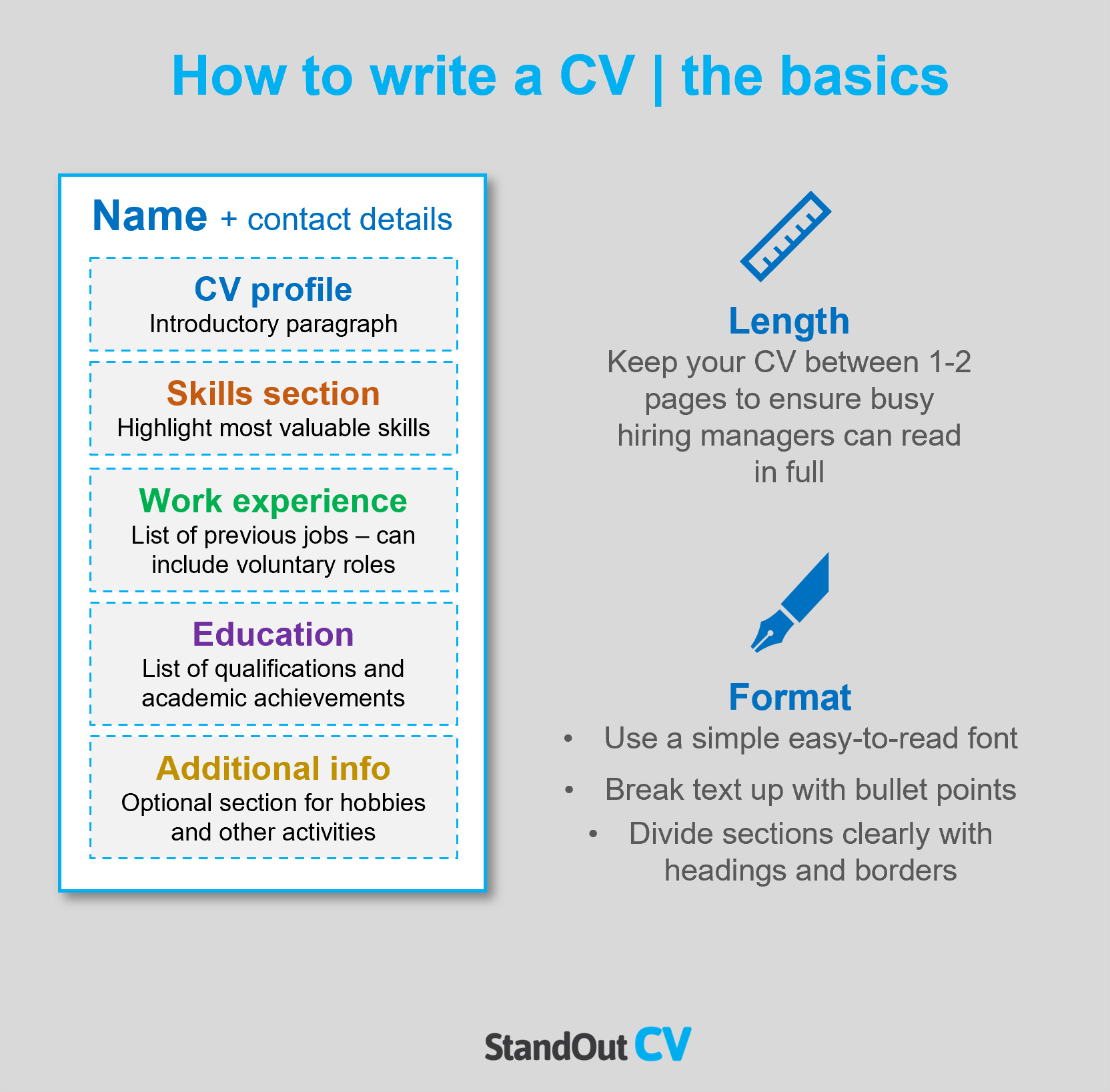

CV structure

When writing your CV, break up the content into the following key sections, to ensure it can be easily digested by busy recruiters and hiring managers:

- Contact details – Always list these at the very top of your CV – you don’t want them to be missed!

- Profile – An introductory paragraph, intended to grab recruiters attention and summarise your offering.

- Work experience / career history – Working from your current role and working backwards, list your relevant work experience.

- Education – Create a snappy summary of your education and qualifications.

- Interest and hobbies – An optional section to document any hobbies that demonstrate transferable skills.

Now, let’s take a closer look at what you should include in each section of your CV.

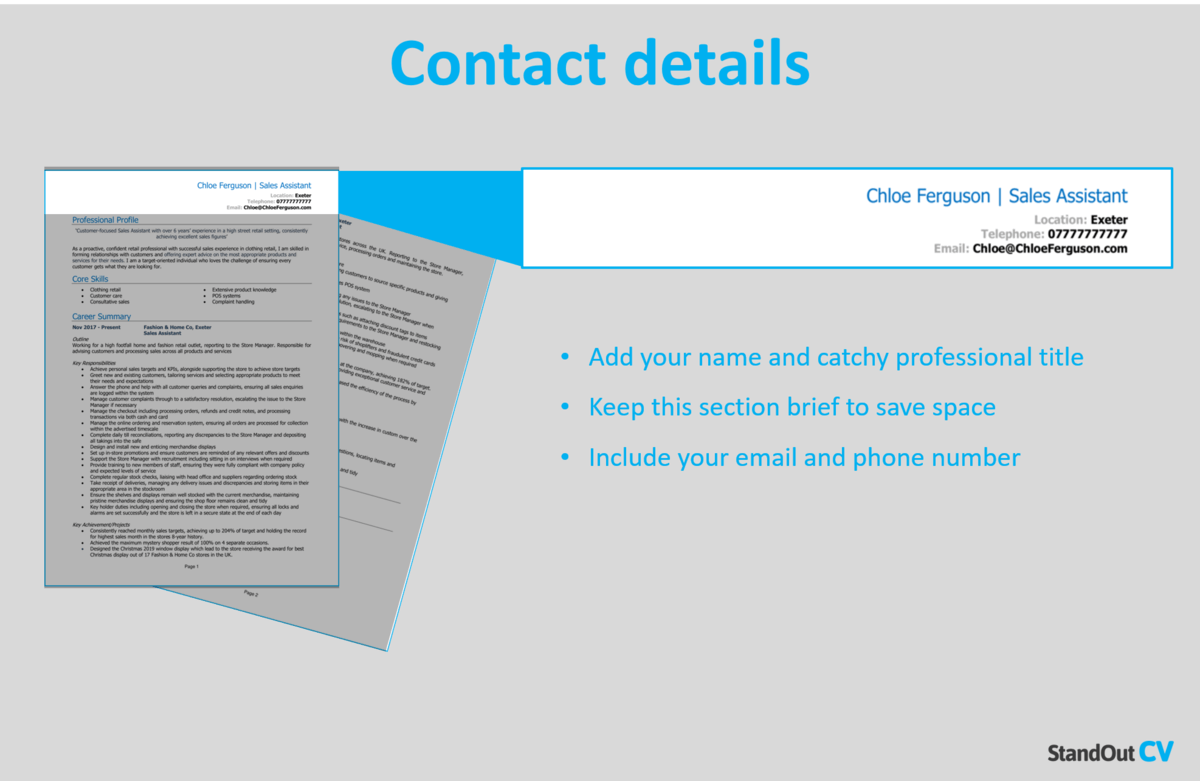

CV Contact Details

Write your contact details in the top corner of your CV, so that they’re easy to find but don’t take up too much space.

You only need to list your basic details, such as:

- Mobile number

- Email address

- Location – Don’t list your full address. Your town or city, such as ‘Norwich’ or ‘Coventry’ is perfect.

- LinkedIn profile or portfolio URL – Remember to update these before listing them on an application.

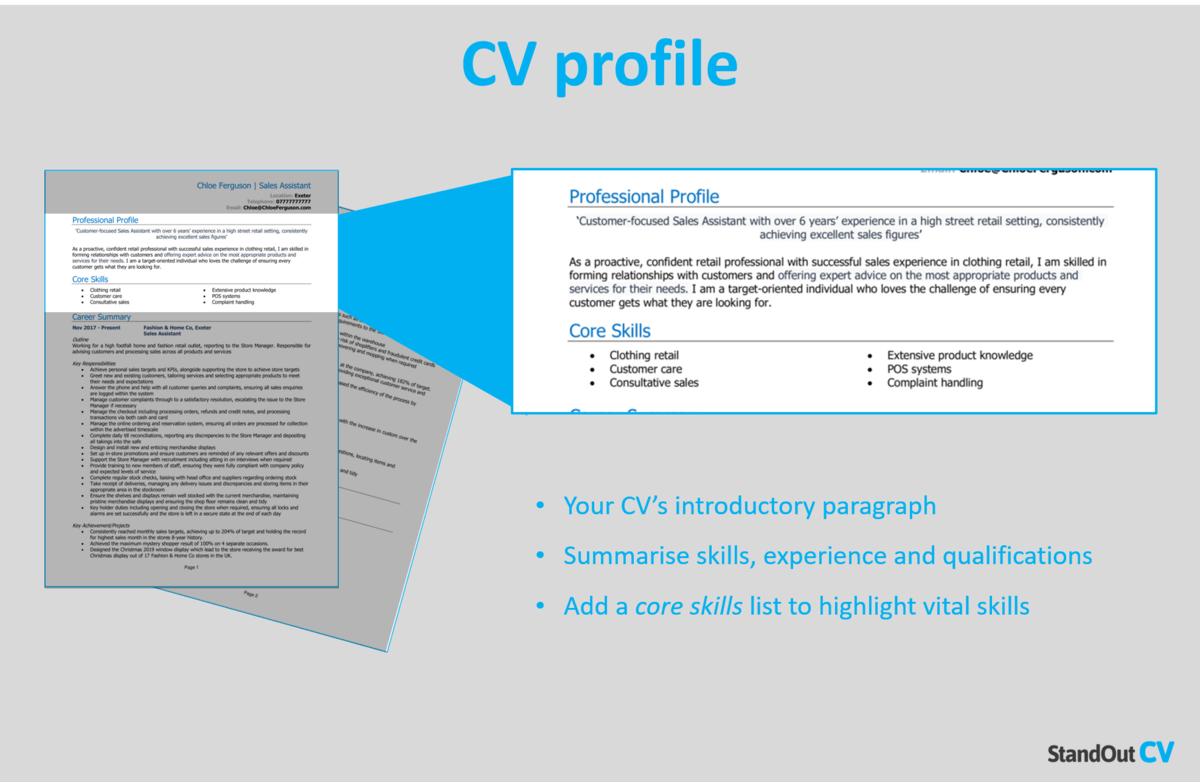

Credit Manager CV Profile

Your CV profile is the first thing recruiters will read – so your goal is to give them a reason to read onto the end of the document!

Create a short and snappy paragraph that showcases your key skills, relevant experience and impressive accomplishments.

Ultimately, it should prove to the reader that you’ve got what it takes to carry out the job.

CV profile writing tips:

- Make it short and sharp: When it comes to CV profile length, less is more, as recruiters are often time-strapped. Aim for around of 3-5 persuasive lines.

- Tailor it: No matter how much time you put into your CV profile, it won’t impress if it’s irrelevant to the role you’re applying for. Before you start writing, make a list of the skills, knowledge and experience your target employer is looking for. Then, make sure to mention them in your CV profile and throughout the rest of your application.

- Don’t add an objective: Career goals and objectives are best suited to your cover letter, so don’t waste space with them in your CV profile.

- Avoid generic phrases: “Determined team player who always gives 110%” might seem like a good way to fill up your CV profile, but generic phrases like this won’t land you an interview. Recruiters hear them time and time again and have no real reason to believe them. Instead, pack your profile with your hard skills and tangible achievements.

Example CV profile for Credit Manager

What to include in your Credit Manager CV profile?

- Summary of experience: Start with a brief summary of your relevant experience so far. How many years experience do you have? What type of companies have you worked for? What industries/sectors have you worked in? What are your specialisms?

- Relevant skills: Make your most relevant Credit Manager key skills clear in your profile. These should be tailored to the specific role you’re applying for – so make sure to check the job description first, and aim to match their requirements as closely as you can.

- Vital qualifications: If you have any qualifications which are highly relevant to Credit Manager jobs, then highlight them in your profile so that employers do not miss them.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

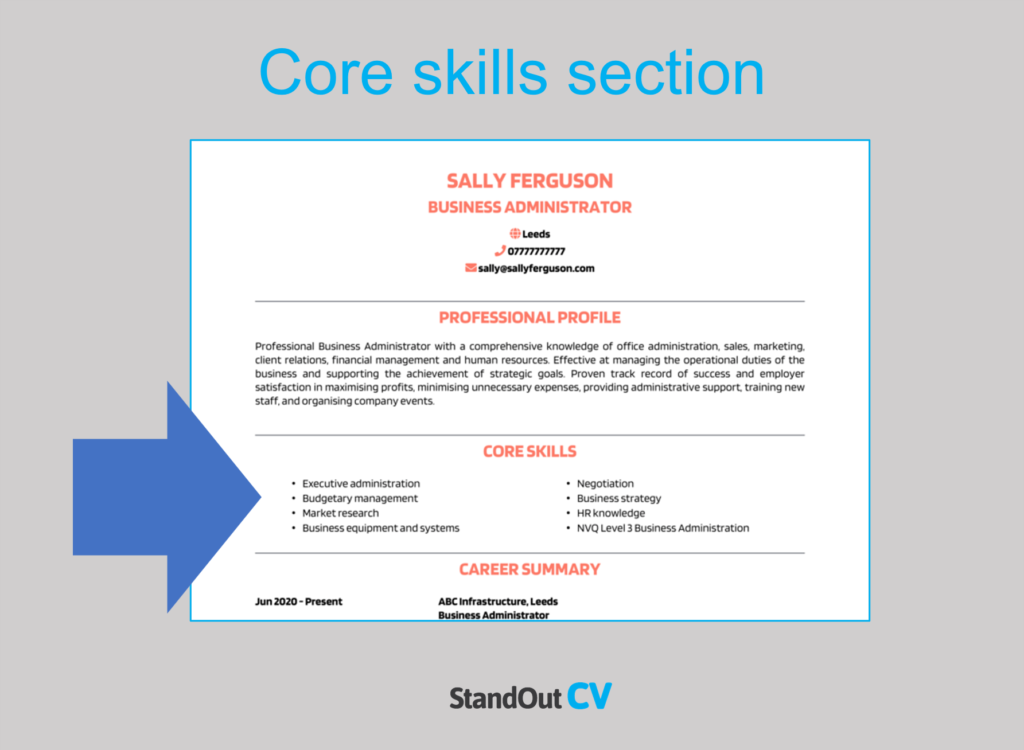

Core skills section

In addition to your CV profile, your core skills section provides an easily digestible snapshot of your skills – perfect for grabbing the attention of busy hiring managers.

As Credit Manager jobs might receive a huge pile of applications, this is a great way to stand out and show off your suitability for the role.

It should be made up of 2-3 columns of bullet points and be made up of skills that are highly relevant to the jobs you are targeting.

Vital skills for your Credit Manager CV

Credit Management – granting credit to customers, setting payment terms and conditions to enable them to pay their bills on time and in full, recovering payments, and ensuring customers (and employees) comply with the company’s credit policy.

Financial Reporting – generating formal records of the financial activities and position of a business, person, or other entity to draw conclusions about their current and future financial health.

Risk Assessment – evaluating and assessing a customer’s ability to repay their line of credit and what risk this poses to the institution.

Contract Negotiations – working with the customer to come to a mutually beneficial agreement around the terms of the loan.

Corporate Credit Policies – following complex policies and procedures that align the institutions corporate goals with business procedures and help them reduce bad debt and write-offs.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

Your work experience section

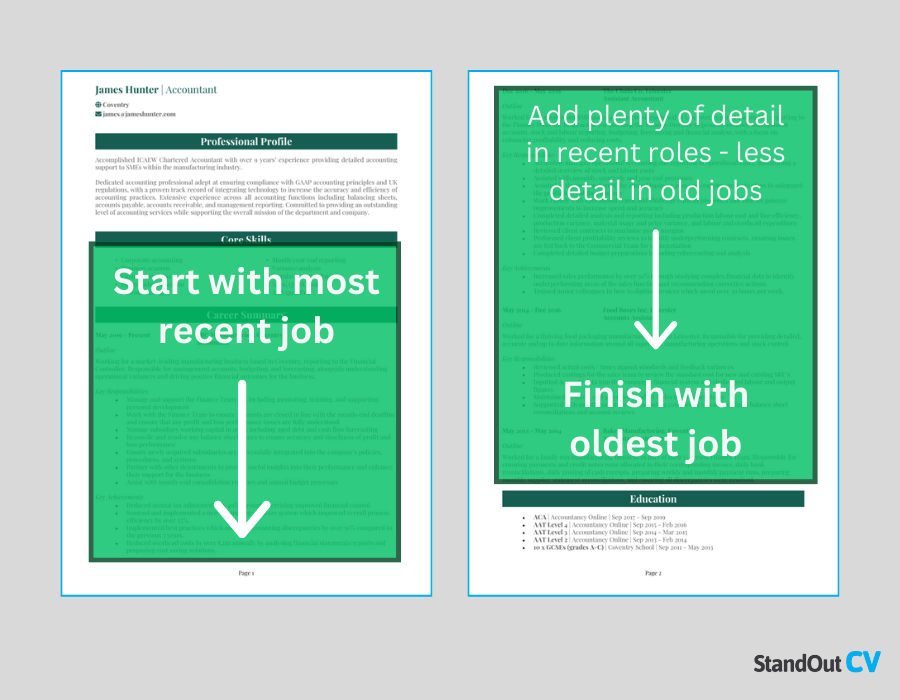

Next up is your work experience section, which is normally the longest part of your CV.

Start with your current (or most recent) job and work your way backwards through your experience.

Can’t fit all your roles? Allow more space for your recent career history and shorten down descriptions for your older roles.

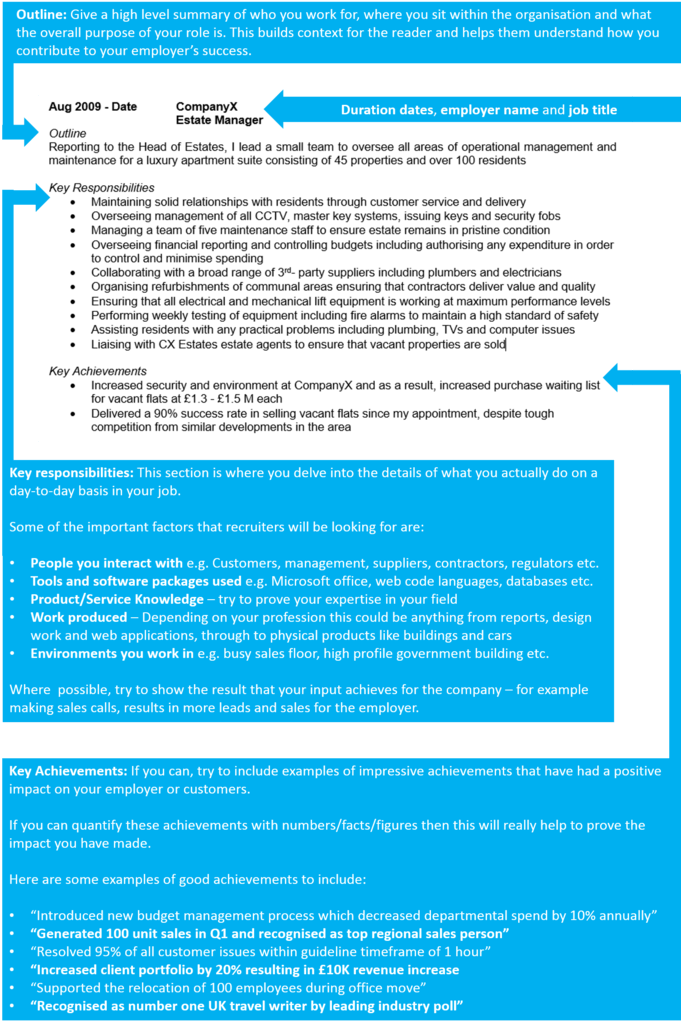

Structuring each role

The structure of your work experience section can seriously affect its impact.

This is generally the biggest section of a CV, and with no thought to structure, it can look bulky and important information can get lost.

Use my 3-step structure below to allow for easy navigation, so employers can find what they are looking for:

Outline

Firstly, give the reader some context by creating a punchy summary of the job as a whole.

You should mention what the purpose or goal of your role was, what team you were part of and who you reported to.

Key responsibilities

Next up, you should write a short list of your day-to-day duties within the job.

Recruiters are most interested in your sector-specific skills and knowledge, so highlight these wherever possible.

Key achievements

To finish off each role and prove the impact you made, list 1-3 stand out achievements, results or accomplishments.

This could be anything which had a positive outcome for the company you worked for, or perhaps a client/customer.

Where applicable, quantify your examples with facts and figures.

Sample job description for Credit Manager CV

Outline

Responsible for recognising emerging insurance and mortgage credit risks for a leading bank that offers a wide range of personal and commercial financial products/services to 600K+ UK customers.

Key Responsibilities

- Oversee the company’s entire lending process, from evaluating clients’ creditworthiness to approving/rejecting loan requests.

- Create effective IFRS9 models to predict financial risks, negotiate/set loan terms with customers, and determine realistic interest rates to stimulate income.

- Monitor payments and follow up with clients to manage debt settlements and loan renewals, as well as meet business goals.

- Track delinquency accounts to establish whether these may require additional attention.

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education and qualifications section

Although there should be mentions of your highest and most relevant qualifications earlier on in your CV, save your exhaustive list of qualifications for the bottom.

If you’re an experienced candidate, simply include the qualifications that are highly relevant to Credit Manager roles.

However, less experienced candidates can provide a more thorough list of qualifications, including A-Levels and GCSEs.

You can also dedicate more space to your degree, discussing relevant exams, assignments and modules in more detail, if your target employers consider them to be important.

Hobbies and interests

This section is entirely optional, so you’ll have to use your own judgement to figure out if it’s worth including.

If your hobbies and interests could make you appear more suitable for your dream job, then they are definitely worth adding.

Interests which are related to the industry, or hobbies like sports teams or volunteering, which display valuable transferable skills might be worth including.

Writing your Credit Manager CV

A strong, compelling CV is essential to get noticed and land interviews with the best employers.

To ensure your CV stands out from the competition, make sure to tailor it to your target role and pack it with sector-specific skills and results.

Remember to triple-check for spelling and grammar errors before hitting send.

Good luck with the job search!