The role of a wealth manager can be varied, but if you’ve got strong financial skills and business acumen, you could be a real asset to your clients.

In order to land the role, you first need to showcase your most impressive experience and achievements from previous positions.

To help you do this, we’ve put together a wealth manager CV example, complete with a whole host of top writing tips to guide you.

|

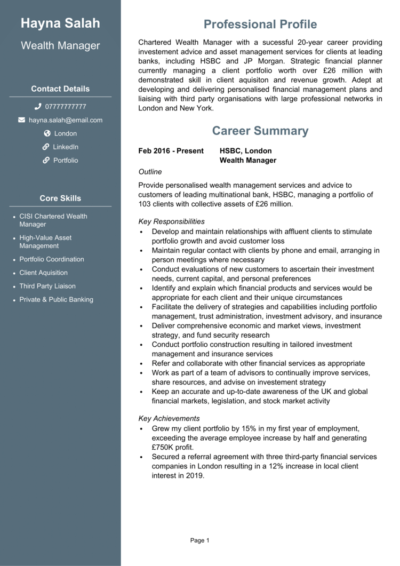

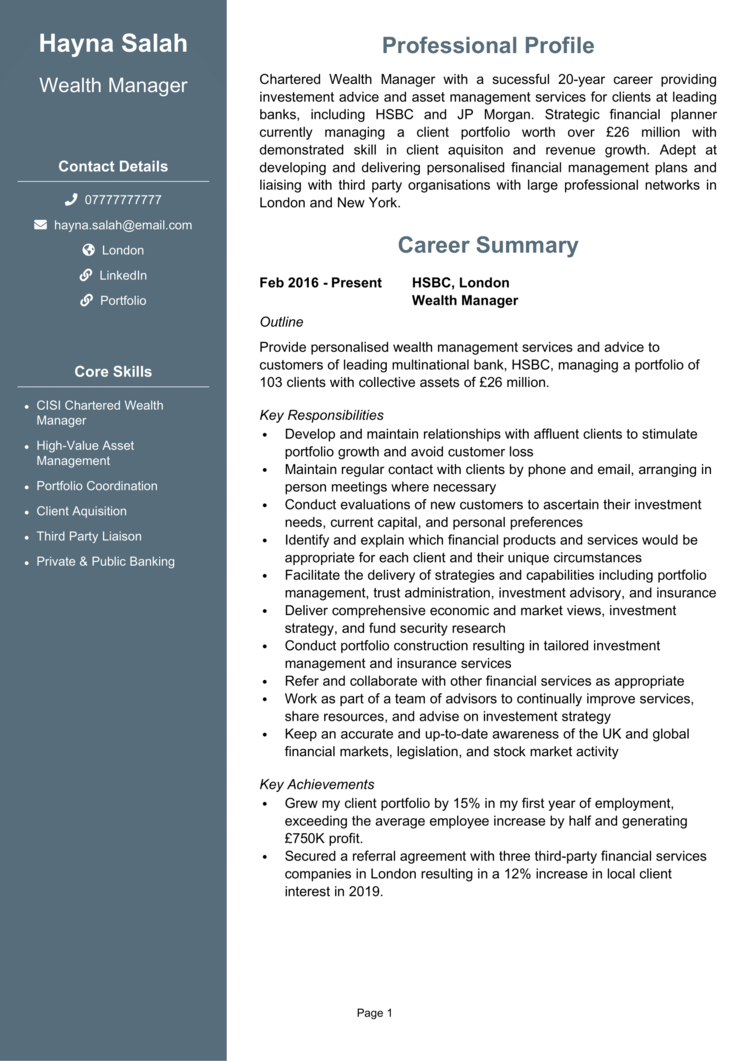

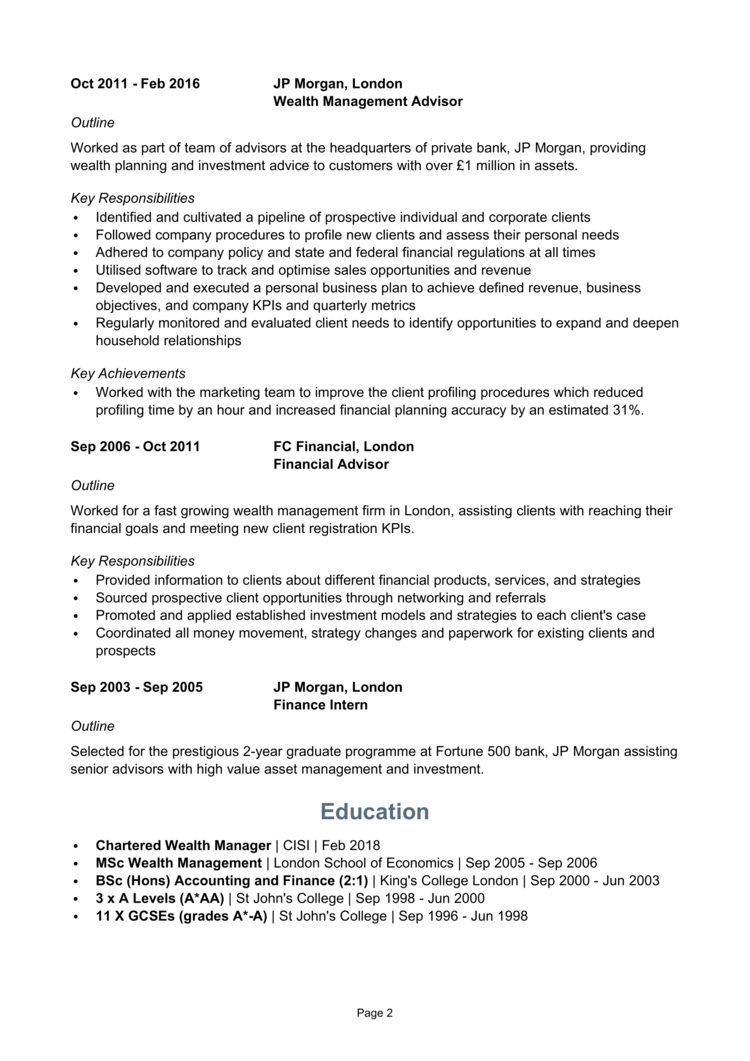

Wealth Manager CV example

Before you start writing your CV, take a look at the example Wealth Manager CV above to give yourself a good idea of the style and format that works best in today’s job market.

Also, take note of the type of content that is included to impress recruiters, and how the most relevant information is made prominent, to ensure it gets noticed.

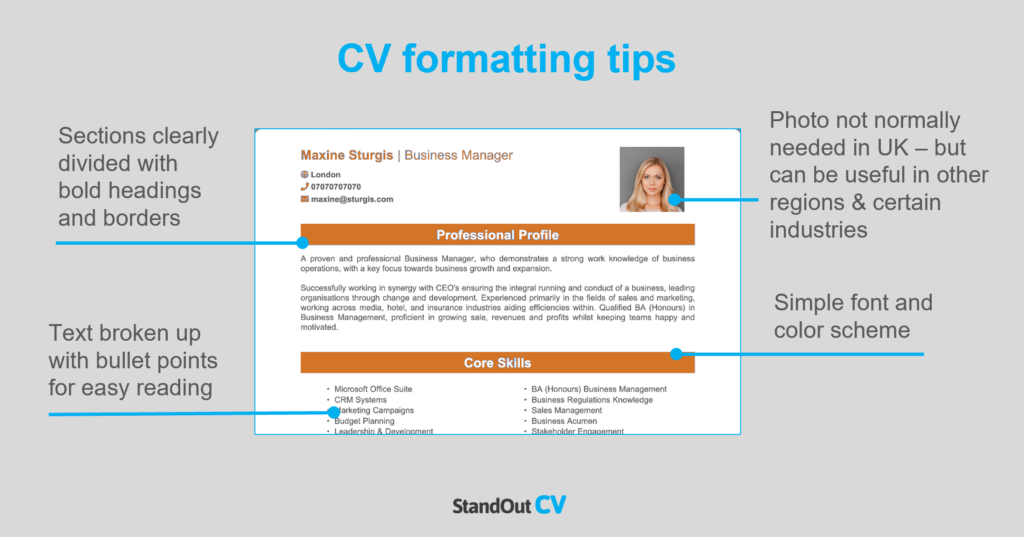

Wealth Manager CV format and structure

Think your CV is just about the content within it? Think again.

Your CV needs to look professional and be easy for recruiters to read, meaning the structure and format of your CV are just as important as the written content within it.

Facilitate ease of reading by using a simple structure which allows anybody to easily navigate your experience.

Tips for formatting your Wealth Manager CV

- Length: Even if you’ve got tons of experience to brag about, recruiters don’t have time to read through overly lengthy CVs. Keep it short, concise and relevant – a CV length of 2 sides of A4 pages or less is perfect for the attention spans in today’s job market.

- Readability: By clearly formatting your section headings (bold, or a different colour font, do the trick) and breaking up big chunks of text into snappy bullet points, time-strapped recruiters will be able to skim through your CV with ease.

- Design & format: Your CV needs to look professional, sleek and easy to read. A subtle colour palette, clear font and simple design are generally best for this, as fancy designs are often harder to navigate.

- Photos: You can add a profile photo to your CV, if you want to add some personality to it, but they are not a requirement the UK, so you don’t have to.

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

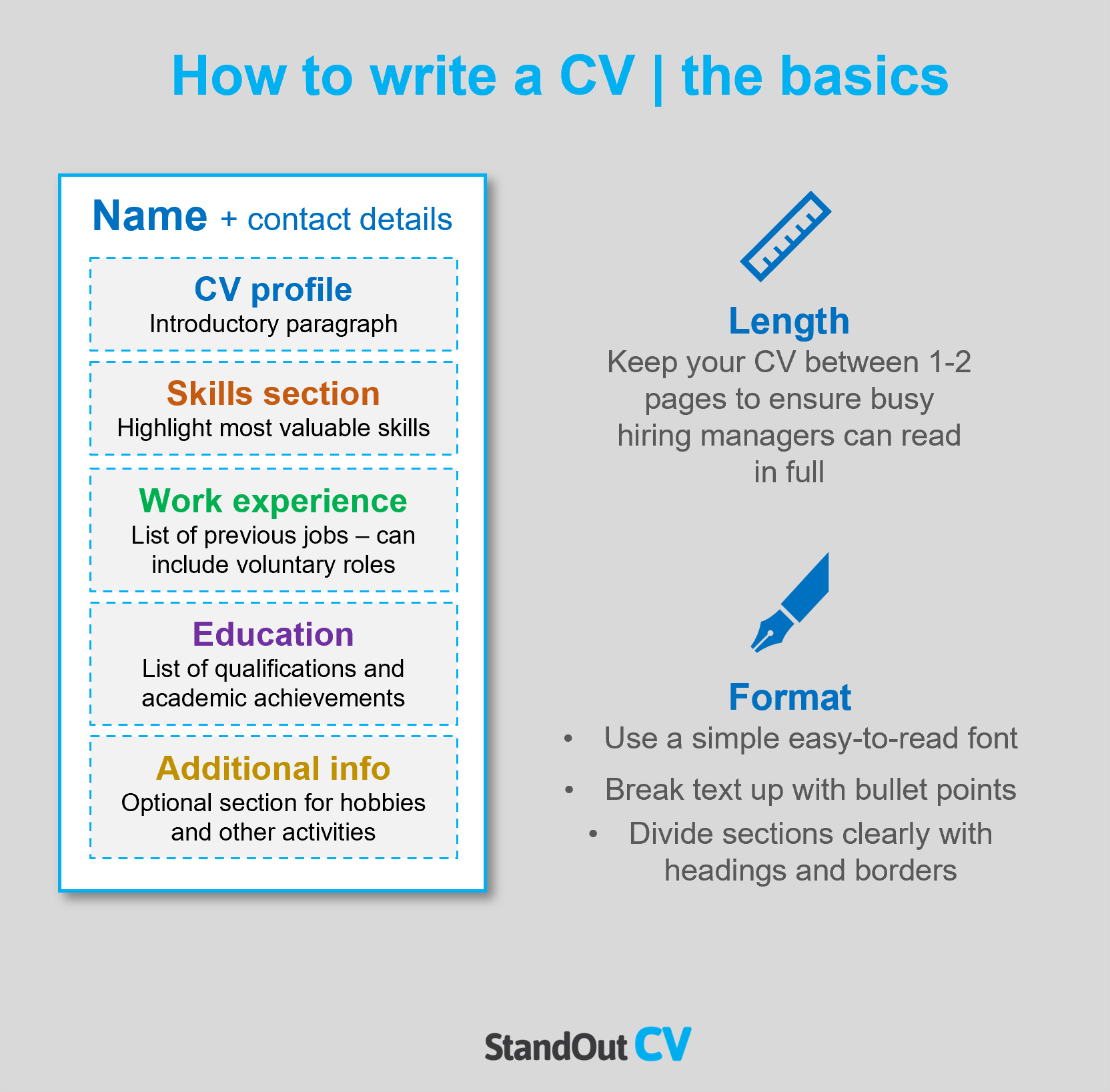

CV structure

When writing your own CV, break up your CV content into the following key sections:

- Name and contact details – Place them at the top of your CV, so that employers can easily get in touch.

- CV profile – A punchy sales pitch of your key experience, skills and achievements to reel readers in.

- Core skills section – A bullet-pointed snapshot of your abilities.

- Work experience – A well-structured list of your relevant work experience.

- Education – An overview of any relevant qualifications or professional training you have.

- Hobbies and interests – A short description of any relevant hobbies or interests (optional).

Now you understand the basic layout of a CV, here’s what you should include in each section of yours.

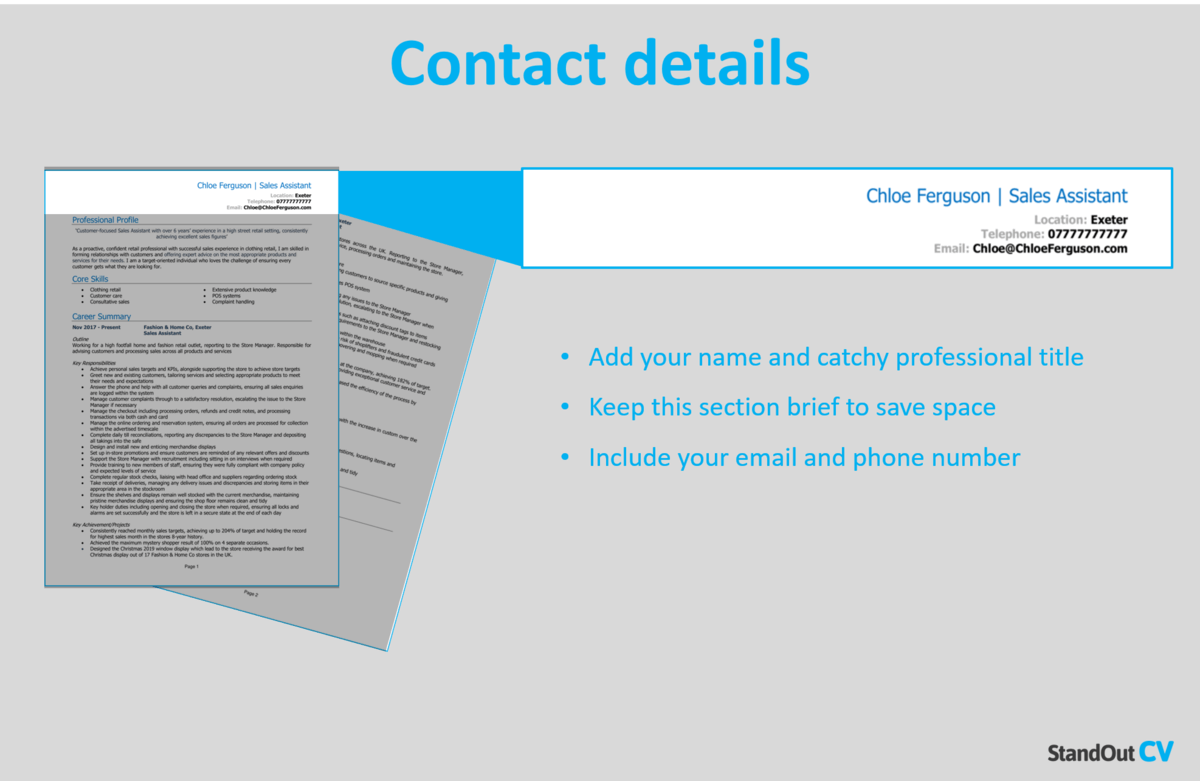

Contact Details

Begin by sharing your contact details, so it’s easy for employers to give you a call.

Keep to the basics, such as:

- Mobile number

- Email address – It should sound professional, with no slang or nicknames. Make a new one for your job applications if necessary.

- Location – Simply share your vague location, for example ‘Manchester’, rather than a full address.

- LinkedIn profile or portfolio URL – Remember to update them before you send your application.

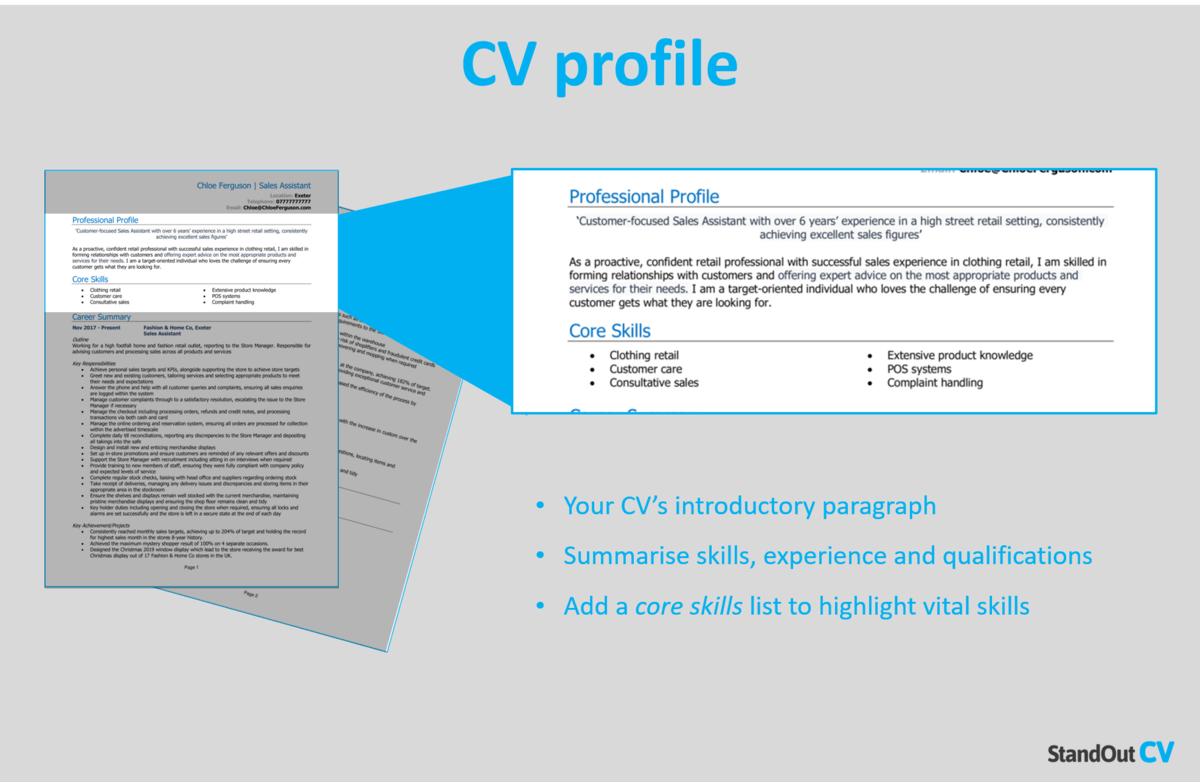

Wealth Manager CV Profile

Recruiters and hiring managers are busy, so it’s essential to catch their attention from the get-go.

A strong introductory profile (or personal statement, for junior candidates) at the top of the CV is the first thing they’ll read, so it’s a great chance to make an impression.

It should be a short but punchy summary of your key skills, relevant experience and accomplishments.

Ultimately, it should explain why you’re a great fit for the role you’re applying for and inspire recruiters to read the rest of your CV.

How to write a good CV profile:

- Make it short and sharp: Recruiters have piles of CVs to read through and limited time to dedicate to each, so it pays to showcase your abilities in as few words as possible. 3-4 lines is ideal.

- Tailor it: The biggest CV mistake? A generic, mass-produced document which is sent out to tens of employers. If you want to land an interview, you need to tailor your CV profile (and your application as a whole) to the specific roles you’re applying for. So, before you start writing, remember to read over those job descriptions and make a list of the skills, knowledge and experience the employers are looking for.

- Don’t add an objective: You only have a small space for your CV profile, so avoid writing down your career goals or objectives. If you think these will help your application, incorporate them into your cover letter instead.

- Avoid generic phrases: If your CV is riddled with clichès like “Dynamic thought-leader”, hit that delete button. Phrases like these are like a broken record to recruiters, who read them countless times per day. Hard facts, skills, knowledge and results are sure to yield far better results.

Example CV profile for Wealth Manager

What to include in your Wealth Manager CV profile?

- Experience overview: Recruiters will want to know what type of companies you’ve worked for, industries you have knowledge of, and the type of work you’ve carried out in the past, so give them a summary of this in your profile.

- Targeted skills: Make your most relevant Wealth Manager key skills clear in your profile. These should be tailored to the specific role you’re applying for – so make sure to check the job description first, and aim to match their requirements as closely as you can.

- Important qualifications: If you have any qualifications which are highly relevant to Wealth Manager jobs, then highlight them in your profile so that employers do not miss them.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

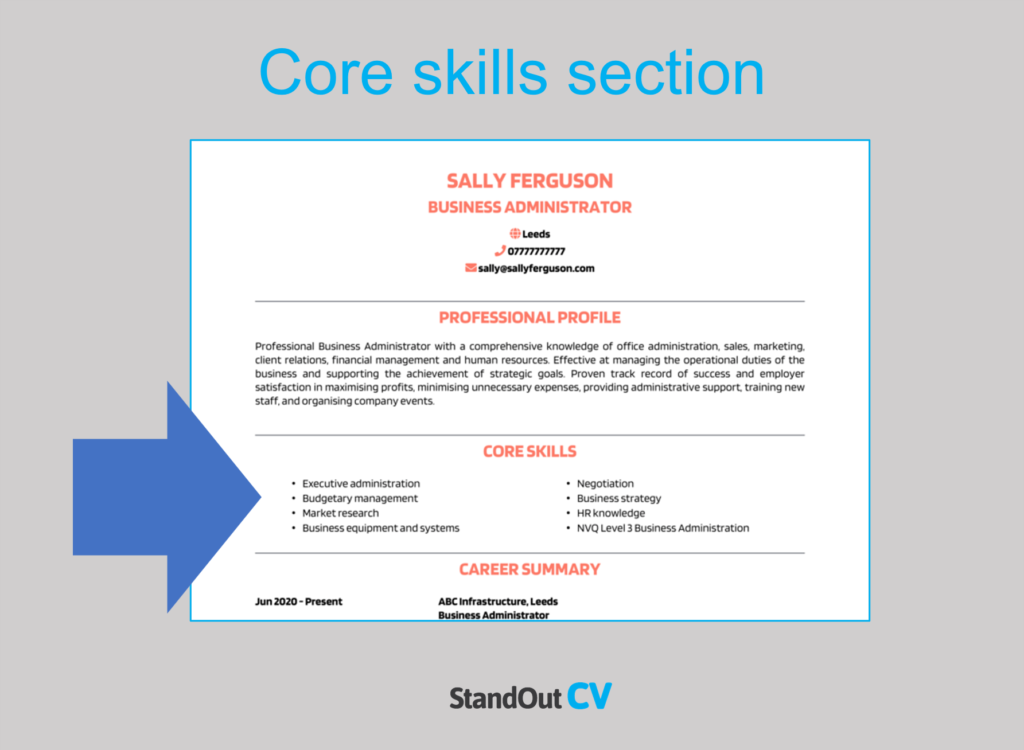

Core skills section

Create a core skills section underneath your profile to spotlight your most in-demand skills and grab the attention of readers.

This section should feature 2-3 columns of bullet points that emphasise your applicable skills for your target jobs. Before constructing this section, review the job description and compile a list of any specific skills, specialisms, or knowledge required.

Important skills for your Wealth Manager CV

Financial Planning – Creating comprehensive financial plans for clients, including investment strategies, retirement planning, tax optimisation, and risk management.

Investment Management – Managing investment portfolios, analysing market trends, identifying suitable investment opportunities, and maximising returns while considering risk tolerance.

Wealth Advisory – Utilising knowledge of various financial products and services to provide tailored advice and guidance to clients, considering their financial goals and risk profiles.

Risk Assessment – Assessing and evaluating investment risks, including market volatility, economic factors, and regulatory changes, to develop risk mitigation strategies.

Estate Planning – Utilising knowledge of estate planning principles and strategies, including wills, trusts, and asset protection, to help clients preserve and transfer wealth to future generations.

Client Relationship Management – Building and maintaining long-term relationships with clients, understanding their needs, and providing personalised financial advice.

Compliance and Regulations – Utilising knowledge of financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements, to ensure compliance with legal and regulatory standards.

Data Analysis – Analysing complex financial data, market trends, and investment performance to make informed decisions and recommendations for clients.

Financial Modelling – Utilising financial modelling techniques and software to assess the potential outcomes and impacts of different investment strategies.

Continuous Learning – Staying updated with industry trends, regulations, and new investment products to provide clients with the most up-to-date advice and strategies.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

Work experience

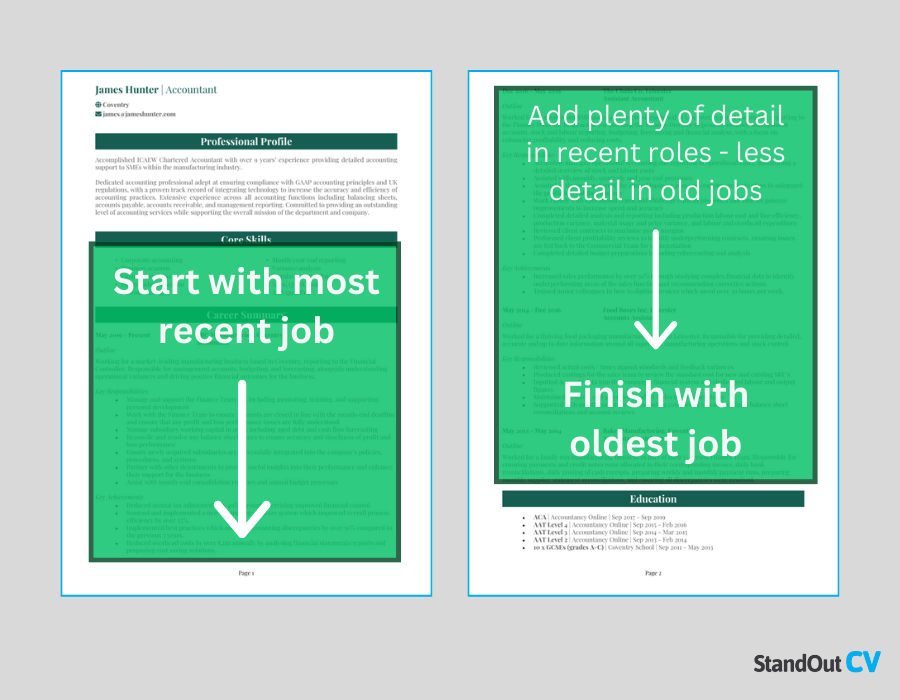

Now it’s time to get stuck into your work experience, which should make up the bulk of your CV.

Begin with your current (or most recent) job, and work your way backwards.

If you’ve got too much experience to fit onto two pages, prioritise space for your most recent and relevant roles.

Structuring each job

Your work experience section will be long, so it’s important to structure it in a way which helps recruiters to quickly and easily find the information they need.

Use the 3-step structure, shown in the below example, below to achieve this.

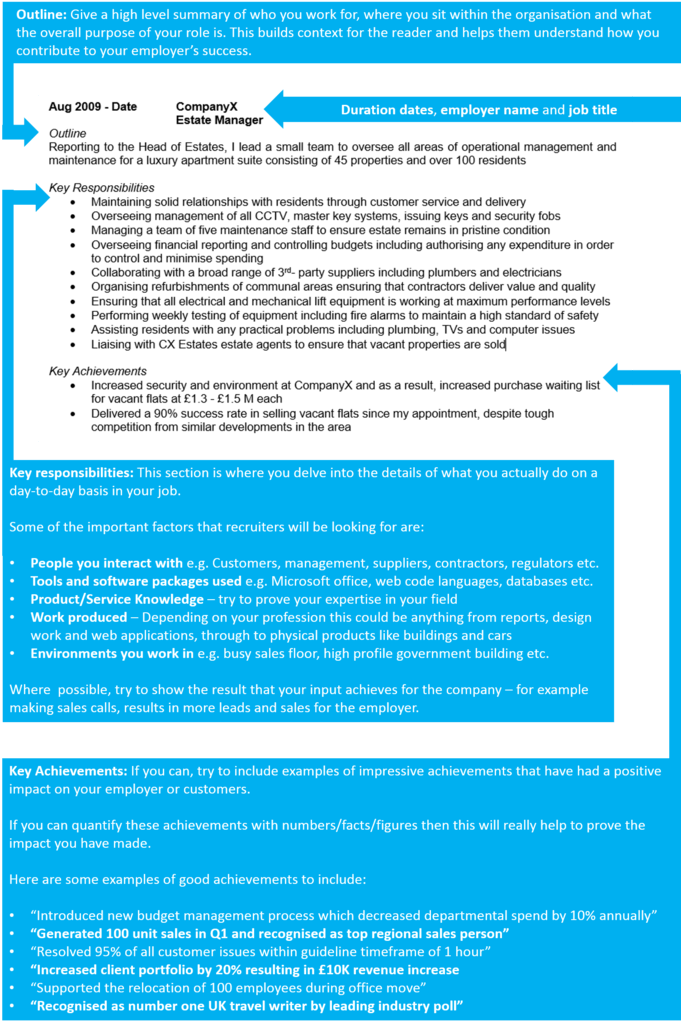

Outline

Start with a 1-2 sentence summary of your role as a whole, detailing what the goal of your position was, who you reported to or managed, and the type of organisation you worked for.

Key responsibilities

Follow with a snappy list of bullet points, detailing your daily duties and responsibilities.

Tailor it to the role you’re applying for by mentioning how you put the target employer’s desired hard skills and knowledge to use in this role.

Key achievements

Lastly, add impact by highlight 1-3 key achievements that you made within the role.

Struggling to think of an achievement? If it had a positive impact on your company, it counts.

For example, you might increased company profits, improved processes, or something simpler, such as going above and beyond to solve a customer’s problem.

Sample job description for Wealth Manager CV

Outline

Provide personalised wealth management services and advice to customers of leading multinational bank, HSBC, managing a portfolio of 103 clients with collective assets of £26 million.

Key Responsibilities

- Develop and maintain relationships with affluent clients to stimulate portfolio growth and avoid customer loss

- Maintain regular contact with clients by phone and email, arranging in person meetings where necessary

- Conduct evaluations of new customers to ascertain their investment needs, current capital, and personal preferences

- Identify and explain which financial products and services would be appropriate for each client and their unique circumstances

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

At the bottom of your CV is your full education section. You can list your formal academic qualifications, such as:

- Degree

- GCSE’s

- A levels

As well as any specific Wealth Manager qualifications that are essential to the jobs you are applying for. Note down the name of the qualification, the organisation at which you studied, and the date of completion.

Hobbies and interests

This section is entirely optional, so you’ll have to use your own judgement to figure out if it’s worth including.

If your hobbies and interests could make you appear more suitable for your dream job, then they are definitely worth adding.

Interests which are related to the industry, or hobbies like sports teams or volunteering, which display valuable transferable skills might be worth including.

An interview-winning CV for a Wealth Manager role, needs to be both visually pleasing and packed with targeted content.

Whilst it needs to detail your experience, accomplishments and relevant skills, it also needs to be as clear and easy to read as possible.

Remember to research the role and review the job ad before applying, so you’re able to match yourself up to the requirements.

If you follow these guidelines and keep motivated in your job search, you should land an interview in no time.

Best of luck with your next application!