You’re confident and approachable and you love working with customers, now you’re ready to showcase these skills as a relationship manager.

The tricky part is creating an application that you can bank on to secure you an interview.

Well, we can help. In the guide below, we’ll teach you how to write a standout application and share with you a bank relationship manager CV example.

|

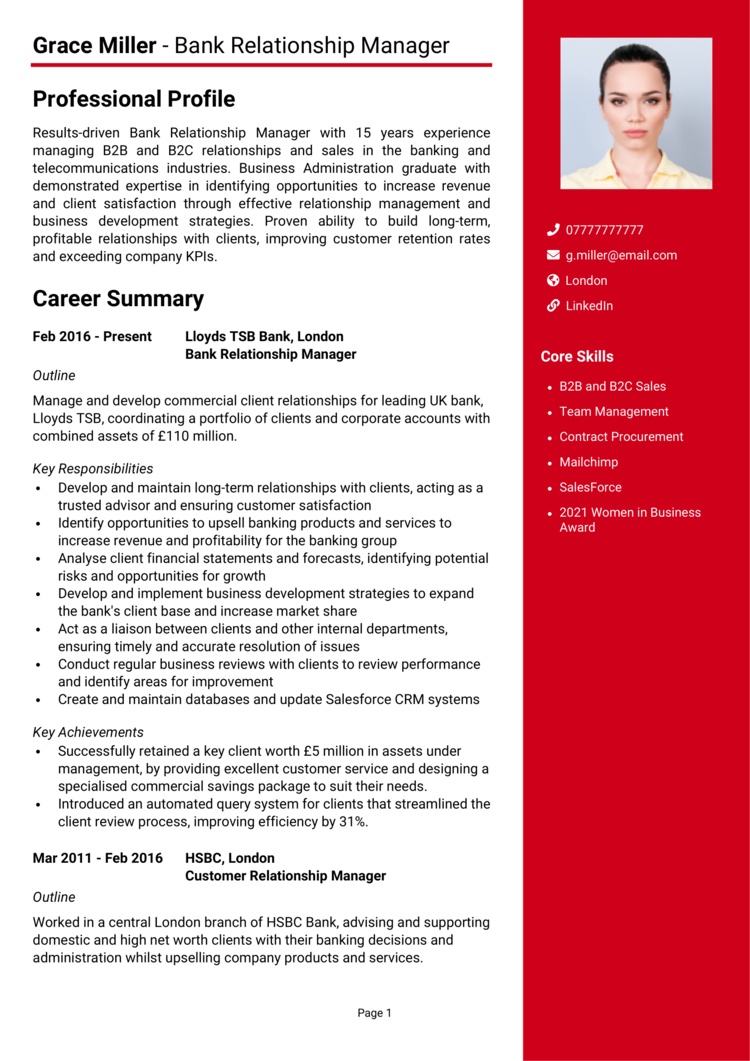

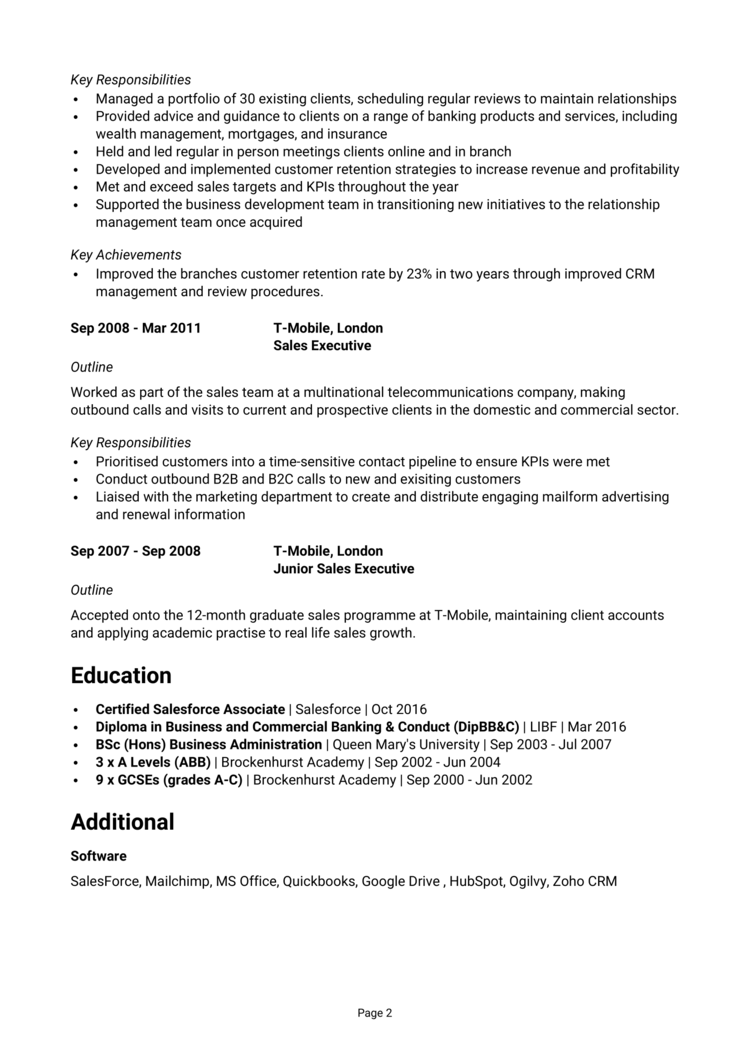

Bank Relationship Manager CV example

This CV example showcases the optimal structure and format for your Bank Relationship Manager CV, providing a pleasant reading experience for busy recruiters.

It also demonstrates the skills, experience and qualifications you should emphasize in your own CV to increase your chances of landing job interviews.

Bank Relationship Manager CV format and structure

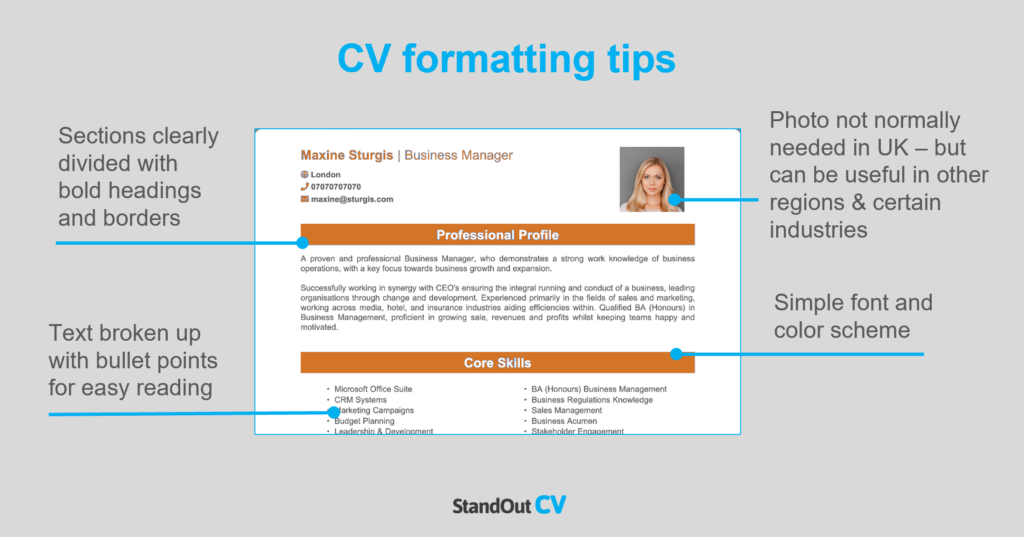

Think your CV is just about the content within it? Think again.

Your CV needs to look professional and be easy for recruiters to read, meaning the structure and format of your CV are just as important as the written content within it.

Facilitate ease of reading by using a simple structure which allows anybody to easily navigate your experience.

Tips for formatting your Bank Relationship Manager CV

- Length: Whether you’ve got one year or three decades of experience, your CV should never be more than two sides of A4. Recruiters are busy people who’re often juggling numerous roles and tasks, so they don’t have time to read lengthy applications. If you’re a recent graduate or don’t have much industry experience, one side of A4 is fine.

- Readability: By formatting your section headings with bold or a different colour font and using bullet points to break up large blocks of text, you can help busy recruiters quickly scan through your CV. This makes it easier for them to find important details without wasting time.

- Design & format: Your CV needs to look professional, sleek and easy to read. A subtle colour palette, clear font and simple design are generally best for this, as fancy designs are often harder to navigate.

- Photos: Recruiters can’t factor in appearance, gender or race into the recruitment process, so a profile photo is not usually needed. However, creative employers do like to see them, so you can choose to include one if you think it will add value to your CV .

Quick tip: Creating a professional CV style can be difficult and time-consuming when using Microsoft Word or Google Docs. To create a winning CV quickly, try our quick-and-easy CV Builder and use one of their eye-catching professional CV templates.

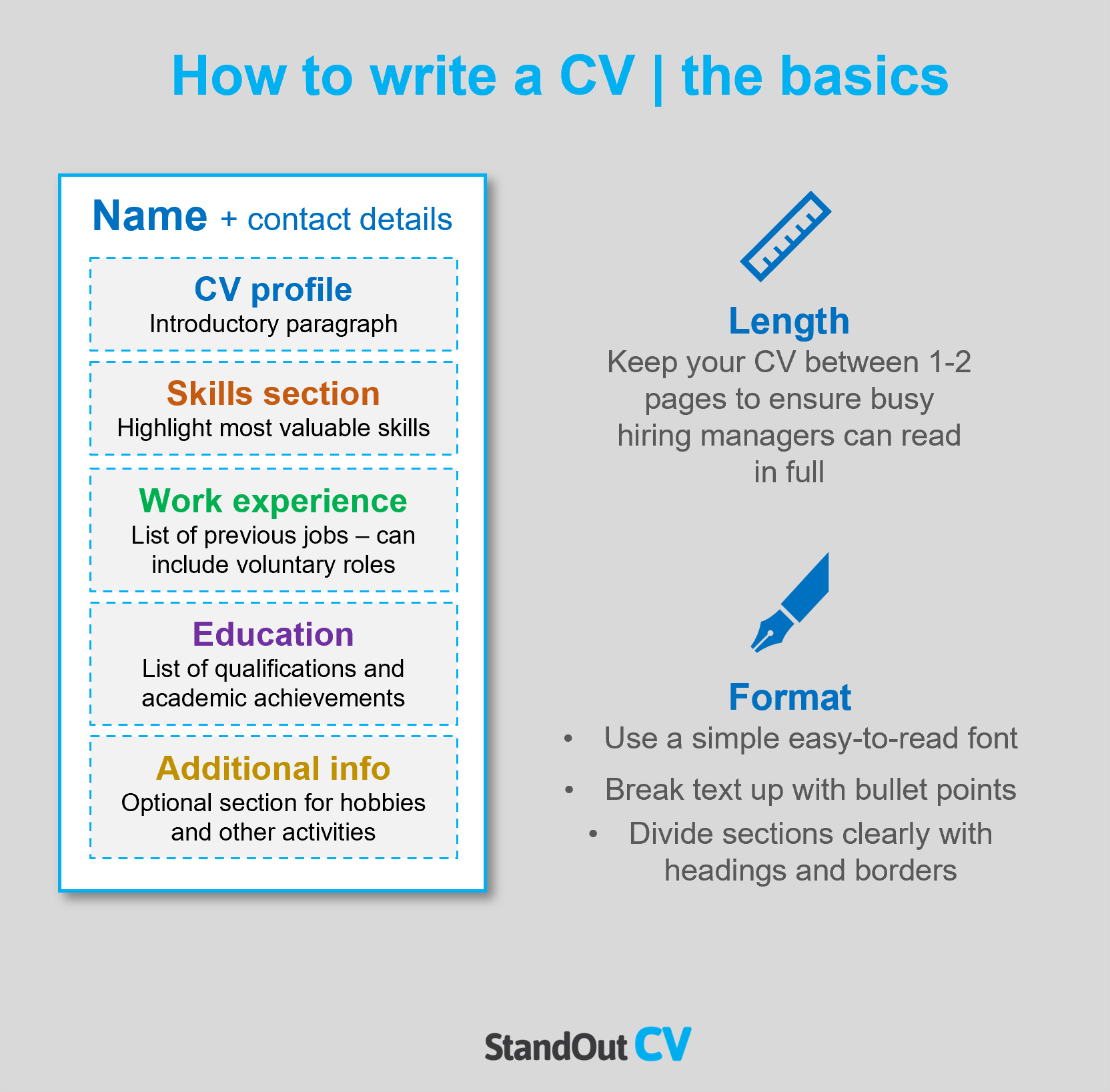

CV structure

As you write your CV, divide and sub-head into the following sections:

- Name and contact details – Always start with these, so employers know exactly how to get in touch with you.

- CV profile – Add a short summary of your relevant experience, skills and achievements, which highlights your suitability.

- Core skills section – A 2-3 columned list of your key skills.

- Work experience – A detailed list of any relevant work experience, whether paid or voluntary.

- Education – An overview of your academic background and any training you may have completed.

- Hobbies and interests – A brief overview of your hobbies and interests, if they’re relevant (optional).

Now you understand the basic layout of a CV, here’s what you should include in each section of yours.

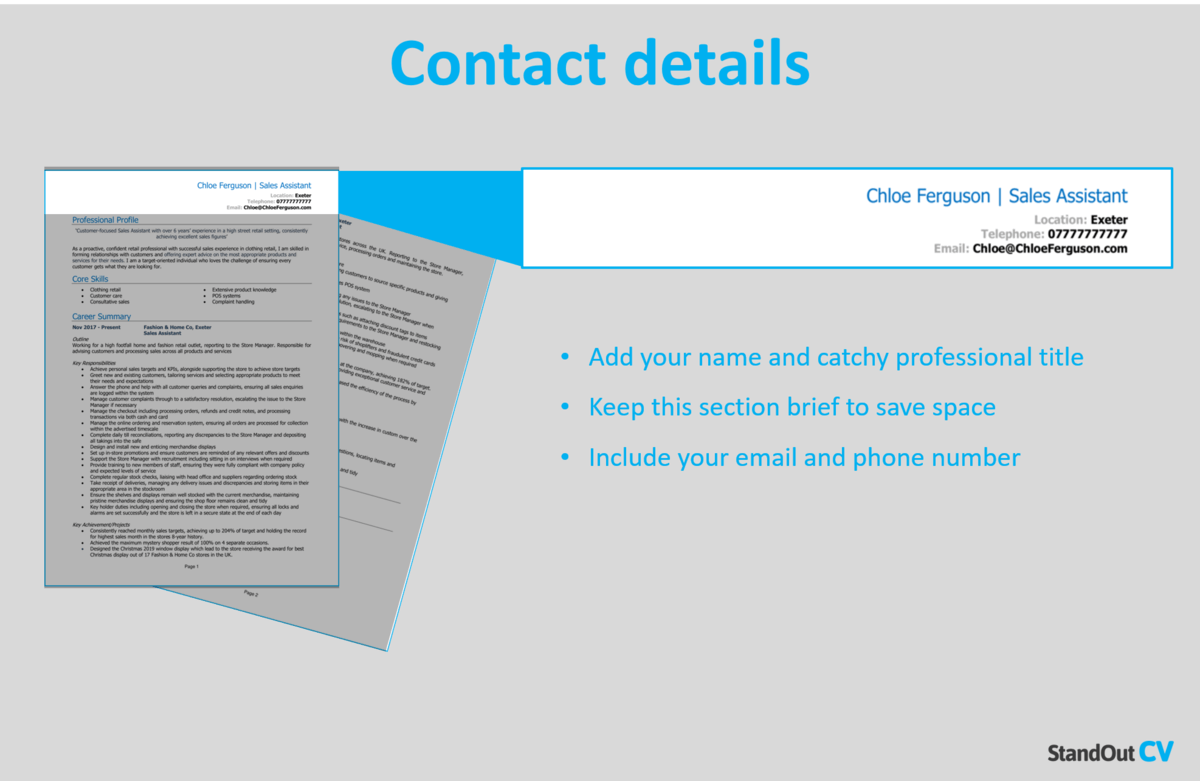

Contact Details

Tuck your contact details into the corner of your CV, so that they don’t take up too much space.

Stick to the basic details, such as:

- Mobile number

- Email address – It should sound professional, such as your full name.

- Location -Just write your rough location, rather than your full address.

- LinkedIn profile or portfolio URL – If you include these, ensure they’re sleek, professional and up-to-date.

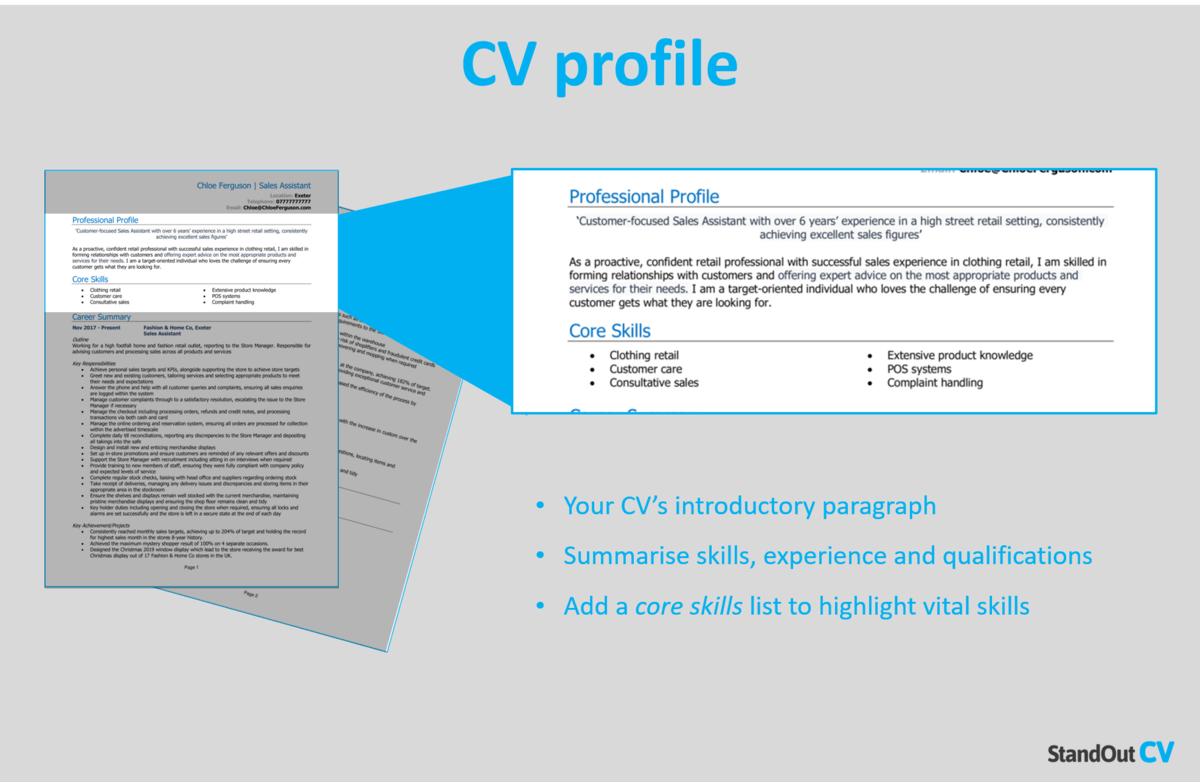

Bank Relationship Manager CV Profile

Make a strong first impression with recruiters by starting your CV with an impactful profile (or personal statement for junior applicants).

This short introduction paragraph should summarise your skills, experience, and knowledge, highlighting your suitability for the job.

It should be compelling enough to encourage recruiters to read through the rest of your CV.

How to write a good CV profile:

- Make it short and sharp: The best CV profiles are short, sharp and highly relevant to the target role. For this reason, it’s best to write 3-4 lines of high-level information, as anything over might be missed.

- Tailor it: Recruiters can spot a generic, mass-produced CV at a glance – and they certainly won’t be impressed! Before you write your profile (and CV as a whole), read through the job advert and make a list of any skills, knowledge and experience required. You should then incorporate your findings throughout your profile and the rest of your CV.

- Don’t add an objective: If you want to discuss your career objectives, save them for your cover letter, rather than wasting valuable CV profile space.

- Avoid generic phrases: Focus on fact, not fluff. Phrases like “Committed and enthusiastic thought-leader” and “Dynamic problem solver” might sound fancy, but they’ll do nothing for your application. Not only do they sound cheesy, but they have no substance – stick to real skills and facts

Example CV profile for a Bank Relationship Manager

What to include in your Bank Relationship Manager CV profile?

- Experience overview: To give employers an idea of your capabilities, show them your track record by giving an overview of the types of companies you have worked for in the past and the roles you have carried out for previous employers – but keep it high level and save the details for your experience section.

- Targeted skills: Ensure that your profile highlights your key skills that are most relevant to your Bank Relationship Manager, and tailor them to match the specific job you are applying for. To do this, refer to the job description to closely align your skills with their requirements.

- Important qualifications: If the job postings require specific qualifications, it is essential to incorporate them in your profile to ensure visibility to hiring managers.

Quick tip: If you are finding it difficult to write an attention-grabbing CV profile, choose from hundreds of pre-written profiles across all industries, and add one to your CV with one click in our quick-and-easy CV Builder. All profiles are written by recruitment experts and easily tailored to suit your unique skillset.

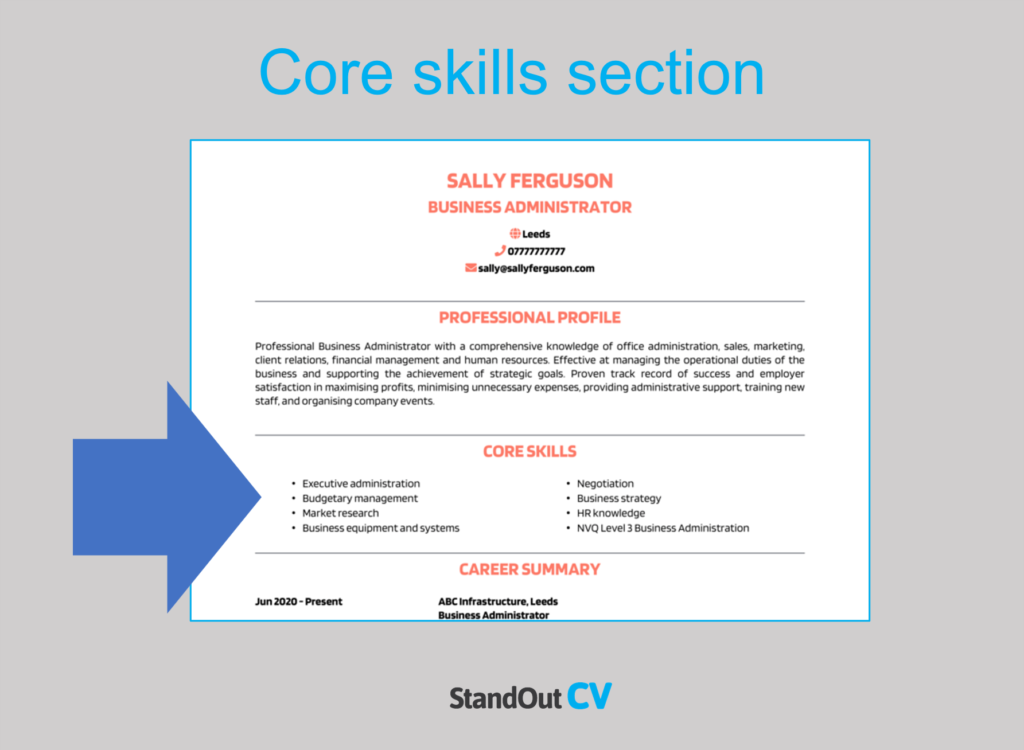

Core skills section

Add a core skills section below your profile to draw attention to your most applicable skills and make them stand out to readers.

This should consist of 2-3 columns of bullet points that emphasise your relevant skills.

Before creating this section, review the job description and compile a list of any specific skills, specializations, or knowledge needed. Incorporate these findings into your list to portray yourself as the ideal candidate for the position.

Important skills for your Bank Relationship Manager CV

Relationship Management – Building and managing relationships with clients, understanding their financial needs, and providing appropriate banking solutions to meet their requirements.

Financial Advice and Guidance – Providing sound financial advice and guidance to clients based on their financial goals, risk tolerance, and market conditions, ensuring they make informed decisions.

Sales and Business Development – Identifying potential business opportunities, cross-selling banking products and services, and expanding the client base to achieve sales targets and revenue growth.

Product Knowledge – Maintaining a comprehensive knowledge of various banking products and services, including loans, mortgages, investments, insurance, and wealth management, to effectively advise clients and address their financial needs.

Risk Assessment and Management – Assessing and managing risks associated with client portfolios, credit applications, and financial transactions, ensuring compliance with regulatory requirements and bank policies.

Financial Analysis – Evaluating client financial statements, assessing creditworthiness, and identifying potential risks or opportunities, enabling informed decision-making and effective risk management.

Client Communication and Presentation – Effectively communicating complex financial concepts, presenting banking solutions, and building rapport with clients.

Negotiation and Influencing – Securing favourable terms for clients, resolving issues, and achieving mutually beneficial outcomes for both the bank and the client.

Regulatory Compliance – Maintaining an in-depth knowledge of banking regulations, compliance requirements, and industry best practices to ensure adherence to legal and regulatory frameworks, protecting both the bank and clients.

Client Service Excellence – Delivering exceptional client service, promptly addressing client inquiries or concerns, and providing timely and accurate information and solutions.

Quick tip: Our quick-and-easy CV Builder has thousands of in-demand skills for all industries and professions, that can be added to your CV in seconds – This will save you time and ensure you get noticed by recruiters.

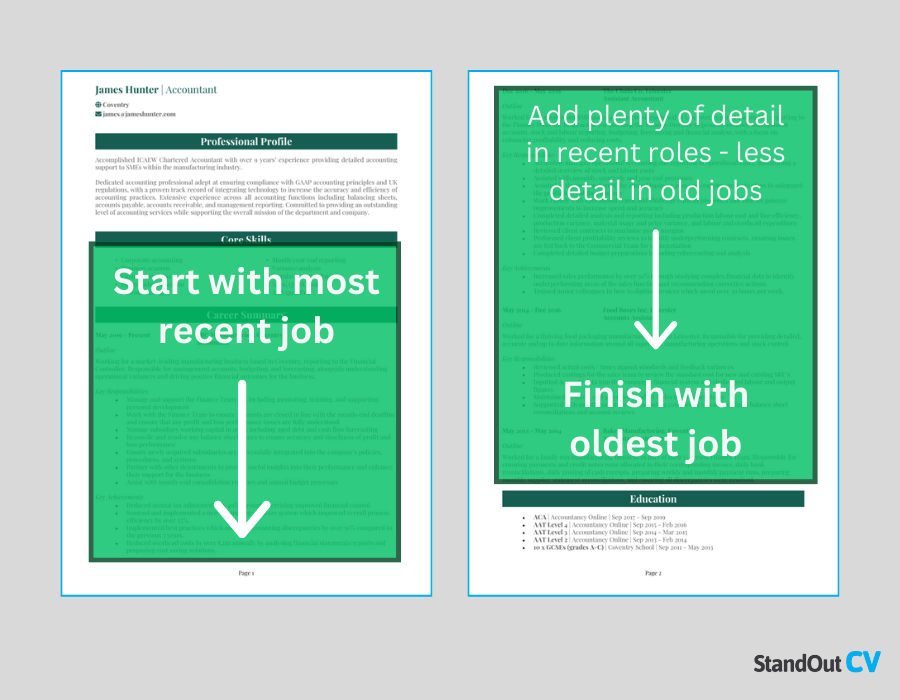

Work experience

Recruiters will be itching to know more about your relevant experience by now.

Kick-start this section with your most recent (or current) position, and work your way backwards through your history.

You can include voluntary and freelance work, too – as long as you’re honest about the nature of the work.

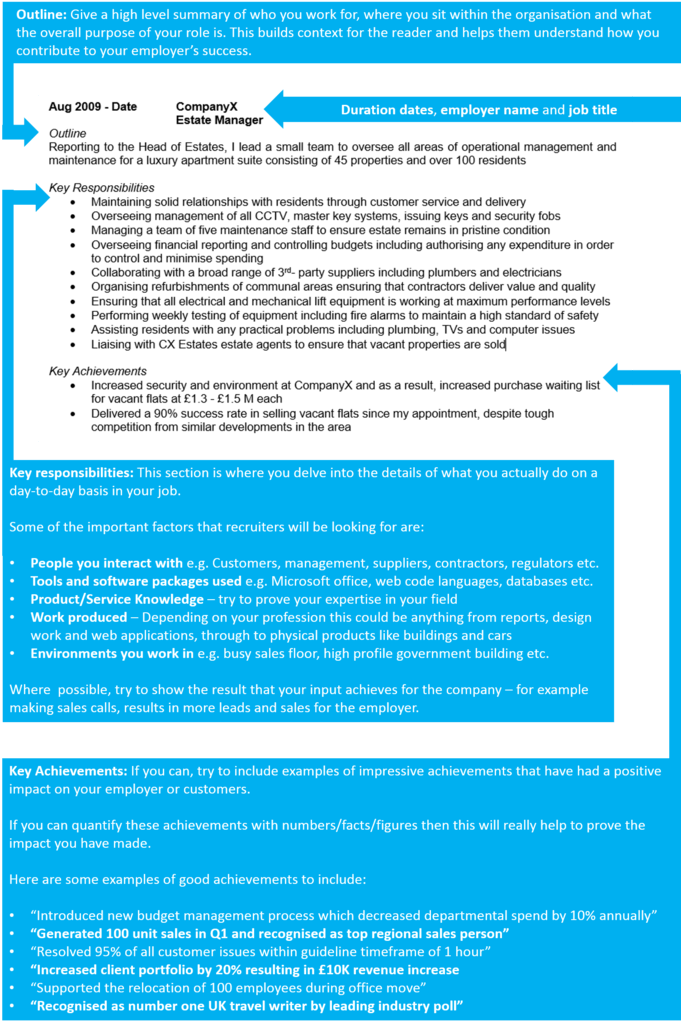

Structuring each job

Whilst writing your CV, it’s essential to look at it from the eyes of a recruiter.

If they’re met with giant blocks of text which are impossible to navigate, they might get frustrated and skip onto the next CV.

Instead, make use of the 3-step structure shown below, to give them a pleasant reading experience.

Outline

Begin with a summary of your role, detailing what the purpose of your job was, who you reported to and what size of team you were part of (or led).

Key responsibilities

Next, write up a punchy list of your daily duties and responsibilities, using bullet points.

Wherever you can, point out how you put your hard skills and knowledge to use – especially skills which are applicable to your target role.

Key achievements

Round up each role by listing 1-3 key achievements, accomplishments or results.

Wherever possible, quantify them using hard facts and figures, as this really helps to prove your value.

Sample job description for Bank Relationship Manager CV

Outline

Manage and develop commercial client relationships for leading UK bank, Lloyds TSB, coordinating a portfolio of clients and corporate accounts with combined assets of £110 million.

Key Responsibilities

- Develop and maintain long-term relationships with clients, acting as a trusted advisor and ensuring customer satisfaction

- Identify opportunities to upsell banking products and services to increase revenue and profitability for the banking group

- Analyse client financial statements and forecasts, identifying potential risks and opportunities for growth

- Develop and implement business development strategies to expand the bank’s client base and increase market share

Quick tip: Create impressive job descriptions easily in our quick-and-easy CV Builder by adding pre-written job phrases for every industry and career stage.

Education section

After your work experience, your education section should provide a detailed view of your academic background.

Begin with those most relevant to Bank Relationship Manager jobs, such as vocational training or degrees. If you have space, you can also mention your academic qualifications, such as A-Levels and GCSEs.

Focus on the qualifications that are most relevant to the jobs you are applying for.

Hobbies and interests

The hobbies and interests CV section isn’t mandatory, so don’t worry if you’re out of room by this point.

However, if you have an interesting hobby, or an interest that could make you seem more suitable for the role, then certainly think about adding.

Be careful what you include though… Only consider hobbies that exhibit skills that are required for roles as a Bank Relationship Manager, or transferable workplace skills.

There is never any need to tell employers that you like to watch TV and eat out.

Once you’ve written your Bank Relationship Manager CV, you should proofread it several times to ensure that there are no typos or grammatical errors.

With a tailored punchy profile that showcases your relevant experience and skills, paired with well-structured role descriptions, you’ll be able to impress employers and land interviews.

Good luck with your next job application!