Supporting financial advisers will make you a very valuable member of any team: you’ll just need a CV as strategic and technically sound as you are.

This guide, with an expertly written Paraplanner CV example, will show you how to package your financial expertise into a clear, persuasive CV that opens doors across the financial advice sector.

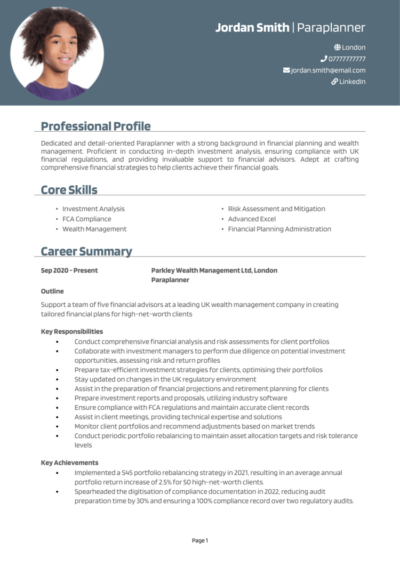

Paraplanner CV sample

How to write your Paraplanner CV

Discover how to craft a winning Paraplanner CV that lands interviews with this simple step-by-step guide.

A good paraplanner knows how to cut through waffle and keep things relevant. Your CV should be no different.

This guide walks you through everything you need to write a CV which shows more than product knowledge – it will reflect your analytical strengths and your vital ability to translate complexity into plain English.

Paraplanner CV format and structure guidelines

Think of your CV like a financial suitability report – if it’s not structured well, no one’s reading past page one. A good structure helps highlight your technical expertise and experience at a glance, so recruiters can quickly see that you tick every regulatory box. Don’t let avoidable mistakes overshadow your suitability for the role: keep in mind the following tips.

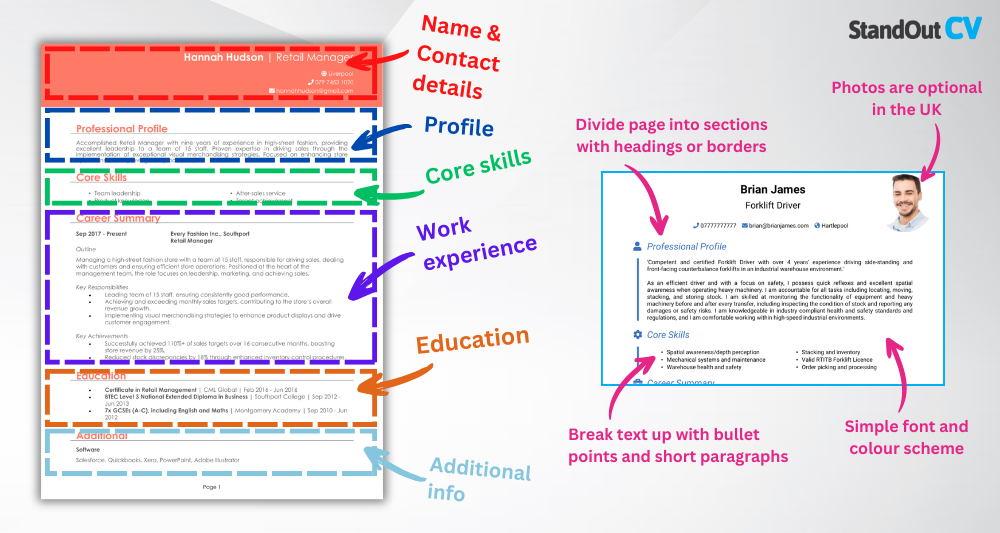

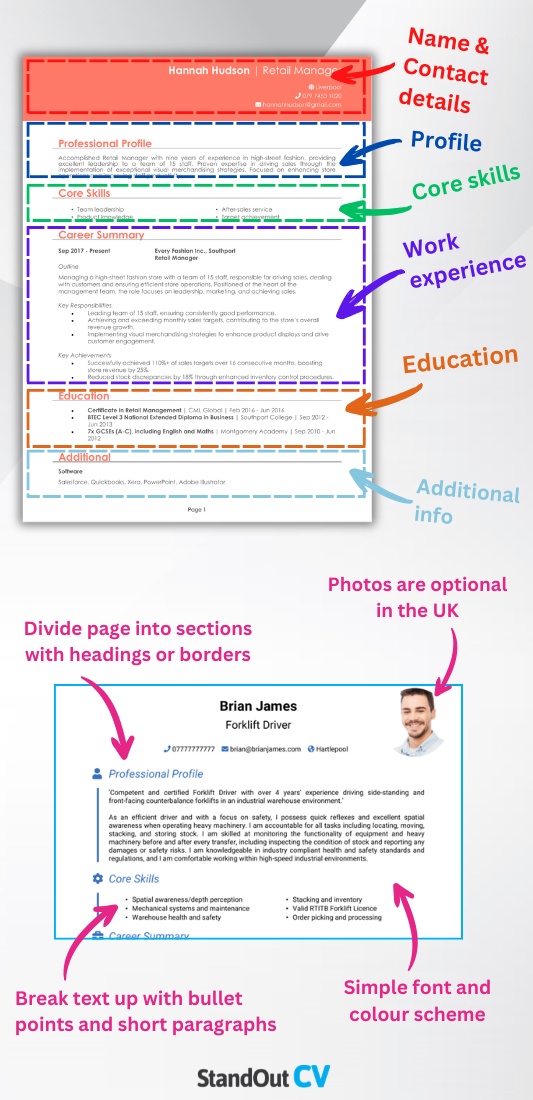

Here’s the layout to follow:

- Name and contact details – Start with your name and personal details – make it simple for recruiters to reach you. Including a photo is a personal choice.

- Profile – Use this section to summarise your experience, strengths, and what makes you a standout candidate.

- Core skills – Outline your primary competencies to give recruiters a snapshot of your strengths.

- Work experience – Walk through your professional experience, beginning with your latest position and moving backwards.

- Education – Outline your education and certifications, focusing on those most relevant to the role.

- Additional info – This section is optional, but it’s a good place for hobbies and interests that complement your CV.

To keep things professional, use bold headings to separate sections and bullet points to break up dense text. Choose a clean, business-appropriate font and don’t let your CV run past two pages length. Keep alignment consistent, leave enough space between sections, and don’t overcomplicate the layout – clarity, as always, is king. Your CV’s format is the first thing anyone notices – before they even read a word – so make sure it’s clean.

Creating a strong Paraplanner profile

Your CV profile is your value statement – a short, sharp summary that shows you understand the financial landscape and can deliver technical support with precision and care. It should reflect both your regulatory understanding and your ability to support advisers in delivering first-class client advice.

This section should clearly convey your role in the advice process, your experience across pensions, investments, or protection products, and your confidence in managing reports.

Paraplanner CV profile examples

Profile 1

Skilled Paraplanner with over 8 years of experience supporting independent financial advisers across pensions, investments, and tax planning. Experienced in drafting suitability reports, conducting research, and managing compliance documentation. Holds the Diploma in Regulated Financial Planning and proficient in tools like Intelligent Office and FE Analytics.

Profile 2

Detail-oriented Paraplanner with six years of experience working in a fast-paced wealth management firm. Adept at preparing client reports, conducting cashflow modelling, and analysing investment portfolios. Strong grasp of FCA regulations and known for producing accurate, compliant, and insightful advice documentation.

Profile 3

Organised Paraplanner with five years of experience in a dual paraplanning and client support role for a boutique financial planning firm. Confident producing suitability reports, maintaining up-to-date fact finds, and liaising with product providers. Progressing toward Chartered Financial Planner status with a focus on delivering high-quality support.

Details to put in your Paraplanner CV profile

To craft a profile that stands out, include:

- Where you worked – IFA firms, wealth management companies, investment consultancies

- Your top qualifications – Diploma in Regulated Financial Planning, RO exams, CII or LIBF routes

- Essential skills – Cashflow modelling, suitability reporting, research and analysis, compliance

- Types of clients or products handled – High-net-worth, SMEs, pensions, protection, ISAs

- Tech and systems knowledge – FE Analytics, Voyant, Intelligent Office, or Xplan

Show off the core skills recruiters look for

This section provides a quick verbal snapshot of your technical strengths. List your core CV skills with bullet points.

Mention anything a recruiter will be looking for when they open up an application: tangible, hard skills which you’ll be expected to use day-to-day. It can be a good idea to look at the job advert for an idea of the terms and skills they’re hoping to see.

Most important skills for a Paraplanner

- Financial Report Writing – Preparing detailed suitability reports and recommendations based on financial advisers’ client meetings.

- Cashflow Modelling and Forecasting – Using financial planning software to create lifetime cashflow models and assess future financial needs.

- Product and Investment Research – Conducting in-depth analysis of pensions, ISAs, investment funds, and protection products to support client recommendations.

- Compliance and Regulatory Documentation – Ensuring all advice documents and reports meet FCA regulations and company compliance standards.

- Client File Review and Preparation – Reviewing client files, fact finds, and risk assessments to ensure accurate and up-to-date information.

- Financial Planning Calculations – Performing pension projections, tax calculations, and investment growth estimates to support recommendations.

- Software and CRM Use – Proficiently using financial planning tools and CRM systems such as Voyant, Intelligent Office, or Truth.

- Liaison with Product Providers – Communicating with investment and insurance providers to gather policy information and clarify details.

- Ongoing Review Support – Assisting with annual client reviews by updating plans, valuations, and investment performance summaries.

- Collaboration with Advisers – Working closely with financial advisers to interpret client needs and deliver tailored financial solutions.

Describing your work experience

This is where you show how you’ve helped advisers do their job better, faster, and more compliantly. Go through your work experience in reverse chronological order, beginning with your most recent role. For each job, start with a short overview of the firm and your position, followed by bullet points outlining your core responsibilities and achievements.

Be specific: mention the types of products you handled, the tools or software used, and your contribution to adviser output or compliance outcomes. If you’ve progressed from admin or client services into paraplanning, include those earlier roles – they show your grounding in financial processes and attention to detail.

What’s the correct way to structure job history on your CV?

- Outline – Briefly describe the company, your role, and the advisory setup – how many advisers you supported, and whether it was an in-house or outsourced team.

- Responsibilities – Use action words like “prepared” and “researched.” For example: “prepared full suitability reports across pensions and investment portfolios” or “researched and analysed fund performance using FE Analytics.” Include tools, reporting duties, and regulatory frameworks where relevant.

- Achievements – Quantify your impact where you can – time saved for advisers, error reduction, positive compliance reviews, or promotion from admin roles. Even small wins matter if they show initiative or accuracy.

Sample work experience for Paraplanners

Paraplanner | Weaverstone Financial Planning Ltd

Outline

Provided paraplanning support to a team of independent financial advisers at a chartered planning firm, focusing on high-net-worth individuals and retirement clients.

Responsibilities

- Drafted suitability reports for pensions, investment, and IHT planning

- Conducted technical research using platforms such as FE Analytics and Selectapension

- Reviewed client fact finds and risk profiles to inform planning recommendations

- Worked closely with advisers to develop tailored financial strategies

- Ensured compliance documentation met FCA requirements before submission

Achievements

- Contributed to firm achieving 100% FCA file-check success rate during annual review

- Helped reduce average report turnaround time from 7 to 3 days through process changes

- Recognised by lead adviser for consistently accurate and high-standard documentation

Paraplanner | Red Oak Wealth Partners

Outline

Supported two senior advisers in a city-based wealth management firm, producing client reports and conducting research across pensions, ISAs, and protection planning.

Responsibilities

- Prepared reports outlining strategy recommendations, product analysis, and fund switches

- Maintained accurate records on Intelligent Office CRM system

- Liaised with providers for valuations, projections, and plan comparisons

- Modelled client scenarios using cashflow forecasting software

- Kept up to date with regulatory changes and CPD requirements

Achievements

- Improved client response time by streamlining follow-up and data collection templates

- Assisted with client segmentation review that enhanced service levels and efficiency

- Passed 3 RO exams within one year while delivering full paraplanning support

Paraplanner | Thorpe & Co. Financial Services

Outline

Worked within a small financial advisory practice, providing technical support and compliance assistance to advisers delivering retirement and estate planning services.

Responsibilities

- Reviewed and validated client data including fact finds, attitude to risk, and objectives

- Produced pre-sale and post-sale reports with FCA-compliant justifications

- Conducted investment research and fund analysis using provider platforms

- Updated internal systems and tracked outstanding client documentation

- Supported regular compliance audits and assisted with file-check readiness

Achievements

- Achieved 99% accuracy rate in file checks over two years

- Reduced adviser admin time by 30% through better process automation

- Received internal award for ‘Team Excellence’ for client service contributions

What should your CV’s education section include?

Your education section highlights your academic background and professional qualifications – especially anything related to finance, economics, or regulation. Begin with your most recent or relevant qualifications, listed in reverse order.

You might include degrees in finance or economics, as well as industry certifications like the Diploma in Regulated Financial Planning or individual RO units. Short courses in compliance, data protection, or financial software tools are worth including too. If you’re still working towards full diploma status, mention your progress.

What qualifications do employers look for in a Paraplanner?

- Diploma in Regulated Financial Planning (CII) – Core qualification for most paraplanner roles in the UK

- Certificate in Paraplanning (CII) – Designed specifically for those in a technical support role

- Advanced Diploma in Financial Planning – For senior paraplanners or those progressing to adviser level

- BSc in Finance, Economics or Accounting – A solid academic base for financial careers

- CeMAP or DipFA – Alternative financial advice qualifications via LIBF, depending on career path