Imagine your CV as a financial statement. Is it clean, easy to audit, and showing steady growth? That’s what recruiters are hoping to see – evidence that you’re organised, detail-focused, and serious about developing your accounting career.

Whether you’re fresh from your AAT, midway through a degree, or switching tracks entirely, this guide and its Trainee Accountant CV examples will help you build a CV that reflects both your potential and your professionalism.

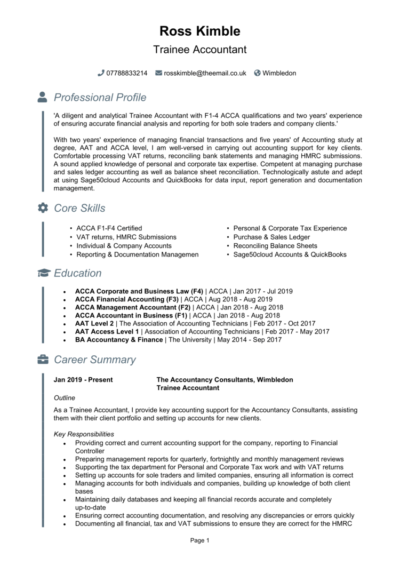

Trainee Accountant CV

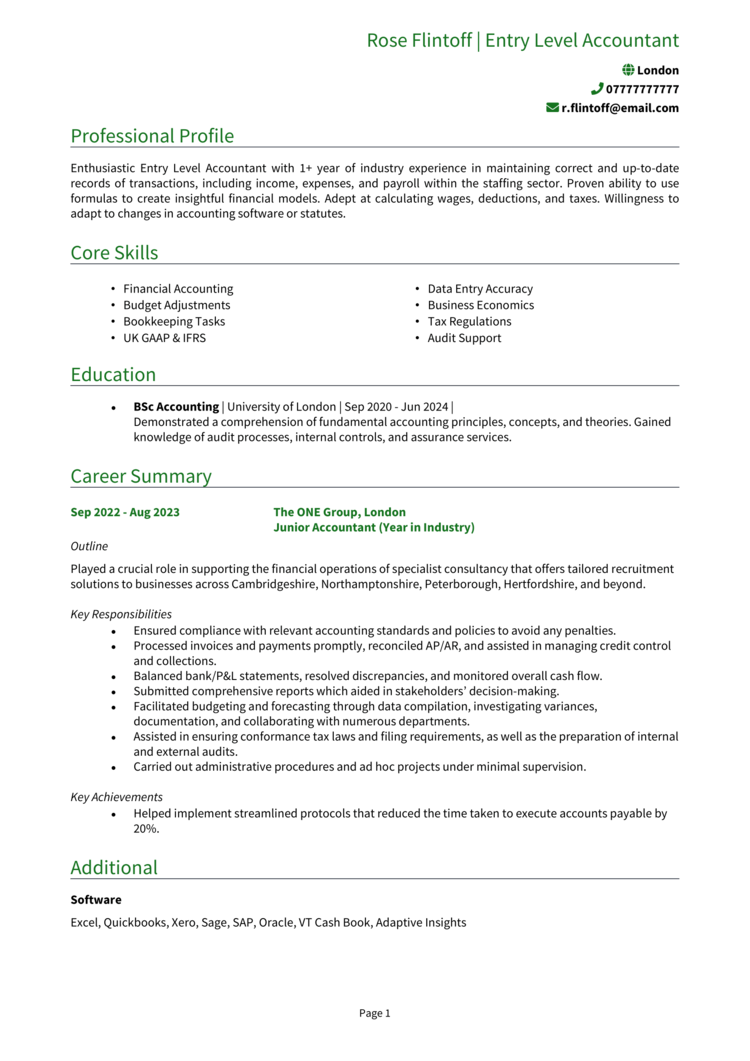

Entry Level Accountant CV

Junior Accountant CV

How to write your Trainee Accountant CV

Discover how to create a quality Trainee Accountant CV with this simple step-by-step guide.

Even if you’re just beginning your accountancy career, your CV should reflect the traits the industry values most: precision and a genuine interest in finance. A well-presented application gives hiring managers confidence that you’re serious about your development and ready to learn on the job.

This guide will walk you through each section of writing a CV – helping you highlight your qualifications, transferable skills, and ambitions – so your CV adds up to a strong first impression.

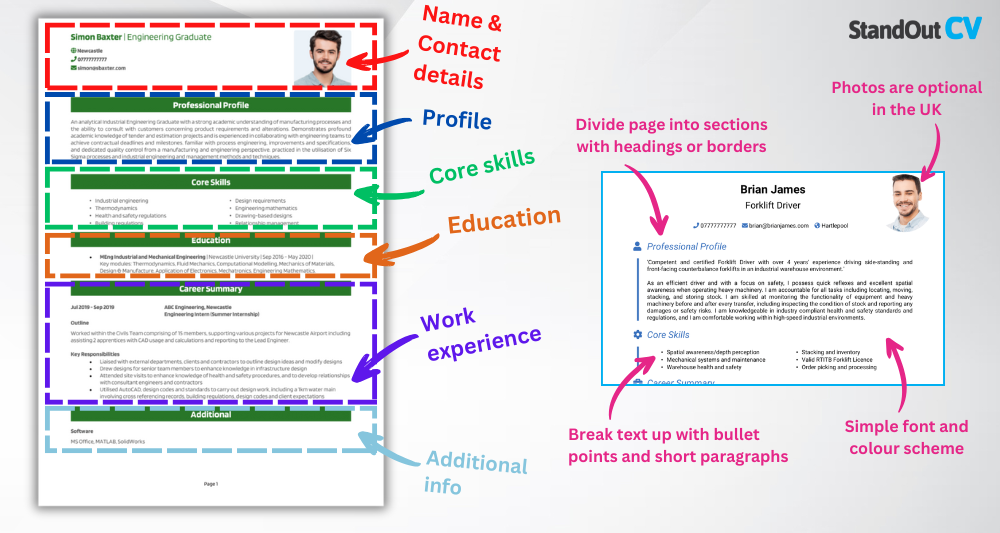

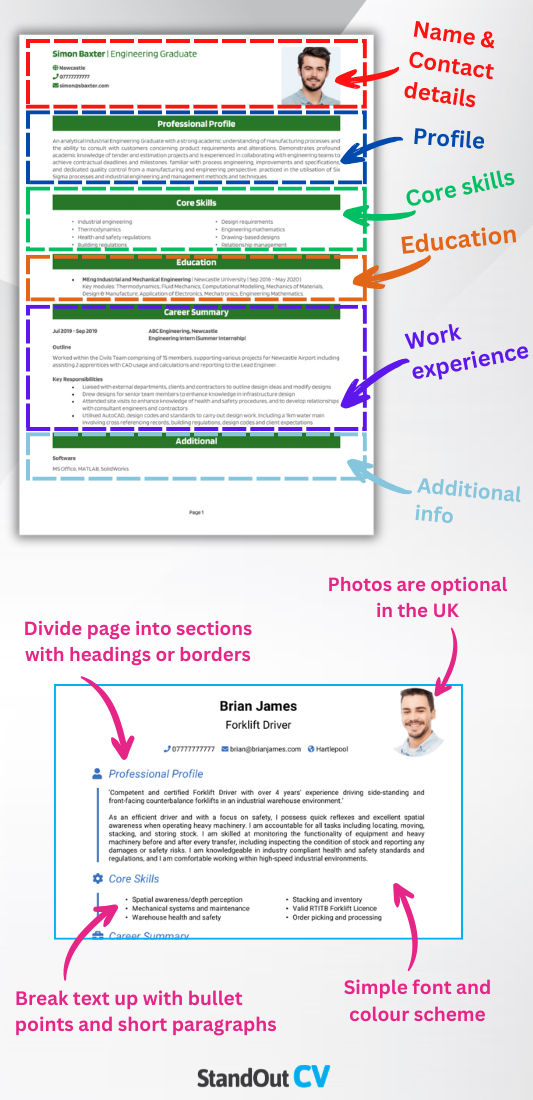

Structuring and formatting your Trainee Accountant CV

In the world of accounting, structure matters – and your CV is no exception. A clear, consistent format shows attention to detail and makes it easy for hiring managers to assess your potential at a glance.

Here’s the layout to follow:

- Name and contact details – Ensure your name and personal details are easily visible at the top. A photo is optional and depends on the role.

- Profile – Craft a short introduction that showcases your professional background and key accomplishments.

- Core skills – Bullet point key attributes like numerical reasoning, Excel proficiency, or financial reporting.

- Work experience – Outline any part-time roles, internships, or placements – especially those involving finance, admin, or analysis.

- Education & certifications – Provide details on your academic background, including a degree, certifications, or specialised training.

- Additional info – Optionally include awards, volunteering, languages, or extra-curricular hobbies that show transferable skills.

Your CV should be no more than 1 or 2 pages in length, with a tidy format, a clear font and logical sectioning, and bullet points to enhance readability. You wouldn’t submit a spreadsheet full of mistakes – treat your CV the same way. Following those formatting tips will ensure a readable and professional CV.

The best way to write a Trainee Accountant CV profile

This short paragraph introduces you as a well-organised, motivated candidate ready to begin your accounting career. It should show that you’re confident working with numbers and eager to build experience, and most of all that you’re already developing the skills needed in a financial setting.

Your CV profile should say more than ‘I like maths’ (you’re not applying to be a calculator) – you need to show off the specific, tangible traits that mean a recruiter should hire you. As a junior candidate, you should consider a longer personal statement with a comprehensive cover letter attached.

Trainee Accountant CV profile examples

Profile 1

Motivated and detail-focused Trainee Accountant with strong academic foundations in accounting and finance, supported by hands-on experience in bookkeeping and reconciliations. Skilled in data entry, invoice processing, and financial reporting. Proficient in Excel, Sage, and Xero. Eager to build on professional qualifications and support financial operations in a fast-paced environment.

Profile 2

Organised Trainee Accountant with one year of experience assisting with month-end reporting, ledger maintenance, and tax preparation in a small practice setting. Adept at using accounting software, analysing transactions, and supporting audits. Currently studying towards AAT Level 3, with a commitment to gaining full professional qualification and progressing within the finance field.

Things to have in your Trainee Accountant CV profile

Include the following:

- Academic background – Note your degree, diploma, or ongoing studies in a relevant subject like accounting, finance, or maths.

- Career goals – Briefly explain your ambition to qualify as an accountant or work in financial analysis, audit, tax, etc.

- Relevant strengths – Highlight qualities like accuracy, organisation, teamwork, or IT skills.

- Industry awareness – Show you understand the basics of accounting and what the role of a Trainee Accountant involves.

How to present your core skills section properly

Your CV skills section should show a well-rounded base of abilities that prove you’re ready for entry-level accounting work. Even if you haven’t worked in finance before, you can highlight strengths developed through study or part-time roles.

Tailor your bullet points to the job, with a mix of technical and soft skills – such as data analysis, spreadsheet proficiency, financial reporting basics, organisation, or customer service.

Key skills that make a Trainee Accountant CV stand out

- Bookkeeping and Data Entry – Recording financial transactions accurately using accounting software and spreadsheets.

- Accounts Payable and Receivable – Assisting with invoicing, tracking payments, and managing outstanding balances.

- Bank Reconciliation – Comparing bank statements with internal records to ensure accuracy and identify discrepancies.

- Financial Reporting Support – Helping prepare balance sheets, profit and loss statements, and monthly financial reports.

- VAT and Tax Preparation – Assisting with VAT returns and basic tax calculations under supervision.

- Payroll Assistance – Supporting the payroll process by managing employee records and tracking deductions.

- Accounting Software Proficiency – Using tools such as Sage, Xero, QuickBooks, or Excel for day-to-day accounting tasks.

- Compliance and Record Keeping – Ensuring financial records are maintained in line with legal and regulatory requirements.

- Audit Preparation – Gathering documentation and assisting during internal or external audits.

- Professional Development and Learning – Studying towards accounting qualifications (e.g., AAT, ACCA, ACA) while gaining practical experience.

Education section

Accounting is a qualification-led profession, so this section will be one of the first places a hiring manager looks. List your education and relevant training clearly, with your most recent qualification first. Especially if you’re a recent graduate, expand on any specific degree modules that instilled important skills.

Include any degrees, diplomas, or accounting-related study, as well as training in progress (e.g. AAT, ACCA, ACA, or CIMA). If you’re planning to enrol soon, you can note this as well.

Example education sections

Education 1

Merit BSc (Hons) Accounting & Financial Management | University of Portsmouth | 2019–2022

Modules included Financial Accounting, Taxation, Business Law, and Management Accounting. Completed a group consultancy project analysing financial performance for a local business. Gained practical experience with Sage and Excel through coursework and case studies.

3x A-Levels (B–C) | Bridgemont Sixth Form College | 2017–2019

9x GCSEs (A*–C) | St. John’s Secondary School | 2015–2017

Education 2

AAT Level 3 Diploma in Accounting | London School of Business & Finance | 2022–2023

Units included Advanced Bookkeeping, Final Accounts Preparation, and Indirect Tax. Completed practical assessments involving real-world financial scenarios. Continuing towards AAT Level 4 with the goal of full MAAT status.

BTEC Level 3 Extended Diploma in Business (D*D*D) | South Thames College | 2020–2022

10x GCSEs (9–4) | Elmfield High School | 2018–2020

What to include in your education section

For each qualification, add the following info:

- Qualification & organisation – Name the certification and where you studied for it.

- Dates studied – Give the start and end dates, or state if they’re ongoing.

- Extra details – Particularly relevant modules should contain more detail, to reassure recruiters that those specific courses have provided you the useful skills that they’re looking for.

Best qualifications for Trainee Accountants

- AAT Foundation Certificate or Level 2 in Accounting – A strong starting point for aspiring accountants.

AAT Advanced Diploma or Level 3 in Accounting – Demonstrates intermediate knowledge and readiness for trainee roles.

BA/BSc in Accounting, Finance, or Economics – A degree gives you a solid academic foundation.

ACCA, ACA, or CIMA qualifications (in progress) – Shows commitment to professional development.

GCSEs/A-Levels with strong maths grades – Still important for entry-level finance roles.

How to present your work experience in your CV

You don’t need years in finance to show potential – use this section to highlight transferable skills and responsibility. Retail jobs, internships, admin support – they all count if they show reliability and organisation. Employers want to see that you’ve handled responsibility, worked as part of a team, and applied attention to detail.

Begin with your most recent work experience and work backward. Even if you have no experience in the field, focus on transferable tasks like handling transactions, working with data, supporting admin processes, or assisting customers.

How should you list jobs on your Trainee Accountant CV?

- Outline – Introduce the employer, your role, and the type of work environment.

Responsibilities – Describe duties that demonstrate transferable skills. Use action words like “processed,” “supported,” or “organised.” - Achievements – Include any positive outcomes, such as improved accuracy, efficiency, or recognition for reliability.

Work history examples for Trainee Accountant

Accounting Shadow Placement | Westvale Accounting Ltd

Outline

Provided accounting support for a regional accountancy firm, assisting with financial processing and reporting tasks for a range of SME clients.

Responsibilities

- Processed sales and purchase invoices using Xero and reconciled client bank accounts.

- Assisted with the preparation of VAT returns and monthly management reports.

- Updated ledgers and maintained accurate client records.

- Communicated with clients to request documentation and clarify financial discrepancies.

- Supported the senior accountant with year-end accounts and audit preparation.

Achievements

- Helped reduce errors in client bookkeeping by implementing a checklist system.

- Completed AAT Level 2 during employment and progressed to Level 3 with employer support.

- Recognised for attention to detail and consistent delivery of tasks ahead of deadlines.

Accounts Trainee | Nexora Finance Group

Outline

Supported the finance team of a national consultancy firm, gaining experience in ledger work, data entry, and reporting.

Responsibilities

- Maintained purchase and sales ledgers, ensuring entries were accurate and up to date.

- Reconciled bank statements and resolved discrepancies with suppliers.

- Assisted in preparing monthly financial summaries for internal reporting.

- Filed invoices and expense claims, checking supporting documentation.

- Used Sage to input financial data and run basic reports.

Achievements

- Reduced data entry turnaround times by 25 percent through improved workflow tracking.

- Successfully supported a transition to digital record-keeping across the department.

- Praised by supervisors for reliability and quick adaptation to finance systems.

Creating an additional info section

For junior candidates, an Additional Information section is a great way to show skills and qualities that don’t fit into work experience or education.

It can highlight hobbies, achievements, and personal projects that demonstrate initiative, teamwork, or attention to detail. This section helps employers see your potential – even if you’re just starting out.

Good additional info for Trainee Accountant

- Hobbies – Choose activities that reflect qualities like precision, logic, focus, or responsibility. Things like budgeting, data-focused hobbies, or strategy-based games can highlight useful traits.

- Awards and Achievements – Academic achievements, competition results, or recognitions for reliability and accuracy can help demonstrate your suitability for an accountancy role.

- Extracurricular Activities – Involvement in business societies, student finance groups, or other team-based activities shows initiative, organisation, and teamwork.

- Personal Projects – Self-directed learning, financial tracking systems, or anything that shows interest in finance or numbers can reinforce your commitment to the profession.

Additional info example

Additional info

Hobbies

Spreadsheet budgeting – Created a monthly personal budget to track spending and savings, developing accuracy and practical financial skills.

Puzzle-solving – Enjoy logic games and number puzzles, which improve attention to detail and structured thinking.

Reading finance blogs – Stay updated on accounting trends, tax regulations, and budgeting tips to build industry awareness.

Awards and Achievements

Top performer in A-level Maths – Recognised for accuracy, problem-solving, and logical thinking.

Certificate of Recognition – Awarded for consistent effort and reliability across all coursework.

Extracurricular Activities

Business Society treasurer – Managed budgeting and spending for student events, keeping clear and accurate records.

Team project lead – Coordinated a small team to deliver a business presentation, strengthening organisation and leadership skills.

Personal Projects

Excel for beginners – Completed a self-study project to learn formulas, functions, and financial templates.

Investment tracker – Built a mock stock portfolio using Google Sheets to understand gains, losses, and basic financial metrics.