Congratulations on earning your degree – you’re a big step closer to a rewarding role in a lucrative field. Unfortunately, before you can start crunching numbers for a firm, you need to make sure your CV adds up.

Graduate accounting roles are competitive, and employers aren’t just looking for someone who can list assets and liabilities – they want someone who can analyse data and communicate insights clearly.

This guide and its 4 Graduate Accounting CV examples will show how to highlight your technical skills and impressive academic achievements to give the best chance of landing your first role in the finance world.

Graduating Accounting CV

Accounting Student CV

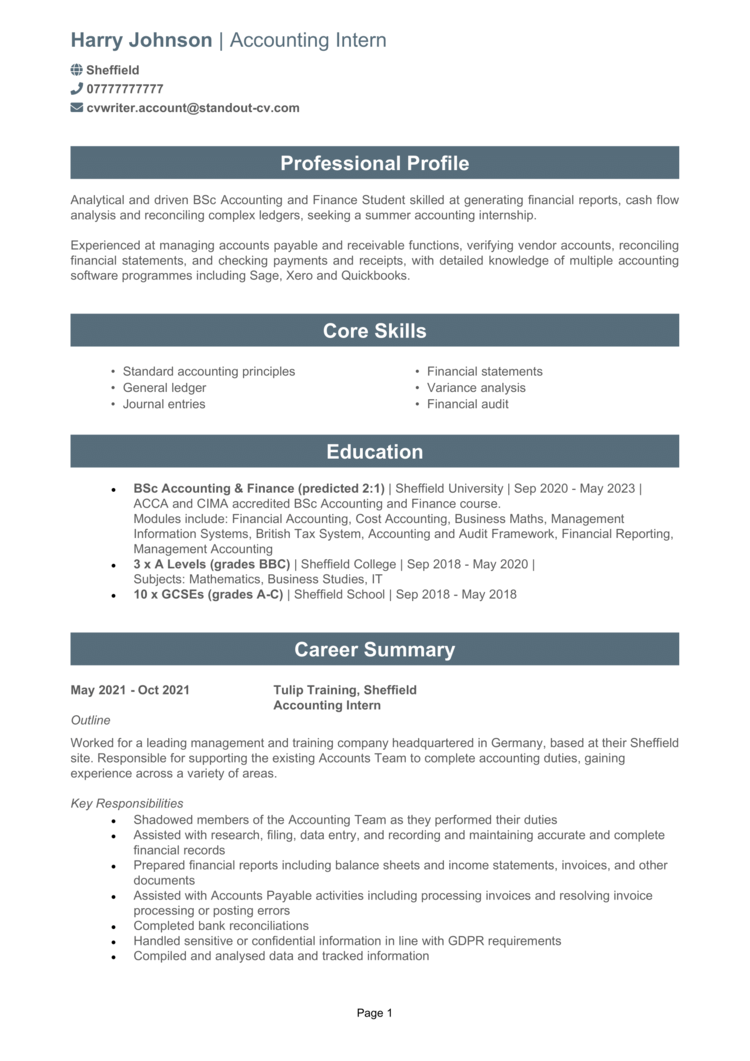

Accounting Intern CV

Entry Level Accountant CV

How to write your Graduating Accounting CV

Discover how to create a quality Graduating Accounting CV with this simple step-by-step guide.

Writing a CV can be daunting, especially if you’ve got little to no experience. This guide breaks down every section of your CV, helping you present your education, internships, and key financial skills in a way that’s easy to read and makes an impact.

Whether you’re applying to an accounting firm, a corporate finance team, or an entry-level analyst role, this guide ensures your application is audit-proof and ready to impress.

Structuring your Graduating Accounting CV

Recruiters aren’t auditors – they won’t waste time hunting for missing details. Much like a well-prepared financial report, a great CV needs structure and precision. If recruiters can’t quickly find your qualifications, software skills, and relevant experience, they won’t take the time to dig deeper.

Here’s the layout your CV should follow:

- Name and contact details – Make sure your contact information is clearly displayed so employers can reach you.

- Profile – Begin with a concise summary of your academic background, key skills, and career aspirations in accounting.

- Core skills – Briefly highlight your top technical abilities, from financial analysis to accounting software proficiency.

- Work experience – Talk about your internships, placements, and part-time roles, with a focus on transferable finance skills.

- Education – Mention your degree, any finance-related coursework, and relevant professional qualifications.

- Additional info – Optionally, include software expertise, awards you’ve earned, relevant hobbies, and professional memberships.

Best format for a Graduating Accounting CV

A good format isn’t just about looking neat – it’s about making sure your key strengths stand out immediately. Attention to detail is critical in accounting, so your CV format needs to be just as polished as your calculations: a well-presented document shows employers you’re capable of handling important financial data.

Follow these formatting tips:

- Bullet points – Keep responsibilities and achievements short and clear.

- Divide sections – Break your CV into distinct sections with clear headings for smooth navigation.

- Use a clear and readable font – A simple, professional font ensures readability while keeping the layout polished and tidy.

- No more than 2 pages – This gives you the length to detail your experience while keeping it concise enough to respect the recruiter’s time.

Creating a strong Graduating Accounting profile

Your CV profile is your introduction to employers, summarising your qualifications, skills, and career goals in a few lines. This is your opportunity to show that you’re more than just a graduate – you’re a future finance professional ready to add value to an organisation.

As a junior candidate, you would benefit more from a longer, more detailed personal statement, along with a tailored and personalised cover letter alongside your CV.

Graduating Accounting CV profile examples

Profile 1

Ambitious Graduate Accountant with a strong foundation in financial reporting, tax compliance, and auditing. Skilled in preparing financial statements, reconciling accounts, and analysing budgets. Proficient in using accounting software such as Sage, QuickBooks, and Xero. Passionate about applying accounting principles to support business growth and financial efficiency.

Profile 2

Detail-oriented Graduate Accountant with hands-on experience in financial analysis, tax preparation, and cost management through internships. Adept at handling payroll, preparing VAT returns, and ensuring compliance with financial regulations. Proficient in Excel, SAP, and financial modelling. Committed to improving financial processes and reporting accuracy.

Things to have in your Graduating Accounting CV profile

Here’s what to include:

- Accounting background – Mention your degree, relevant coursework, and any specialisations.

- Technical skills – Highlight your experience with financial reporting, auditing, or tax preparation.

- Software proficiency – List any accounting tools you’ve used, such as QuickBooks, SAP, or Excel.

- Analytical thinking – Show you can interpret financial data and provide meaningful insights.

- Career ambition – Demonstrate your enthusiasm for the field and where you see your career heading.

Show off the core skills recruiters look for

A strong skills section gives recruiters an instant snapshot of your abilities. As a graduate, this section should highlight your most valuable technical competencies, ensuring you present yourself as a well-rounded and capable candidate.

Since different accounting roles focus on different aspects of finance, tailor this section to match the job description, ensuring it aligns with what employers are looking for.

Avoid generic soft skills like “working in teams” or “attention to detail” – that’s the sort of CV mistake that costs your roles. Instead, focus on the specific, tangible things recruiters are actually looking for a candidate to do.

Most important skills for a Graduating Accountant

- Financial Reporting and Analysis – Preparing and interpreting financial statements, including balance sheets, income statements, and cash flow reports.

- Bookkeeping and Ledger Management – Recording financial transactions, reconciling accounts, and maintaining accurate financial records.

- Taxation and Compliance – Gaining knowledge of corporate tax, VAT, and personal tax regulations to ensure compliance.

- Budgeting and Forecasting – Assisting in financial planning by analysing income and expenses to predict future trends.

- Audit and Internal Controls – Understanding auditing processes, risk assessment, and compliance with financial regulations.

- Accounting Software Proficiency – Using platforms such as QuickBooks, Xero, SAP, or Sage for accounting tasks.

- Cost Accounting and Financial Management – Evaluating costs, margins, and profitability to support business decision-making.

- Regulatory and GAAP/IFRS Compliance – Ensuring financial practices align with international accounting standards.

- Excel and Financial Modelling – Applying spreadsheet analysis, pivot tables, and formulas for financial data management.

- Communication and Stakeholder Engagement – Presenting financial insights, collaborating with teams, and working with clients or management.

What should your CV’s education section include?

Your education is one of the most important sections on a Graduate Accounting CV, as it proves you have the foundational knowledge needed for the role.

List your degree and any relevant coursework, including financial accounting, auditing, taxation, or business finance. If you’ve completed additional training or started working toward professional qualifications, mention that too.

Expand on specific modules and projects which instilled especially useful skills, and relate them to jobs you’re applying for.

Example education sections

Education 1

First Class BSc (Hons) Accounting & Finance | University of Nottingham | 2020–2023

Modules included Financial Reporting, Corporate Taxation, and Audit & Assurance. Completed a dissertation on the impact of IFRS 16 on financial statement transparency, achieving a distinction. Undertook a summer internship at a top accountancy firm, assisting in tax compliance and financial statement preparation.

3x A-Levels (A-B) | Manchester Sixth Form College | 2018–2020

10x GCSEs (A*-C) | Manchester Academy | 2016–2018

Education 2

Upper Second Class BSc (Hons) Accounting & Business Management | University of Southampton | 2019–2022

Modules included Management Accounting, Business Law, and Financial Risk Analysis. Completed a placement year at a multinational corporation, supporting financial reconciliations and budget forecasting. Led a group project on corporate fraud prevention, presenting findings to finance executives.

BTEC Level 3 Extended Diploma in Business (D*DD) | Bristol City College | 2017–2019

9x GCSEs (A*-C) | Bristol High School | 2015–2017

What to include in your education section

For each qualification, add the following info:

- Qualification & organisation – Say the name of each qualification and the school, university, or training body where you earned it.

- Dates studied – Give the start and end (or expected end) date for every one.

- Extra details – For modules which relate particularly well to the role you’re applying for, feel free to expand a bit and showcase the specific skills you picked up through the course.

What qualifications do employers look for in a Graduating Accountant?

- BSc/BA in Accounting, Finance, or Economics – The most common degree routes into accounting.

- ACCA (Association of Chartered Certified Accountants) – Early Stages – Completing initial ACCA exams can boost your employability.

- CIMA (Chartered Institute of Management Accountants) – Certificate Level – A strong choice for those interested in management accounting.

- AAT (Association of Accounting Technicians) Qualification – A useful foundation in bookkeeping and finance.

- Excel & Financial Modelling Training – Highly valued for accounting and financial analysis roles.

Describing your work experience

Even if you haven’t worked in a full-time accounting role yet, your experience section should show that you’ve developed relevant skills. Whether through internships, university placements, or part-time jobs in reverse order, highlight any tasks that required problem-solving, data handling, or financial accuracy.

If you lack direct accounting experience, focus on transferable skills such as data entry, financial reporting, or working with spreadsheets.

What’s the correct way to structure job history on your CV?

- Outline – Briefly describe the company, department, or financial tasks you were involved with.

- Responsibilities – List key duties, such as assisting with financial reports, auditing processes, or tax calculations. Use action words like “analysed,” “prepared,” and “reviewed.”

- Achievements – Highlight any measurable results, like improving data accuracy, reducing processing time, or supporting a key financial project.

Sample work experience for Graduating Accounting

Trainee Accountant | Safeharbour Accounting Services

Outline

Within the finance department of a mid-sized accountancy firm, assisted in financial reporting, tax calculations, and client advisory services.

Responsibilities

- Prepared financial statements and assisted with end-of-year accounts for clients.

- Conducted bank reconciliations and reviewed general ledger transactions.

- Processed VAT returns and assisted with corporate tax filings.

- Analysed financial data and provided insights for management reports.

- Liaised with auditors and supported external audit processes.

Achievements

- Helped improve financial reporting efficiency by 30 percent through streamlined data entry processes.

- Identified cost-saving opportunities for clients, improving profit margins by 10 percent.

- Received positive feedback from senior accountants for attention to detail and accuracy.

Accounting Admin Assistant | Roseworth Corporate Solutions

Outline

For a national financial consultancy firm, supported senior accountants in preparing financial statements and maintaining financial records.

Responsibilities

- Assisted in producing balance sheets, profit and loss statements, and cash flow reports.

- Reviewed invoices and expense reports, ensuring accurate record-keeping.

- Supported payroll processing, checking tax deductions and pension contributions.

- Performed variance analysis to assess financial performance against forecasts.

- Maintained financial compliance by updating records in accordance with UK GAAP and IFRS.

Achievements

- Reduced financial discrepancies by 25 percent through detailed reconciliation processes.

- Improved invoice processing speed by introducing automation tools.

- Recognised for efficiently managing financial tasks during peak reporting periods.

Additional info

Candidates with less experience should take a little extra space to flex any additional skills and information which might help to sway a recruiter.

Focus on relevant and impressive things like hobbies and awards, or software you’re particularly adept with.

Good additional info for Graduating Accounting

- Hobbies – Activities that develop numerical skills, attention to detail, and problem-solving—such as budgeting, financial analysis, or puzzle-solving—can be relevant.

- Awards and Achievements – Recognitions for academic excellence, financial competitions, or leadership roles demonstrate strong analytical and organisational abilities.

- Extracurricular Activities – Participation in finance or business societies, leadership roles, or team projects showcases teamwork, initiative, and industry engagement.

- Personal Projects – Independent financial tracking, investment management, or online coursework in accounting software can highlight a proactive approach to learning.

Additional info example

Additional info

Hobbies

Personal budgeting – Developed a financial tracking system in Excel to monitor expenses and savings effectively.

Sudoku and logic puzzles – Enhancing problem-solving skills and attention to detail through complex numerical challenges.

Business podcast listener – Regularly following finance and accounting-related discussions to stay informed on industry trends.

Awards and Achievements

Highest grade in financial accounting module – Recognised for strong understanding of financial statements and reporting.

Accounting Society competition finalist – Successfully prepared a business financial report as part of a university challenge.

Extracurricular Activities

Accounting & Finance Society member – Attended industry networking events and guest lectures on taxation and auditing.

Student consultant – Provided financial forecasting support for a university-led business project.

Personal Projects

QuickBooks self-learning – Completed online tutorials to gain proficiency in accounting software.

Financial statement analysis – Independently studied and compared annual reports of major corporations to understand financial performance.