Our CV builder will get you more interviews & better job offers

Thousands of job seekers have used our CV builder, CV examples and templates, to create an attractive CV and land a job they love.

What makes our CV builder the best?

Our CV builder is packed with helpful features and benefits to help you create an attractive CV format in minutes and start getting noticed by employers

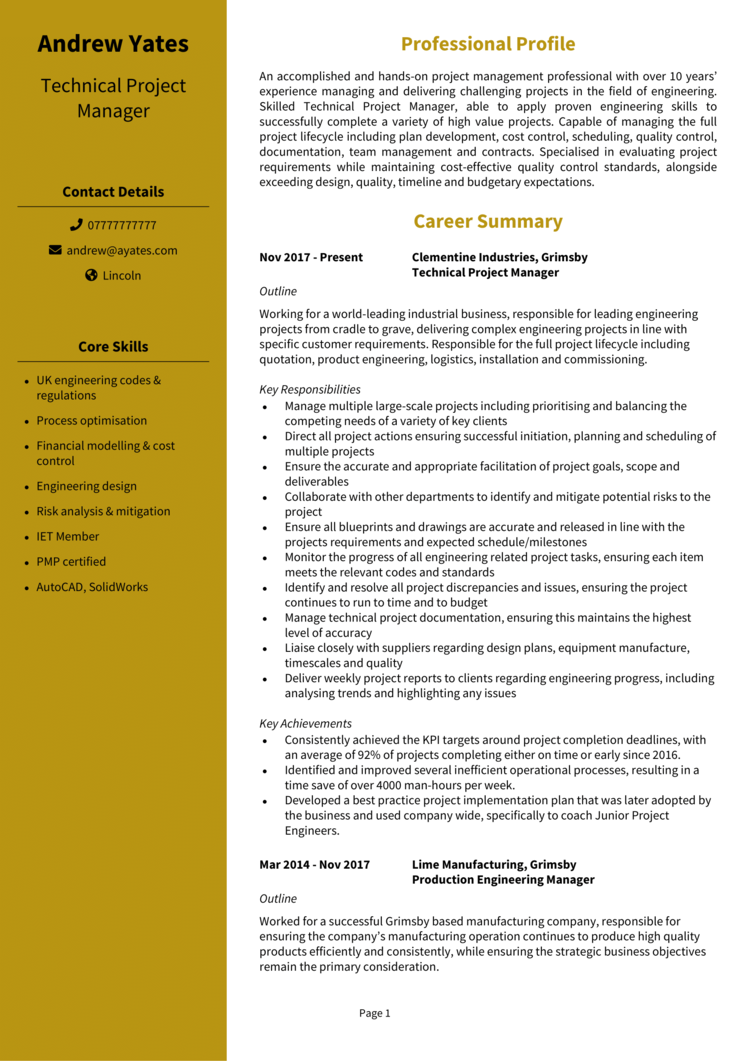

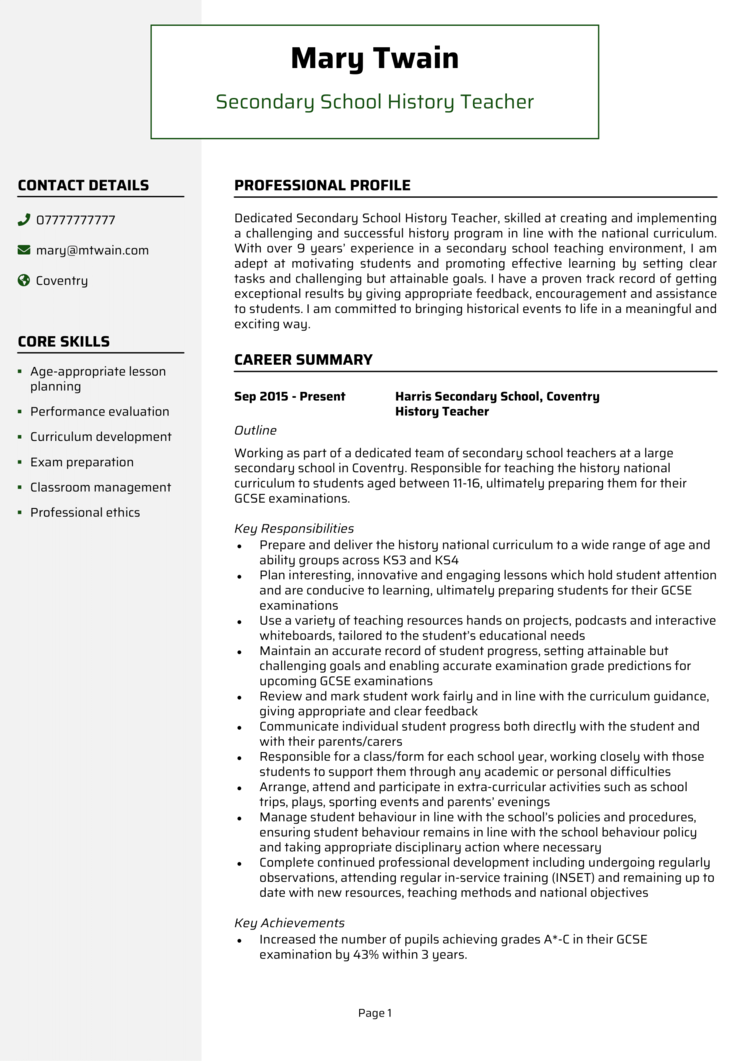

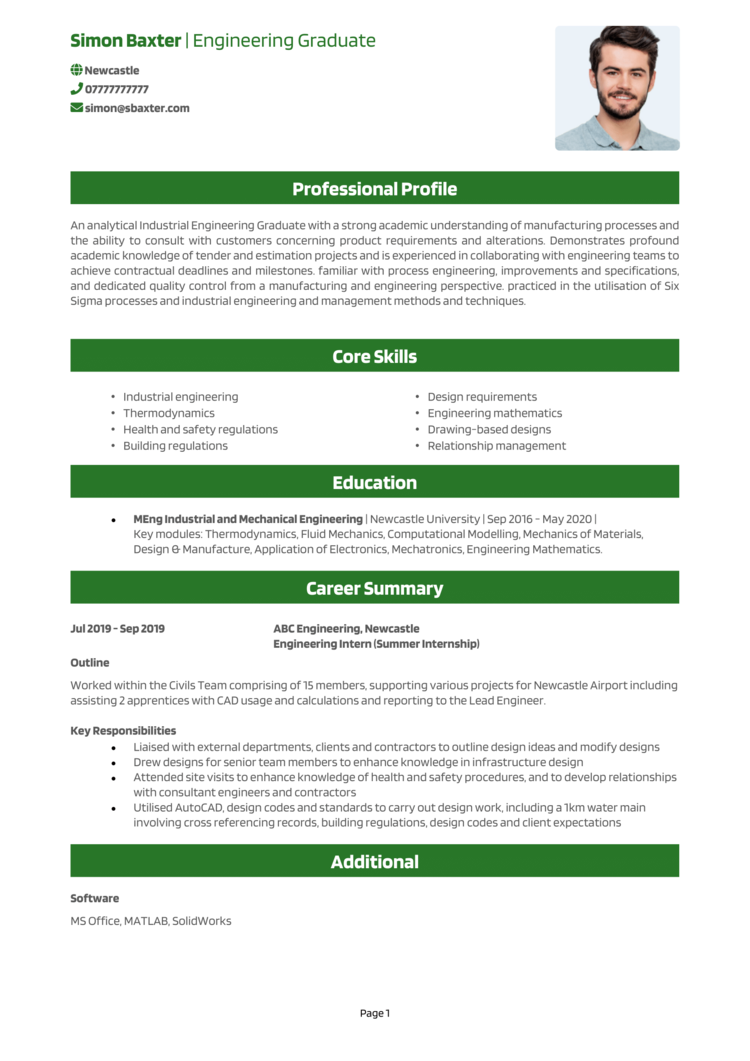

CV templates that stand out

Select from a range of professional CV templates that have been designed to attract employers and pass ATS scans.

No more playing around with tricky formatting options in Microsoft Word. All fully customisable to suit your style and profession.

Expert pre-written CV content

Save time and build an interview-winning CV easily by adding pre-written content from our recruitment experts.

Choose from thousands of phrases and skills across all industries and easily edit to match your individual needs.

Pro CV tips & guidance

Receive tips and guidance from recruitment professionals through every of step your CV building process.

Tailored to your experience-level and career goals, and proven in helping you land more interviews.

Easy CV editing & Lifetime access

Once you have created your winning CV, editing is quick and easy within your account. Make edits on the move or tailor your CV for a new opportunity within seconds and increase your chances of landing an interview.

You can access your CV at any time, whether that’s next week or 5 years from now – meaning you’ll always be ready for the next opportunity.

How to use the StandOut CV Builder

Creating a standout CV has never been easier with the StandOut CV Builder. Our intuitive tool guides you through the process step by step, ensuring your CV is professional, ATS-friendly, and packed with impactful content. Follow these simple steps to craft a CV that gets results.

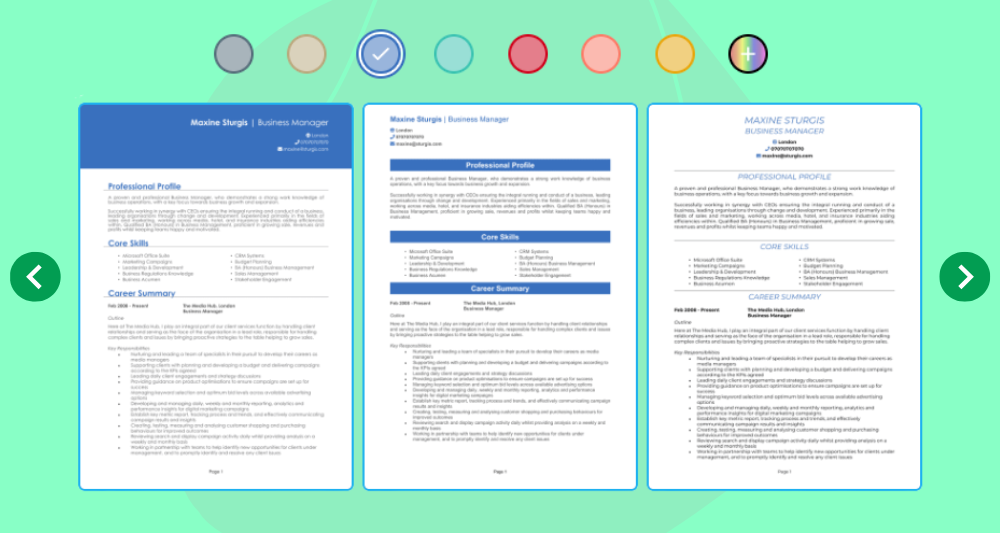

1. Choose your professional CV template

Start by selecting from a range of expert-designed CV templates, built to impress employers and pass applicant tracking systems (ATS). Whether you’re in a creative industry or a corporate role, there’s a template to suit your needs. You can switch CV template at any stage of the process and the layout will remain perfect.

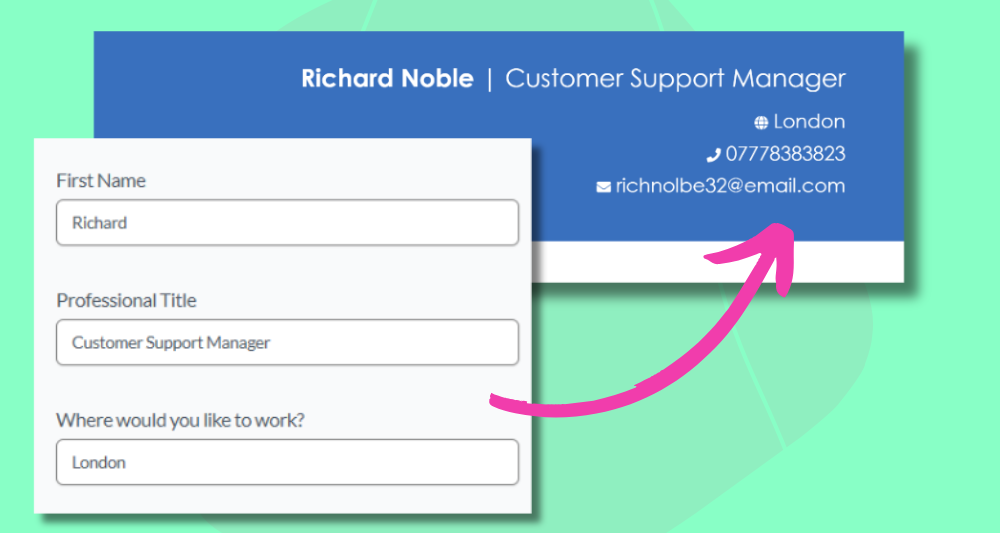

2. Enter your personal details

Simply fill in your name, contact details, and location to ensure recruiters can reach you. Our CV builder formats everything neatly, so you don’t have to worry about spacing or alignment. You can also add links to social profiles and portfolios, a photo or custom details.

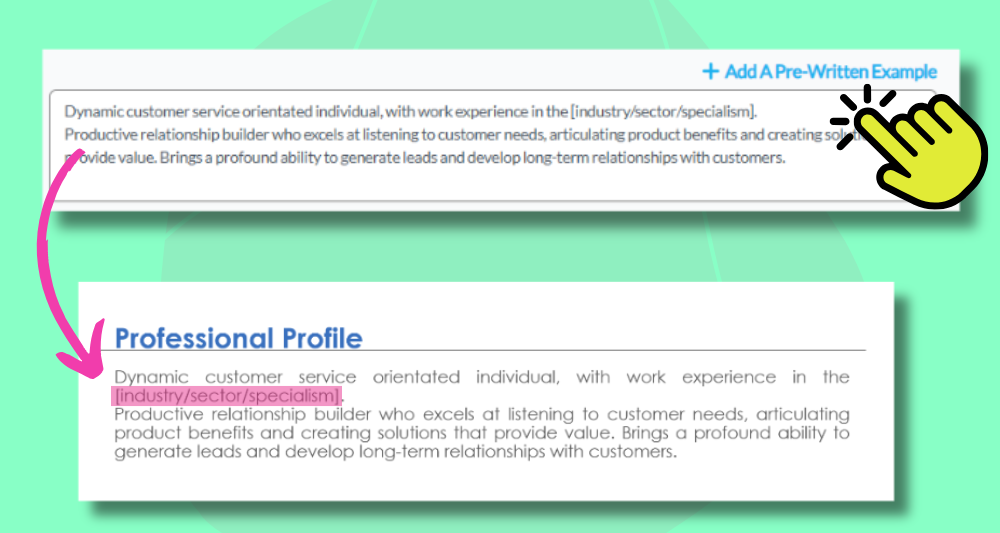

3. Add an impressive CV profile

Your CV profile is the first thing employers read—make it count! With the StandOut CV Builder, you can use our pre-written professional CV profiles, tailored to different industries, and tweak them to match your experience. Simply add them with one click and edit in seconds – this saves lots of time while ensuring your profile is polished and impactful.

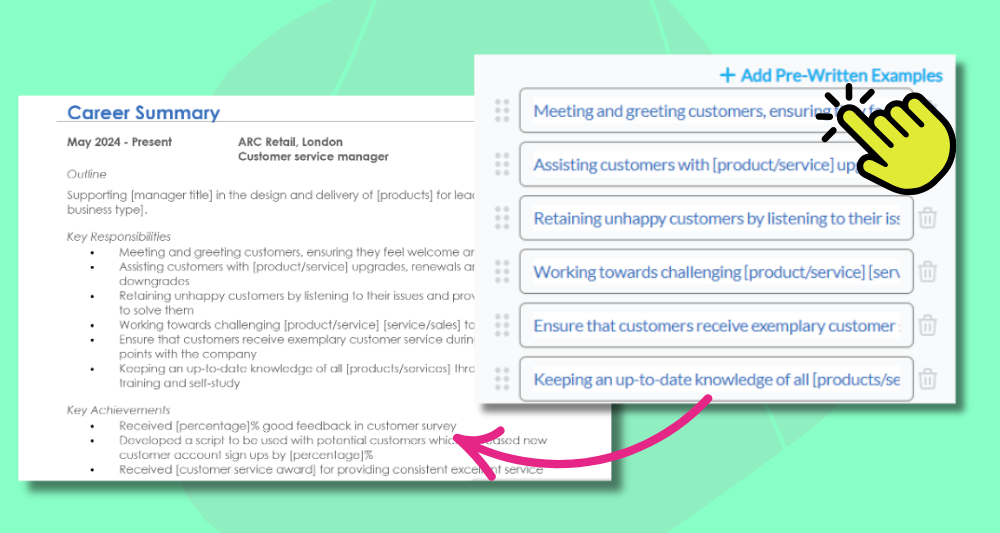

4. Add your work experience & education

Highlight your career achievements with our pre-written job descriptions and bullet points. Simply choose your industry, and our CV builder will suggest expertly written content that you can customise, making it easy to showcase your skills and experience in the best light.

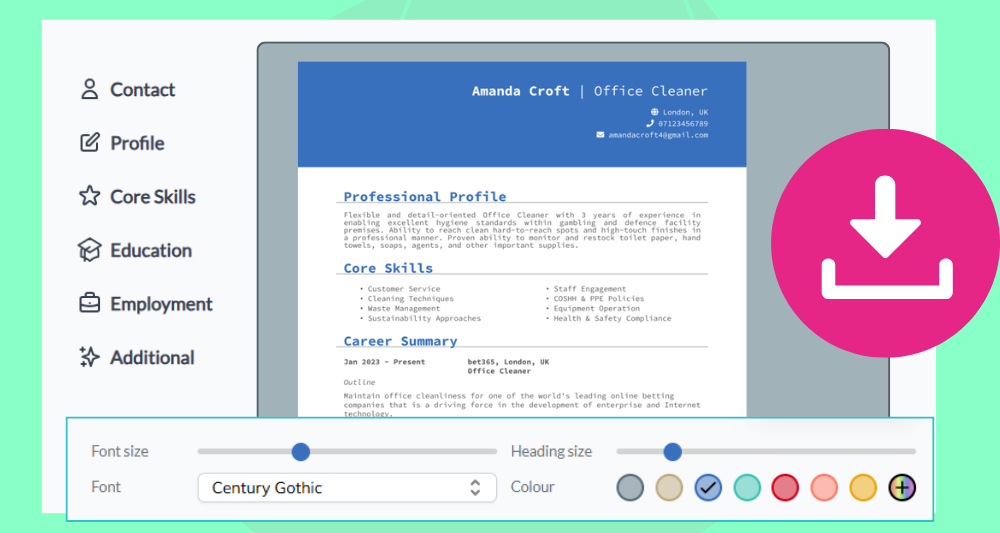

5.Review your CV and download

Once you’ve filled in your details, preview your CV to ensure everything looks perfect – you can switch templates, fonts and colours here. Our builder automatically structures and formats your CV for readability and professionalism. When you’re happy, simply download your CV in a professional format.

6. Store and edit your CV forever

Need to update your CV later? No problem… With unlimited cloud storage, you can access and edit your CV anytime from within your account. Whether you’re applying for a new job or refreshing your skills, your CV is always ready at your fingertips, and can be edited and downloaded as often as you like.

Start using the StandOut CV Builder today and create a job-winning CV in minutes!

CV builder FAQs

Answers to the most commonly asked questions about our CV builder and how to write a good CV

Should I use a CV builder?

Yes, absolutely! A CV builder makes it faster and easier to create a professional, well-structured CV without struggling with formatting or wording. Whether you’re starting from scratch or updating your existing CV, our tool provides pre-written content, expert tips, and professionally-designed templates to ensure your CV looks polished and quality.

How quickly can I make a CV?

With our easy-to-use builder, you can have a complete, professional CV in just a few minutes. Simply choose your preferred design, enter your details, and select from pre-written content or enter your own.

Can I edit my CV after I’ve downloaded it?

Yes! You can log back into the CV builder at any time to update, edit, or customise your CV. Whether you gain new experience, earn a certification, change career paths, or just want to switch up the visuals, you can quickly make updates without starting from scratch.

Can I change my CV template after I start?

Yes, of course. If you want to try a different look, you can switch templates at any time without losing your content. You can also tinker with the colour scheme, typeface, and font size, to suit your preference. Your information will automatically adjust to the new format.

What format can I download my CV in?

You can download your CV as a PDF, which is the preferred format for job applications and favoured by recruiters. PDFs keep your formatting intact, ensuring your CV looks the same on any device or system. You can edit your CV at any time from within your account.

What is the purpose of a CV?

A CV (Curriculum Vitae) is a summary of your work experience, skills, and education. It’s used to apply for jobs, showcasing why you’re the right candidate. Employers use CVs to quickly assess whether an applicant has the qualifications and experience they need.

How do I make a good CV?

A strong CV is clear, concise, and tailored to the job you’re applying for. It should follow a structured format with sections for contact details, a profile, skills, work experience, and education, and use bullet points for easy readability. It should also highlight achievements with numbers to show impact, and be no longer than two pages, unless applying for an academic or research role.

How far back should a CV go?

In most cases, a CV should cover the last 10-15 years of your career. Older jobs can be summarised or removed unless they’re highly relevant. If you’re early in your career, include all relevant experience, even internships or part-time roles.

What should I include in my CV?

A standard CV should contain the following sections:

Contact details – Your name, email, phone number, and general location.

Professional profile – A brief summary of your experience and key strengths

Core skills – A bullet-pointed list of relevant skills.

Work experience – Previous job roles, responsibilities, and key achievements.

Education – Degrees, certifications, and qualifications.

Additional info (if relevant) – Awards, hobbies, or professional memberships, etc.

Get more help with your CV

Get more help writing your CV by checking out our huge library of CV advice and resources, from professional CV examples, free CV advice from recruitment experts and a range of CV templates to create an impressive CV layout, structure and format.

CV examples

Find the perfect CV example to guide and inspire you to job-search success with our library of over 1,000 real life professional CV examples.

Expert CV advice

All of the CV advice on our website and within our CV builder comes from our founder and director Andrew Fennell, a former recruitment professional and leading UK careers expert.

How to write a CV

Learn how to write a CV that will attract recruiters and land you interviews with top employers.

Cover letter examples

Check out our library of cover letter examples for inspiration and guidance on creating a cover letter that will get you noticed.

CV examples

Good CV examples from all industries and career levels to inspire and guide you in the writing of your own winning CV.